UK Housing Market Forecast: August 2024

Forecasts unaffected by the general election and interest rate cut but October’s Budget and the Renter’s Reform Bill could change the outlook.

4 minutes to read

In the three months since our last housing market forecast in May, there has been a general election and a rate cut.

The Bank of England acted earlier than expected when it cut by 0.25% this month, but the outcome of the election was predictable.

Our forecasts appear on track but the first Labour government in 14 years and the first rate cut since March 2020 have clearly changed the mood music.

We have left our numbers unchanged for now but will reassess them after the Budget on 30 October.

So, how has the landscape in the UK property market altered over the last 90 days?

Mainstream Sales Markets on Track

The mainstream sales market has been impacted by the rate cut more than the change of government.

Following the drop to 5% from 5.25% and lower-than-expected inflation data, SONIA five-year swap rates fell towards 3.5% in August. Financial markets were pricing in a further cut in November.

It will lead to a “meaningful increase” in the number of lenders offering sub-4% mortgages this autumn said Simon Gammon, head of Knight Frank Finance. As a result, demand and sales volumes will be stronger in the final months of this year than in 2023.

HMRC data shows that the number of transactions was 19% below the five-year average (excluding 2020) in 2023, largely due to stubbornly-high inflation and fast-rising borrowing costs.

In terms of prices, the Halifax and Nationwide indices registered growth of just over 2% in July, meaning our 3% forecast for the year looks like it should be met if not exceeded.

Nationwide also showed growth of 1.6% in Greater London in the year to June, which means prices in the capital are fast-approaching our 2% forecast for 2024.

Prime Markets Face More Risks

The prospect of the Budget means the outlook in prime markets is hazier.

The decision to charge private schools VAT from January rather than September next year has created a mood of wariness ahead of 30 October.

The measure by itself won’t have a dramatic impact in prime property markets, but together with other potential tax rises, it may keep demand in check.

Given the government’s pledge not to raise income tax, VAT or National Insurance, speculation has centred on capital gains tax, inheritance tax and pension tax relief among others.

Changes will also be made to rules surrounding non doms, the 74,000 individuals living in the UK who do not pay tax on their non-UK income.

How pre-existing overseas trusts are treated for inheritance tax purposes will be a particular focus for those wondering if large numbers of them will leave the UK.

Our prime central London (PCL) forecast is therefore subject to a bigger revision than our other projections later this year. The annual decline was -2.4% for the third successive month in July, which we forecast will narrow to -1% by December.

Any impact would be less marked in prime outer London (POL), where we forecast an increase of 2% this year. Average prices in POL rose 0.6% in the six months to July, putting them on track for a low single-digit increase in 2024 as demand strengthens this autumn.

Prime Country prices continue their descent from the highs of the pandemic and the so-called ‘race for space’.

Our forecast of -2% for 2024 is broadly on track, though it may prove overly-negative as demand strengthens in the final months of the year. The annual decline recorded in June was -3%.

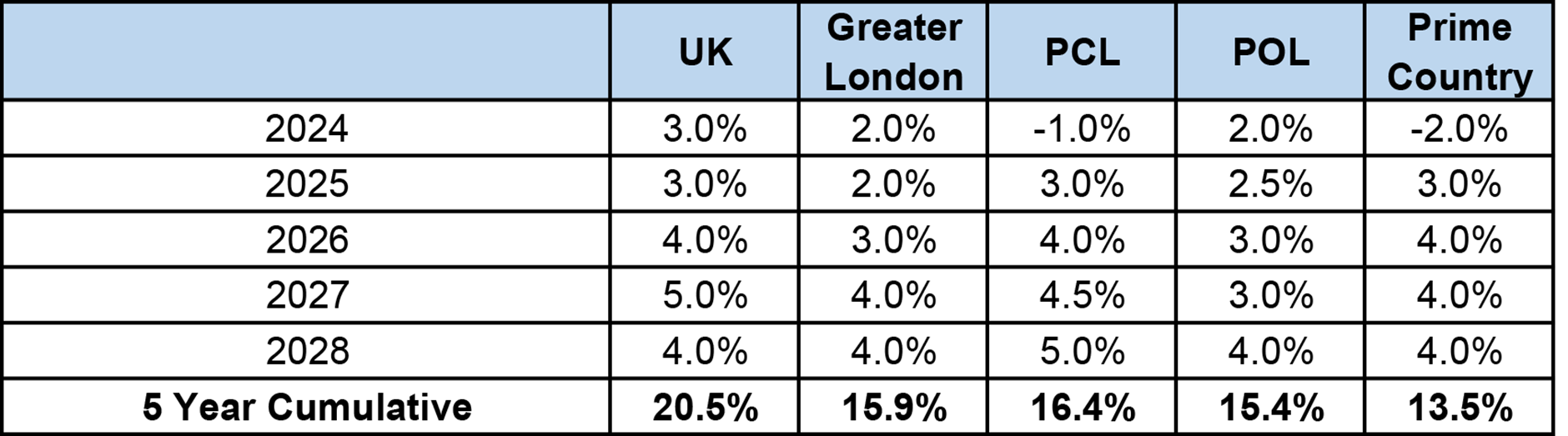

Sales Forecast

Legislative Uncertainty Hangs Over Lettings Market

Our forecasts for rents in 2024 also appear broadly on track, if you ignore the uncertainty surrounding the Renters Reform Bill.

In PCL, we forecast growth will fall to 2% this year as supply increases from the lows of the pandemic. The increase was 0.9% in the six months to June.

Meanwhile, rental values in POL increased 0.7% in the six months to June. Our forecast is 2.5% for the whole year.

In the wider UK market, annual growth was 8.6% in July and falling, which means it should end the year close to our 6% forecast.

We will reassess the numbers once we know more about the government’s plans for the lettings industry.

For now, only two things are certain, as we explored here.

First, the Labour government will introduce their own version of the Conservative Party’s Renters Reform Bill during this Parliament. Second, it has been talking tougher on landlords.

Measures could include making it harder to evict tenants and tighter rules around green credentials for lettings properties, according to recent press reports. Meanwhile, capital gains tax could also rise in October’s Budget.

If enough landlords sell because the new rules are too financially punitive, it will increase upwards pressure on rents, which our forecasts would reflect.

We therefore expect the next three months to provide more clarity about the longer-term future for the UK housing market than the last three.

Lettings Forecast