Government’s housing challenge as permissions hit new low

Plus, how real estate shapes university choices

3 minutes to read

The UK government has made good on its pledge to put housebuilding front and centre of politics, but the road ahead is going to be tough, as evidenced by the latest planning permission data.

Since our last newsletter in August, it has launched a New Homes Accelerator to speed up large-scale housing projects and concluded an eight-week consultation on the National Planning Policy Framework, which has received “thousands and thousands” of responses according to the Lords minister for housing and local government, speaking at the Labour Party Conference.

But the supply pipeline of new homes across England is under immense pressure.

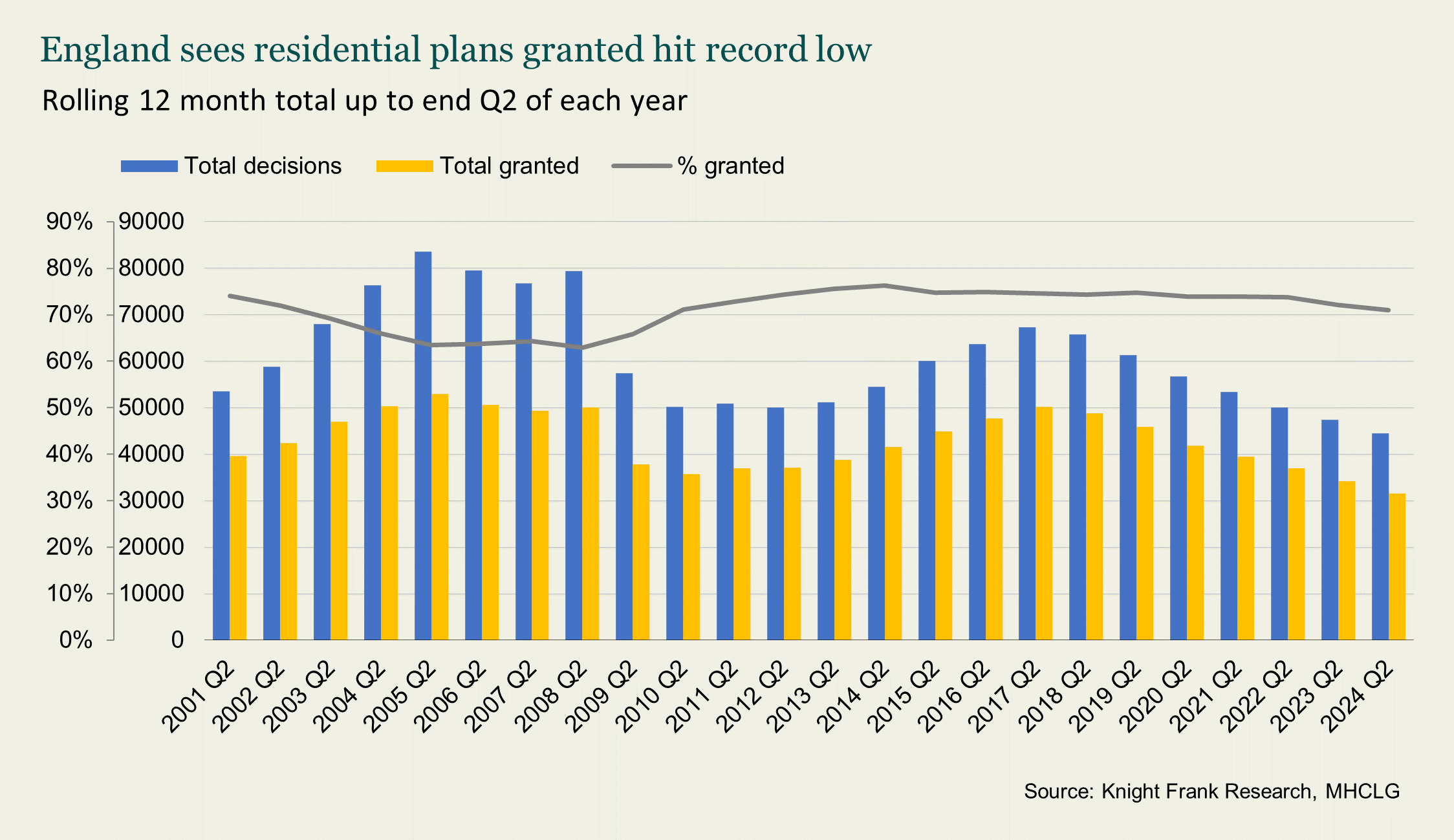

Overall, the number granted permission has fallen 15% over the past 12 months to just 231,000, illustrating the extent of the challenge to ‘get Britain building again’.

Between April and June this year, only 7,609 housing projects were granted permission in England, the lowest level since records began, according to the latest government statistics out this week.

The applications range from proposals to build a single property to much larger housing developments.

The most recent quarterly peak was back in Q3 2016 when approvals hit over 12,900 – but they have since plunged 40% to the current level below 8,000.

Approvals are down 5% in Q2 this year compared to Q2 2023.

On an annual basis, residential plans granted have fallen to 31,556 in the 12 months to end June, also a record low – and a decline of 8% from the year before.

It is the number of planning applications brought forward by developers that has fallen sharply. Councils are not rejecting a much higher percentage of applications.

Far from it, the approval rate for residential applications remains stable above 70%.

This has been driven by a weaker appetite to build in light of higher finance costs, a weaker sales market, rising build costs and planning delays.

Overall planning applications across all sectors, residential and commercial real estate combined, were down 9% in Q2 compared to a year earlier. This is despite an even stronger approval rate of 86%.

In London, the volume of residential plans granted have hit a 14-year low in the second quarter of 1,192, the lowest level since early 2010.

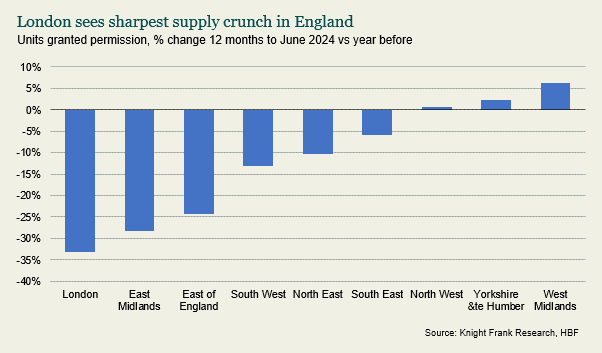

Over the past 12 months, all regions in England bar the West Midlands have seen a fall in the number of housing projects given the go-ahead by councils. London and the East Midlands have recorded the steepest falls, both are down 12% compared to the previous year.

New data out this month from the Home Builders Federation also shows that London has seen the sharpest drop in housing units securing permission in the past year (see graph).

However, while challenges remain, the recent fall in mortgage costs and the fact that planning and development are central to the government’s objectives has already boosted sentiment and should give more developers confidence in bringing new housing projects forward. Crucially, those that act now in bringing schemes through the planning system will be selling new stock in a market facing a sharp supply crunch in the near term.

Student property dilemmas

More than 65% of those applying to university for the first time said the availability of accommodation had influenced their decision on where to apply. That’s according to the fifth edition of our Student Accommodation Survey, conducted in partnership with UCAS.

The full report gives a unique insight into the opinions and preferences of students about where and how they live, what they like and dislike, and – crucially for the sector - what they value and are willing to pay for.

The survey demonstrates that PBSA leads in quality and value: 66% of respondents living in private purpose-built student accommodation (PBSA) rated the quality of their accommodation as either good or excellent. This compares to 44% and 54% of those living in the private rented sector or in university-owned accommodation.