On track for a record year for BTR completions

Knight Frank’s quarterly review of the key investment themes in the UK Build to Rent (BTR) market covering co-living, multifamily and single family housing

6 minutes to read

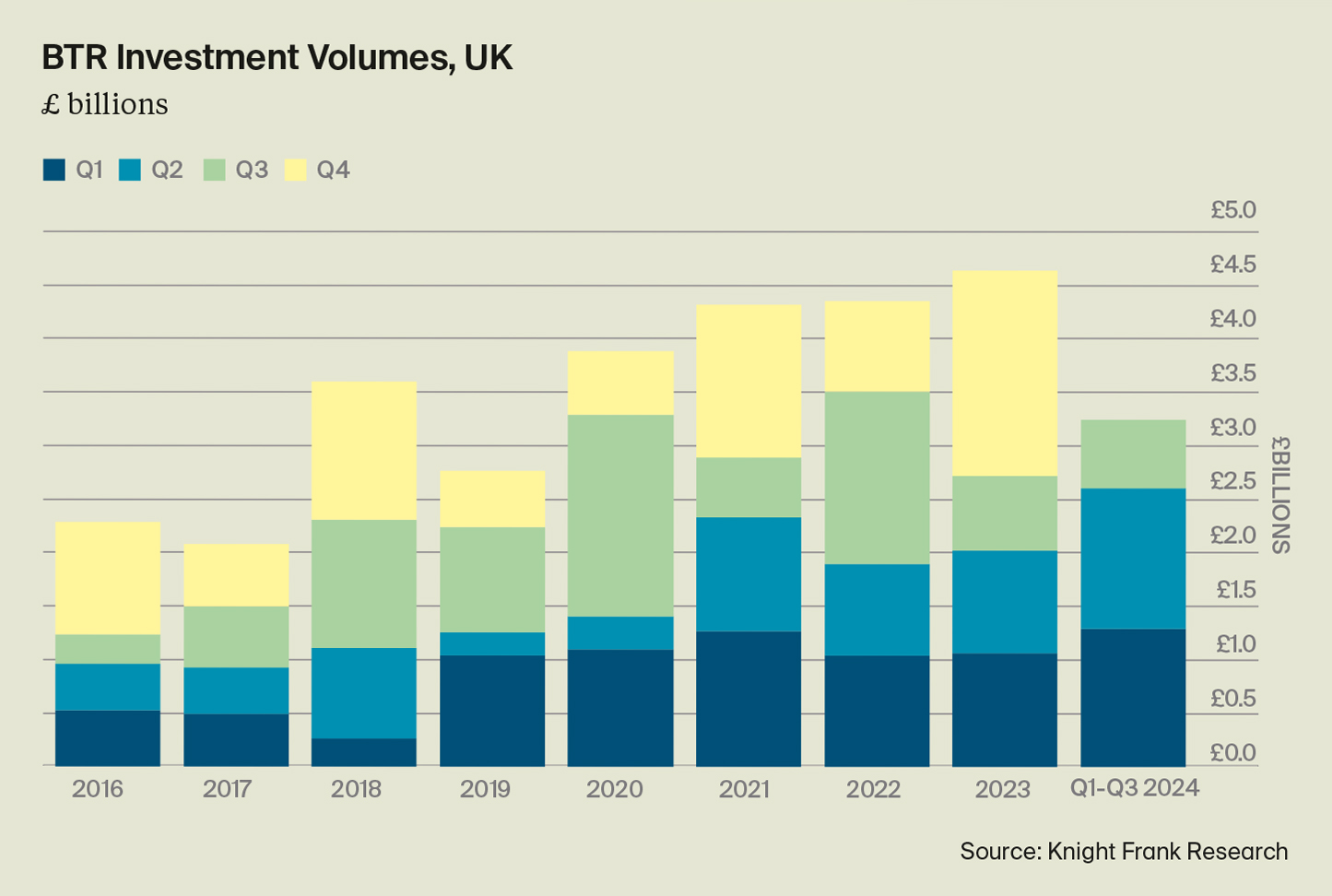

Investment volumes subdued in Q3…

Investment volumes in the third quarter of 2024 were muted, following a record- breaking first half of the year. A quieter Q3 reflects a seasonal lull in activity over the summer period, as well as the fact that deals are taking longer to put together. The market also remains in price discovery mode, with a wide spread of bids on some assets. In total, 14 deals completed, with a combined value of £640 million. Investment in Q3 was 8% lower than the near £700 million that traded in Q3 2023. Some 65% of investment over the course of the quarter was for multifamily transactions with the remainder for single family assets, whilst 35% of capital deployed was into operational schemes – up from just 20% in H1. As has been the case throughout the year, there remains greater liquidity for smaller deals. In total, deal volumes so far in 2024 are 29% higher than Q1-Q3 2023.

