Monthly UK Residential Property Market Update – April 2021

March proves a turning point for UK property market

5 minutes to read

March was a pivotal month for the UK property market after a period of hesitancy amongst sellers since the start of 2021 and the third national lockdown.

Sales activity picked up sharply over the month with London and the Country markets performing strongly (see below for more).

A net balance of +42% of respondents to the latest RICS UK Residential Survey said they had seen an increase in buyer enquires during March. This was up from a reading of zero last month and the strongest figure since September 2020.

Near-term sales expectations showed a net balance of +35%, up from a figure of +9% in February. It means the near terms sales outlook is the most upbeat it’s been since January 2020, according to RICS. New instructions coming into the market also improved but demand is still running ahead of supply.

The latest house price sentiment survey results from IHS Markit suggest UK households are more confident about future price growth than at any time since mid-2018. With 50 equating to no change, the April survey recorded a score of +65 of respondents expecting future prices to increase. Expectations of current price growth, at +54, are at their second highest level since mid-2017 (Feb 2020 was the most recent peak).

Halifax reported renewed growth, with a 1.1% increase in UK house prices on a monthly basis after a decline in February. This took annual price growth to 6.5%.

March’s strong performance was foreshadowed by individuals borrowing an additional £6.2 billion secured on their homes during February, according to the Bank of England. This was the strongest net borrowing since March 2016 (£7.2 billion), the last time stamp duty changes significantly distorted the market.

"The strength in mortgage borrowing follows a large number of approvals for house purchase. In February, there were 87,700. While this was down from a peak of 103,700 in November 2020, it was well above the monthly average in the six months to February 2020 of 67,300."

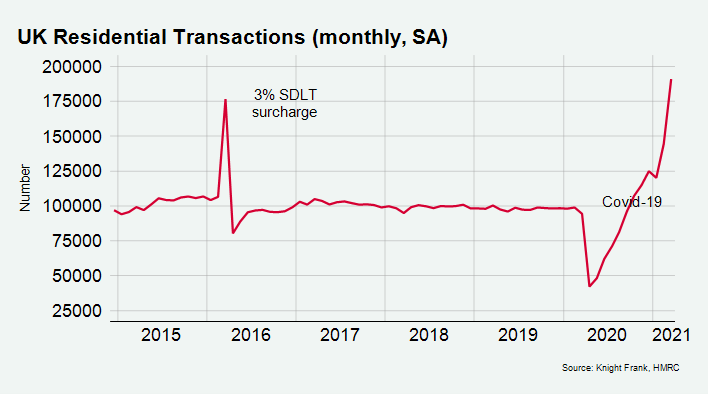

Underlining the supporting role that the stamp duty holiday has played, provisional data from HMRC suggested there were 190,980 residential transactions in the UK in March on a seasonally adjusted basis, with buyers and sellers rushing to complete deals in time for the original 31 March deadline. This is more than double (102%) the amount of transactions in March 2020 and 32.2% higher than February 2021. It also exceeds the previous spike in March 2016, when the introduction of a surcharge on second homes drove transactions to a previous high.

Despite the expected softening due to the original stamp duty holiday end date, annual UK house price growth was 6.3% in the first quarter of 2021, according to Nationwide. The top performer in the period was the North West (up 8.2% on an annual basis) and the weakest growth was in London (up 4.8%). The average price of a property in the North West is £181,999 compared with £482,576 in London.

