The election obscures the path forward for energy efficiency

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

Asking voters to make short term sacrifices in exchange for long term benefits makes for tricky politics.

It's one of the major factors that makes decarbonisation so complicated. The Office for Budget Responsibility estimates that the cost of reaching net zero by 2050 could reach £321 billion, amounting to about £1.4 trillion in costs offset by £1.1 trillion in savings. The benefits to the economy should be large - about 480,000 new jobs and £1 trillion in goods and services by 2030 alone.

Still, consumers and businesses will need to foot the bill via taxes and investment in the short term, which is particularly difficult when the cost of debt is at a two-decade high. “We’re going to make progress towards net zero but we’re going to do that in a proportionate and pragmatic way that doesn’t unnecessarily give people more hassle and more costs in their lives,” Prime Minister Rishi Sunak said this time last week.

This is the backdrop for an election that has to take place by January 2025 at the latest. It also provides context for a spate of recent policy changes and announcements made by the government. They include making it cheaper to pollute in Britain compared to the EU via the UK's carbon trading scheme, ordering a review of low traffic neighbourhoods and delaying energy efficiency targets for residential landlords.

The property perspective

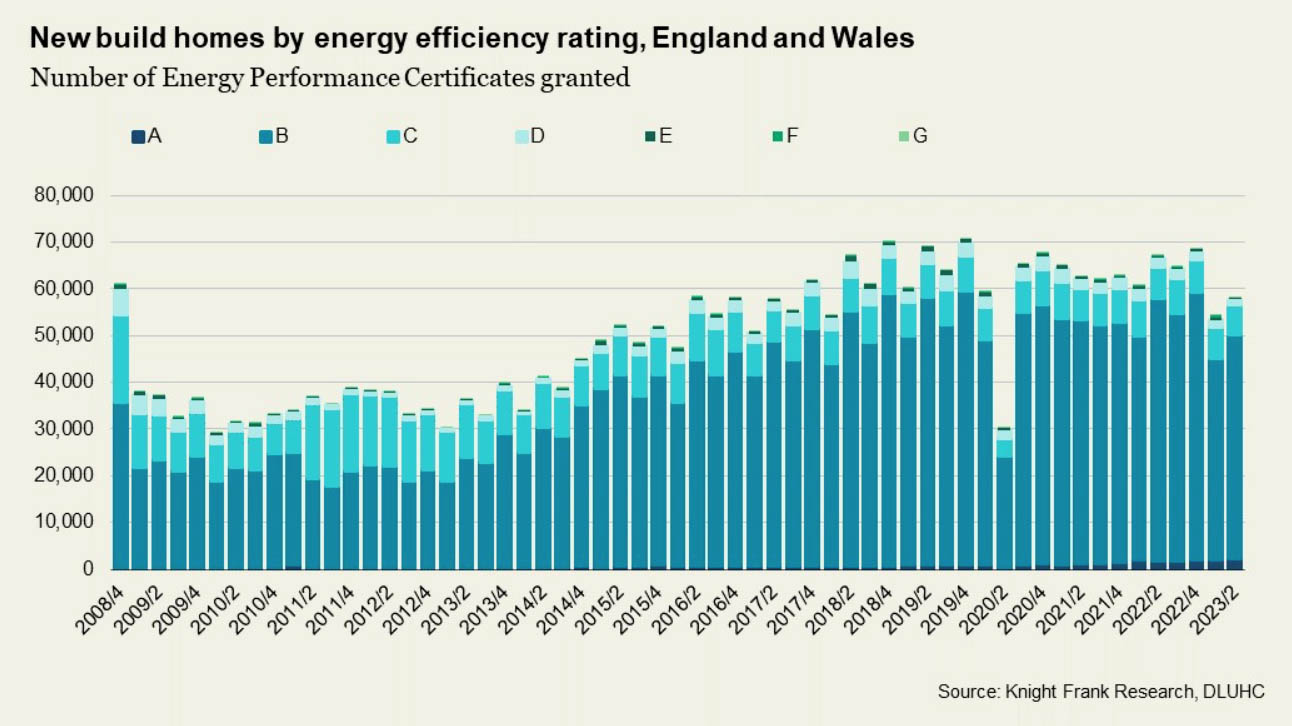

Both consumers and industry have been waiting for clues as to how the government will decarbonise the UK's stock of existing homes. Energy Performance Certificate (EPC) data analysed by Anna Ward last week revealed quite how slow progress has been so far.

A negligible 0.2% of existing homes received the top EPC A grade during Q2. Almost half received a C-rating, while almost 40% were awarded a D. These figures have been largely static for years.

The degree to which UK energy policy backs heat pumps or hydrogen for heating homes is one of many key unanswered questions and the decision has become highly political. Heat pumps are only for the “privileged” who can afford them, the chief executive of National Gas told the Sunday Telegraph yesterday. The National Infrastructure Commission (NIC) issued an exhaustive list of the remaining policy gaps back in March.

The government is holding firm on some key issues. The ban on the installation of new gas boilers in homes from 2035 looks locked in, but are we likely to see a roll out of highly contentious policy initiatives of the sort that the NIC says are required before the election? It looks more unlikely now than it did a month ago, to say the least.

New homes make the grade

Anna's EPC figures (linked above) do reveal change in the new build market.

In total, 2,387 made the A grade in Q2, up 36% from 1,758 in Q2 2022, and a 12% improvement on the previous quarter. The proportion of A-rated new homes out of all new stock also hit a record high of 4.1%, compared with just 2.6% in Q2 2022 and 3.8% in the previous quarter.

The bulk of new builds have been granted a B rating since records began in 2008, but the proportion of B-rated homes has advanced significantly since then: from around 60% of all stock to 82% in Q2 of this year.

Delivery of new homes is likely to decline through the second half of the year. Around 270,559 new homes gained full planning consent in the year to Q2 2023, according to data from Glenigan and the HBF. Consents are 17% below the pre-covid 2017-19 average, which will limit future delivery. See Oliver Knight's newsletter for more.

Betting on rates

About a dozen lenders reduced rates for residential mortgages last week, according to Saturday's Times. The moves prompted a fairly swift reaction from borrowers:

“There has been a change in borrower behaviour over the past two weeks," Simon Gammon of Knight Frank Finance told the paper. "Before the recent reductions in mortgage rates, everyone was fixing for two years and was nervous about more price increases. But now everyone wants a tracker deal — if this is the start of a slow and steady decline in rates, why would you not take a tracker deal and then lock in when rates are a bit lower.”

The Bank of England will very likely raise the base rate to 5.25% on Thursday. While hawkish comments in the meeting minutes could put an end to falling mortgage rates, it's likely the market has now stabalised. Inflation figures due out around the middle of next month will dictate the degree to which easing has further to run.

In other news...

Flora Harley unpacks the ESG implications of the English Housing Survey.

Elsewhere - Companies with good ESG scores pollute as much as low-rated rivals (FT).