Economic data triggers hesitation in UK residential property market

The pace at which underlying inflation comes down will determine rate response by Bank of England.

4 minutes to read

May’s stubbornly high inflation data provided a reality check for the UK residential property market.

The sector has been enjoying a relatively robust period this year after being derailed by last September’s mini-Budget, with demand proving resilient despite the bank rate climbing to a 14-year high of 4.5%.

However, while headline inflation of 8.7% in April was an improvement on 10.1% in March, core inflation nudged up from 6.2% to 6.8%.

Financial markets were quick to price in further rate rises, reasoning that the Bank of England will feel its work to rein in inflation is not done.

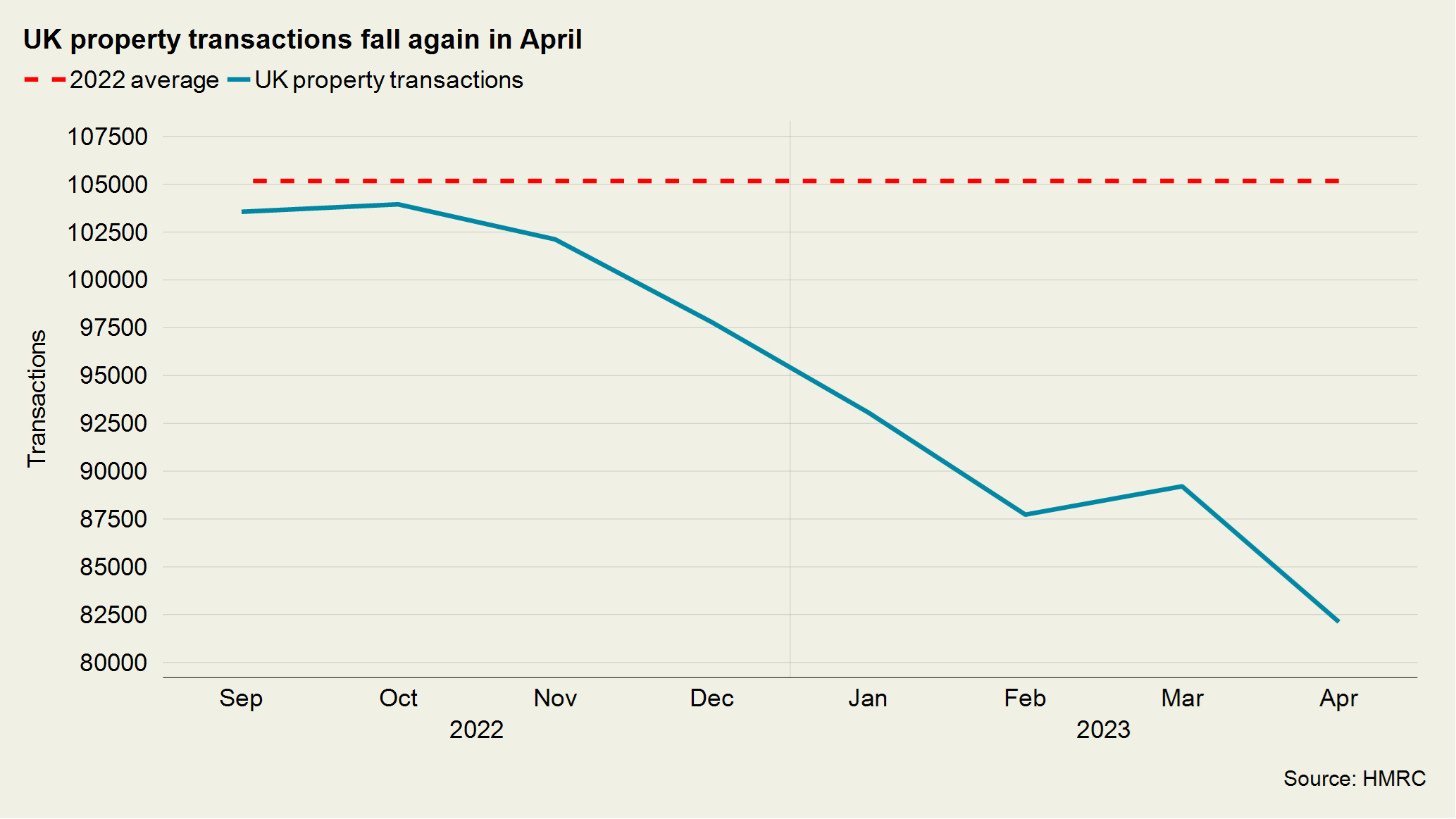

Provisional UK property transaction data from HMRC suggested the current cost of borrowing is already weighing on activity.

Transactions had appeared to have bottomed in March, but April’s data, showed a month on month decline of 8% to 82,120. March’s performance was bolstered by the completion deadline for the discontinued Help to Buy scheme, as well as more working days than April.

Compared with April last year, UK residential transactions were down by a quarter.

Mortgage approvals, which had climbed for two consecutive months, also stumbled. The leading indicator of future demand fell by 5.4% from 51,500 in March to 48,700 in April.

Other than during the pandemic, it was the first time on record that UK consumers paid back more mortgage debt than they borrowed, with a figure of net £1.4bn in April.

While the overall trend for house prices has been a gradual decline since peaking last August, month on month there was stability with lenders Halifax and Nationwide reporting no change and a fall of 0.1% respectively.

The timing of the latest RICS UK residential sentiment survey means it is unlikely to reflect the full impact of expected rate rises, however a host of key indicators were the most positive they’d been in months.

The net balance for new buyer enquires was -18% in May up from -34% a month earlier. The net balance is the proportion of respondents seeing an increase versus those reporting a fall.

Net agreed sales were -7% in May (compared to -29% in March) and net sales in 12 months’ time was +2% (compared to +3% in April).

New instructions ended a 13-month run of negative monthly readings in May, with a net balance of +14%.

However, there’s likely more pain to come. Roughly half of mortgage holders are yet to refinance since the Bank of England started raising interest rates, and about 1.6 million households will see their fixed rate deal expire this calendar year, according to the Resolution Foundation.

