Unpicking the Autumn Statement

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

The Autumn Statement

There were no big surprises and no big moves in sterling, gilt yields or swap rates. The government's truce with financial markets lives on.

The top line for the property market? It could have been worse. The stamp duty changes announced by former Chancellor Kwasi Kwarteng in September will now be reversed from 1 April 2025. That means the nil-rate band will revert back to £125,000 from £250,000 (which represented a maximum saving of £2,500). The first-time buyer relief (representing a saving of up to £11,000+) will also be reversed. This effectively means a 28-month stamp duty holiday is in place that will lead to higher levels of transaction activity closer to the deadline.

The annual exemption for capital gains tax (CGT) will be cut from £12,300 to £3,000 from April 2024. That means anyone selling a second residential property will pay CGT on all gains above £3,000. This will disproportionately affect landlords of lower-value properties. A policy to align CGT rates with income tax bands had been trailed in the papers but wasn’t announced. The top rate of income tax is 45%, which would have been a bigger disincentive for landlords.

Our sector specialists dissect the statement in more detail here. I'm also joined by Tom Bill and Flora Harley for a new edition of our Intelligence Talks podcast this morning. You'll hear their views on the likely fall out, plus some bold predictions that we can hold them to in the new year… Listen here, or wherever you get your podcasts.

Forecasting

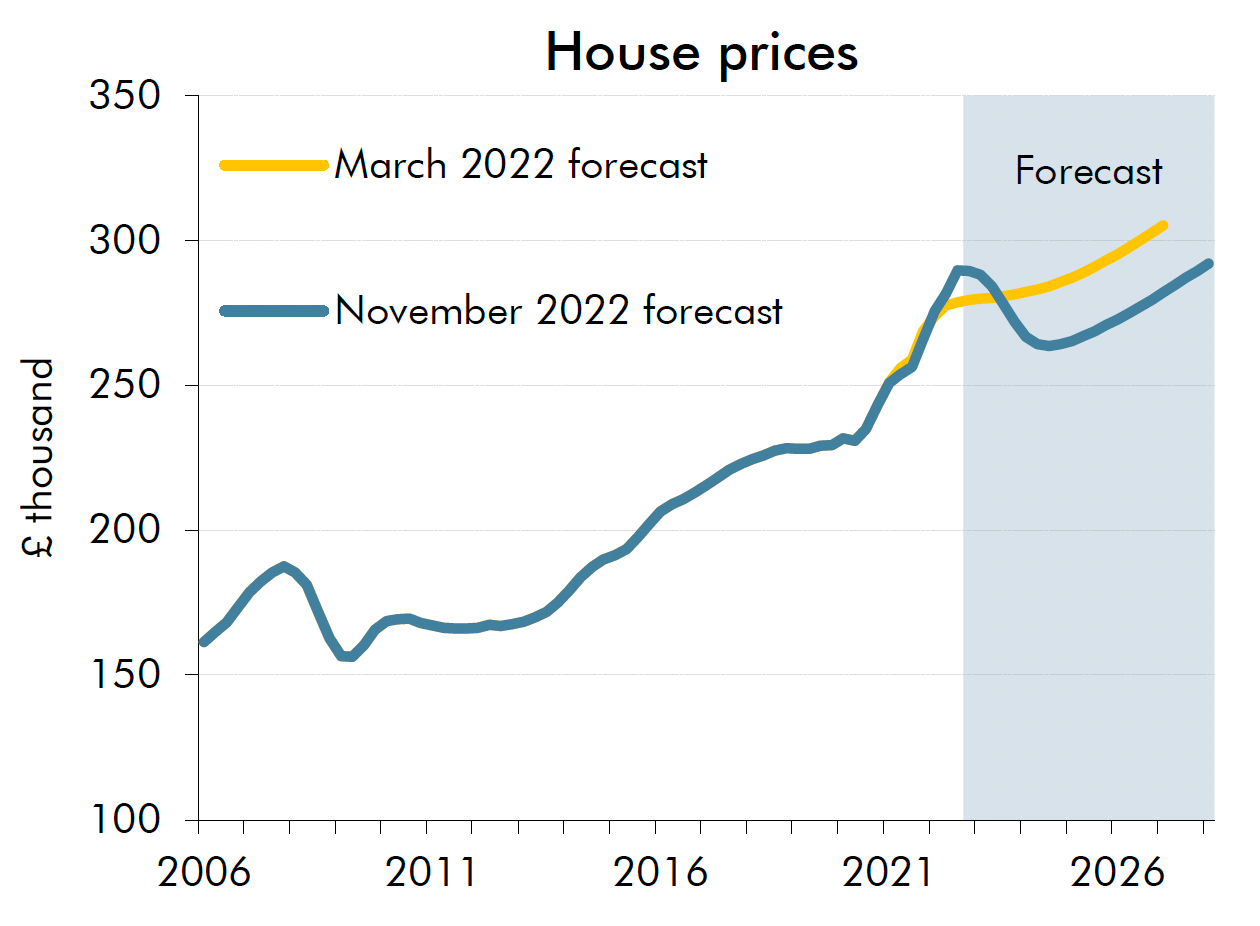

House prices will fall 9% between the fourth quarter of 2022 and the third quarter of 2024, according to Office for Budget Responsibility forecasts published alongside the statement. Modest growth of 1.2% returns in 2025 before picking up to 3% in 2026 and 3.5% in 2027 (see charts).