…but investor appetite undimmed

Despite a quieter third quarter for investment volumes, there is still strong appetite among investors to acquire assets. Our agency and valuation teams are tracking a further £1.6 billion of transactions that are under offer or due to complete, of which 84% is for multifamily transactions. Outside of our investment figures, there has been a flurry of recapitalisations and equity raises, including a £755 million preferred equity commitment between Ares and Lone Star at Wembley Park, advised by Knight Frank, while Greystar raised €1.5 billion to invest in its European value-add fund focused on rental residential real estate. Such deals and commitments confirm the long-term attractiveness of the sector.

Macro backdrop looks bright(er)

The Bank of England’s decision to cut the base rate for the first time since 2020 in August has shifted the narrative from when to how far rates will be cut in the current cycle. Much still depends on the path of inflation, which rose 2.2% in the year through August, unchanged compared to July and in-line with expectations. Services inflation picked up to 5.6%, from 5.2% in July. Economists had expected a rise to 5.5%. Overall, the news is broadly positive and will have little impact on the consensus view that the Bank of England will cut rates once or possibly twice more before the end of the year. Capital Economics is currently forecasting that rates will settle at 3% by the end of next year. As the cost of debt continues to come down, transactional activity will pick up further as sentiment improves and more forward funding opportunities emerge.

