UK mortgage rates continue to fall

Making sense of the latest trends in property and economics from around the globe

3 minutes to read

Back to the city

Homebuyers flocked to rural property markets during the pandemic in search of new lifestyles enabled by hybrid working. Town and city markets are now recovering amid a broad return to the office.

From Q3 2020 to Q3 2022 the number of exchanges in regional towns and cities increased by 10%, Knight Frank data shows. In the same period rural exchanges declined by 9%.

This shift back to more urban areas with a shorter commute can be seen right across the UK. Compared with the peak period for the “escape to the country” trend in Q3 2020, nine of the top ten areas in England and Wales that have seen the largest increase in properties under offer are classified as majority urban, OnTheMarket data shows (see the linked piece for a table).

UK mortgage rates slide

Average UK five year fixed mortgage rates are below 6% for the first time since the days after the mini-budget, according to data from Moneyfacts out yesterday. The best deals now start with a four - see Friday's note.

Fixed rates could fall further, but the days of 1 or 2% mortgage rates are behind us for now, Simon Gammon of Knight Frank Finance tells the FT. “This is perhaps the new normal,” he adds. “People will have to get used to it.”

Simon was asked what advice he had for borrowers in these conditions - here's what he said: -

"It still makes sense to move to a tracker while fixed rates are falling. Even if the Bank of England makes another substantial hike in December, there should still be a gap between variable rate deals and fixed products so it makes sense to wait on a tracker for the time being. Of course much of that depends on a borrower's circumstances and their appetite for risk, but headline two year trackers are still in the threes, whereas most two and five year fixed products are in the fives, with one or two in the fours. That will make tracker products attractive for at least a few more months."

US home sales feel the squeeze

US existing home sales plunged 5.9% in October, according to the National Association of Realtors. That's the largest drop since December 2011 when you exclude the early months of the pandemic.

Average 30-year mortgage rates peaked at 7.08% during the period, which squeezed many would-be buyers out from qualifying for a mortgage.

Supply is still tight, which is underpinning prices. Total inventory registered at the end of October was 1.22 million units, down 0.8% from both September and the same month a year earlier. Unsold inventory sits at a 3.3-month supply at the current sales rate, up from 3.1 months in September and 2.4 months in October 2021. Properties typically remained on the market for 21 days in October, up from 18 days in October last year.

New York

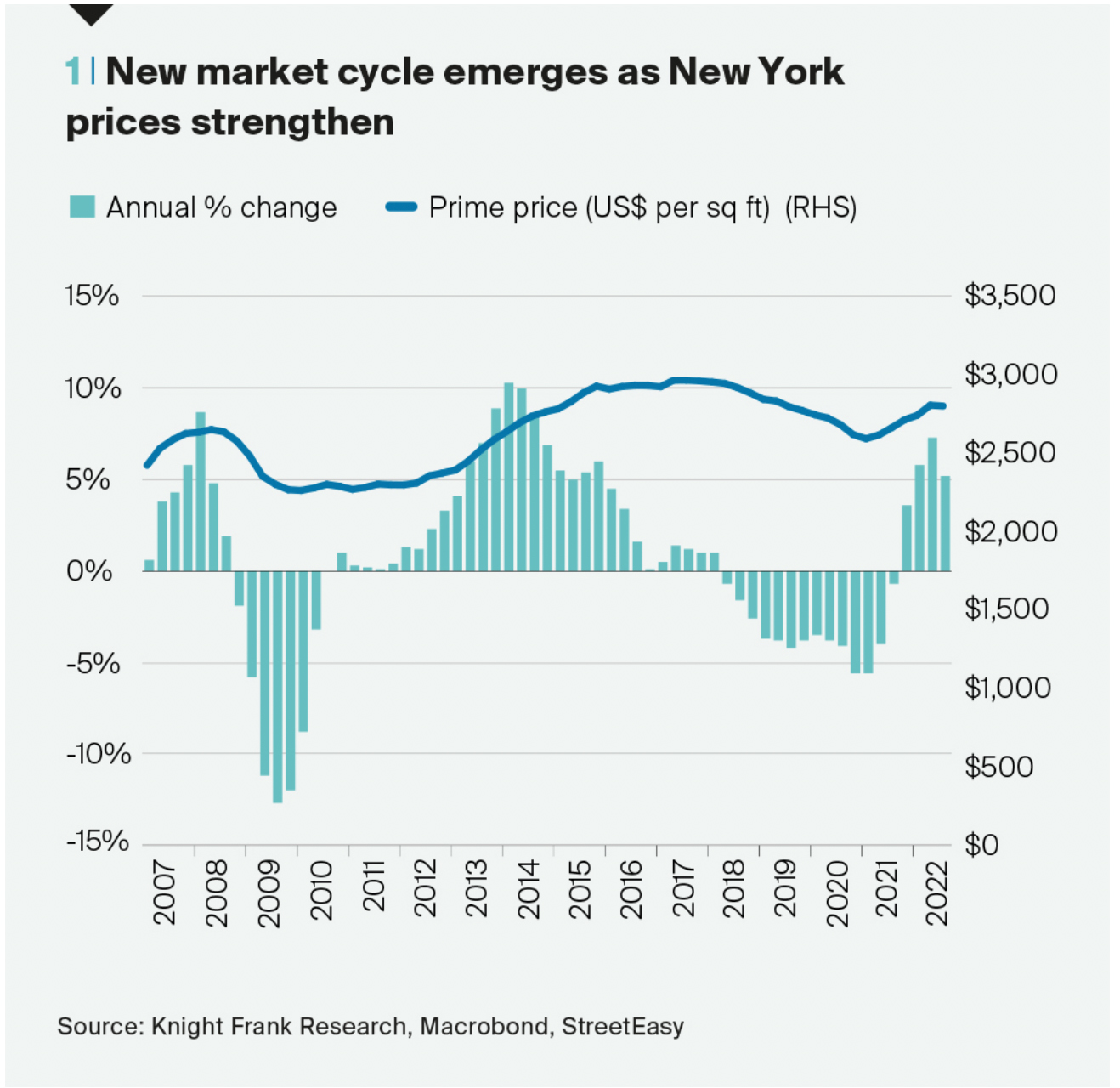

Double-digit price growth eluded New York during the pandemic, unlike other US cities.

As we enter a period of uncertainty New York is back in the spotlight as buyers seek a mature, secure, liquid and highly transparent market. In June 2022, prime prices across Manhattan increased by 7.1%, the strongest rate of growth recorded for eight years.

Although the rate of annual price growth had slowed to 5.2% by September 2022, it remains significantly higher than a year earlier when luxury prices were falling 0.4% year-on-year. More than 8,300 sales were registered across Manhattan in the first half of the year, up from 7,373 in the same period a year earlier.

The super-prime market (US$10 million) displayed similar strength. Some 146 super-prime sales were agreed in the first six months of 2022. Of the 10 super-prime markets Knight Frank tracks globally, New York’s tally was the highest. Furthermore, 20 of these sales exceeded US$25 million.

In other news...

Stephen Springham on better-than-expected retail sales in October.

Elsewhere - Spain approves mortgage relief plan (FT), and finally, Europe to be hit hardest in global slowdown (Reuters).