A bright outlook for the logistics sector with structural dynamics supporting long-term prospects

4 minutes to read

Occupier market stats point to further signs of stabilisation

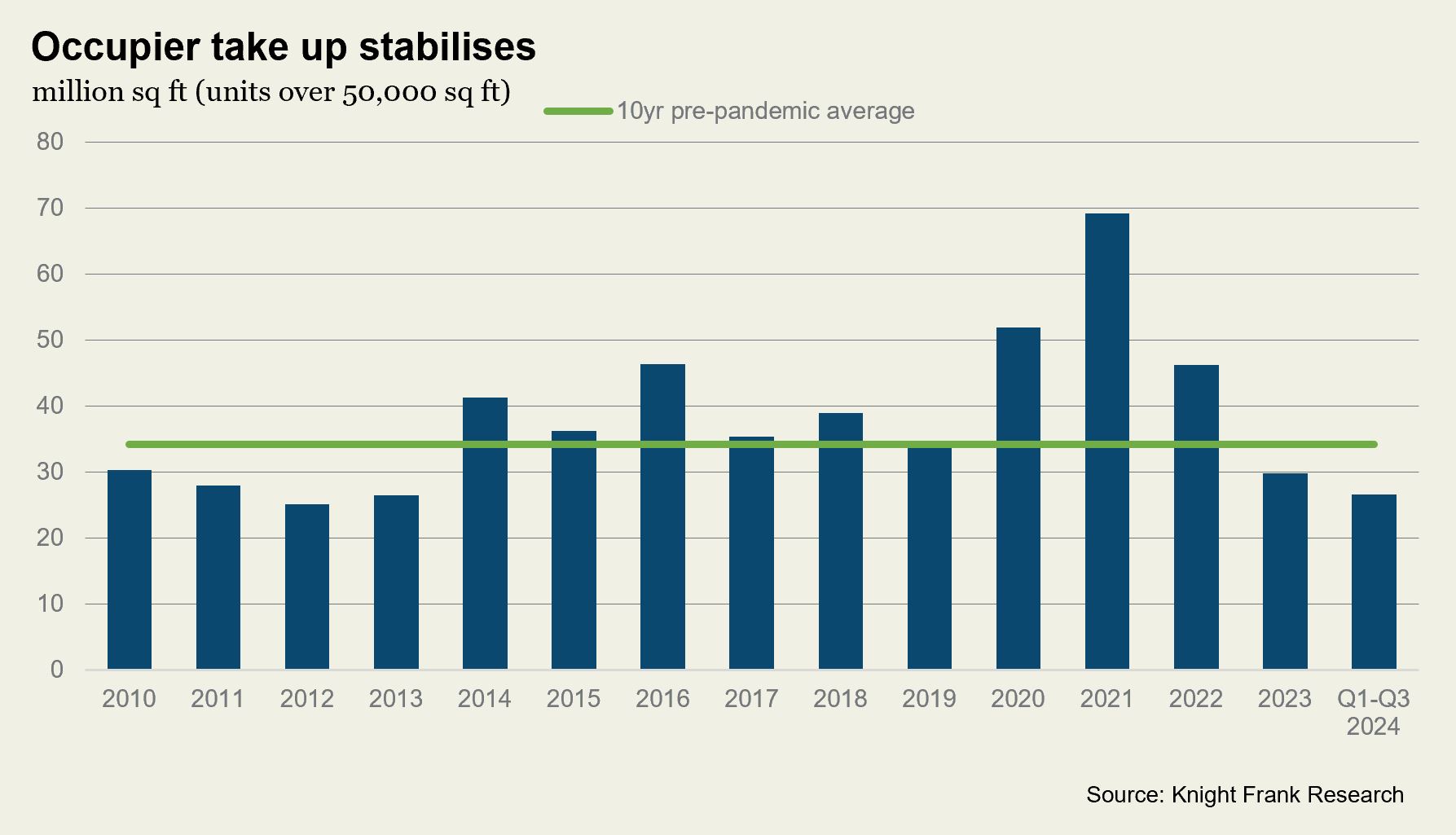

Across the UK, occupiers took up 9.3 million sq ft of industrial and logistics floorspace in Q3 2024. This figure exceeds average quarterly totals recorded over the past couple of years and brings total take up for 2024 (Q1-Q3) to 26.6 million sq ft.