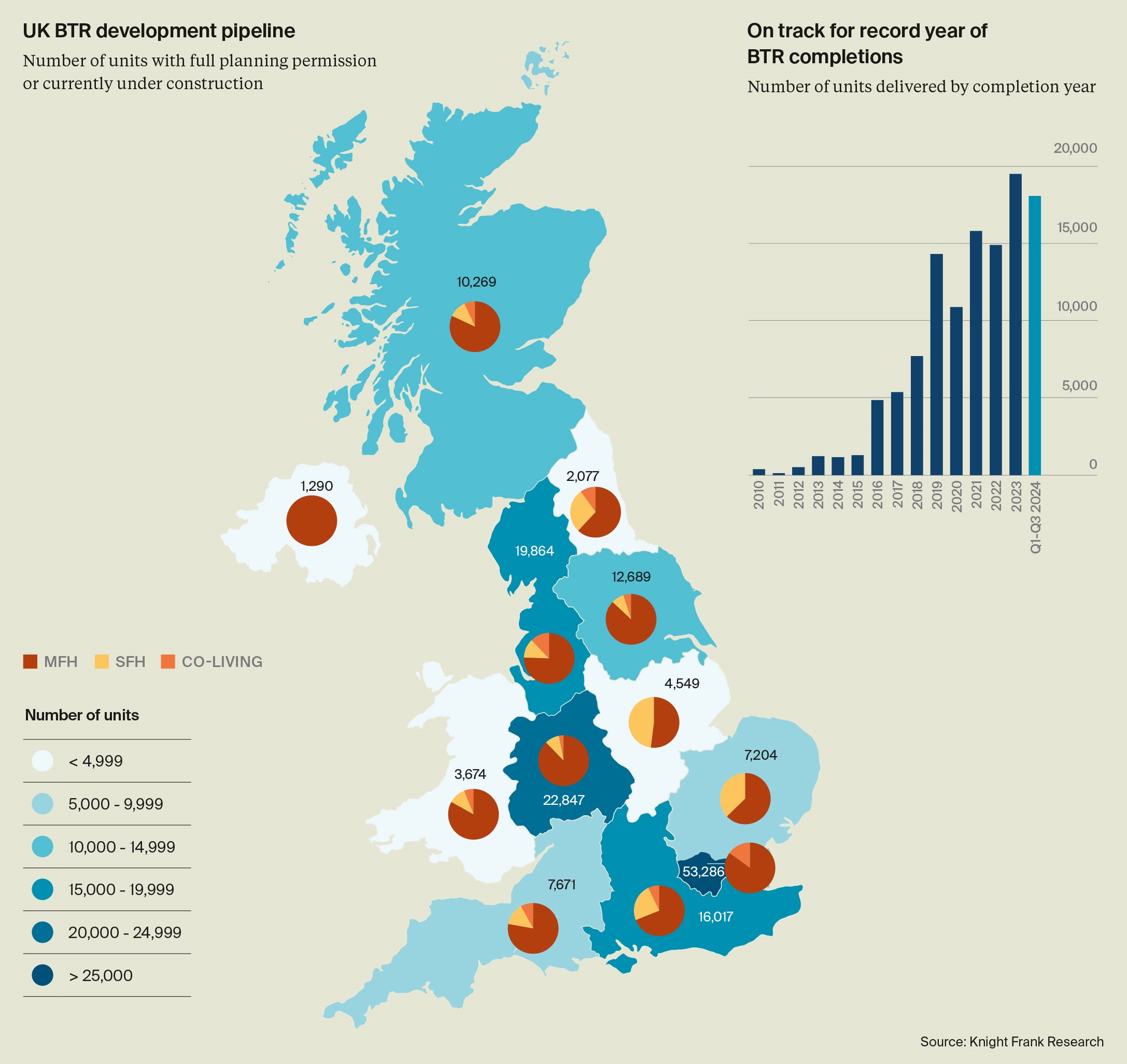

On course for a record year for new BTR supply

There are currently 122,238 completed BTR homes across the UK in schemes within co-living, single family housing and multifamily schemes. A further 58,951 are under construction and 101,729 have full planning permission granted, taking the total size of the sector to 282,918 homes.

So far in 2024, more than 18,000 BTR homes have been completed, putting the market on course for a record year for new delivery. Supply continues to build in regional markets, with 67% of completions so far this year outside of the capital led by Manchester and Birmingham. In total, 68% of the pipeline is located outside of London.

Constraints in the PRS underpin need for increased delivery…

The number of homes for rent across the UK in Q3 was 32% higher than a year ago as a reduction in mortgage rates means some renters are able to transition to the sales market. However, longer-term the picture is more concerning. A scarcity of supply has been an ongoing feature of the rental market for the last three years. Indeed, despite the short-term increase in supply, the number of homes for rent remains 33% below the pre-pandemic average, limiting choice for renters. This pattern of a short-term pick up in supply from a low base is consistent across London and many regional cities. At the same time, demand remains high: in Q3 Knight Frank analysis shows the average time to let a BTR home was 25% faster than when compared with 2019.

…with pressure likely to build

There has been a steady flow of individual private buy to let landlords selling for the last few years, largely as a result of changes to policy and taxation over that time. Incoming policy changes, including tighter regulation as proposed in the Renters Rights Bill (RRB) and the introduction of minimum energy efficiency standards, which will require every rented home to achieve an Energy Performance Certificate (EPC) rating of C or above by 2030, could result in a further increase in landlord sales. Around 63% of existing stock in the private rented sector has an EPC of D or below. Whilst the BTR sector is well placed to navigate any changes, there are questions around some aspects of the RRB including the mechanisms and capacity for tenants to challenge rent increases. The net result of any further erosion in the stock of rented homes will be to sustain rental growth in the medium term and accelerate absorption of new rental product.

