Friday property news update - 16th April

London's shifting skyline, Berlin's rent controls and a big call to scrap stamp duty

5 minutes to read

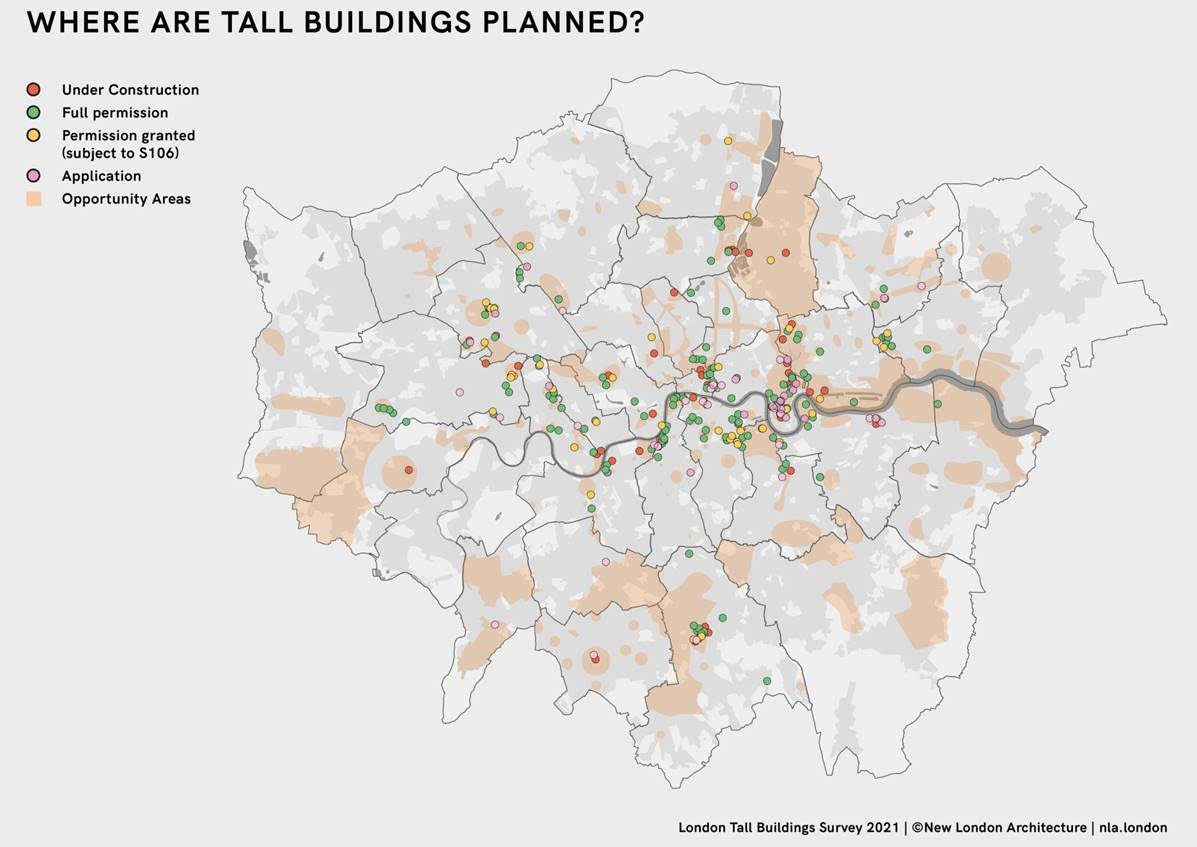

London's shifting skyline

A new Tall Buildings Survey by Knight Frank and the NLA suggests that London's boom in tall buildings slowed in 2020. That includes a decline in both the number of new planning applications put forward by developers and new construction starts - bellwethers for the state of the market.

Given an average build time of around four years for the tall buildings completed in 2020, future surveys will register a slowing in delivery rate as the dip in starts works its way through, according to analysis from Oliver Knight. However, the overall pipeline remains significant, with 587 tall buildings at various stages of the planning process at the end of the year, some 7.9% higher than in 2019. Most of the planned towers are residential, accounting for almost 90% of the pipeline.