The year-to-date total is now just 11% below the annual total for 2023. Given this and the large volume of floorspace currently under offer, we expect 2024 occupier take up to exceed last year’s figure and reach or exceed the pre-pandemic annual average (of c.34 million sq ft).

Vacancy rate rises further

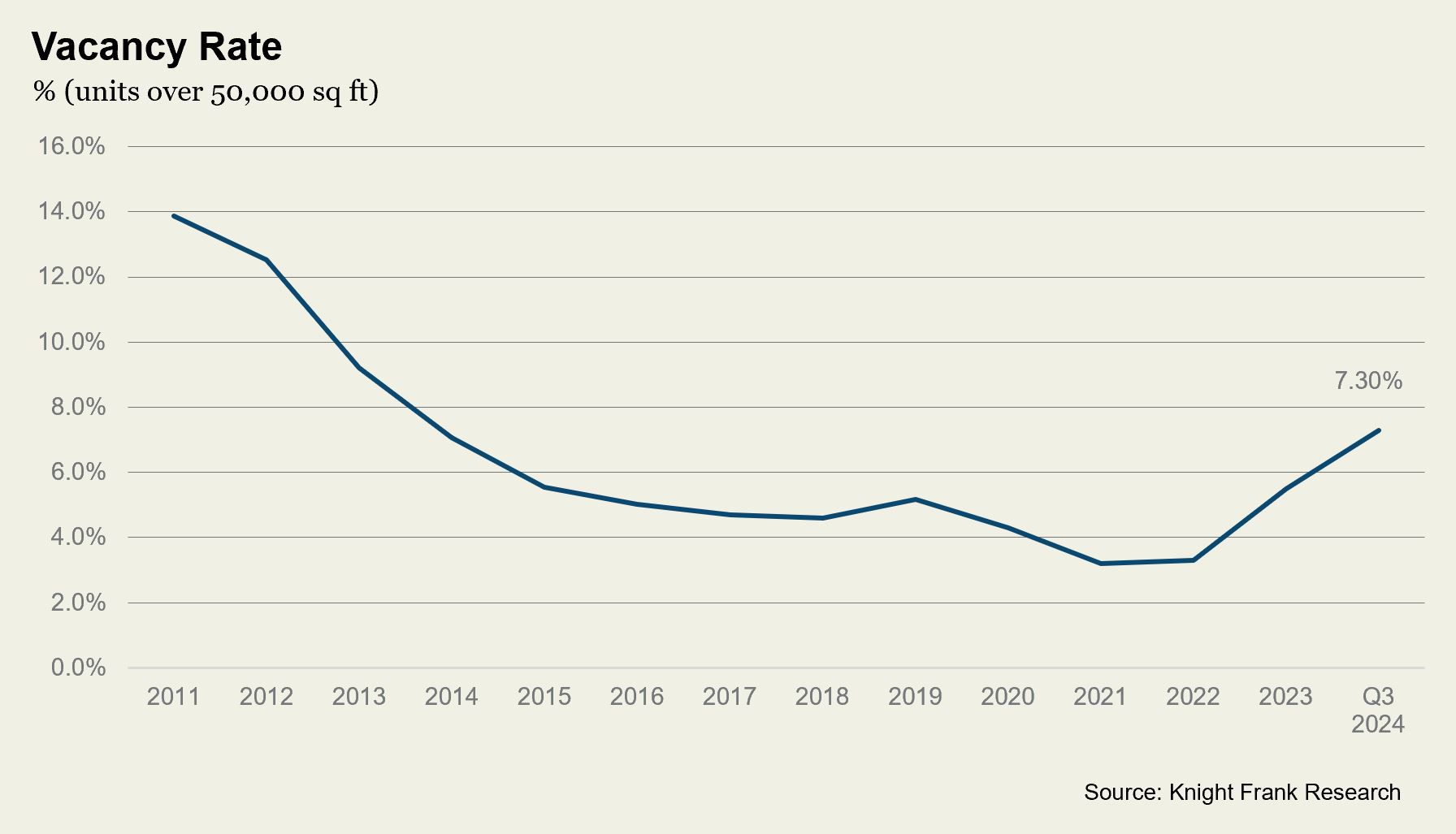

The vacancy rate rose from 6.9% at the end of last quarter to 7.3%. Much of the space currently available is within second-hand units; some of these units will fall short of the fit-out and amenity requirements of many modern occupiers.

