Investors are calling the bottom in China

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

Most up, first down

Annual growth in prime house prices eased to 7.5% during the third quarter, down from a peak of 10% in the year to Q1, according to our latest Prime Global Cities Index.

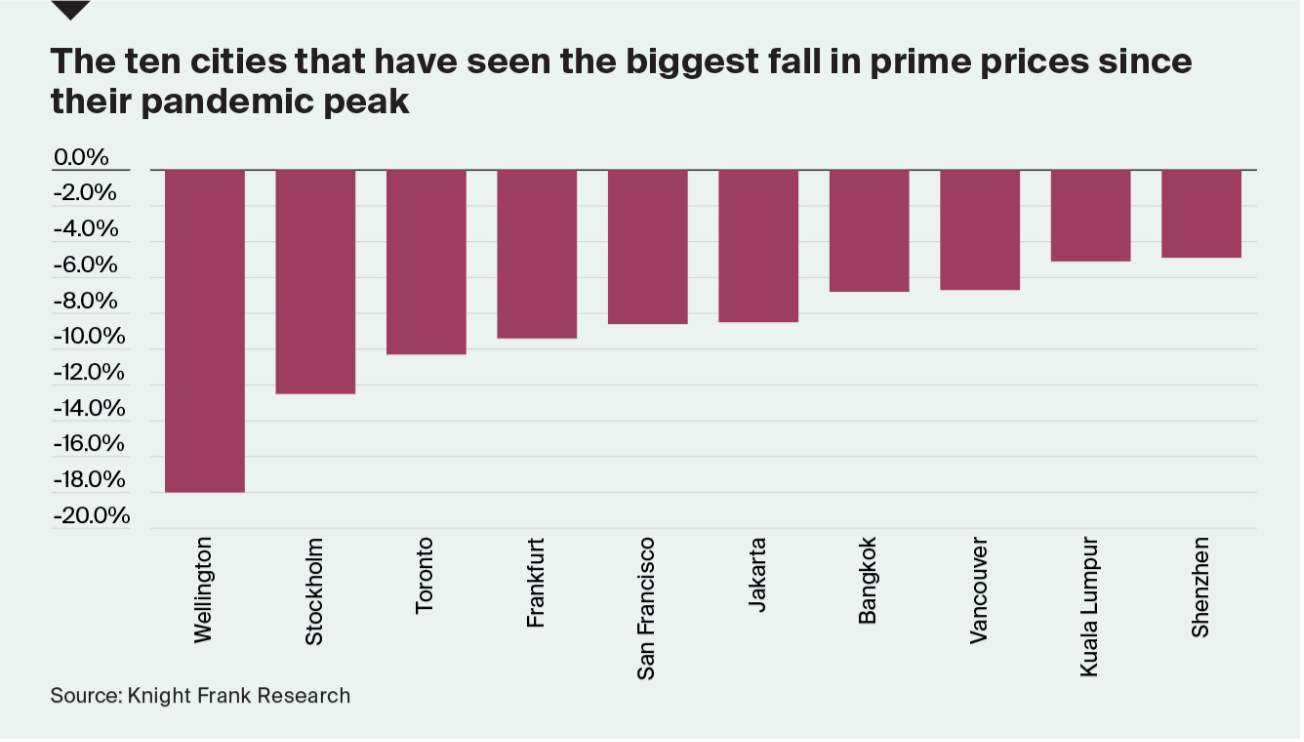

Of the 45 cities we track, 19 saw prime prices decline between June and September 2022, up from seven in Q1 2022. Markets that registered some of the strongest price rises during the pandemic are well represented amongst this group: San Francisco, Toronto, Wellington, Stockholm, Vancouver, Los Angeles, Seoul, as well as some Chinese mainland cities (see chart).

The strong performance of some European cities is likely to reflect seasonal demand over the summer, but also a degree of safe haven capital flight. Zurich (10.7%), Edinburgh (9.9%), Berlin (9.4%), Dublin (8.6%) and Madrid (5.6%) have all risen up the rankings in the last 12 months despite the drop in sentiment and the slowdown in the Eurozone’s economy.

Calling the bottom in China

The Chinese government has for months been battling to turn around a residential property slump and housebuilder debt crisis. Investors are beginning to believe that stimulus efforts are working - a Bloomberg Intelligence index of developer stocks surged 10% overnight, the biggest gain in eight months.

An expansion of a government debt financing package prompted the rally but it follows a week or so of rumours that the government might embark on a protracted exit from its zero-Covid strategy. The government has poured cold water on those rumours in the interim and it's hard to see a residential market turnaround with current policies in place.

Property sales by floor area in 100 Chinese cities fell about 20% year-on-year in October, according to the China Index Academy (CIA). That's despite more than 230 stimulus policies introduced by 160 local governments in September and October.

China's commitment to utilise real estate to underpin growth (see final section of this note) will have implications for the climate. The nation's colossal building materials sector this week pushed back its date for peaking carbon emissions to 2030, back from the 2025 target in place as recently as September. China’s cement industry alone is responsible for as much carbon as the whole of India’s energy production, according to BP Plc data cited by Bloomberg.

The growth of UK Build to Rent

Investors spent almost £1.5 billion on Build to Rent assets in the third quarter, up 10% on the same period the previous year, according to Knight Frank data. That brings total investment this year to £3.165bn - a record year is within reach.

Mortgage costs are rising as the stock of rental properties continues to decline, providing a powerful long term tailwind to the sector. Nearly a third of letting agents have seen at least 10% of the landlords on their books quit the sector during the last year alone, according to a recent survey by lettings platform Goodlord.

There are headwinds. The cost of debt has risen in recent weeks, though it now looks to be stabilising. Still, investors have earmarked huge pools of capital for the sector and a combination of the intelligent use of debt and strong rental growth will help unlock much of it. We'll be taking a deeper dive into these numbers later this month.

Trading updates

On Wednesday we covered the woes of many online retailers - you can see Stephen Springham's take here. A view from the other side comes in the form of a Hammerson trading update yesterday.

Footfall across its UK and Ireland properties continues to improve and is now at about 90% of 2019 levels. Sales are running above 2019 levels. Shares climbed almost 10%.

Another trading update comes from Persimmon. The company is positioned to deliver full year completion numbers within its expected range of between 14,500 and 15,000 homes. Mortgage providers and borrowers are starting to adapt to higher mortgage rates, though the full impact on consumer behaviour is yet to be determined, the company said.

In other news...

The pandemic followed by a major transport strike boosted the use of bicycles and electric scooters in Greater Paris. David Bourla canvasses real estate investors to see how they are adapting.

Why ESG investing in Africa should form part of the conversations at COP27, from Knight Frank's Boniface Abudho.

Elsewhere - the Bank of England’s stance on QE may have added to high inflation, says Pill (FT), and finally, can the building sector clean up its act? (Bloomberg).