What does stronger UK population growth mean for the housing market?

The ONS published its latest population projections in January which suggest that the UK’s population is likely to grow far faster than previously expected.

2 minutes to read

News last month that the UK population could reach 70 million by mid-2026, a decade sooner than previously thought, has potentially big implications for the housing market, and for the private rented sector in particular.

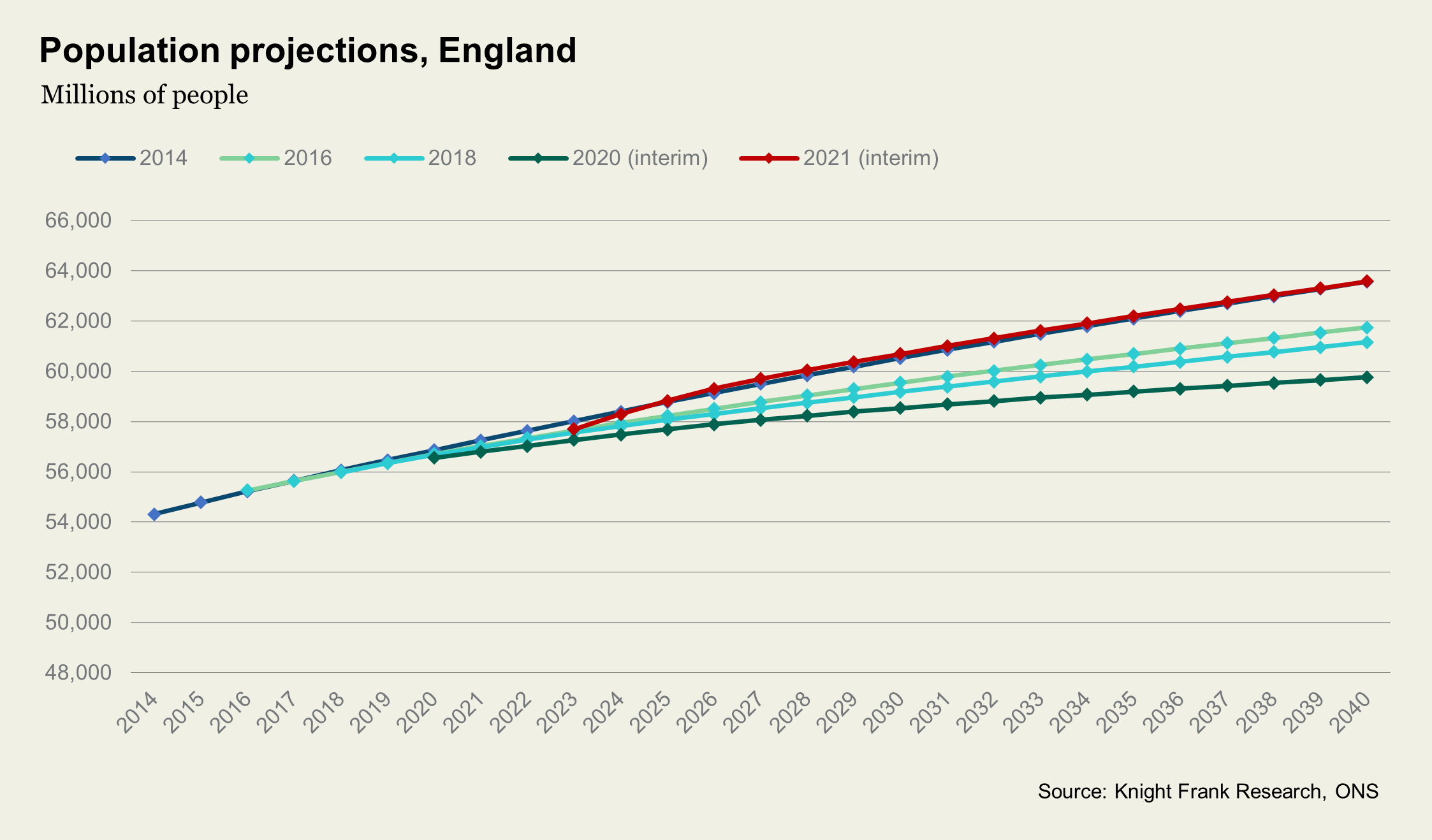

Over the next ten years, annual population growth is expected to reach 361,000 per year, the latest population projections from the ONS suggest. By 2040, England’s population alone is projected to reach just over 63.5 million. The projections point to the population growing far quicker than anticipated in previous projections.

So why the big change? The biggest driver of population growth is a significant increase in projected in-migration - as opposed to natural change through births and deaths. The ONS now expects long-term in-migration to be 315,000 annually, far higher than it had previously projected.

Assuming all of this is right, it has implications for the planning and provision of new housing.

