France senior housing sector outperforms residential market

Senior housing investment volumes up almost 20% in 2022 as investors capitalise on growing demand.

6 minutes to read

A booming asset class, the need for senior housing across Europe is becoming more of a necessity. In France the need for diversification of location, and an ageing population, offer a unique opportunity for investors.

The managed accommodation market, which includes student and senior accommodation as well as co-living, is very developed in North America and the United Kingdom and is expanding rapidly in Europe, particularly in France.

The senior housing sector is particularly dynamic, benefiting from strong demand, the gradual structuring of a network of specialised players and the upmarket nature of supply. The changes in the regulatory framework could also play a role, with ageing well becoming one of the major national priorities for 2023, one year after the ORPEA scandal, which highlighted evidence of financial wrongdoing at the nursing home.

The "Old Age and Autonomy" law, which has been postponed several times, has returned to the forefront of the parliamentary stage with the submission in December 2022 by the majority of a bill "aimed at building a society for ageing well in France", several provisions of which relate to housing.

Demographic challenge

Senior housing includes, on the one hand, serviced apartments for non-dependent seniors (private accommodation and collective services: reception, cleaning, catering, entertainment, and others.) and, on the other hand, medicalised accommodation whose occupants are assisted with their healthcare and loss of independence such as nursing homes and long term care units.

At the end of 2021, France had more than 7,350 nursing homes according to the Ministry of Social Affairs, i.e. almost 600,000 beds. With less than one place available for every 10 senior citizens, the supply seems very low given the number of French people aged 75 and over - 6.85 million on 1 January 2023 according to INSEE.

Considering the demographic trends and the coming explosion in the number of senior citizens (+89% by 2070, i.e. 5.7 million more people aged 75 and over than in 2021), demand will grow very strongly for over thirty years. There is therefore an urgent need to increase supply. The number of public or medicalised establishments is expected to grow more slowly, mainly because of the need to obtain administrative authorisations. The development of private accommodation with services, which are not subject to medico-social regulations, will therefore play a central role in increasing supply.

Investor enthusiasm

Managed accommodation, which is highly sought after because of its stability (long leases, assets uncorrelated with economic cycles, etc.) and higher yields than other types of assets, is attracting increasing interest from investors. The United Kingdom is the main European market: the volumes invested in this market sector totalled €2.8 billion in 2022 after €3.2 billion in 2021.

In France, the investment volumes are not as high, but increased by almost 20% in the last year, totalling €650 million in 2022. French investors remain the main players in the French market (pension and mutual funds, SCPIs, etc.).

Certain profiles are increasingly present, such as insurers like MALAKOFF HUMANIS and AG2R LA MONDIALE, developers such as VINCI IMMOBILIER, BOUYGUES and other types of players seeking to diversify their assets (LA POSTE IMMOBILIER through a partnership with JARDINS D'ARCADIE).

Foreign funds are also driving the market, as shown by the acquisitions made in France in 2022 by LIM, PFA, ABRDN and COLUMBIA THREADNEEDLE INVESTMENTS. This enthusiasm is contributing to the increased number of openings. The think tank Matières Grises has identified around one hundred new senior accommodation facilities opening each year. The increase in supply is also supported by the conversion of obsolete assets, particularly offices, as in the case of the recent inauguration by NOVAXIA of a new 6,675 sq m senior housing facility in Levallois-Perret (97 rue Jean Jaurès).

Conversion projects are also multiplying in the regions, such as the transformation of a former industrial site into a mixed-use complex in Villeurbanne. BNP PARIBAS IMMOBILIER and GINKGO, winners of the call for tenders, are planning to create around 320 homes, including 80 for seniors.

Unevenly distributed supply

In France, the stock of senior accommodation has almost doubled in six years, rising from 540 establishments in 2016 to almost a thousand by the end of 2022. According to Xerfi, their number could rise to 1,300 by 2025, which would still be insufficient given the enormous needs.