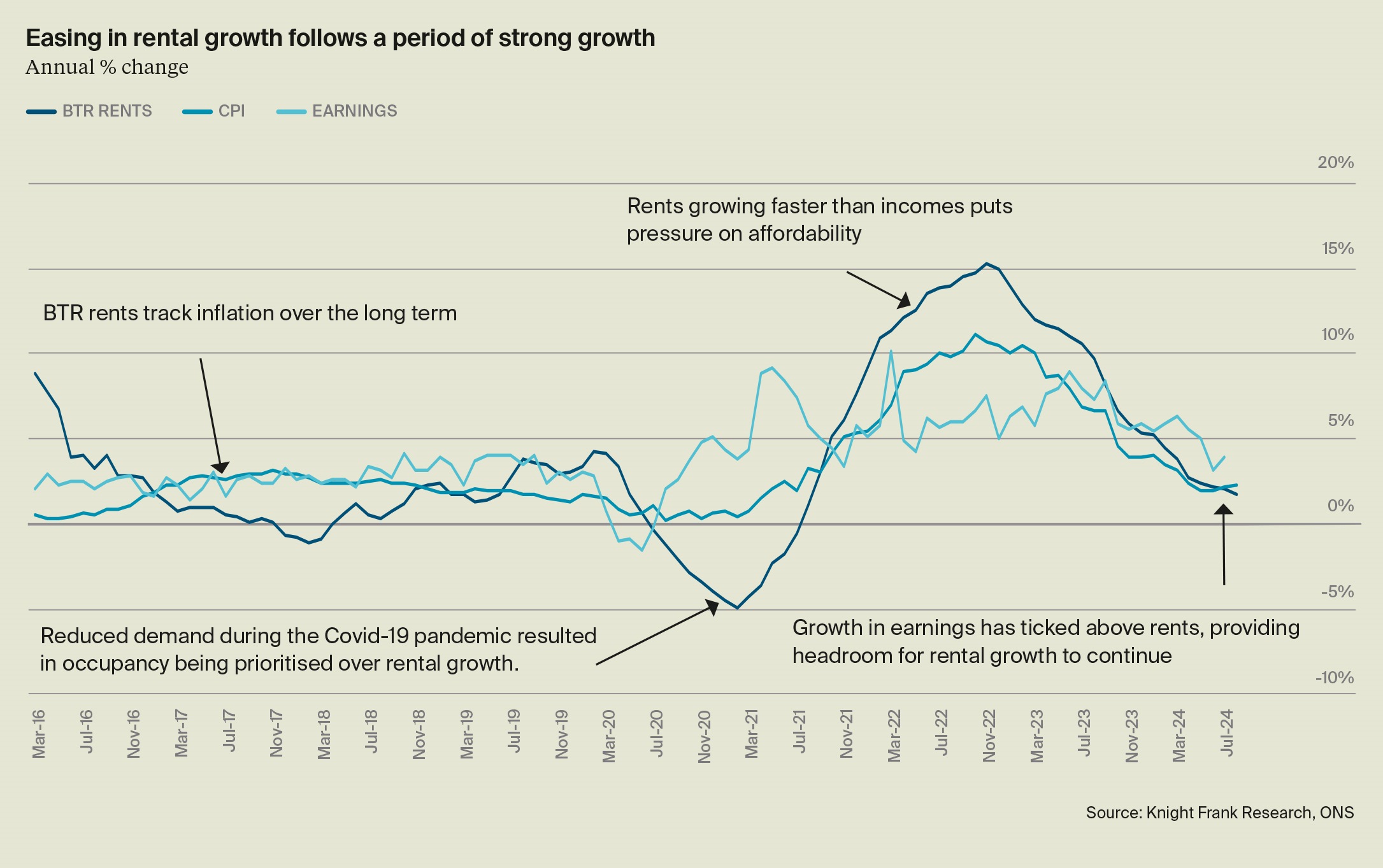

Rental growth easing

Annual BTR asking rents have eased from the record highs of the last few years, reflecting the moderation also reported in the wider private rental sector. While still positive, the easing in rental growth from its double digit highs reflects the fact the market is now adjusting to follow its more sustainable and longer-term relationship with earnings, whilst also providing a hedge against inflation. Our BTR Rental Index has eased to annual growth of around 3% in markets outside of London and below that in the capital. This means that rental growth has dropped below wage inflation, providing headroom for further rental growth in the medium term. Longer term, over the last five years, BTR rents have increased by around 30%, representing a CAGR of around 5%.

