Soft mobility uptake influencing real estate investment

The major transport strike and health crisis of 2019 have given a boost to use of bicycles and electric scooters in Greater Paris.

5 minutes to read

Fear of the virus, the search for well-being, comfort and savings, and the reduction of carbon emissions from daily travel are some of the reasons for this uptake in use.

Soft mobility is also benefiting from favourable public measures, including financial aid to individuals, an increase in the number paths and an increasingly restrictive regulatory framework for the circulation and parking of combustion engine vehicles.

Changes in the workplace also play a key role. With the health crisis, employee well-being has become more important for companies who are eager to enhance their employer brand as well as bring employees back to the office.

Key figures:

• 40 Million journeys per day in the Greater Paris Region, of which 72% are home-to-work journeys of less than 10 km.

• 91% of French people would like to reduce the environmental impact of their daily travel.

• 200 km of temporary cycle paths were created in the Greater Paris Region during the health crisis. Some of these will be made permanent and will be added to the 6,000 km of existing cycle routes.

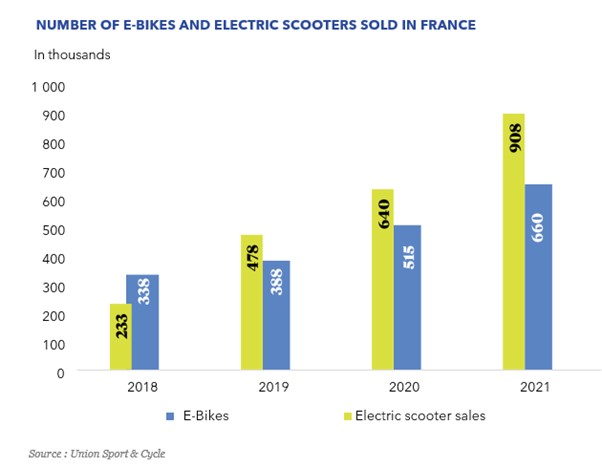

Soft mobility increasing popularity

Although it is commonly accepted that cycling is the most environmentally friendly mode of transport, it accounts for just 3% of all journeys in France, well behind the car (31%).

As part of its "Cycling and Active Mobility" scheme, the government announced in 2018 that it wanted to triple this share by 2024 .

This is an ambitious goal, but one that is achievable for the shortest journeys, for which the car accounts for a high proportion (60% of journeys of less than 5 km in the Greater Paris Region).

For home to work journeys of less than 5 km, soft mobility accounted for 23% in France in 2017 (source INSEE). The proportion varies significantly depending on the size of the urban area and the quality of the infrastructure but is generally increasing.

The " Vélo & Territoires " association estimates that bicycle journeys in cities between January and May 2022 increased by 42% compared to 2019.

Parisians are increasingly favouring walking (48% of investments compared to 40% in 2018), while the share of cars is gradually decreasing (31% compared to 34% in 2018).

As for cycling, the increase remains modest but real (3% in 2021, after 1% in 2010). According to Vélo & Territoires, cycling increased by 35% between 2019 and 2021, compared with an average of 18% in France.

Greater Paris cycling infrastructure

The health crisis made it possible to improve infrastructure for cycling in a very short space of time.

The cycle paths which appeared just after the outbreak of the pandemic will in part be made permanent and will greatly increase the density of the network of cycle paths in the Greater Paris Region.

A total of 52 km of cycle paths will be made permanent between now and the 2024 Olympic Games; the same applies to the La Défense business district (almost 6,000 cyclists now use the Pont de Neuilly path every day).

Green regulatory framework

The French regulatory framework has been gradually strengthened to better integrate environmental issues including having companies with more than 100 employees to establish a mobility strategy to limit the carbon footprint of commuting.

Companies lead on environmental change

The outbreak of the health crisis has largely contributed to an increased awareness of the ecological crisis.

This phenomenon is particularly noticeable in the business world where savings, in the energy consumption of buildings as well as in home-work trips, are a priority.

Corporate Social responsibility, choosing accredited real estate assets, covering soft mobility costs and the creation of new solutions are some of the ways companies are taking ecological responsibilities seriously.

How are investors responding?

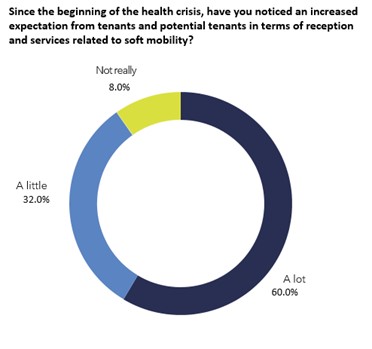

A recent Knight Frank survey was conducted, made up of a large panel of investors, real estate companies, savings collectors, insurers and international investment funds.

The aim was to assess the impact of the growth in soft mobility on the management and marketing of their assets.

Main findings of the survey:

Investors appreciate soft mobility importance

• Since the health crisis began, 92% of them have noted that office occupiers' expectations in this area are higher and 97% say they have improved the integration of soft mobility in their assets. Furthermore, for 57% of them, the development of dedicated solutions to encourage the use of soft mobility in their new projects will be systematic.

A marketing tool

• Only 9% of respondents believe that improving facilities and services for soft mobility does not help the marketing of an asset. For the others, this is primarily achieved by providing dedicated facilities (lockers, changing rooms, etc.) and increasing the number of parking spaces.

Amortise the cost of new facilities

• Almost 20% of respondents indicate that they are still considering how best to recoup the costs of increased integration of soft mobility. For 30% of them, it is seen as an additional service, reinforcing the quality of the services offered to the tenant.

Adapting new buildings

• For 88% of respondents, the ability to adapt existing buildings is the main obstacle to the integration of soft mobility in office buildings. This finding is a reminder of one of the main challenges facing the real estate industry in the years to come: adapting existing buildings to new uses.

Too many car spaces

• Almost half of the respondents (47%) see an excess of parking spaces for cars in their assets. Among the solutions implemented to use this unused space, partnerships have been formed with service providers such as Yespark or BePark. But this space can also be reallocated to other uses than the car, and in particular to make more room for soft mobility.

Discover more

Download the full report or sign up for more market-leading research, comment and analysis.