Inflation peaks, what next?

Making sense of the latest trends in property and economics from around the globe.

5 minutes to read

Pivot latest...

US consumer prices rose at the slowest rate for 15 months in November, a second consecutive reading that all but confirms that peak inflation has passed. Shares in Europe and the US accelerated shortly after publication and traders quickly pared back bets on where the current cycle of rate hikes will peak.

The Fed is widely expected to raise rates by 50 basis points later today, bringing the federal funds rate to a range of 4.25% and 4.5%. Investors now expect two more 25bps hikes in the new year, before the Fed pauses at 4.75% to 5%. Fed funds futures are even pricing in three quarter point cuts by the end of 2023.

All of this optimism could be tempered as early as 2pm Eastern Time, or 7pm in London, when the Fed's decision will be published alongside its latest projections. Wages, food and shelter costs remain causes for concern. The Fed may opt to issue a signal that it's prepared to outdo expectations in order to restore price stability.

UK inflation

The Bank of England will have its turn tomorrow. We covered expectations on Monday.

The ONS this morning said U.K. consumer prices rose 10.7% in the twelve months to November, down from 11.1% in November. Like in the US, it's a pretty strong sign that the worst has passed.

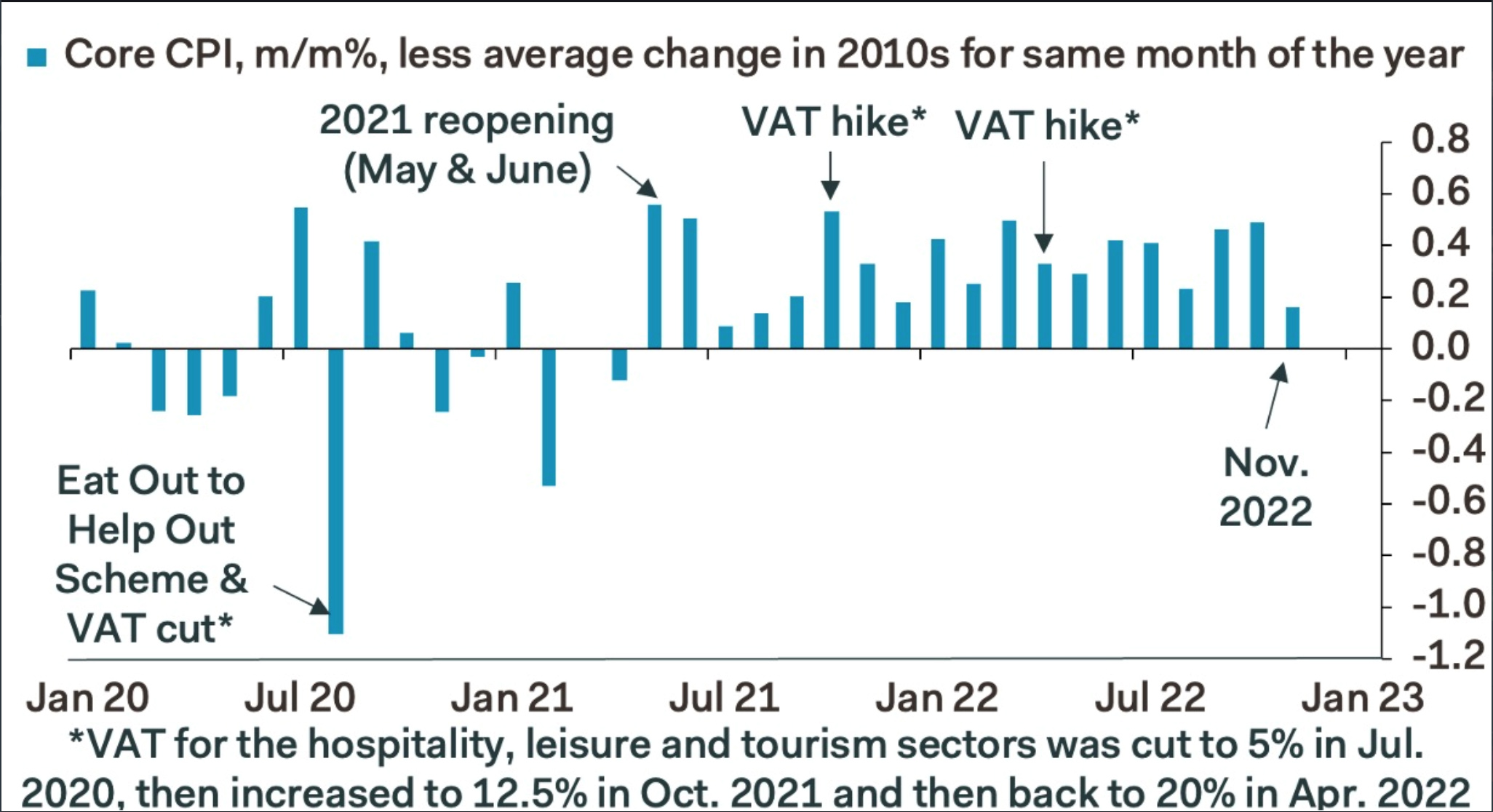

The monthly core CPI exceeded the long run average for November by just 0.16%, the smallest margin on this basis since Dec 2021, according to Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

Financial stability

Yesterday, The Bank of England issued its twice yearly Financial Stability Report that seeks to assess economic risks and considers how the Bank should react to them.