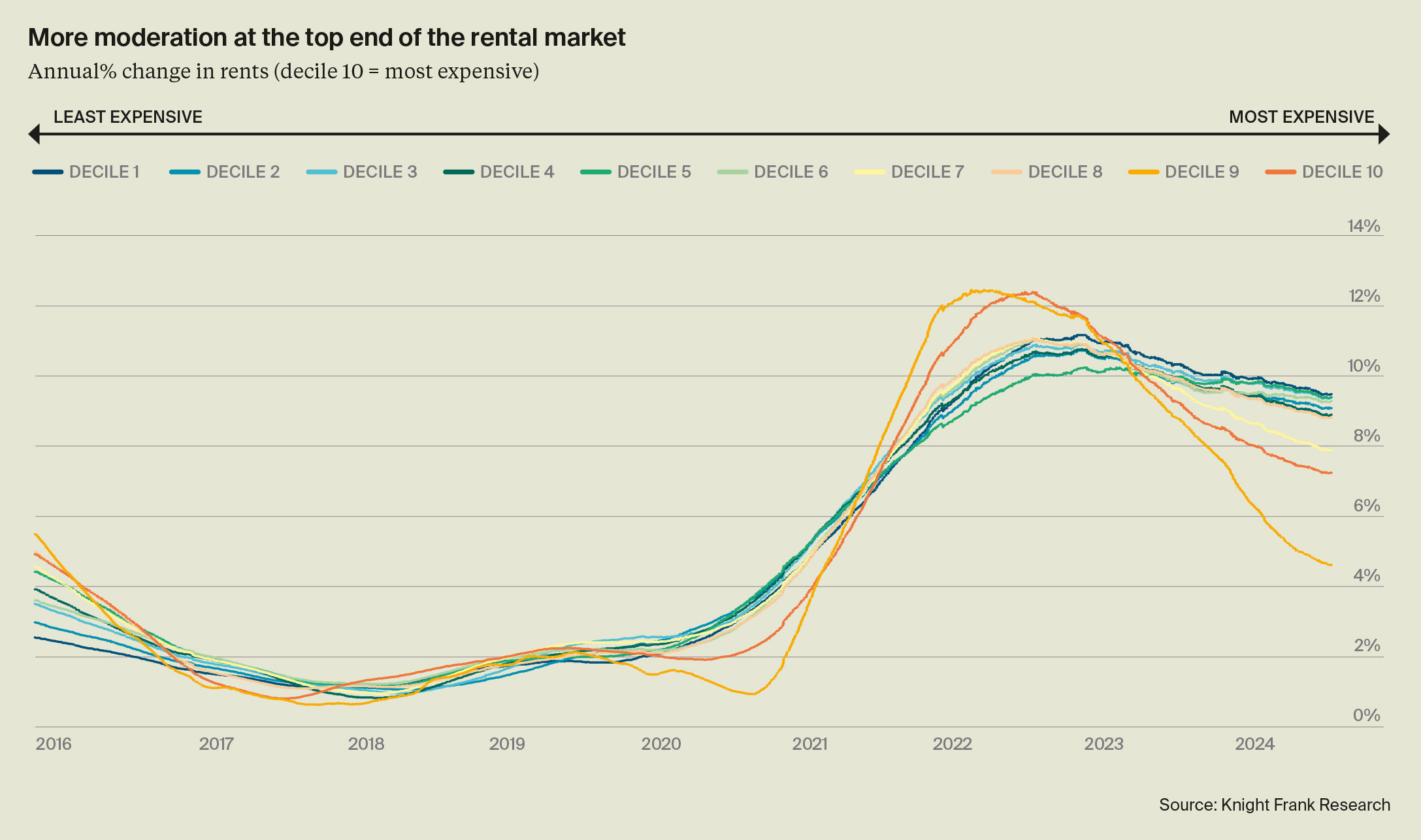

Our analysis of the whole private rented sector confirms that the slowdown in rental inflation is being led by the top end of the market. Segmenting the country by price shows the greatest slowdown has been in the most expensive areas. In contrast, rental growth is moderating less quickly in the most affordable areas. From a BTR perspective, it means schemes targeting the mid and core markets have tended to outperform.

Focus on the mid-market

Consequently, we expect to see more investors looking to deliver BTR product targeting the mid-market which caters for a much larger UK renter demand pool, and provides the potential to save on build costs with reduced amenity offering and more mid-market specification. Our analysis shows that rents for existing BTR schemes tend to sit close to the upper quartile of their local markets. While occupancy and tenant retention for these schemes remains high, in some markets a clustering of supply around a particular price band has impacted operators’ ability to push rents. Accordingly, as the sector continues to grow and mature, more schemes will be delivered across a broader range of price points and locations, within the constraints of viability. Indeed, as our recent research confirms, schemes which prioritise resident experience – which is driven by much more than specification and amenity provision – are able to command premiums to the local market.