Meeting the Commercial Property Retrofit Challenge - Part 2: The Business Case for Action

Quantifying the costs and benefits associated with improving ESG credentials of commercial properties in the UK

3 minutes to read

You can find the full report here, but for the quick take and a guide of where to find the information in the report see below.

In Part 1: Defining a Strategy, we defined the scale of the potential obsolescence challenge and the avenues to consider. This report, the second in the three-part series, begins to weigh the benefits and costs of intervention to uncover optimal solutions

18% relative rental uplift

Assessing the potential rental uplift from retrofitting or refurbishing will play a role in determining the overall optimal scenario. Offices which have been retrofitted or refurbished, upgrading from EPC C (or lower) to EPC B or above, often with added amenities, have, on average, seen the gap to prime rental levels narrow by 18 percentage points, see page 4 for details. However, investors should consider the potential value enhancements alongside the level of intervention, the market context, future pipeline, the occupier pool and requirements as there can be wide variation and it requires bespoke asset assessment, as noted on page 3.

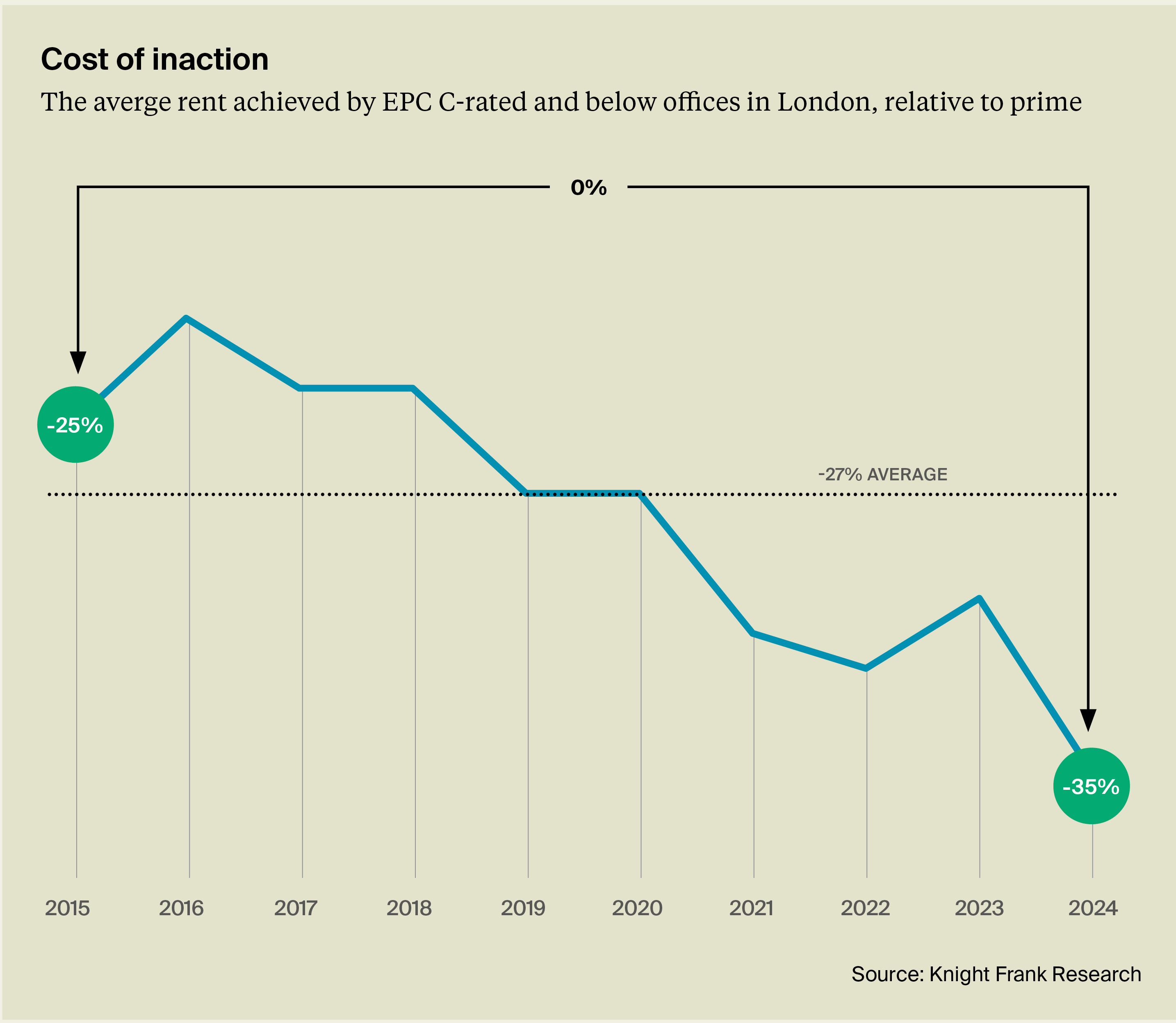

27% below prime

The cost of inaction, or base case, is growing and may continue to do so, given the trends highlighted in Part 1. The rents achieved by the retrofitted and refurbished London sample remain, on average, 10% lower than the relative prime levels. However, rents for London offices rated EPC C and below are, on average, around 27% lower than prime levels, and this gap has widened in recent years, see page 4. While new construction may achieve prime rents, it must be balanced against longer timelines, higher costs, lifetime carbon considerations, and potential planning challenges, which will be further explored in Part 3.

