Caution Rises in London Super-Prime Market Ahead of Budget

Demand and deal numbers are down as political uncertainty persists, particularly in the highest price brackets.

4 minutes to read

For London’s super-prime (£10 million-plus) property market, Budget uncertainty has replaced election uncertainty.

Many buyers and sellers switched off early for the summer ahead of July’s election, but some have stayed on the sidelines due to concerns surrounding the Budget on 30 October.

Others have been more active, particularly under £20 million, driven by the long list of evergreen reasons people choose to live in London, the relative value on offer and the fact they would be unaffected by any future non dom rule changes.

In addition to new non dom rules, changes the Chancellor could announce relate to capital gains tax, inheritance tax, carried interest for private equity funds and pension tax relief. That’s on top of new VAT rules for private schools from January.

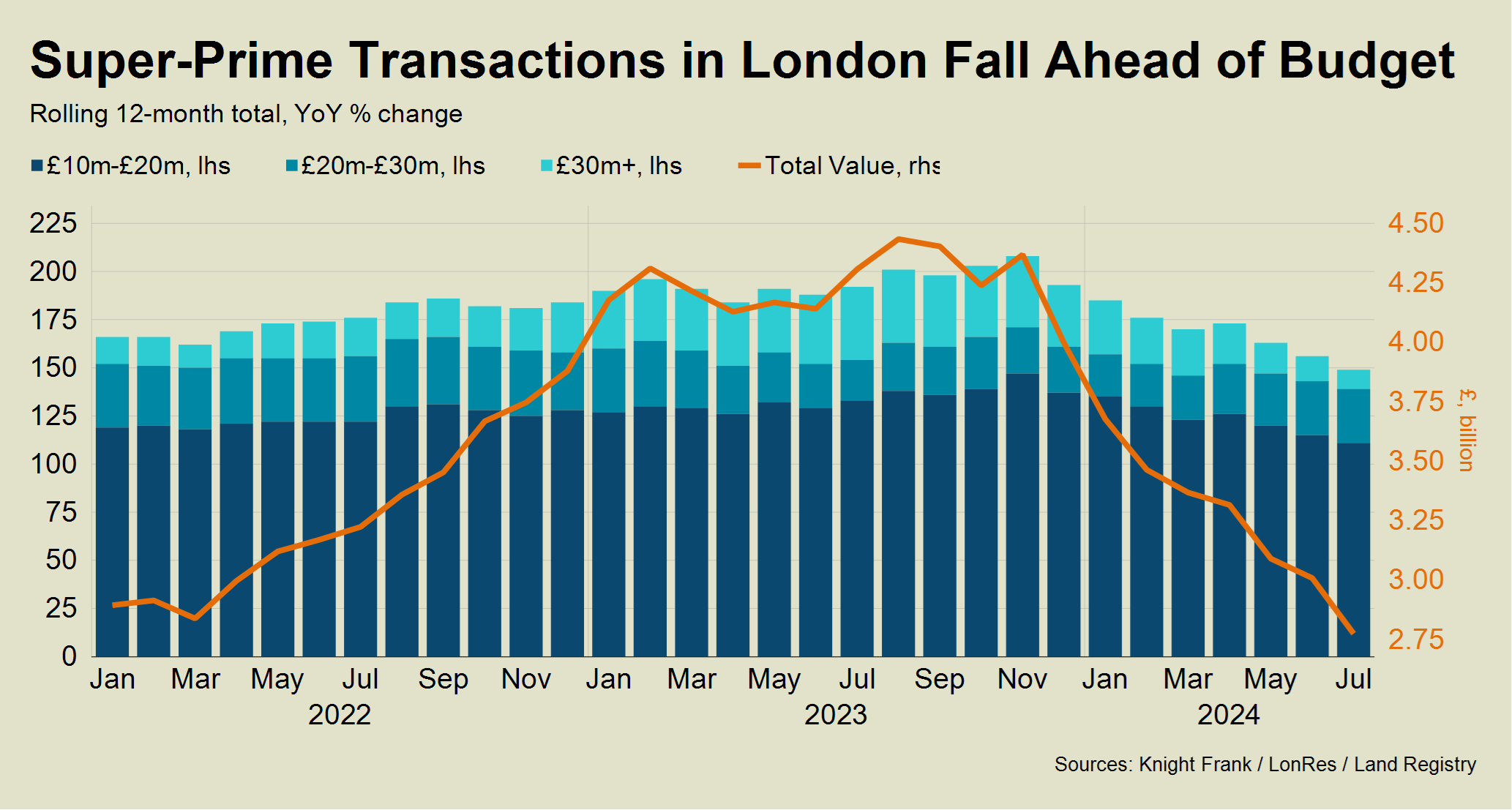

The resulting mood of uncertainty means activity in the capital’s super-prime market has dropped. There were 22% fewer transactions in the year to July than the previous 12 months, whole-market data shows. The figure fell to 149 from 192.

Despite the political risks, the UK’s economic backdrop has actually become more settled, with a second rate cut of 0.25% priced in by financial markets before Christmas.

“It’s the overall sense of uncertainty rather than any single measure that is making some people hesitate,” said Stuart Bailey, head of London super-prime sales at Knight Frank. “Despite the fact supply levels are good, buyers at this level are very discretionary.”

The higher the price band, the greater the discretion, as the below chart shows.

There were 10 transactions above £30 million in the year to July, which compared to a figure of 38 over the preceding 12-month period, whole-market data shows. The fall was less marked below £20 million, where the equivalent drop was to 139 from 154.

As a consequence, the total value of transactions over the last 12 months above £10 million has fallen disproportionately compared to sales volumes.

Sales in London totalled £2.77 billion in the 12 months to July, which was a 36% decline from the equivalent figure of £4.3 billion in July 2023.

