Investors continue to target France residential market

The residential sector in France is still a top investor target despite slowdown in market.

5 minutes to read

Following the euphoria of 2021, which saw a clear increase in residential sales, the situation deteriorated in 2022 in the French residential market due to the tightening of credit conditions.

Economic and political pressures such as inflation, the war in Ukraine, and the energy crisis, also contributed.

Although still slightly up in the Greater Paris Region (+3% in 2022 over one year), the number of sales of second-hand homes decreased by an average of 6% throughout France.

The new housing market has seen an even more pronounced drop of 31% in France and 14% in the Greater Paris Region. Finally, new residential production has been particularly limited, with less than 60,000 residential units started in 2022 in the Greater Paris Region (-11%).

The investment market

In 2022 €57 billion was invested in the European residential property market, a 48% drop over one year due to a much less dynamic second half than that of the previous year. In 2021, activity actually accelerated over the months, with the year ending with an exceptional fourth quarter, particularly in Germany.

The slowdown in the European residential market should, however, be put into perspective. For example, the volumes invested in 2022 are 5% higher than the average for the last five years.

On the other hand, all asset classes have suffered a slowdown due to the sudden rise in interest rates and the wait-and-see attitude of investors. All types of property combined; the sums committed to the European real estate market in 2022 have fallen by 30% year-on-year.

The residential sector accounts for a high proportion of this amount, around a quarter, compared with 40% for offices, 21% for industrial and 14% for retail. The United Kingdom accounts for the largest share of the volumes invested in 2022 in the European residential market (27%), ahead of Germany (20%), Sweden (10%), France (9%) and the Netherlands (5%).

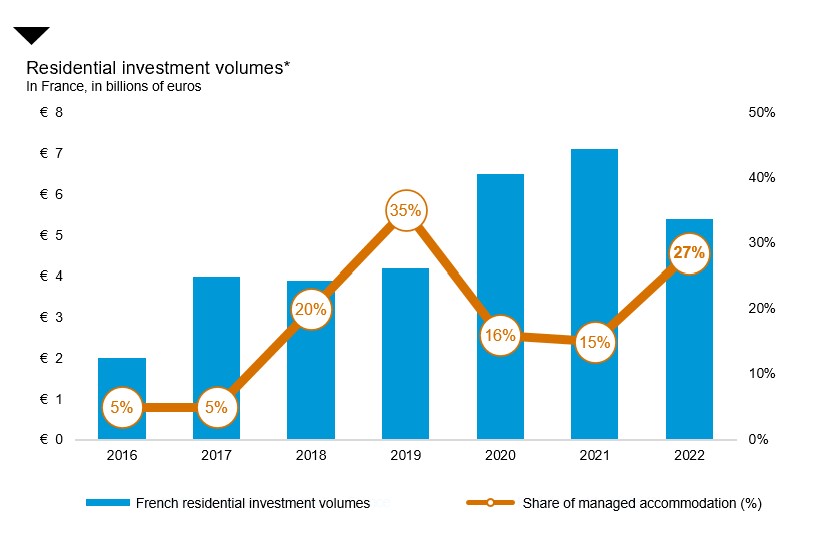

Like the rest of Europe, and after two exceptional years, activity in France slowed significantly in 2022. Block sales totalled €5.4 billion, after 6.5 billion in 2020 and 7.1 billion in 2021. This decrease, which is less marked than the one observed on a European scale, needs to be put into perspective since the sums committed in 2022 in France are twice as high as the average for the four years preceding the outbreak of the health crisis.

As with corporate real estate, it was in the second half of the year that the drop in volumes was most pronounced, with the sums committed in the second half of the year being 47% lower than in the first half. It should be noted, however, that the amounts were greatly inflated at the beginning of the year by the sale by CDC HABITAT to CNP ASSURANCES of the "Lamartine" portfolio for a little over €2 billion.

New buildings

A few significant transactions were recorded in the second half of 2022, including STAM's purchase of 68 boulevard de Courcelles in Paris and the sale to ABRDN of a mixed-use development including managed residential accommodation in Nanterre for almost €100 million. These transactions have helped to consolidate the Greater Paris Region's dominance, which accounted for nearly three quarters of total investment in the French residential market in 2022.

Lastly, new residential property accounted for a majority share (61%) of the total volume invested in the French residential market in 2022. This share was inflated by the sale of the "Lamartine" portfolio, as well as by the high number of forward-funding sales in the managed residential market.

French investors

The residential market remains overwhelmingly driven by French investors. The latter accounted for 87% of the sums committed in France in 2022, a share inflated by the year's largest transaction: the sale of the "Lamartine" portfolio to CNP ASSURANCES. Other insurers have been active, including AG2R LA MONDIALE, but they are far behind OPCI/SCPIs in terms of number of transactions. Among the most active are PRIMONIAL REIM, LA FRANÇAISE and SOFIDY, which, by reinforcing their investment strategy in favour of more defensive assets, have targeted both traditional housing and managed accommodation.

