UK residential market: cost of borrowing weighs on activity but higher price brackets resilient

Expectations of approaching interest rate peak will be significant moment for buyers’ confidence but affordability challenges remain.

3 minutes to read

Despite the Bank of England (BoE) raising interest rates by another quarter point to 5.25% this week, there’s a sense after an unexpectedly large fall in inflation from 8.7% in May to 7.9% in June that we may be nearing the peak of the current rate hiking cycle.

While more pain is set to enter the system – with the BoE warning up to 4 million mortgage accounts are likely to renew at higher rates by the end of 2016 – the arrival of a rate ceiling will be critical in bolstering buyer confidence and allowing effective planning.

Even with improved sentiment, affordability will continue to be stretched, with our latest sentiment survey highlighting both concern about the cost of borrowing and the real impact it has had in reducing individuals’ spending power.

It means that we expect transactions to fall, and house prices to decline by 10% over the remainder of this year and next. Strong wage growth, low unemployment, the forbearance of lenders and availability of longer fixed-rate mortgages are the reasons that we do not expect a steeper decline.

Prime regional markets

Outside of the capital, prime house prices have come under pressure and are down by 4.2% since June 2022’s peak.

However, higher value brackets are still seeing strong activity, insulated somewhat by the prevalence of cash and equity rich buyers at the top end of the market.

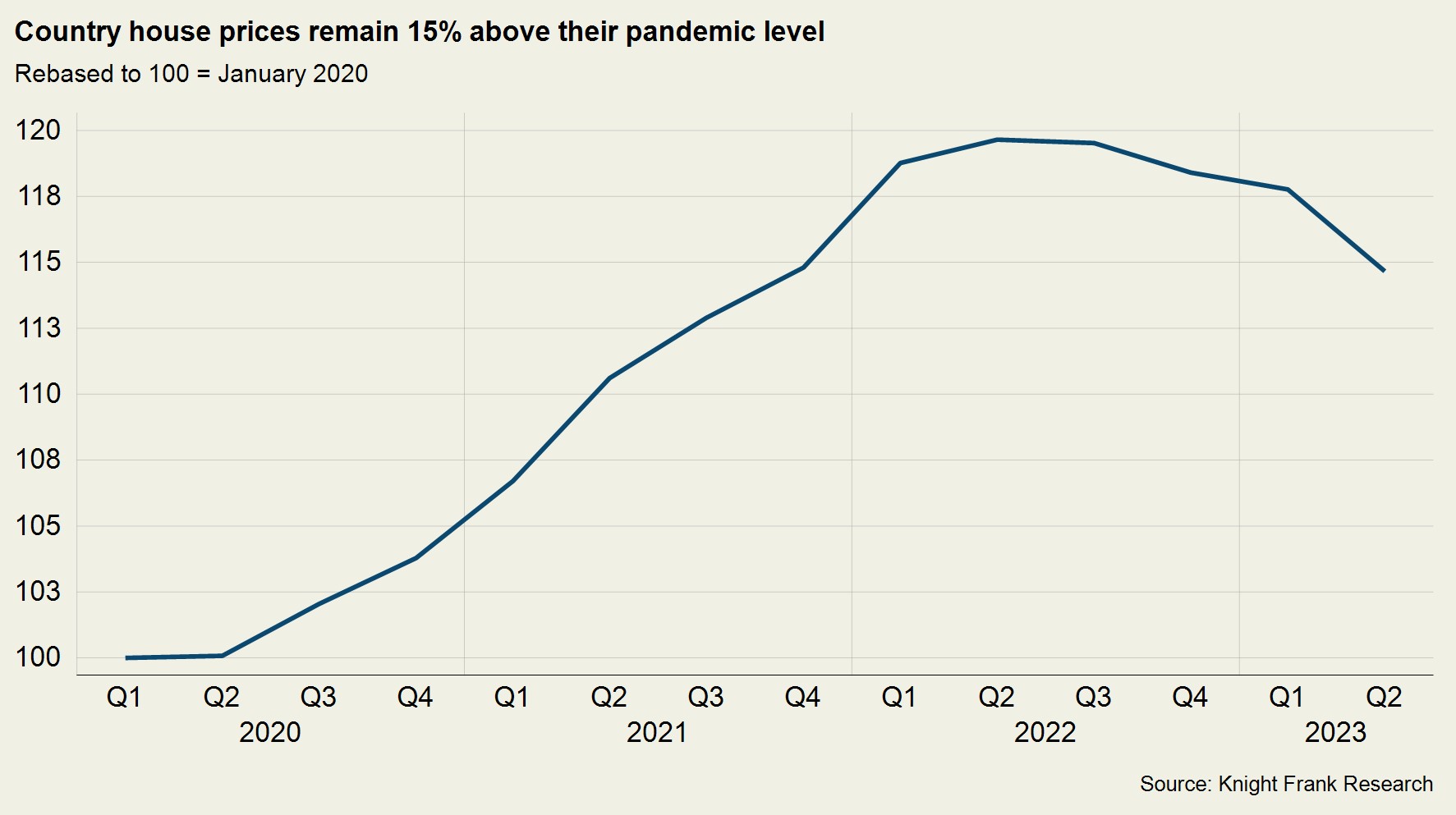

Following the pandemic boom, which supported a surge in prices as people upgraded their homes and took advantage of a period of stamp duty savings, the average price of a prime regional property remains 15% higher than at the onset of Covid in the UK [see chart].

Prime London

As with the upper end of the prime regional market, London is showing resilience. While the high cost of borrowing has had an impact, it hasn’t been a particularly dramatic one.

The resilience is perhaps no surprise given that around half of sales inside zone 1 are typically in cash. The market will also be supported by greater levels of affluence, the relatively weak pound (depending on your timing) and the fact overseas travel is returning to pre-Covid levels.

Higher price-brackets have certainly proven more robust as activity tends to be less reliant on mortgage debt. And overall, activity in London is stronger than outside the capital, where there is a less discernible post-pandemic economic bounce.

Prime Lettings

The story of low supply in the prime London lettings market appears to be coming to an end.

The primary cause is the recent uncertainty in the sales market, which means more owners are letting out their property after failing to achieve their asking price.

The combined number of lettings listings in PCL and POL was the second highest level since September 2021, Rightmove data shows.

Rising supply is not universal and remains tight in areas like Notting Hill and Kensington, where demand in the sales market is resilient and the overall supply of property is low.

As a result of the imbalance between supply and demand becoming less pronounced, annual rental value growth in prime central London fell to 14.4% in June, the lowest level since October 2021. In prime outer London, a figure of 12% was the lowest over the same time period.

Read more or get in contact: Tom Bill, head of UK residential research

Subscribe for more

Get exclusive market analysis, news and data from our research team, straight to your inbox.

Subscribe here