This combined with increasing supply is why we believe house prices will fall by 5% this year.

In the lettings market the challenge of demand outstripping supply continued unabated in May. RICS found +44% of contributors had seen an increase in tenant demand in May. On the same basis, new landlord instructions were down -23%.

Almost two-thirds of survey participants report seeing an increase in the number of buy-to-let landlords looking to sell their properties, an issue we have looked at in more detail here.

Prime London Sales

The mini-Budget is fast becoming a distant memory in the prime London property market. Demand is robust, with the number of new prospective buyers 35% above the five-year average in the first four months of this year, excluding 2020.

Supply is also picking up and the number of sales instructions was 16% higher over the same period, which helped push the number of exchanges up by 8%.

Transaction activity was particularly strong in higher price brackets, with the number of exchanges above £5 million up by 40% over the same period. Below £2 million, there was a 3% decline.

Prime London Sales Report – June

Prime London Lettings

During the first four months of this year, the number of new prospective tenants in prime central and prime outer London was 39% higher than the five-year average.

The problem is supply. In the same period, the number of new listings was 34% lower, Rightmove data shows.

A number of landlords have left the sector in recent years after a series of tax changes means it has become more financially punitive for them, and the laws of supply and demand mean the pain is spreading to tenants.

Prime London Lettings Report – June

Country Market

An analysis of the prime regional market in the first four months of 2023 lays bare the consequence of deals that weren’t done at the backend of last year because of the uncertainty unleashed by the mini-Budget.

The number of exchanges outside of London in the first four months of 2023 are down 31% on the same period last year.

However, demand remains stronger than before the pandemic. The number of new prospective buyers registering with Knight Frank in the first four months of 2023 outside of London remained the third highest in a decade (behind 2022 and 2021 respectively), and 14% higher than the same period in 2019.

Country market still feeling mini-Budget hangover

Subscribe for more

For more market-leading research, expert opinions and forecasts, subscribe below.

Subscribe here