Foreign investment

Foreign investors accounted for only 13% of the total amount committed in France in 2022, and were behind a limited number of transactions, most of which went to pan-European and German funds. PGIM and HINES, for example, dominated the French market in 2021. In 2022, ABRDN, DWS, M&G, COLUMBIA THREADNEEDLE INVESTMENTS and the Danish fund PFA stood out, investing mainly in the Greater Paris Region and in the managed residential sector.

Strong appetite for managed residential properties

Foreign investors accounted for 28% of the volume invested in the managed residential sector in France in 2022, and they played a major role in the dynamism of this market, as illustrated by the acquisitions made by ABRDN in Nanterre, PFA in Alfortville and COLUMBIA THREADNEEDLE INVESTMENTS in Lille in the second half of the year.

On the French side, KLEY, CDC INVESTISSEMENT and large savings collectors such as PRIMONIAL REIM, LA FRANÇAISE, SOFIDY and EURYALE were among the most active players in acquisitions.

In 2022, the managed residential market totalled €1.4 billion, an increase of almost 40% compared to 2021 and 27% of the total amount invested in the French residential market.

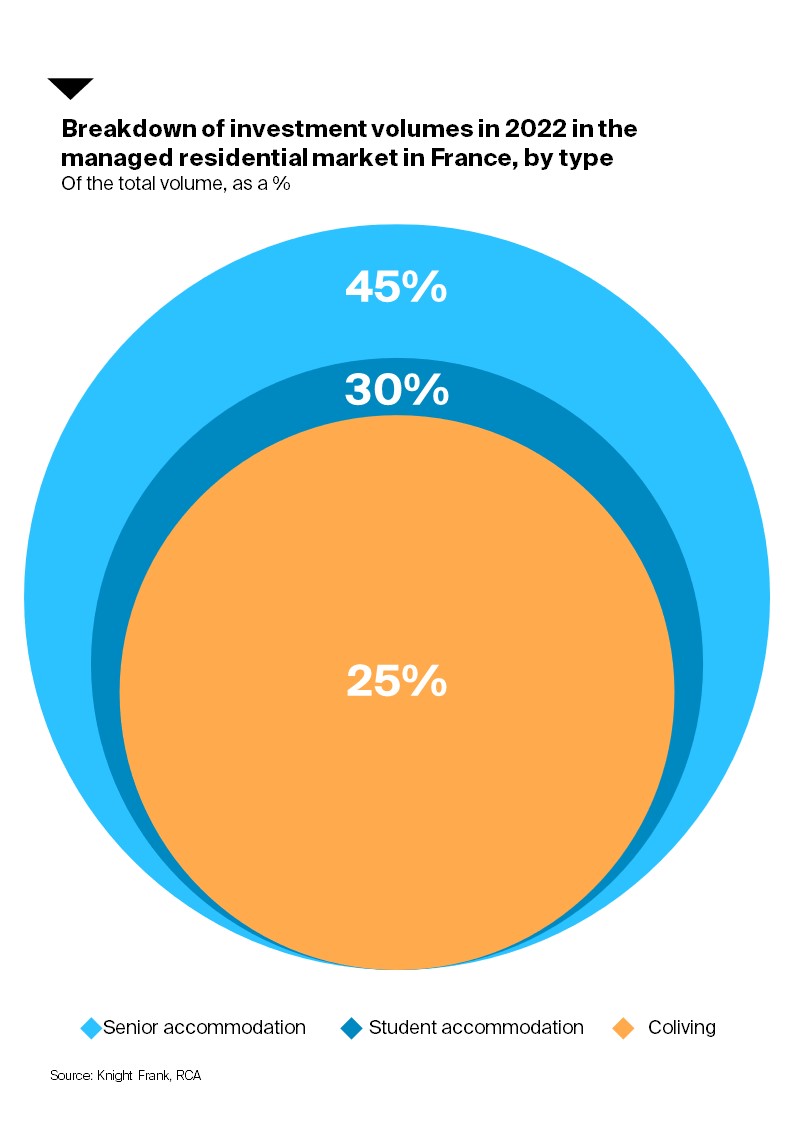

This result can be explained in particular by investors' appetite for senior housing, with some thirty transactions totalling €650 million, of which just over half was in the Greater Paris Region and almost two thirds in the form of forward-funding sales. Forward-funding sales also dominate the student accommodation market, which accounted for 30% of the sums committed in the managed residential sector in France in 2022, as well as the co-living market (20%).

What is the outlook for 2023?

After the record result of 2021, the slowdown experienced in 2022 will continue in 2023 due to the wait-and-see attitude of investors faced with the rise in interest rates. The market will also be constrained by a lack of new products, related in particular to the rise in construction costs and the difficulties of certain developers.

However, investors will continue to make the residential sector one of their priority targets as part of diversification strategies aimed at secure asset types that are uncorrelated with economic cycles.