Is the biodiversity market a silver bullet for landowners?

Five months of data reveal that off-site biodiversity credit requirements average just over one unit per Local Planning Authority (LPA) annually. Is this a timing issue, a policy design flaw, or an indication of limited future demand?

5 minutes to read

Background

From April 2024, the UK government made it mandatory for developers to deliver a minimum of 10% Biodiversity Net Gain (BNG) for every new development in England, compared to the pre-development baseline, albeit with some exceptions, with large sites having done so since February 2024.

Developers can meet this BNG requirement in one or a combination of the following ways:

- On-site: Enhancing and/or restoring biodiversity within the development boundary.

- Off-site (see Note 1): Developers can deliver biodiversity gains on other land they own or buy off-site biodiversity units.

- Statutory credits from Natural England: As a last resort, developers can buy statutory credits if they cannot meet the BNG requirements on-site or off-site. Natural England will use the revenue to invest in habitat creation in England.

However, early analysis suggests that demand for off-site solutions—BNG units—has been very limited, we explore the numbers and question why?

Sizing the market demand

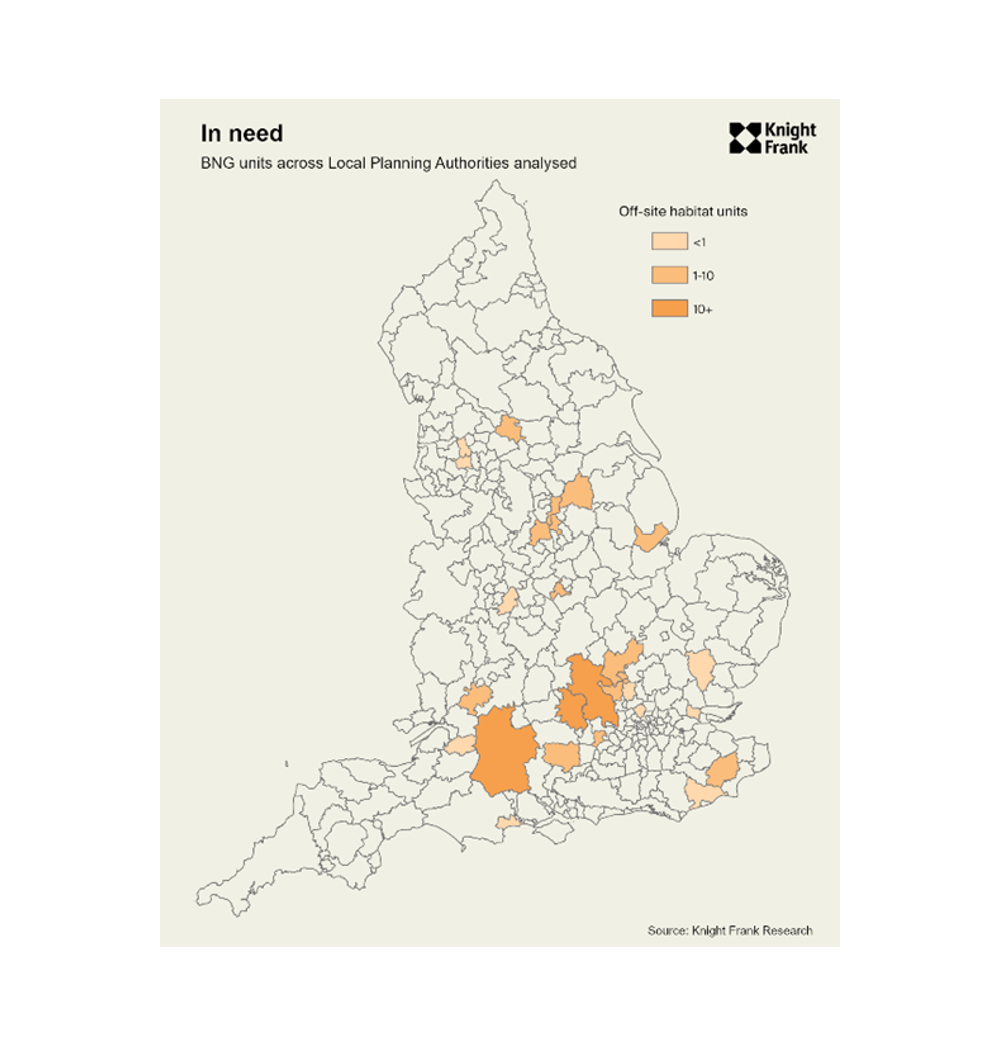

To understand the potential demand for off-site biodiversity units and its implications for local landowners, Patrick Dillon, a Senior Analyst in Knight Frank’s Analytics team, analysed 1,300 planning applications across 29 local planning authorities (LPAs) from February to June 2024. The findings are as follows:

- 245 applications (19%) triggered a BNG assessment.