The trajectory of the data points to an increased willingness from boroughs to consider more high density buildings. Local authorities have two issues: high targets to meet in terms of housing delivery and a shortage of development land. Going tall is the option they seem to be focused on.

It looks like 2021 could be a bumper one for completions, with 52 tall buildings expected to complete this year - a 50% increase on the 2020 total.

Rent controls

Germany's highest court struck down the city of Berlin's rent cap yesterday following a year of legal battles between campaigners and property companies. The ruling is more about the constraints of municipal power rather than any comment on rent caps as a policy move.

Germany introduced a rent cap in 2015. Berlin imposed its own caps last year after campaigners successfully argued the national cap didn't go far enough. That move was an overreach, the court said.

The judgement is a reminder of the broader housing affordability crisis that has grown worse as asset prices have climbed over the course of the pandemic. Rents are particularly problematic in Germany, where rates of home ownership are among the lowest in Europe.

Research suggests rent caps create winners and losers, but mostly losers. The Berlin policy capped rents for anything constructed before 2014. Rents in that market plummeted, but as Bloomberg's Andreas Kluth wrote back in March; since the excess demand of apartment hunters had to go somewhere, rents in the unregulated market simultaneously started rising faster in Berlin than in 13 other large German cities.

The supply of regulated stock froze and then began declining - as tenants moved out landlords tended to sell. Listings in the unregulated market, still constrained by construction schedules, increased only marginally faster than in other cities.

A 2018 Stanford study in San Francisco came to the same conclusions: the caps were great for those ensconced early in regulated apartments but hurt other groups. Researchers there concluded cities should look for alternative forms of protection for renters — such as tax credits or subsidies that offset soaring rents.

Scrapping stamp duty

More positive UK economic news. First quarter sales at builders' merchant Travis Perkins surged 6.8% compared to a year earlier, job postings are back at pre-pandemic levels and restaurant bookings are soaring.

There is, however, much that can be improved, according to the OECD's annual 'Going for Growth' report. The UK snapshot of the much larger annual report raises concerns that poverty is set to increase as jobs are lost and self-employed see incomes dwindle, accentuating regional differences.

Solutions to rebalance the UK's economic growth include pushing on with proposals to ease land-use regulations, while taking into account environmental and social concerns to spur more investment in housing and improve housing affordability and competition in construction. The report also suggests making the temporary cut in stamp duty permanent and reforming "regressive" Council tax.

Solving the green homes problem

The UK government's decision last month to scrap the green homes grant was a reminder of how far the residential sector has to go in order to meaningfully start combatting emissions. Fixing existing stock is going to be expensive and scrapping the grant left 20 million households on moderate incomes without any government help to undertake improvements.

Last week we talked about green mortgages and whether better financing could meaningfully move the needle. For a new Intelligence Talks podcast, I join host Patrick Gower and global wealth specialist Flora Harley to unpick the issue. We also cover why London leapfrogged rivals New York and Hong Kong as the top spot for super prime home purchases.

Listen here, or wherever you get your podcasts.

Central London rents

Average rents in prime central London (PCL) declined 14.3% in the year to March, continuing a pattern established over the course of the pandemic. While supply has spiked due to the closure of the short-let market, demand has been curtailed by international travel restrictions.

There are signs that is beginning to change, according to analysis from Tom Bill. Firstly, the rate of rental declines is slowing sharply and secondly, demand grew faster than supply in PCL last month for the first time since November 2019. The number of new prospective tenants increased by 167% in March compared to the same month last year. Meanwhile the number of market valuation appraisals rose by 127% over the same period.

For more key data on what's moving the UK property market, see the latest monthly update from Chris Druce.

In other news...

We continue our insight series for The Wealth Report with a webinar next Wednesday, 26th April. Our expert panel will explore the key trends, including how wealth movements, creation and growth can have a sizeable impact on property markets globally. If you’re curious about the biggest opportunities and risks for wealth, sign up here.

Plus, the outlook for Europe's largest economy, high street’s woes hit private landlords, the Chinese economy grew by a record 18.3% in the first quarter, retail sales rise takes Wall Street to new highs, and finally, a letter to Amazon shareholders from an outgoing Jeff Bezos.

Photo by Stefan Widua on Unsplash