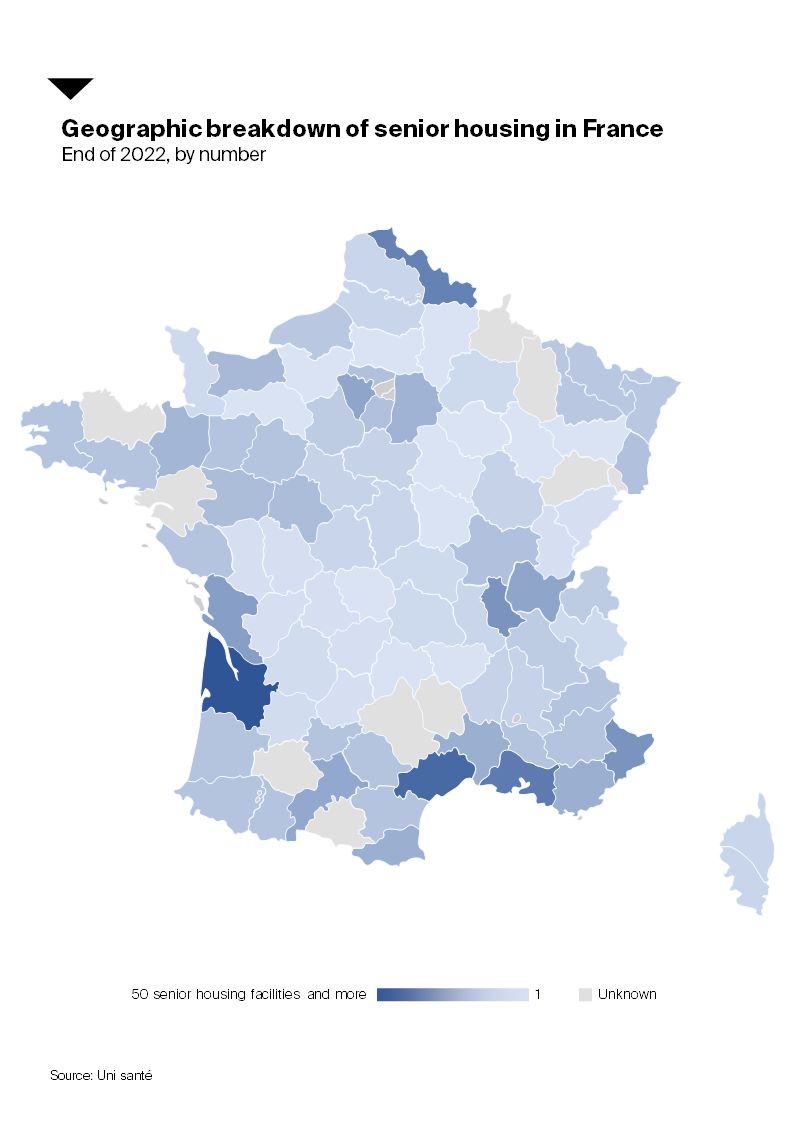

Unevenly distributed throughout France, the stock is concentrated in coastal areas, usually favoured by the elderly population, as well as in dense and dynamic urban areas, mainly in city centres for reasons of accessibility, socialisation and proximity to services. Supply is particularly well developed in the regions of New Aquitaine (especially in Gironde and Charente-Maritime), Provence-Alpes-Côte d'Azur (in the departments bordering the Mediterranean) and Brittany. There are also many establishments in the Paris region and close to regional cities such as Lille and Lyon.

Conversely, the stock is much smaller in the Centre-Val-de-Loire and Bourgogne-Franche-Comté regions, as well as in the more rural and less accessible areas of New Aquitaine, Occitania and Auvergne-Rhône-Alpes. The diversification of locations remains a major challenge in a context of strong demand in suburban and rural areas.

New concepts for a new generation of senior citizens

In addition to the urgent need to create new accommodation, the changes in society and the arrival of the retired baby boomers also require a rethink of the residential provision for senior citizens so that it takes into account the finances of the most modest such as loss of purchasing power, low pension increases, new expectations such as security, diversification of services, home automation, and varied lifestyles such as sedentary and nomadic.

This is reflected in the development of new real estate solutions, such as accommodation attached to a medical establishment or an nursing home with the aim of reducing costs (pooling of services such as collective catering, proximity and responsiveness of health professionals, for example). Several players, such as the EMERA group, are already focusing on these synergies. Accommodation sharing between seniors has also increased in France in recent years in order to help residents maintain their autonomy and socialise. Since 2018, KORIAN has been experimenting with this type of housing with its subsidiary Ages & Vie (300 houses by 2024).

Finally, more and more intergenerational accommodation, mixing elderly people, students and families, is being created in France, in response to the problems of isolation accentuated by the health crisis. These types of intermediate accommodation, a significant proportion of which are managed by social landlords such as CDC Habitat, should become more widespread and make it possible to create economies of scale to reduce monthly rents (between €1,200 and €1,500 on average depending on the services provided by the "all-inclusive" housing and up to €2,500 for top-of-the-range housing).