What’s happening to land values in England?

Land prices in England were flat in the final quarter of the year, with housebuilders predicting values will stay stable in early 2024.

3 minutes to read

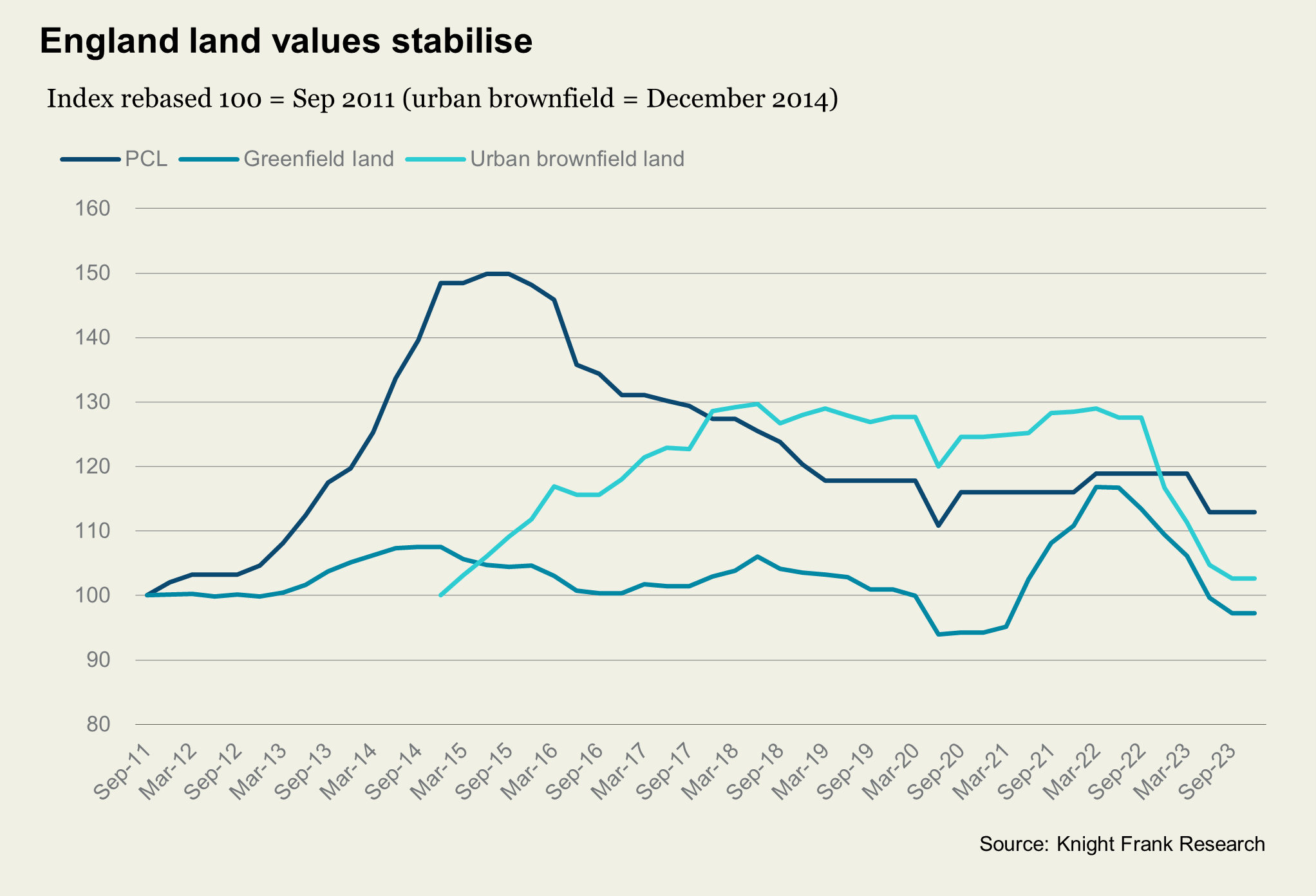

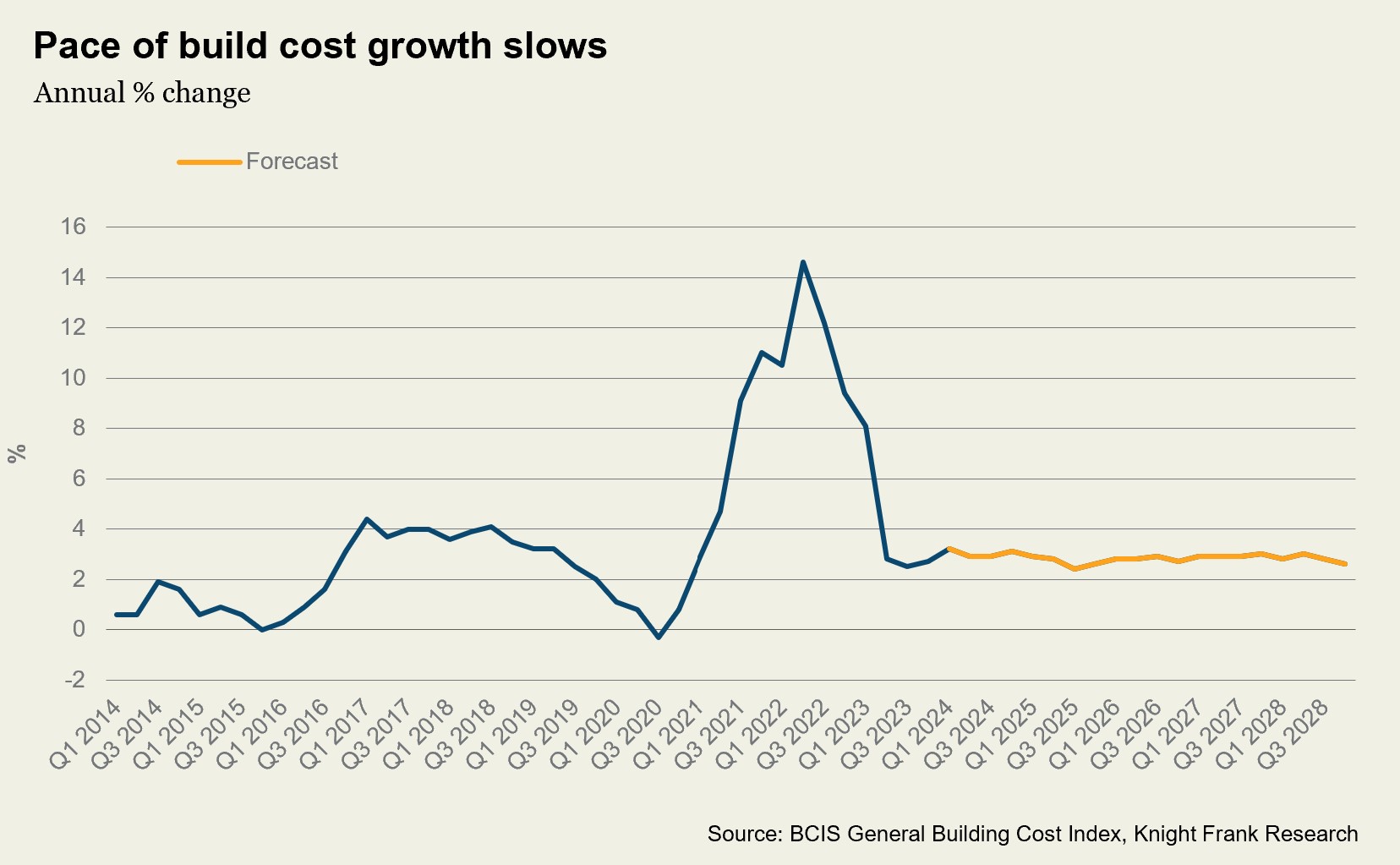

The double digit falls in our Knight Frank land index have bottomed out as the UK’s economic outlook has improved, the pace of build cost growth has slowed considerably, and new home site visits and reservations have picked up.

Block sales to build-to-rent (BTR) housing operators and investors are also helping housebuilders to de-risk sites.

England greenfield and urban brownfield values were flat in Q4 2023 compared to the previous quarter. Previously, urban brownfield values had fallen by 20% since the most recent peak of the market in the first quarter of 2022 up to Q3 last year, with greenfield down 17% during this period (see chart).

In prime central London, land prices were also flat. The PCL land market has proven more resilient over the past couple of years, given its lack of available sites, bigger pool of cash buyers and robust overseas demand.

The majority of housebuilders (70%) said they thought that land prices would be stable in the first quarter of the year, unchanged from Q4 2023, with a fifth predicting a fall and 10% an increase. Previously, half had anticipated a fall in land values when surveyed in Q3.

Economic data improves

In October, financial markets were pricing in a single interest rate cut of 0.25% by the end of 2024. They are currently expecting just shy of five.

Annual inflation rose slightly in the year to December, but this is widely viewed as a temporary blip caused by isolated product lines rather than a reversal of the downwards trend; overall inflation has plummeted from a high of 11% in late 2022 to low single digits.

Plus, wage growth is slowing. This should reassure the Bank of England that higher interest rates are working their way through the economy, reinforcing expectations that they will begin cutting borrowing costs later this year.

Build costs level out

While build costs are still rising, the rate of increase has slowed considerably, which is reducing pressure on housebuilder margins to some extent. The BCIS is forecasting that annual build cost hikes will broadly remain below 3% over the next five years.