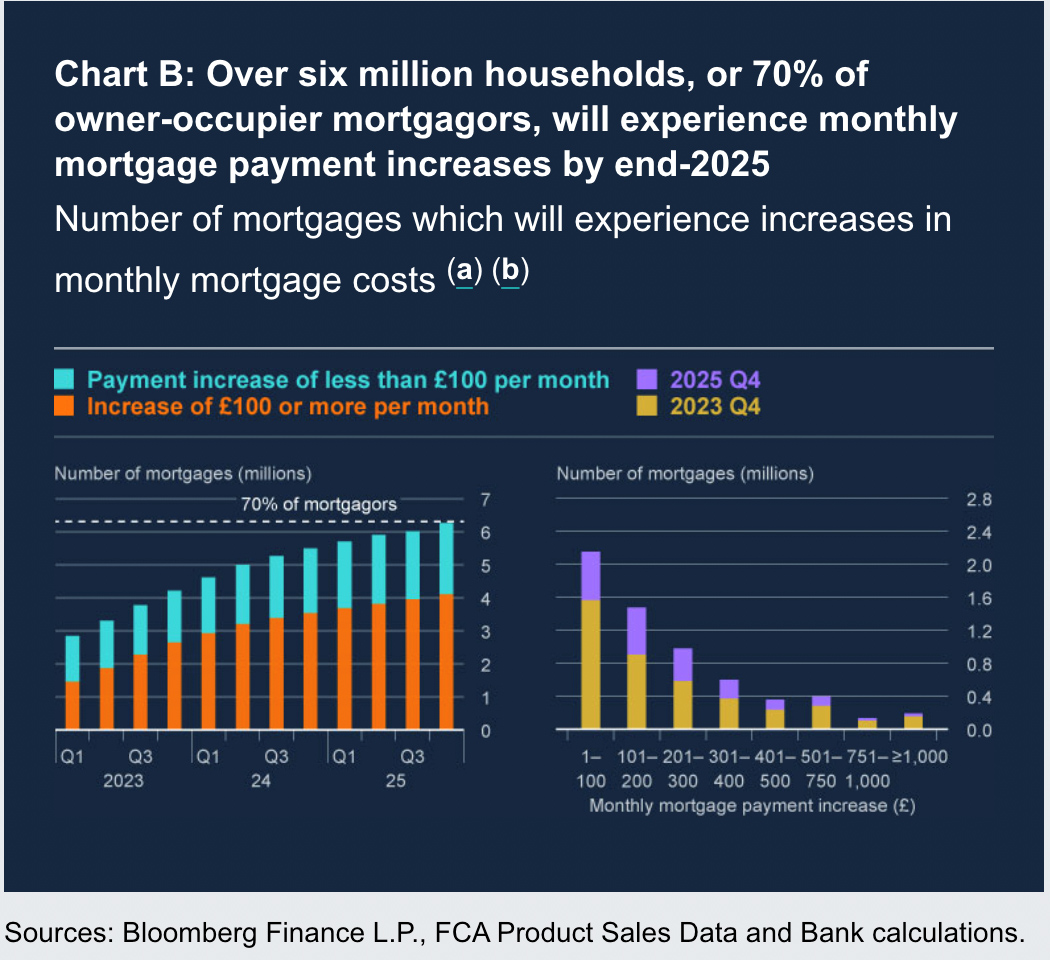

The report includes an assessment of the latest mortgage market figures. Based on average mortgage rates at the end of November, borrowers on fixed rates set to expire next year are facing increases in monthly payments of about £250 when they refinance. For an average household, that means monthly payments rise from £750 to £1,000. That equates to about 17% of their average pre-tax income, up from 12% over the summer. Those most affected are typically younger, have lower incomes and are most leveraged. In total, the Bank expects about four million households will be exposed to higher mortgage rates next year.

The behaviour of landlords "is also likely to have an influence on house prices and there is some uncertainty about how they will act," the report says. There are currently about two million buy-to-let mortgages outstanding, so about 8% of total housing stock. About 85% of those are on interest only mortgages, so higher interest rates have a greater proportional impact. By the end of next year, the Bank expects monthly landlords' monthly repayments to rise by an average £175. One in five will face increases of more than £300.

Some may pass on those costs to tenants, and the Bank estimates that landlords would need to raise rents by about 20% to offset the projected rise in mortgage costs. Others may choose to sell, and the Bank has seen evidence that a growing number of landlords are choosing that option.