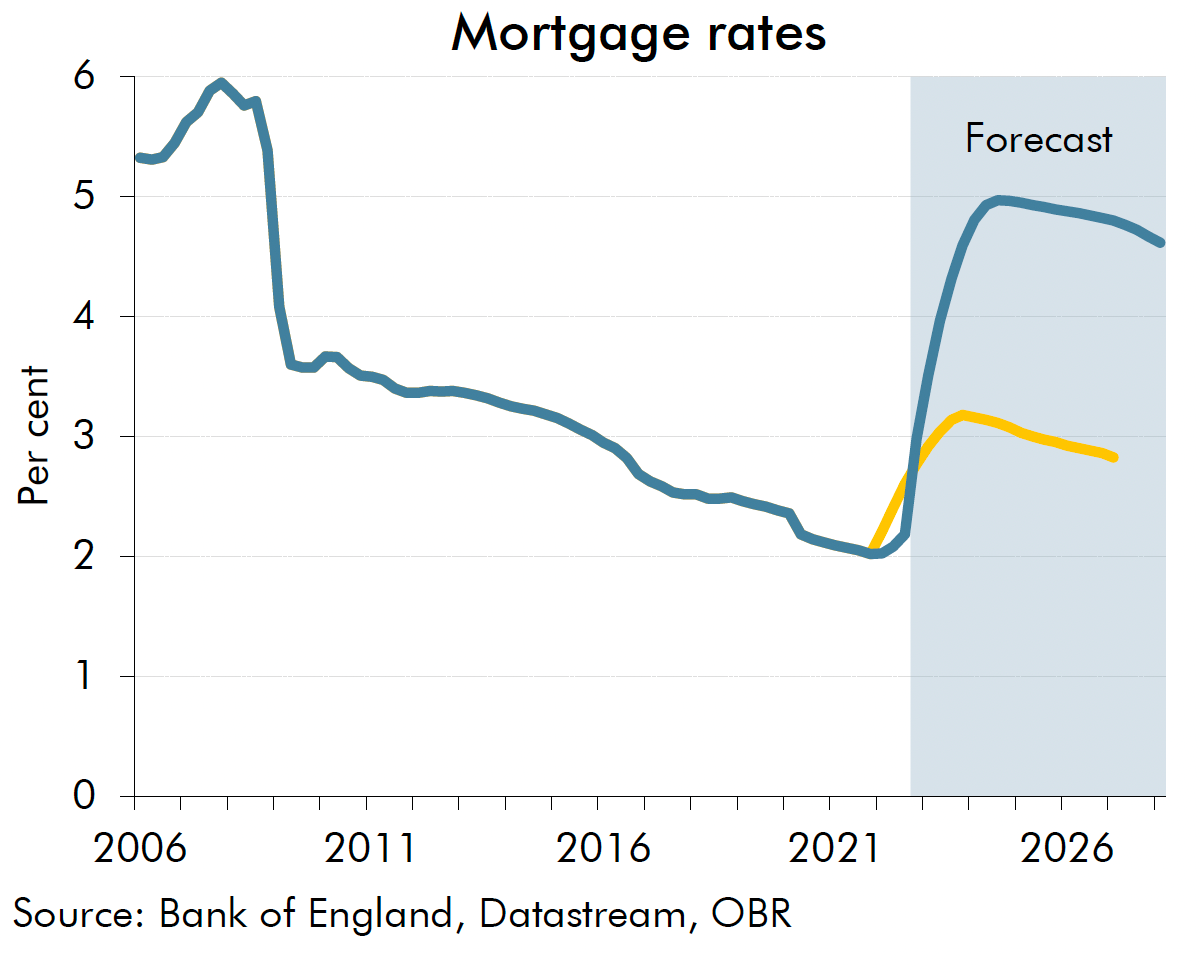

The average mortgage rate paid by homeowners will peak at 5% in the second half of 2024 and will only ease to 4.6% by 2027. Everything comes with a big health warning "given the sensitivity of house prices to mortgage rates and the recent volatility in the bond yields that drive pricing in the mortgage market."

Mortgage rates continue to fall and the cheapest deals now start with a four. The Skipton and Yorkshire building societies cut the cost of deals yesterday and more are expected to follow.

This is the beginning of the new normal, Simon Gammon of Knight Frank Finance tells the Times: "People will have to realign their expectations to loans that are 4 per cent or more. While there will have to be a lot of changes in discretionary spending, most should still be able to afford their mortgage despite how painful it will feel."

US mortgage rates tumble

October's US Consumer Price Index provided the firmest signal so far that America's rate of inflation has peaked.