“There are obvious risks at the moment, but the super-prime market is still functioning, just at a reduced level,” said Paddy Dring, global head of prime sales at Knight Frank. “It’s sometimes easy to forget just how attractive London is on the global stage.”

Proposed non dom rule changes have been frequently cited as a factor affecting London’s super-prime market, but that assertion is too simplistic, says Stuart.

The new government has announced it will scrap the rules relating to non doms, the 74,000 individuals who live in the UK but don’t pay tax on their global income. The prospect of tighter rules and uncertainty over new inheritance tax regulations in particular mean some have already left the UK. Estimates vary over how many more will follow and how much money the new plan will raise.

“I would say that about 30% of deals above £10 million in London have involved non dom buyers over the last two years,” Stuart said. “We completed more than £100 million of super-prime deals in the six weeks after the election, which was 20% higher than last year. It shows that irrespective of what may come in October, many buyers believe prices are at a low ebb.”

Average prices in prime central London above £10 million are 14% below their last peak in September 2015, Knight Frank data shows. For buyers denominated in or pegged to the US dollar, the equivalent decline is 25% given the weakening of the pound since the Brexit vote against the dollar.

We expect prices in prime central London to rise by 16.4% in the five years to 2028, according to our latest forecast.

Houses have become more popular than flats over the last year, partly due to the decreasing pipeline of super-prime new-build apartments on the market, said Stuart. Furthermore, houses typically have more scope for renovation and adding value in a price sensitive market.

Meanwhile, demand is still skewed towards self-contained properties since the pandemic.

In the 12 months to July, 70% of super-prime sales were houses, which was the highest figure in the equivalent period since before the pandemic.

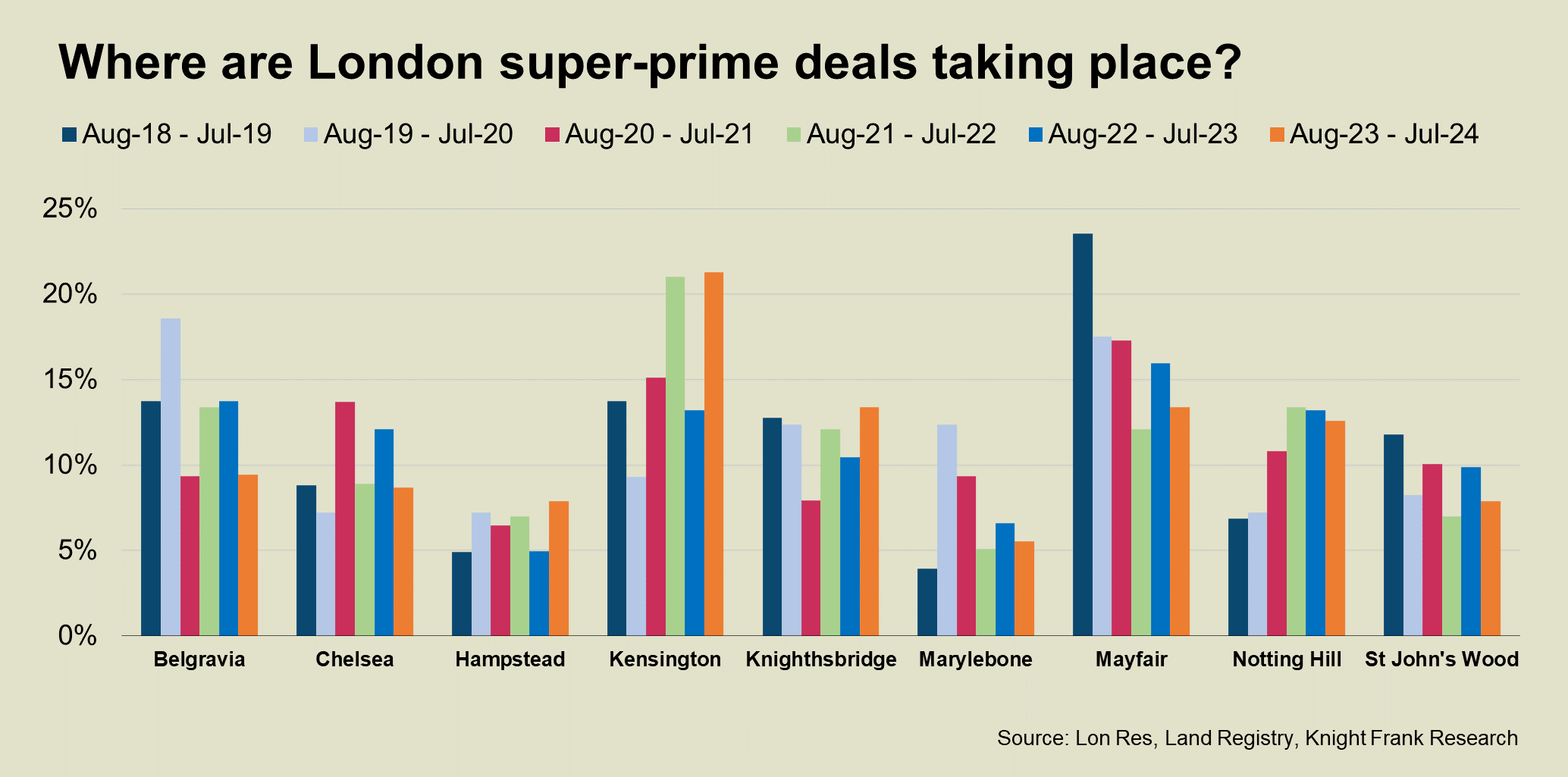

The biggest percentage of super-prime deals in the year to July was in Kensington (21%), followed by Notting Hill (13%), Mayfair (13%), Knightsbridge (13%), as the chart shows.