UK rural property: To protest or not

The Knight Frank Rural Property and Business Update – Our weekly dose of news, views and insight from the world of farming, food and landownership

8 minutes to read

Opinion

The big issue currently vexing farmers on Twitter is whether they should be joining their EU counterparts in organising mass public protests. A snap Farmers Weekly poll suggests a majority are in favour, although I suspect this type of poll may be slightly self-selecting. The big questions are what would their demands be, would such demands resonate with the public, how much disruption to their lives would people be prepared to put up with to support farmers, and what would success look like? The cost-of-living crisis means most shoppers and businesses are having to tighten their belts so any demands from an industry still heavily supported with public cash would have to be laser focused to gain any sympathy, and any action significant enough to make policymakers and those further up the foodchain take notice. That’s a tough ask.

Do get in touch if we can help you navigate through these interesting times. You can sign up to receive this weekly update directly to your email here.

Andrew Shirley Head of Rural Research

In this week's update:

• Commodity markets – Wheat down, oats up

• Trade – EU checks in place

• Protests – UK farmers eye action

• Hedges – Around the world x 10

• Welsh farming – Consultation closes soon

• Borrowing costs – Rates fall

• International news – EU land prices

• Fore! – Essex leisure opportunity

• Exmoor – More acres available

• Development land – Market stabilises.

• Farmland prices – 2023 ends on a high

• Country houses – 2023 better than expected

• Residential – Our forecasts revised

• The Rural Report – Watch the videos

Commodity markets

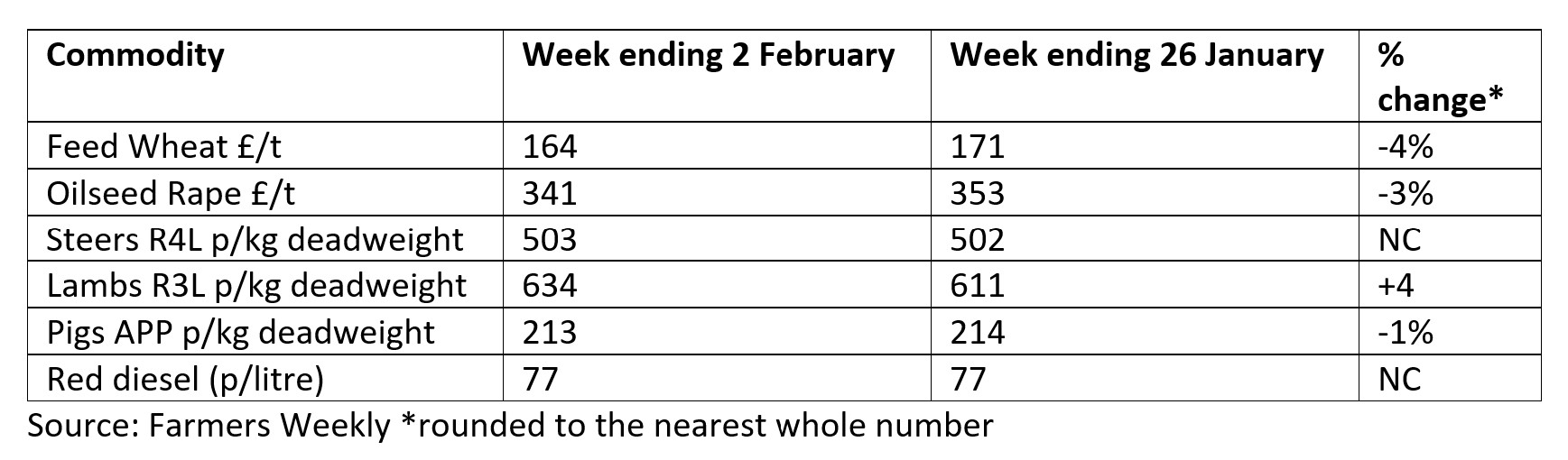

Commodities – Wheat down, oats up

Wheat prices continued to decline last week, with London and Paris futures contracts falling to their lowest levels since July 2021. Over supply and slow demand have encouraged speculative selling, with managed money traders holding record short positions in the Paris market, reports trader Frontier. However, highlighting the value of more diverse cropping, milling oats, are doing better. They hit a 19-month high in January, according to AHDB, and are now worth £252.20/t, up 5.8% from December’s average and up 14.4% year on year. A decrease in production and uptick in consumption is helping to support values.

Talking points

Trade – EU checks in place

After multiple delays food imports into the UK will now be subject to the same checks that British products heading into the EU have been subject to for the past three years. The UK government has introduced the first phase of the Border Target Operating Model (BTOM) for food and feed imported into Great Britain from the EU, Iceland, Liechtenstein, Norway and Switzerland. All medium risk imported products of animal origin from the EU and European Free Trade Association (EFTA) countries will now be required to be accompanied by an Export Health Certificate. Farmers’ representatives have welcomed the tardy playing-field-levelling move. However, parliament’s Food and Rural Affairs Committee is concerned about budget cuts for spot checks on cars and vans suspected of meat smuggling.

