Decision time for central banks

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

A big week for data

It's going to be another important week packed with releases of economic data that will set the tone for at least the first six months of 2023.

A new US consumer price inflation index will drop tomorrow, before the Fed makes its next decision on interest rates on Wednesday. Consumer sentiment improved markedly during December as the public's expectations of inflation fell to a 15-month low. Mortgage rates peaked four weeks ago.

A soft CPI reading tomorrow will further embed beliefs that the Fed's war on inflation is entering a new phase - economists surveyed by Bloomberg expect a 50 basis point hike on Wednesday and another 50bps of tightening next year before pausing. What happens next is now a point of contention. While respondents believe rates will stay on hold through 2023 after peaking, markets are betting on a rapid retreat as the economic data sours.

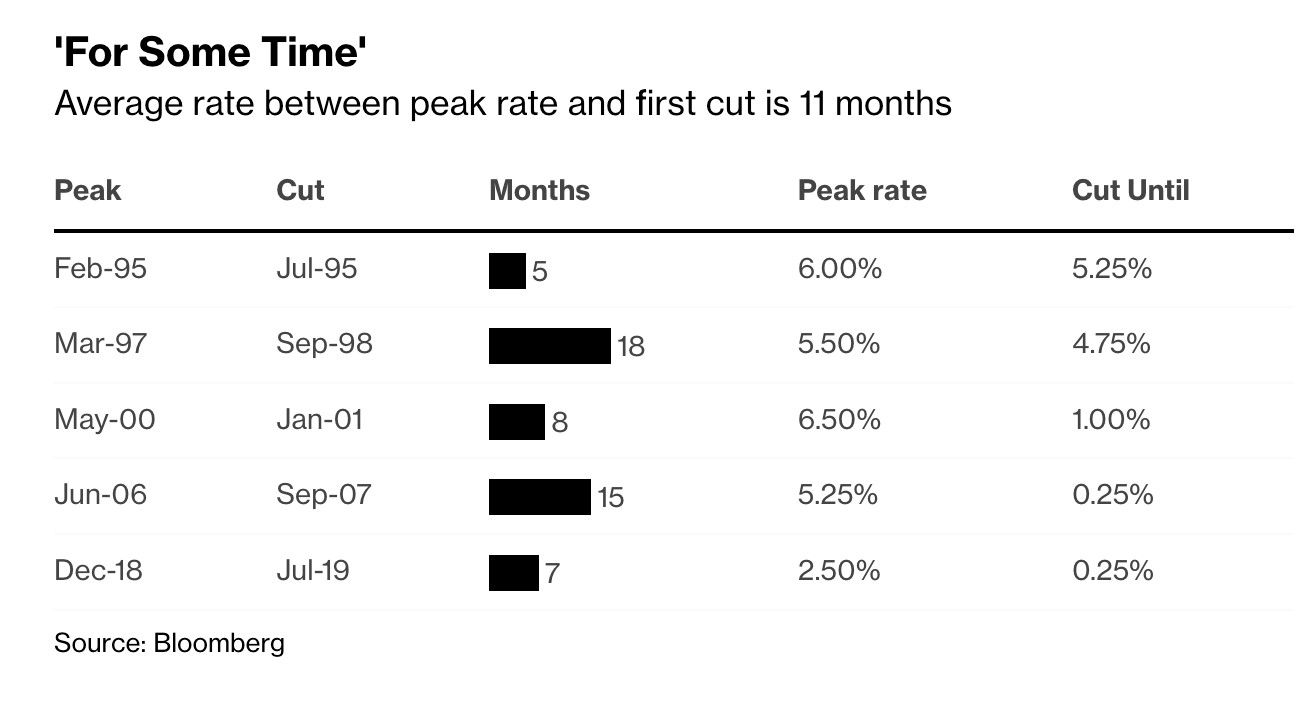

Over the last five interest rate cycles, the average time spent at peak interest rates before the first cut was 11 months - table courtesy of Bloomberg.

Inflation attitudes

The British public aren't as optimistic. Their expectations of inflation over the next one and two years are running at the highest level in almost a decade, according to the Bank of England's quarterly Inflation Attitudes Survey, released Friday. Faith in the Bank to control inflation cratered to the lowest level on record.

Inflation expectations further out look more benign, which tallies with the influential Citi/YouGov survey. Regardless, the Bank is expected to execute a 50bps hike on Thursday, taking the base rate to 3.5%. Economists recently surveyed by Reuters expect a peak of 4.25% in Q2.

The European Central Bank is also likely to execute a 50bps hike on Thursday, easing off from two consecutive 75bps hikes at the previous meetings.

UK housing activity

The hit to UK housing market sentiment brought on by the mini-budget slowed activity markedly. We talked on Friday about the RICS survey showing contractions in housing metrics spanning new buyer demand, agreed sales and new instructions.

Rightmove this morning reports that asking prices dropped 2.1% in December. Meanwhile new forecasts from banking industry body UK Finance indicated lenders expect to advance 23% less to homebuyers next year, taking volumes back to their pre-pandemic level after two very active years.