70% include outdoor spaces

The type of amenity, rather then the quantity, appears to have the most impact on relative rental uplift. Outdoor space, such as a courtyards or terraces, offers the greatest differential in our sample, with some 70% of properties experiencing above average relative rental growth featuring such amenities, compared to just over 40% of those with below average uplifts. Identifying the right amenities will aid in assessing the balance between net lettable area and amenity space, as well as informing certification strategies, see page 5.

6 months pre-let

The wider benefits to assess include lower risk premiums from reduced vacancy and void periods, as well as ancillary income streams. In London, retrofitted and refurbished offices, that achieved BREEAM Outstanding or Excellent certification or an EPC A-rating were pre-let, on average, six months before completion. In contrast, buildings with lower ratings averaged just over two months before completion. We explore more on page 6, alongside our expert discussions on wider benefits, such as ancillary income or financial implications through sustainability-linked loans, on page 7.

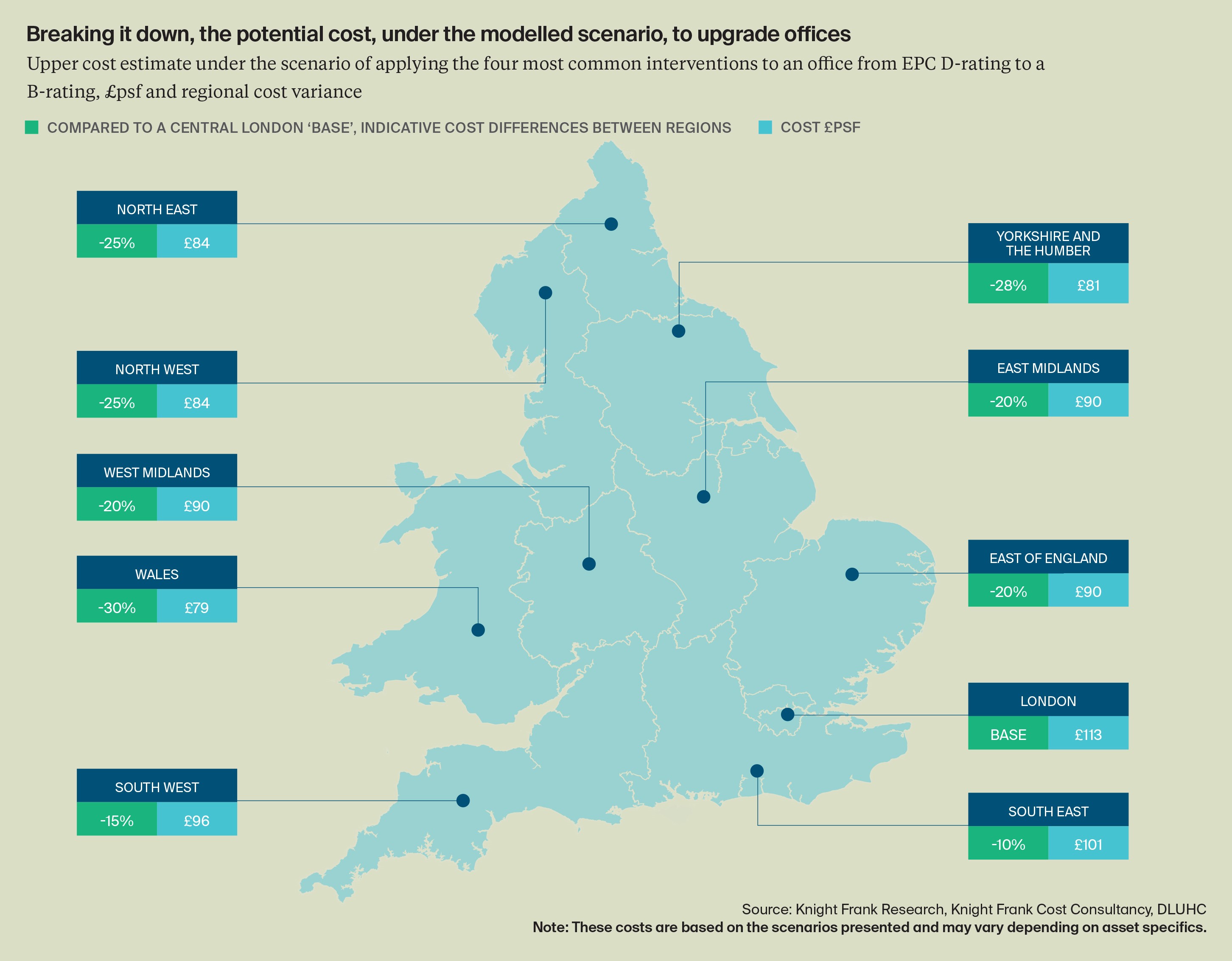

£113 psf cost for EPC improvements

The cost to upgrade will depend on building factors, location, size, interventions required, and amenity provision, making asset-specific assessment critical. Understanding the variance and baseline costs can help narrow down potential strategies. Our hypothetical scenarios, include an EPC D-rated office building in London being upgraded to meet the potential EPC B minimum, which would cost £113 per square foot (psf). When combined with a high level of amenity, see page 12 for details, this would rise to £268 psf. Costs vary greatly with asset specifics as well as location.

£250 psf for F&B

Amenity provision versus net lettable area becomes a greater factor when weighing up costs and practicalities. For example, whilst food and beverage (F&B) is among the top amenities on occupiers wishlists, the cost can be c.£250 psf, and practicalities of operation are important to consider, as pointed to on page 8. Similarly, collaborative meeting spaces can cost between £90 and £120 psf. Detailed, asset-specific analysis is crucial to determine the most cost-effective approach, ensuring that investments align with both regulatory requirements and market demand to maximise potential value.