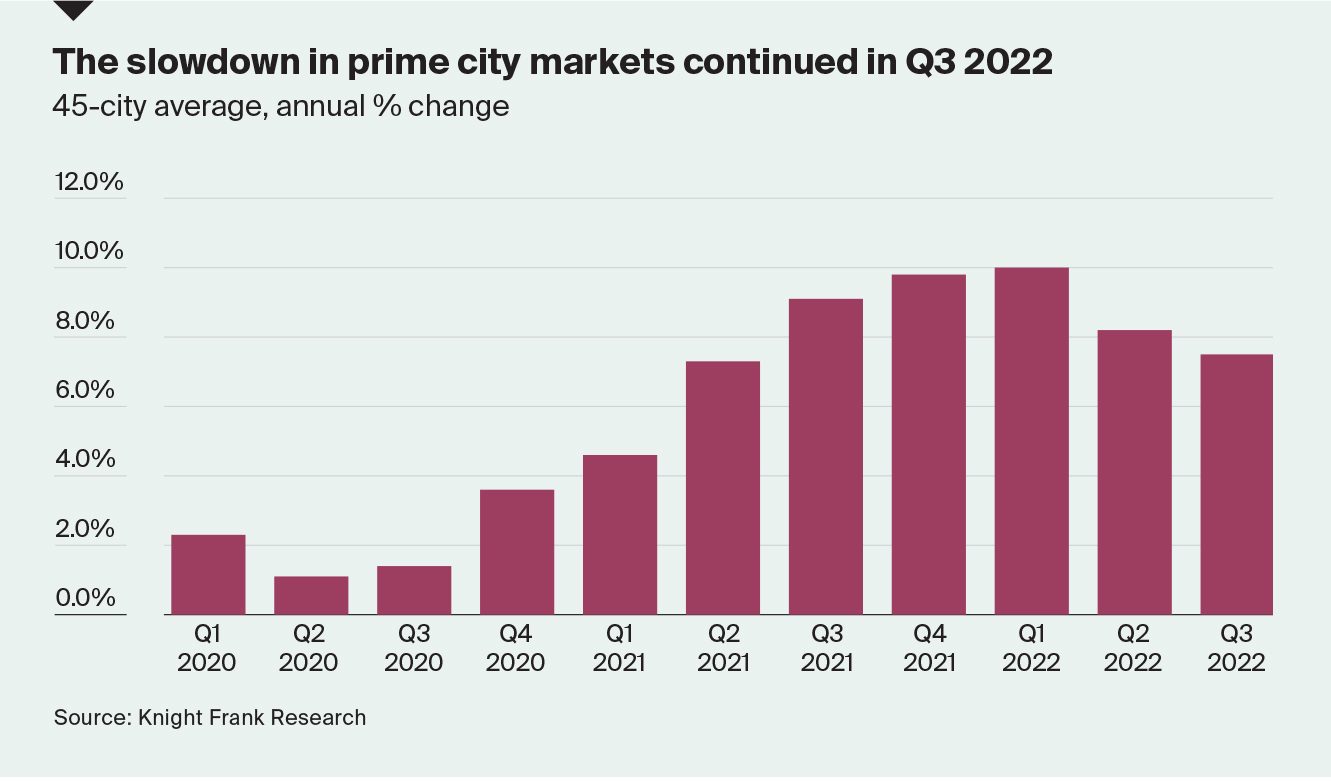

Prime residential price growth dipped for second consecutive quarter in Q3 2022

Prime Global Cities Index recorded average annual growth of 7.5% in Q3 2022, down from 10% peak in Q1 2022.

1 minute to read

However, at 7.5%, annual growth still sits above the index’s average five-year growth rate of 4.4%, and the number of cities registering year-on-year price falls has only shifted from six last quarter to seven this quarter.

The index tracks the movement in the top 5% of residential prices across 45 global cities.

But dig deeper and the quarterly data reveals a marked slowdown. Of the 45 cities tracked, 19 saw prime prices decline between June and September 2022, up from seven in Q1 2022.

Those markets that registered some of the strongest price rises during the pandemic are well represented amongst this group: San Francisco, Toronto, Wellington, Stockholm, Vancouver, Los Angeles, Seoul, as well as some Chinese mainland cities.

In prime central London (2.7%) prices are now rising at their fastest rate since Q1 2015. Meanwhile, in New York, the rate of annual growth has dipped to 5.2% from 7.1% last quarter, but it remains well above its average rate of growth over the last five years of -1.2%.

The strong performance of some European cities is likely to reflect seasonal demand over the summer, but also a degree of safe haven capital flight. Zurich (10.7%), Edinburgh (9.9%), Berlin (9.4%), Dublin (8.6%) and Madrid (5.6%) have all risen up the rankings in the last 12 months despite the drop in sentiment and the slowdown in the Eurozone’s economy.

Resilient labour markets, a lack of supply and well capitalised lenders will support prime prices in most markets into 2023. However, the transition out of a sustained period of low lending rates will lead to pinch points in some markets, particularly amongst highly-leveraged prime landlords, potentially adding to stock levels in some cities.