The group expects lending to buy-to-let landlords to fall 27%, while UK-wide transactions will fall to 1.01 million, from 1.27 million this year.

Prime London

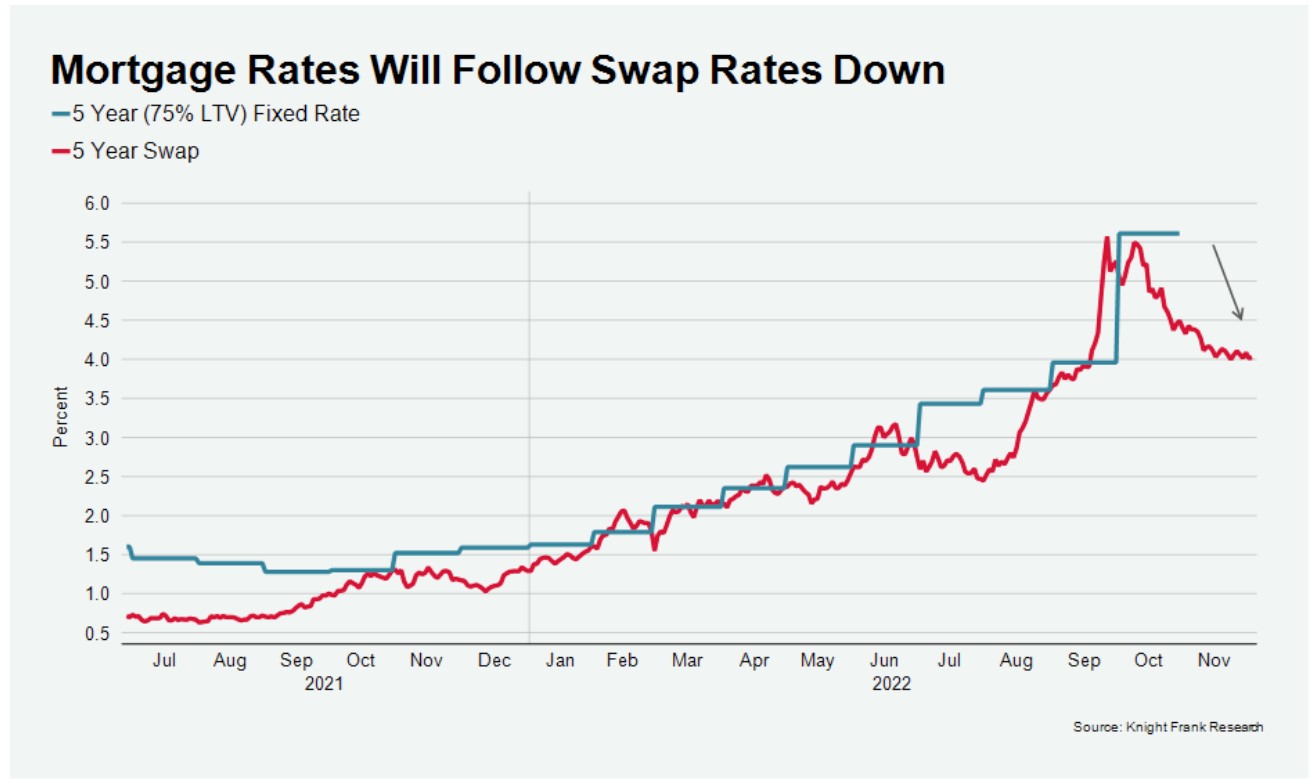

We expect mortgage rates to continue easing in line with swap rates, which will support activity - see chart courtesy of Tom Bill's update on prime central London this morning.

Prime London markets are more protected from high mortgage rates, but they are not immune. Demand is still relatively strong, but the recent mortgage market volatility has led to fewer offers being made.

While the number of new prospective buyers was 26% above the five-year average in November (excluding 2020), the number of offers made was 17% lower. Meanwhile, on the supply side, the number of new sales instructions was 5% higher.

Prices in prime London postcodes dipped for the second consecutive month, mirroring the wider UK market. Average prices in PCL fell 0.2% in November, taking the annual change to 1.7%. In POL, the decline was 0.1%, which produced an annual increase of 4.6%.

Industrial land

The value of industrial land climbed 163% between Q1 2019 and Q1 2021 amid fierce competition. Values are now easing again, driven by rising build costs, lower capital values and downward revisions for growth, according to the latest index from Claire Williams.

Values have dropped by an average 35% in the most recent six months The rapid fall in what sellers are willing to pay has created a disconnect with what sellers are willing to accept, which is weighing on transactions. Pricing shifts and changing growth expectations have also made development unviable in some markets.

All regions recorded a fall in land values, though Greater London held up best, recording a regional decline of just 12%. The London Borough of Brent performed best over the period, with land values dipping just 3%, followed by Wandsworth and Merton, where values declined 5%.

See the piece linked above for the outlook for rents and capital values.

In other news...

Next year’s unpleasant choices confronting the Fed (FT).