Protests – UK farmers eye action

A poll in Farmers Weekly suggests 61% of British farmers are in favour of direct protests similar to those spreading across the continent. Producers in Holland, France and Germany have notched up some wins by persuading the EU to delay the introduction of new environmental measures they claim would make their businesses less profitable. Welsh farmers seem particularly up for a fight with over 1,000 meeting at Welshpool livestock market last week to protest against the Welsh government’s post-Brexit agricultural policy (see below).

Hedges – Around the world x 10

Newly published research from the UK Centre for Ecology and Hydrology reveals that England has a total of almost a quarter of a million miles of biodiversity-supporting and carbon-storing hedgerows around its field boundaries – enough to go round the world almost 10 times. Unsurprisingly for anybody who has driven down the region’s narrow lanes, the south-west boasts the highest hedgerow densities, led by Cornwall with over 5,000 metres of hedgerow per square kilometre. The lowest densities, excluding major urban areas, are found in Surrey, Hampshire and Berkshire.

Need to Know

Welsh farming – Consultation closes soon

Farmers in Wales concerned about the shape of the country’s new and highly controversial Sustainable Farming Scheme have until March 7 to respond to a final consultation on the initiative. Producers are complaining that the scheme is heavy on the environment, but does little to support agriculture and food production, which was heavily reliant on EU subsidies to remain profitable.

Borrowing costs – Rates fall

Lending markets reacted positively to last week’s decision by the Bank of England to keep the base rate on hold at 5.25%. “The five-year swap rate fell to 3.6% after the announcement,” says Bradley Smith, a rural lending specialist at Knight Frank Finance. “Once banks have added on their margins that means we can currently access fixed deals of sub 5% on commercial loans and sub 4% for residential assets.” With inflation forecast to stabilise by April, there are hopes that the Bank of England will cut the base rate within the next few months. “It’s a pretty good time to either fix or go on a variable rate,” reckons Brad. Read my colleague Liam Bailey’s latest economic note for more insight.

International news – EU land prices revealed

Number crunchers in Brussels have just revealed their latest research into average land values and rents across the EU. Based on 2022 data, Croatia has the cheapest arable land at €3,700/ha while (excluding Malta) Holland’s is the most expensive at over €85,000/ha. Obviously, the UK is no longer included in the study but based on Knight Frank research, arable land here is worth around €30,000/ha, significantly higher than the EU average of €10,578/ha.

On the market

Fore! – Essex leisure opportunity

Our Bishop’s Stortford Rural Consultancy team has an exciting opportunity that could appeal to a rural entrepreneur looking to start a new leisure business on a former golf course. The team is renting 30 acres of irrigated land at Clays Lane, formerly the nine-hole Loughton Golf Course, which also includes a hardstanding car park and the footprint of a club house, restaurant, bar, pro shop and auxiliary storage that were demolished after a fire at the property in 2021. “The property offers a commercial opportunity for a long-term lease allowing for the development of a new business venture which could include the redevelopment of the existing building footprint,” says my colleague Henry McNeil Wilson, who is helping to handle the deal.

Exmoor – More acres available

If you’re looking for some natural capital potential in the south-west of England, picturesque Emmetts Grange could fit the bill. It includes 748 acres of pastureland and moorland on Exmoor, near Simonsbath, and offers significant environmental opportunities alongside traditional farming. The land is available as a whole or in five lots ranging from 37 acres of pasture to 256 acres of moorland. The overall guide price is £3.5 million. Contact Alice Keith for more details.