- 97 applications (7%) identified a need for BNG.

- 81 applications (6%) assessed the number of biodiversity credits required to satisfy the 10% target.

Across these applications, 118 biodiversity units were required, an average of just over 4 units per LPA. However, there is a vast level of variation—from as low as 0.1 units to as high as 21.6 units per LPA. Suppose we were to scale to all LPAs in England; that would suggest an annual demand of c.3,100 BNG units. However, this is total requirement and not all developers will turn to off-site or statutory credits, many will be delivering on site solutions.

According to the Knight Frank’s quarterly survey of volume and SME housebuilders:

- Two-thirds of respondents expect to require up to 25 BNG credits per year.

- 14% need between 25 and 50 credits, and 3% require between 50-100 credits.

- A further 14% require 100-200.

Some 76% of developers plan to meet their BNG requirements on-site, leaving just 15% seeking off-site solutions with the residual resorting to statutory. This points to an average off-site demand of around 1.5 units per LPA per annum (see Note 2). Scaling up, this equates to a total of 466 units per year across England. Even in the LPA with the highest demand, this equates to just shy of 8 units per annum.

Defra’s own estimates from March this year were that the off-site market would be worth between £135 million and £274 million annually. So why the gap?

Diversification and considerations

Thus far, the demand for off-site BNG units is limited, yet The Rural Report’s latest survey found that over 20% of respondents were looking to create BNG or other environmental credits. The wider nature-based carbon market warrants greater consideration and exploration, as we will do, yet it is clear that for BNG, there could be limitations.

“With regards to the emerging BNG market, we are seeing suppressed demand for off-site BNG units, with a number of habitat bank operators and investors seemingly quite nervous because of that“, notes James Shepherd, Partner in Knight Frank’s Rural Consultancy. He continued that “there needs to be a consideration as to why this lack of demand exists to date - it may be timing (legal requirement is relatively new nationally), lack of actual development projects coming forward or developers choosing to pursue on-site in-setting opportunities. There are also musings around exemptions available - such as sites being declared as self-build or operating below the de-minimis threshold rules.”

“From a landowner's perspective, there is more of a cautious approach to setting up or investing in habitat banks than earlier in the year. We expect this to increase as confidence grows in the policy, development applications pick up, and the Government’s planning reform proposals become clearer,” adds Shepherd. “In my view, mandatory BNG is a brave and forward-thinking policy that is world leading. It should be fine-tuned and supported.”

With the new government’s pledge to build 1.5 million homes over the next five years, demand for biodiversity credits could grow. But, for landowners, it is important, as cited in The Rural Report, to ‘think before you leap’. In particular, understand the local market dynamics and what could happen, but also assess all other options available – be that carbon or payments from the Sustainable Farming Incentive.

If you'd like to understand more about BNG or need advice please visit our dedicated page.

Notes:

1: The off-site rules

Once created, off-site BNG sites must be maintained for at least 30 years.

Off-site gains located in intertidal zones, watercourses, or linear habitats are exceptions. Gains made outside the local planning authority (LPA) where the development occurs will generally be worth fewer biodiversity units than those made within the same LPA. Off-site gains beyond the neighbouring LPA will be worth even less. The BNG metric also incentivises achieving off-site biodiversity gains in areas of strategic significance. These are areas that are especially positive for off-site interventions and, if applicable, are set in the local nature recovery strategy.

The land manager selling biodiversity units must register the gain site on the national biodiversity gain sites register either before, at the same time as, or after the buyer purchases the units.

2: This is determined by taking the average number of biodiversity units required per LPA of just over 4 units every 5 months, or 9.8 units per year, if only 15% of the total demand for biodiversity units is met off-site.