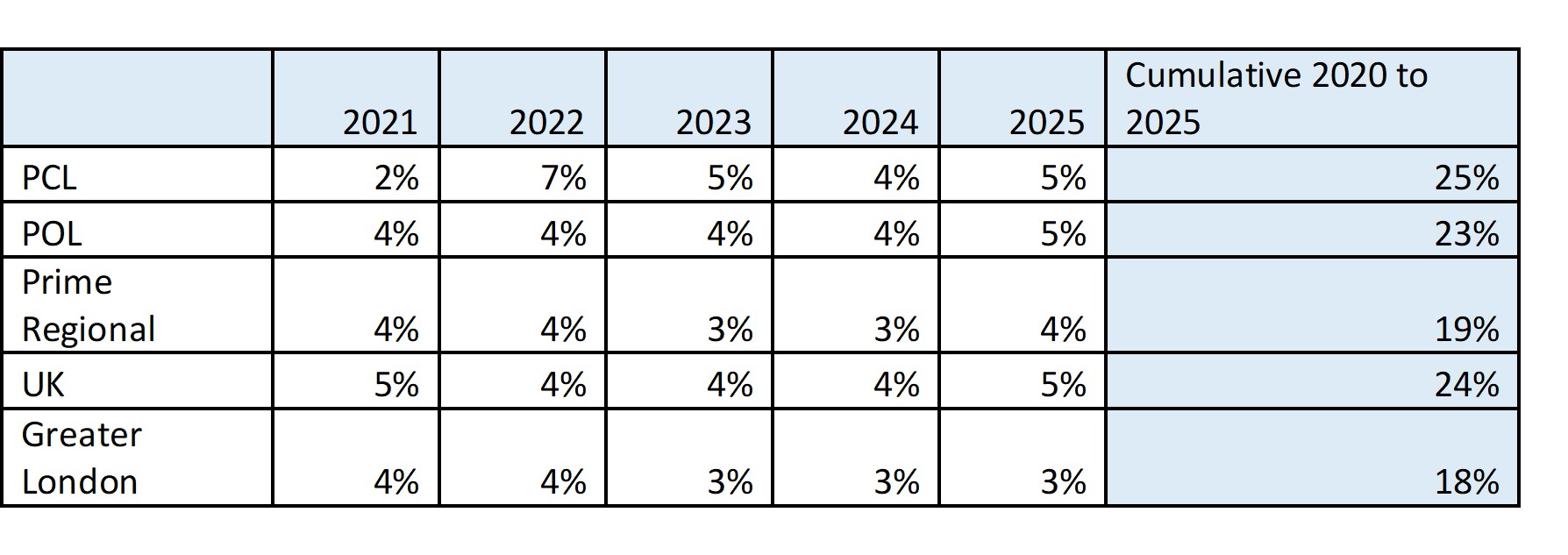

Following last month’s Budget and the stamp duty extension in England and Northern Ireland and strong demand in the first months of 2021, we have revised our forecast.

The key changes are a revision up from 0% to 5% growth in the mainstream UK residential property market this year, with a reduction in PCL growth from 3% to 2% in 2021 due to the continuing travel restrictions that are preventing international buyers from returning to the market in significant volumes.

Residential Property House Price Forecast in full.

Prime London Sales

March was one of the most active months in the UK property market for ten years and prime areas of London were no exception.

While the stamp duty holiday extension would have been less of a motivating factor in prime markets in the capital, a wider return to normality driven by the vaccination programme produced high levels of activity in March.

Last month, the number of transactions in prime central London was the highest it has been since March 2016. There was a spike in activity in March 2016 ahead of a 3% stamp duty surcharge that was introduced the following month.

Prime London Sales Report: March 2021

Prime London Lettings

Average rents in prime central London declined 14.3% in the year to March, continuing a pattern established over the course of the pandemic, however there are signs that is beginning to change.

The annual decline of 14.3% in PCL suggests rental value declines are bottoming out. It was the smallest increment in the annual decline since the start of the pandemic 12 months ago, having widened from 14.1% in February.

A more significant shift took place in prime outer London. Average rents fell by 11.4% in March, which compared to 11.7% in February. It was the first time the annual decline had shrunk since February 2020.

Prime London Lettings Report: March 2021

Country Market

After a record 2020, the start of 2021 brought a pause in momentum in the Country market with more buyers chasing fewer properties. However, with the arrival of the spring market this has changed.

"Market valuation appraisals were above the five-year average for the first time this year in March (up 5%) as sellers respond to the progress of the vaccine roll-out and brightening economic data."

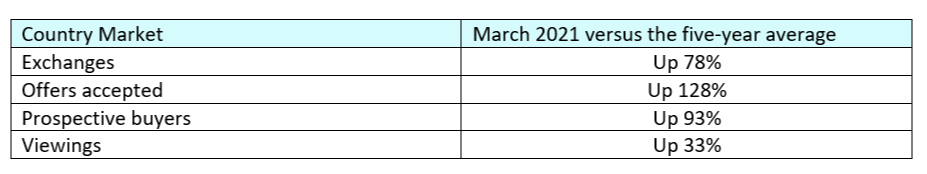

Meanwhile, the number of offers accepted in the Country business in March 2021 was the highest in ten years. The number of viewings in March was the highest since last autumn, and the number of prospective buyers was the fourth highest amount in the past decade. Exchanges in March 2021 were the highest since last October.