For the time being though, the combined cost of materials and labour is viewed as a key challenge for at least a fifth of developers, our survey shows. More critical issues include planning delays, which have worsened, according to our survey, with 90% of respondents flagging these as their biggest issue, up from 80% last quarter. Meanwhile, concerns over mortgage availability and cost have fallen from 47% in the third quarter to a third of respondents in Q4.

Sales supports

When asked what they thought would most support sales this year, 40% said ‘offering incentives’ with 24% pointing to sales to build-to-rent.

The trend of housebuilders selling blocks into the BTR space – predominantly suburban single-family housing – to de-risk sites has longer to run. Overall, 40% of housebuilders said they had sold or intended to sell units to either BTR or single-family housing investors or operators.

For those that had already sold units into BTR, 60% of them said they were prioritising incorporating relevant design elements from the outset, while 40% said that sales into the BTR sector were more of a ‘secondary plan’.

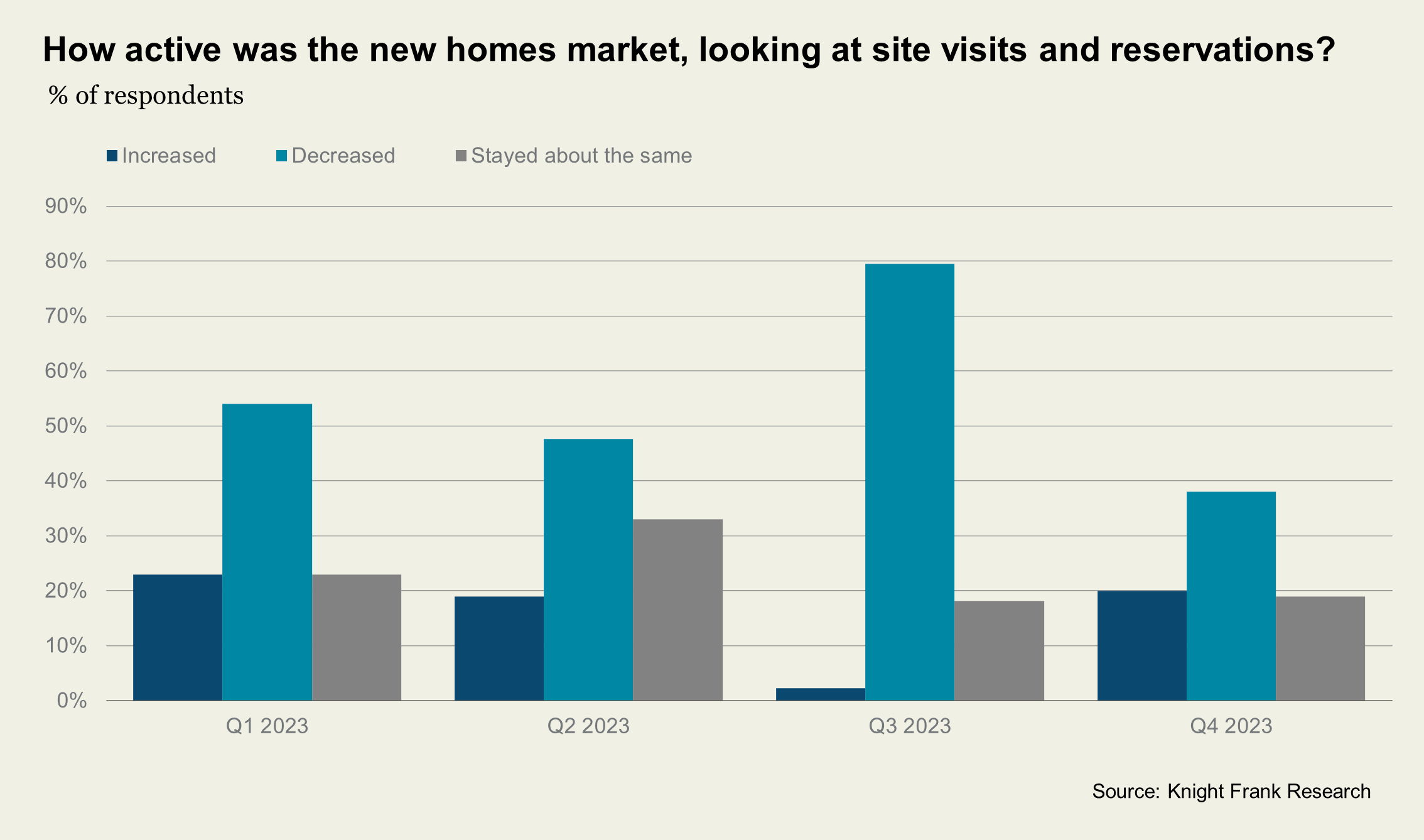

Several housebuilders are yet to report sales rates for the second half of 2023, but our latest Q4 survey of 50 volume and SME housebuilders points to a moderate improvement in site visits and reservations.

Overall, 40% said that these either increased or stayed about the same in the final quarter, compared to a fifth who said this in Q3.