They may also fall short of tightening Minimum Energy Efficiency Standards (MEES). Commercial landlords and property owners have until 2028 to meet the requirement of achieving an EPC rating of C for their properties. Properties that don’t comply with these requirements will need refurbishment works to bring them up to standard, which may not be viable for some assets.

Whilst levels of availability have risen across the UK over the past two years, some regions have fared better than others. The most significant rise in vacancy has been recorded in the South Yorkshire region. Two years ago, vacancy rates here were just 2.1%; they have risen to 11.5%. In Wales and Scotland, however, vacancy rates have risen more modestly. Two years ago, Wales had a vacancy rate of 10.3%, compared with 12.4% currently.

Reduced development activity

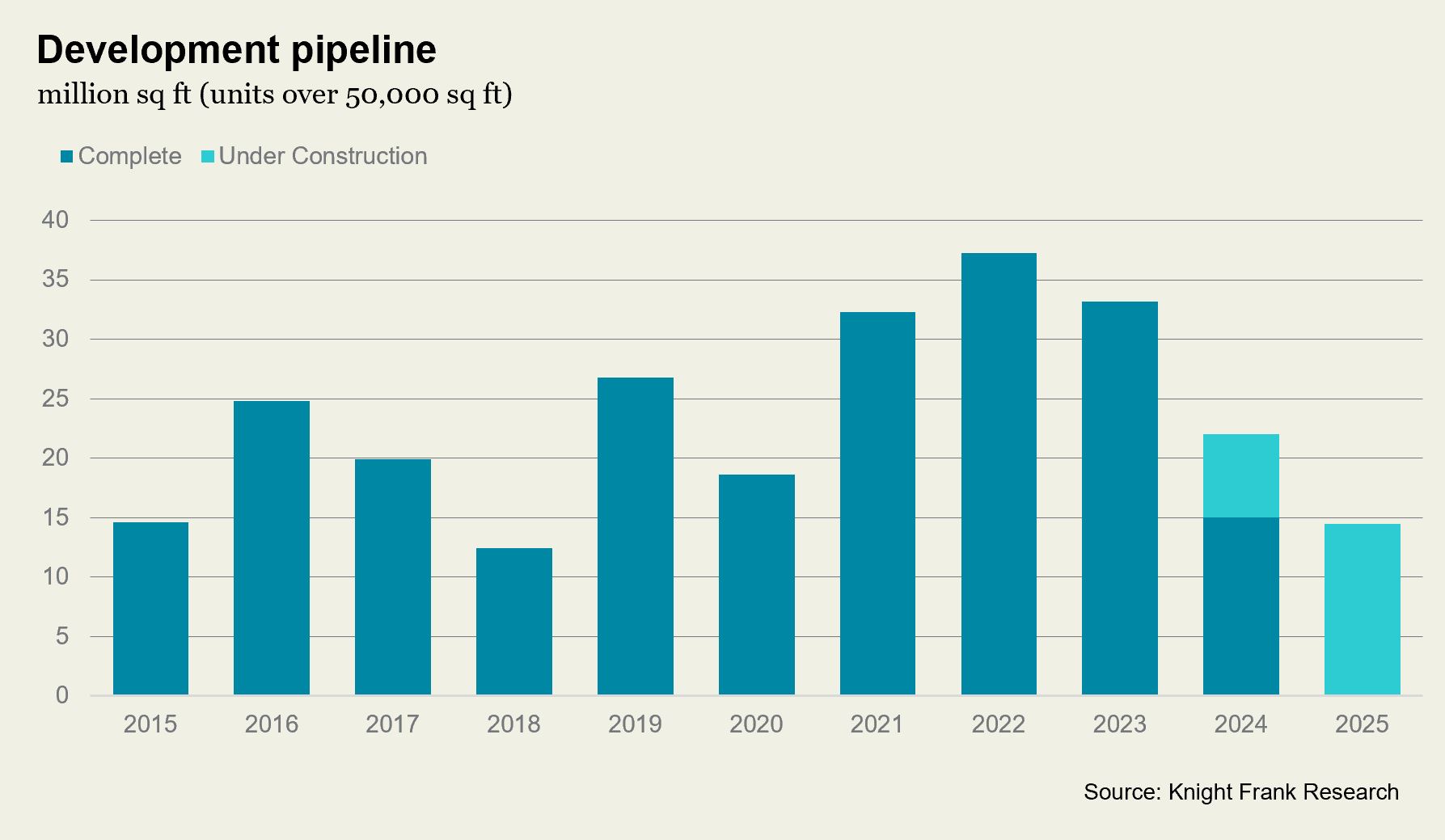

The number of developments underway, particularly speculative development starts, have fallen sharply. Overall, a total of just 22 million sq ft is expected to complete in 2024, down from 33.2 million sq ft completed last year and 37.2 million sq ft the year before.

There is currently 14.5 million sq ft under construction and expected to complete in 2025. This figure is likely to rise, given that we have yet to reach the end of 2024 and the relatively short construction timelines for industrial units. However, construction cost pressures, high financing costs, along with political and economic uncertainty, continue to impact appetite for development.

Need for greater efficiencies and sustainability keeps demand focused on best-in-class assets

Growth in the online retail market has helped to fuel a rise in outsourcing and expansion of the third-party logistics (3PLs). In a bid to gain efficiencies and minimise risk, retailers have increasingly outsourced their online order fulfilment to 3PLs. Rising sustainability requirements and the need for efficiencies will drive continued demand for 3PL services as retailers outsource more and more of their supply chain and inventory management to specialist 3PLs, who are well-placed to capitalise on new technological innovations in supply chain management and undertake sustainability reporting requirements.

The focus on efficiencies and sustainability has typified occupier demand, which remains focused on new and grade A buildings that can offer sustainability credentials as well as operational efficiencies. Sustainability measures are becoming increasingly important throughout the supply chain, as tightening regulations and growing consumer awareness are compelling improvements to logistics operations and influencing building choices.