London lettings

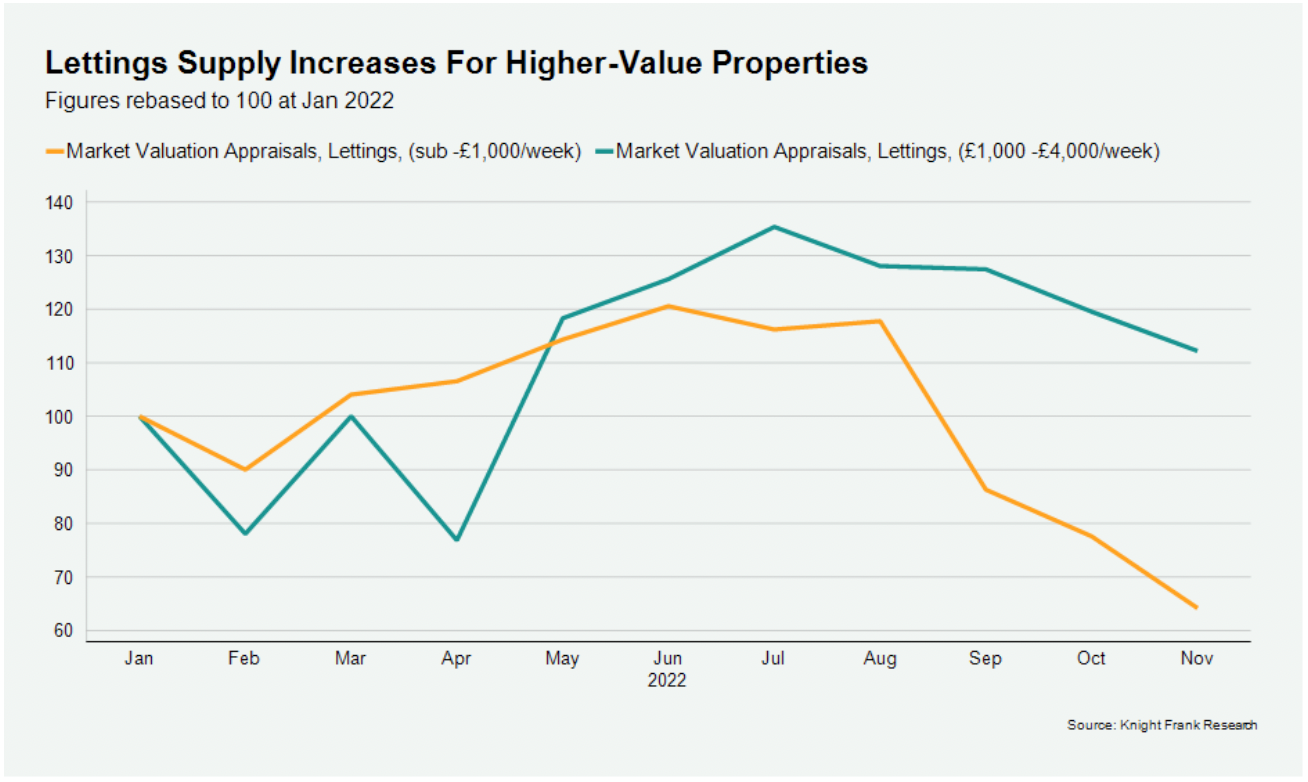

Tenants in London's lettings market have struggled with low supply for months and, though there are some signs that supply is improving, stock levels remain down about a third on the five year average.

Supply has improved more markedly in higher value markets (see chart), in part because sellers of higher-value properties are typically more discretionary and able to sit out the current period of mortgage market volatility by renting out their home. That's cooling rental growth. The average increase in prime central London (PCL) was 17.4% over the most recent 12-month period, while a rise of 15.3% was recorded in prime outer London (POL). That leaves rents 22.1% above their pre-pandemic level in PCL and 20% in POL, according to the latest update from Tom Bill.

For the wider market, lettings supply may not pick up meaningfully until next spring, which is when more accidental landlords could be created, according to Tom. Higher mortgage costs have led to downwards price pressure in the sales market, which is likely to intensify from next year as mortgage offers made before September’s mini-Budget lapse. If owners fail to achieve their asking price, they could explore the rental option in the same way as owners of higher-value properties have done this year.

The view from the US

We're seeing similar themes in New York, where prime rents hit an all-time high in September. Average rents broke the US$5,000 per month threshold for the first time in June 2022, and now sit at US$5,287. Kate Everett-Allen has more.

Sales continue to slow in the national market. Sales through October of this year are just shy of 4.4 million, and the National Association of Realtors estimates the 2022 total will reach 5.13 million units when November and December data are reported, down by more than 16% from 2021’s 6.12 million. See the write up from Reuters here.

Supply is constrained, which is putting a floor under price falls. There were 1.22 million homes for sale in October, roughly half the long-run average.

In other news...

Canary Wharf Group plans life sciences tower (Reuters), Berkeley slows down new UK developments (FT), Bank of England says not worried for now over 'Brexodus' in banker jobs (Reuters), and finally, Shapps defends flexible working rights (Times).