Our Latest Property Research

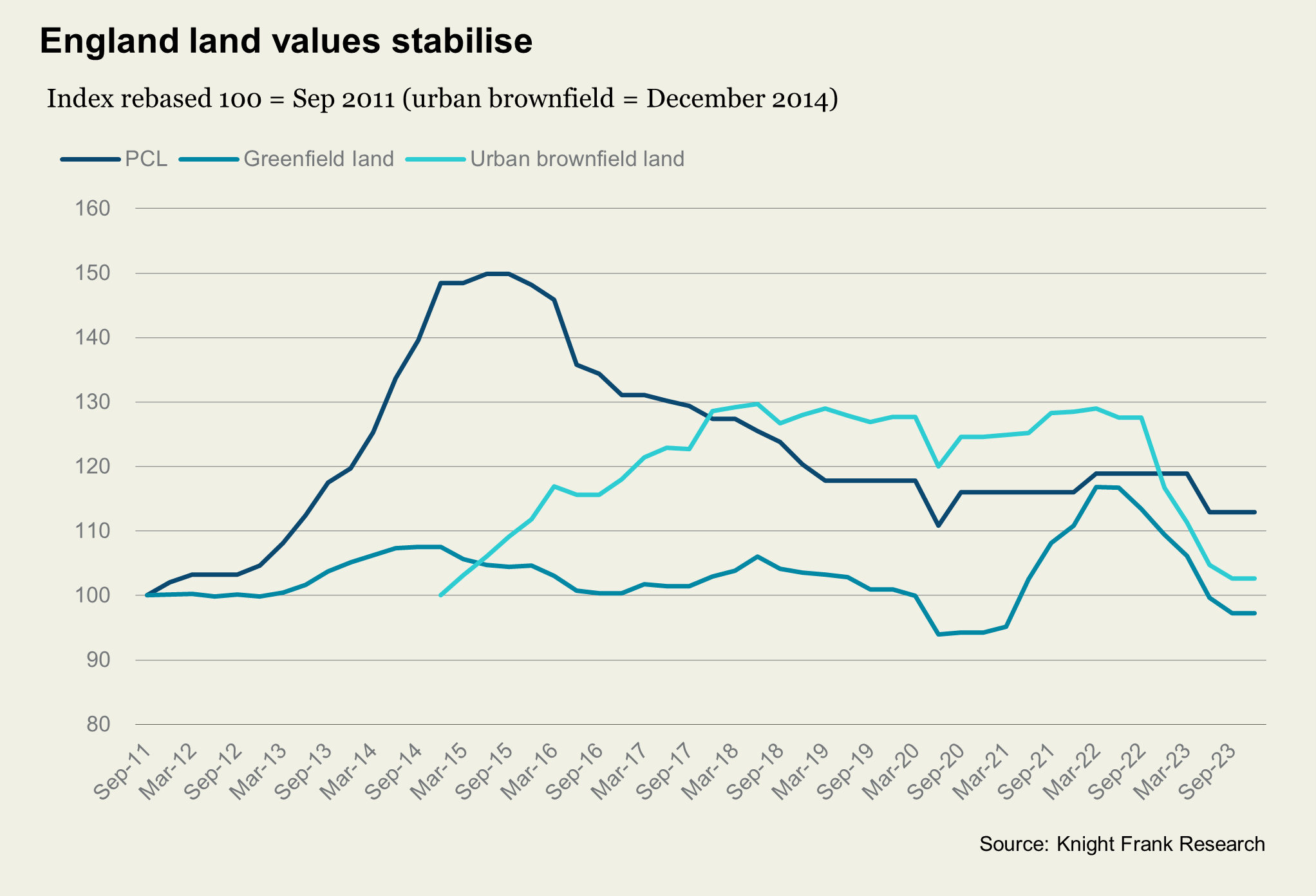

Development land – Market stabilises.

Newly released figures from the Knight Frank Residential Land Index show that England greenfield and urban brownfield values were flat in Q4 2023 compared with the previous quarter. Previously, urban brownfield values had fallen by 20% since the most recent peak of the market in the first quarter of 2022 up to Q3 last year, with greenfield down 17% during the same period. Greater economic confidence and a slowdown in the rise of build costs helped underpin values, says my colleague Anna Ward. Read her full report for more numbers and insight.

Farmland prices – 2023 ends on a high

The Q4 2023 instalment of the Knight Frank Farmland Index has now been published. The average value of bare agricultural land rose by 2% in the final quarter of the year to break the £9,000/acre barrier for the first time. Annual growth was 7%, which outperformed a number of other asset classes. Our research suggests values may flatten out this year, but supply remains limited and demand robust. Read the full report for more insight and analysis.

Country houses – 2023 better than expected

Kate Everett-Allen, our international residential research guru, has added the country homes market to her portfolio and has a bit of good news to report. “Prime country house prices declined by 5.8% in 2023. While this figure represented a sizable correction after two stellar years of growth, the rate of decline was lower than our forecast of -7% for the year. A growing sense that mortgage rates are at, or close to their peak, began to influence market sentiment towards the end of the quarter – a theme we expect to build this year. That’s not to say prices and sales volumes will bounce back strongly. Although the Bank of England opted to hold interest rates at 5.25% in December, the cost of borrowing remains at a 15-year high.” Read Kate’s full report.

Residential – Our forecasts revised

Better-than expected inflation figures leading to lower mortgage rates mean my research colleagues have revised their forecasts upwards for the wider UK housing market. Head of UK Residential Research Tom Bill says: “We now expect UK mainstream prices to rise by 3% in 2024, which compares to a decline of 4% predicted in October. With low-level single-digit growth in subsequent years, we expect cumulative growth of 20.5% in the five years to 2028.”

The Rural Report – Watch the videos!

You've read the book, now watch the videos! To complement the thought-provoking articles contained within the 2023/2024 edition of The Rural Report our whizzy Marketing team has also created a series of videos featuring many of the report's contributors. Head to our very own YouTube channel to discover more about biodiversity net gain and regenerative farming; find out how we are helping Guy Ritchie's Ashcombe Estate on its diversification journey; and read about the travails of an entrepreneurial Zimbabwean searching for a farm for his family. Plus, lots more.