Where to capture opportunities as the outlook brightens

Despite slowing rental growth and rising vacancy, the outlook for the logistics sector remains highly positive. According to the latest forecasts from RealFor, the UK industrial and logistics sector offers stronger rental growth and capital appreciation prospects than other commercial real estate sectors. Rising population pressures, rising incomes, and long-term structural changes to our lifestyles, particularly how we shop, will continue to underpin growth in the occupier market.

Robust rental growth prospects are witnessed for the sector, across all regions. However, rental growth prospects are particularly appealing for urban logistics/locations, with rental growth within city markets generally expected to outperform their regional averages.

Urban logistics remains particularly favourable, given the growing concentration of populations within urban centres. Rising urban populations are driving demand for housing, putting pressure on land supply in and around these cities. Large swathes of industrial land have been lost to residential uses over past decades, capping the supply response. Though measures have been taken to protect industrial floorspace from being lost to other uses, the lack of developable land in urban areas means that increasing floorspace typically means intensification of land use. Meanwhile, on the demand side, rising populations, consumer spending and demand for convenience all support consumption and the growth of a diverse occupier base in these locations. These demand and supply side factors are highly supportive of further rental growth in these areas.

In London and the South East region, satellite towns offering good access into Greater London are proving popular with occupiers. Given the surge in rents in London in recent years, occupiers with more flexibility in terms of location are looking at cheaper locations further out. The differential in rents in some of these satellite towns is proving a strong draw.

Investors are facing intense competition for assets that offer the potential for value-add or reversion. Industrial open storage (IOS) is also proving popular with investors given the growth of a more institutional occupier base. Sites also benefit from low capex requirements and some may offer longer-term re-development potential.