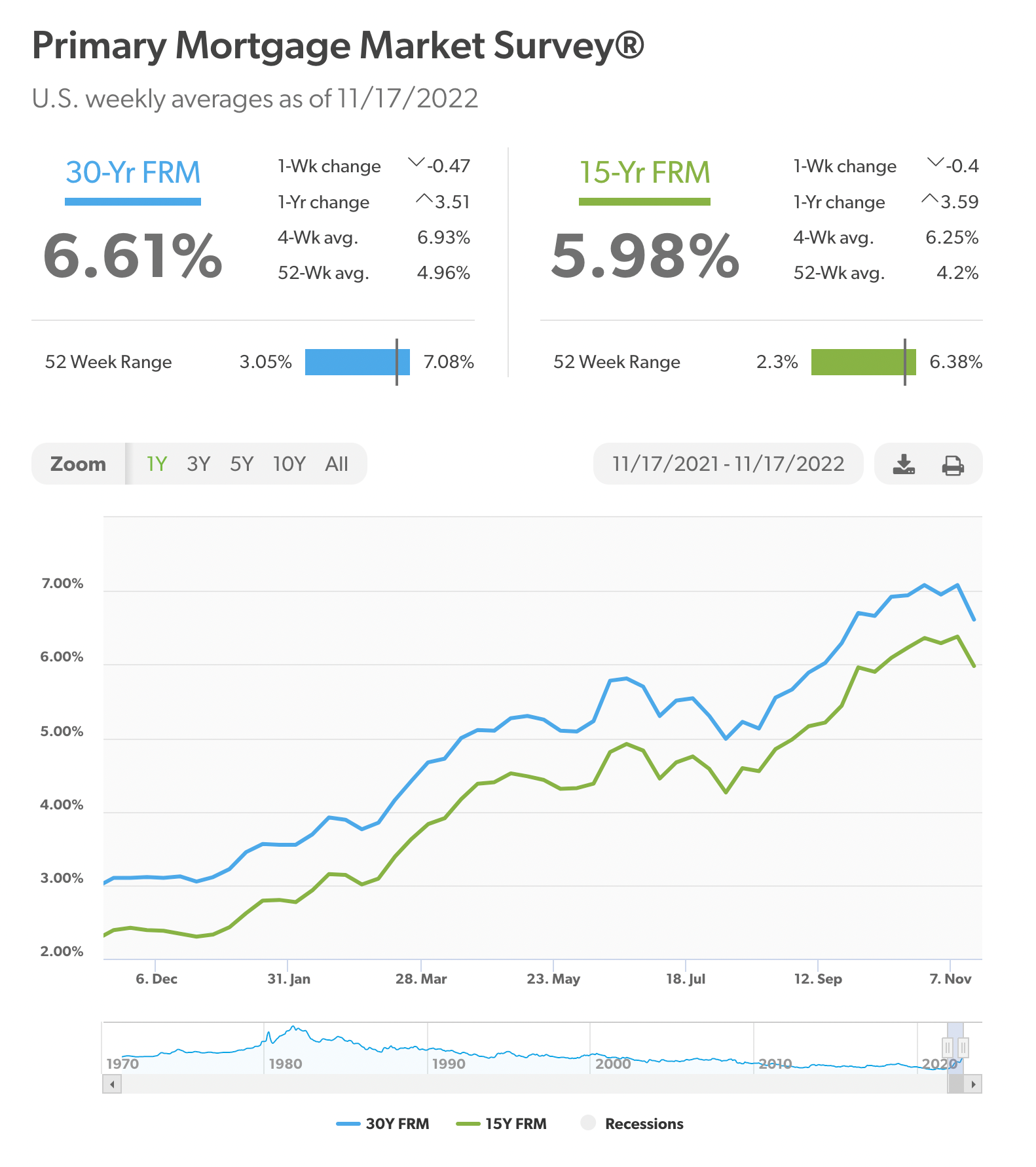

Mortgage rates fell sharply in response. The average 30-year mortgage tumbled to 6.61% this week, from more than 7% a week earlier, according to Freddie Mac data. Bloomberg makes that the largest drop since 1981.

Something verging on euphoria seized markets in the hours after the inflation reading. That's been tempered in subsequent days as Fed rate setters have suggested it's too early to pivot. The most hawkish remarks came yesterday from James Bullard, president of the Federal Reserve Bank of St. Louis, when he suggested that the rate may have to rise to a level somewhere between 5% and 7%.

Rising office rents

Rising rents for the best offices are softening the blow of higher rates on valuations, London's biggest commercial landlords said this week.

Great Portland Estates said in a trading update yesterday that the company had booked £16.7 million of new annual rent between April and September at an average 4.4% ahead of where it had expected six months earlier.

"Whilst economic challenges may persist in the near term, our experience is that many customers are looking through the downturn in assessing their real estate needs, seeking to trade up to great spaces that are fit for future working patterns," said GPE chief executive Toby Courtauld.

Landsec and British Land expressed similar sentiments earlier this week.

In other news...

UK consumer morale edges higher, but still very low (Reuters)