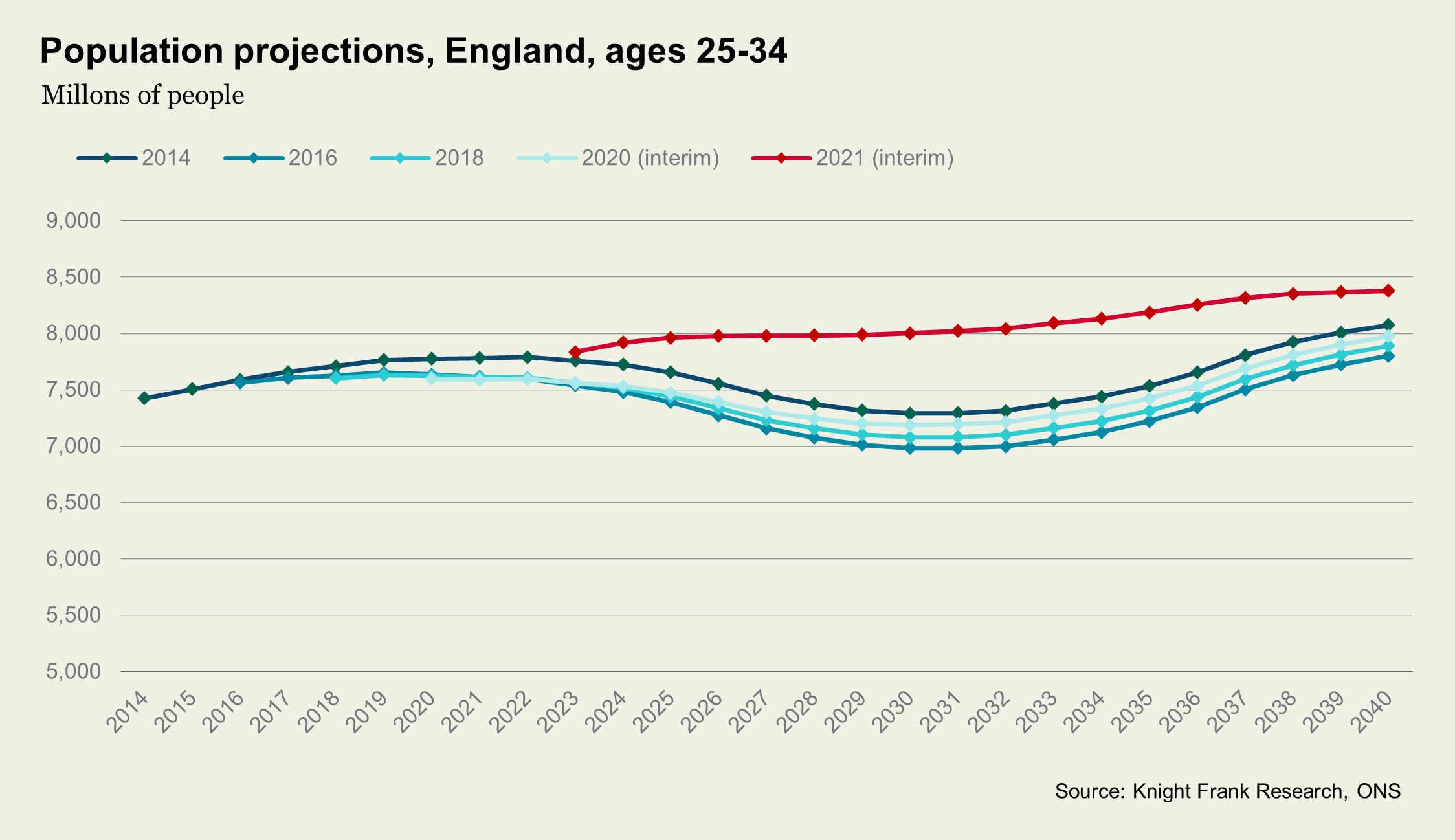

Higher than previously expected migration, for example, will yield a younger population. That’s reflected in the new numbers. The population of 25-to 34-year-olds in England between now and 2040 is now expected to be more than double that in the lowest projection (2016) and 70% higher than that in the 2014 projections (see chart).

Given nearly 40% of existing households in this age cohort rent privately it’s fair to assume that this shift will put additional demand pressures on an already stretched private rented sector. Above average levels of migration over the last few years have been one factor underpinning record rental growth.

Any further uptick in rental demand comes against a backdrop where new buy-to-let investment from private landlords is falling following regulatory and tax changes. Meanwhile, affordability pressures and the removal of government support for first time buyers (in the form of Help to Buy) are keeping more people in rental accommodation for longer.

Accordingly, the type and tenure of new homes will need to reflect this change. A further increase in demand in the PRS – driven by demographic change – strengthens the need for more purpose-built rental housing, for example. That provides a further tailwind for the growth of build to rent (BTR) sector, especially given this age group is most likely to live in BTR.

Encouragingly, BTR development has picked up. There are almost 100,000 BTR homes now completed across the UK, up 19% on the previous year. A further 67,000 are under construction and 77,000 have full planning permission granted, taking the total size of the sector to 244,000 homes.

Yet it remains a small fraction of the overall UK rental market. Completed BTR homes account for just 1.7% of total privately renting households.

For policymakers, the shifting age profile set out in the new projections highlights the need to plan appropriately for the provision of appropriate housing types and tenures which align with the needs of a changing demographic landscape.