Lettings supply in London likely to remain low until next spring

November 2022 PCL lettings index: 200.8

November 2022 POL lettings index: 204.3

2 minutes to read

Rental value growth in prime London markets continued to slow in November as the disparity between supply and demand narrowed.

The average increase in prime central London (PCL) was 17.4% over the 12-month period, while a rise of 15.3% was recorded in prime outer London (POL). It left rents 22.1% above their pre-pandemic level in PCL and 20% in POL.

Even though growth is slowing, there are few signs that life is getting easier for prospective tenants in the capital due to stock levels that are down by about a third on the five-year average.

Demand has soared as offices and Universities have re-opened but supply has struggled to keep pace as owners took advantage of a resurgent sales market. Prospective landlords have also been put off by tax hikes in recent years and the prospect of further legislative changes, intensifying upwards pressure on rents.

Last month’s Autumn Statement could have contained worse news for landlords but a cut to the annual exemption for capital gains tax (CGT) means they will have to pay an extra £2,600 from April 2024 when they sell.

There was speculation that rates of CGT and income tax would be aligned, which would have been more punitive given the top rate of income tax is 45%, but it failed to materialise.

Perhaps the government is aware of the risk that it could be fighting the next election against the backdrop of rising rents and falling house prices.

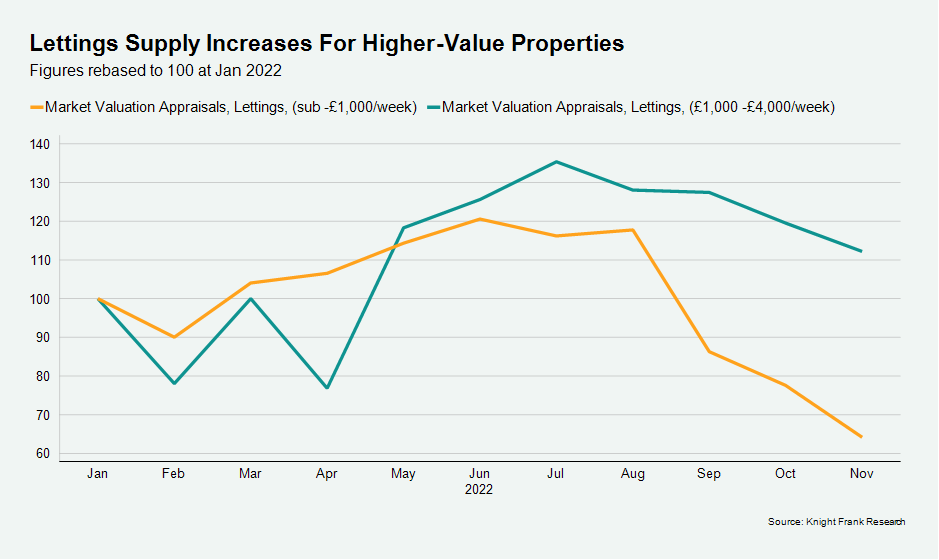

There are some signs that supply is improving but this is primarily in higher-value markets, as we explored last month and the chart below shows.

Market valuation appraisals for lettings properties valued between £1,000 and £4,000 per week were 12% higher In November than January. Below £1,000 per week, there was a 35% decline, and the overall fall is 24%. Appraisals are a leading indicator of supply.

The reason is that sellers of higher-value properties are typically more discretionary and able to sit out the current period of mortgage market volatility by renting out their home.

For the wider market, lettings supply may not pick up meaningfully until next spring, which is when more accidental landlords could be created.

Higher mortgage costs have led to downwards price pressure in the sales market, which is likely to intensify from next year as mortgage offers made before September’s mini-Budget lapse.

If owners fail to achieve their asking price, they could explore the rental option in the same way as owners of higher-value properties have done this year.

Provided the uncertainty doesn’t mean a larger wave of buyers become tenants, only then may we see meaningful downwards pressure on rents.