Price declines slow as sentiment is buoyed by improving economic indicators

Knight Frank's quarterly valuation-based index tracking the price performance and health of the UK prime country house market

3 minutes to read

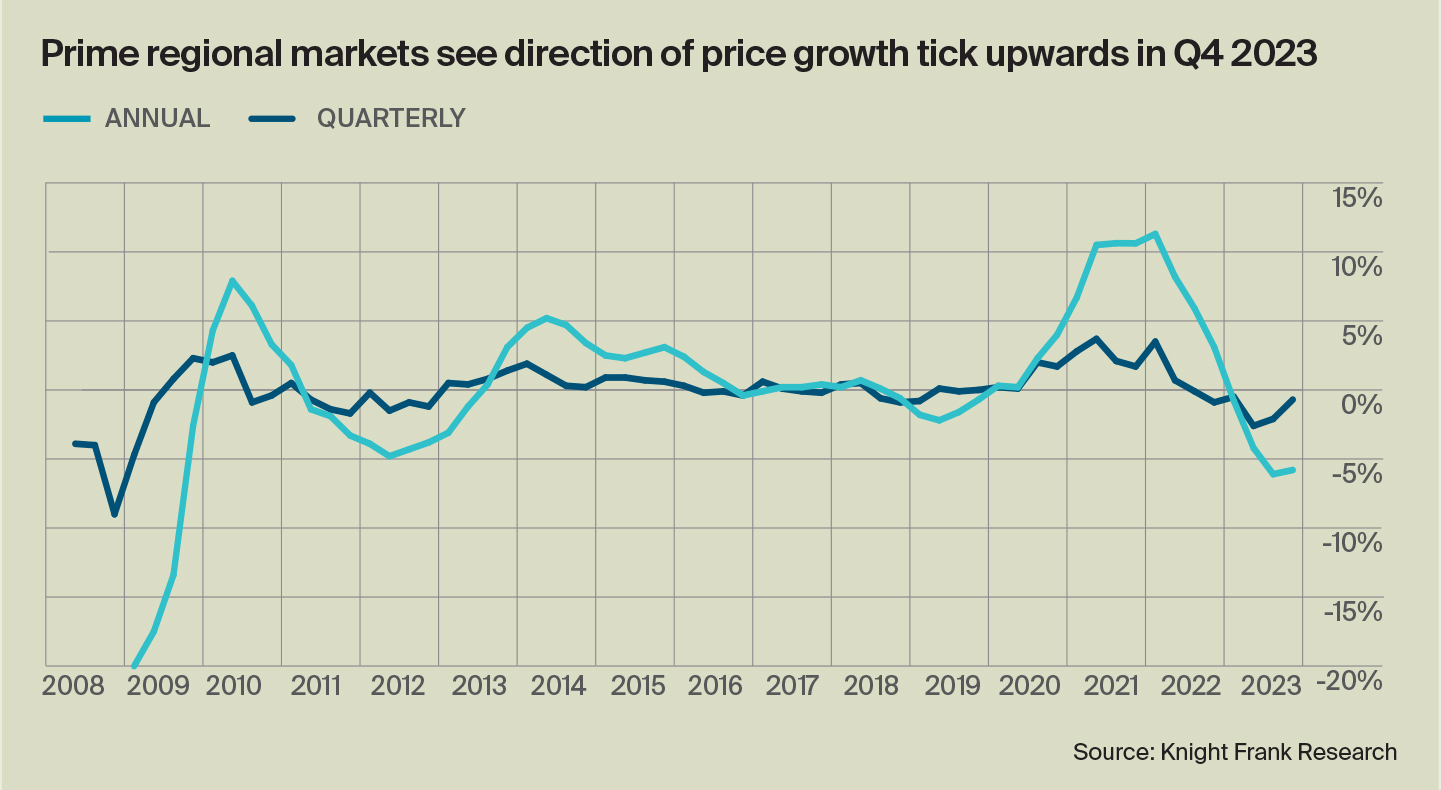

Prime country house prices declined by 5.8% in 2023. While this figure represented a sizable correction after two stellar years of growth, the rate of decline was lower than the 6.1% registered in the previous quarter, and on our forecast of -7% for the year.

A growing sense that mortgage rates are at, or close to their peak, began to influence market sentiment towards the end of the quarter – a theme we expect to build this year.

For the first time since Q1 2022 the index’s annual rate of growth improved quarter-on-quarter in Q4 2023, offering some hope that the worst of this cycle’s price declines may be in the rear view mirror.

That’s not to say prices and sales volumes will bounce back strongly. Although the Bank of England opted to hold interest rates at 5.25% in December, the cost of borrowing remains at a 15-year high.

A look back

Uncertainty pervaded 2023, not good news for housing markets which are largely sentiment driven.

From stubbornly high inflation and resultant interest rate hikes to geopolitical crises in Ukraine and the Middle East, residential markets had a lot to contend with.

The good news is the labour market proved resilient, equity markets surprised on the upside, the FTSE 100 ended the year 3.8% higher, and there was little evidence of forced selling or repossessions.

Despite this it was clear that there was a widening gap between buyer and seller expectations.

Some sellers were seeking pandemic-era prices whilst buyers, aware stock levels had increased along with the cost of debt, were only willing to progress sales if discounts were negotiable.

The data for Q4 2023 provides some positives. On a quarterly basis, average prices were down just 0.7%, which was an improvement on the 2.1% fall seen in Q3.

The latest data shows market appraisals were up 9% compared to the five-year average (excluding 2020) but instructions down 3% over the same period, suggesting some sellers are doing their due diligence, preparing to bring their property to the market.

On the demand side, new prospective buyers were up 3.5% in Q4 compared to the five-year average (excluding 2020) further evidence the market may be gaining traction.

The long view

A quieter 2023 for the country market must be viewed in the context of the last three years. In direct contrast to prime central London, prices are coming off a stellar, and arguably unprecedented, period of growth.

Prime regional prices are 11.4% higher than they were in June 2020, the first full month after the re-opening of the property market due to Covid, when a mass lifestyle reassessment, in part heralded by the transition to hybrid working, prompted a ‘race for space’ which was boosted further by a stamp duty holiday.

A look ahead

Economic data hints at an improving landscape in 2024. The mood music shifted markedly in December 2023 as UK inflation slowed faster than anticipated.

We expect the country market's 5.8% decline in prices to moderate to -3% in 2024, as the economic picture brightens and interest rates start to fall, with positive annual price growth returning in 2025.

When it comes to economic indicators, analysts will be more concerned with GDP than inflation, but it will be politics that take centre stage in 2024.

There is a window of opportunity for buyers and sellers as the economy settles and before a UK general election is called.

Changes to non-dom rules and rates of stamp duty for overseas buyers will be touted as the big election issues for prime housing markets but much has already been priced in.