Signs that imbalance in rental market is reducing as prices come under pressure

The supply of lettings properties is picking up though there are differences across regions and price bands

3 minutes to read

There are clear indications that supply in the lettings market is growing from a low base.

Frustration has grown among tenants over the last eighteen months as a scarcity of rental properties has resulted in fast-rising rents. The UK experience has been mirrored around the world as offices and universities re-opened and demand surged.

At their peak last spring, rental values in prime London markets and the Home Counties were rising by more than 20% a year, Knight Frank data shows.

A strong sales market, driven by a stamp duty holiday, low borrowing costs and the ‘escape to the country’ trend led to a sharp rise in the number of sales during the pandemic, exacerbating the supply shortage.

Things are reversing as mortgage rates normalise and the sales market stutters, which means stock is rising and upwards pressure on rents is relenting, new data shows.

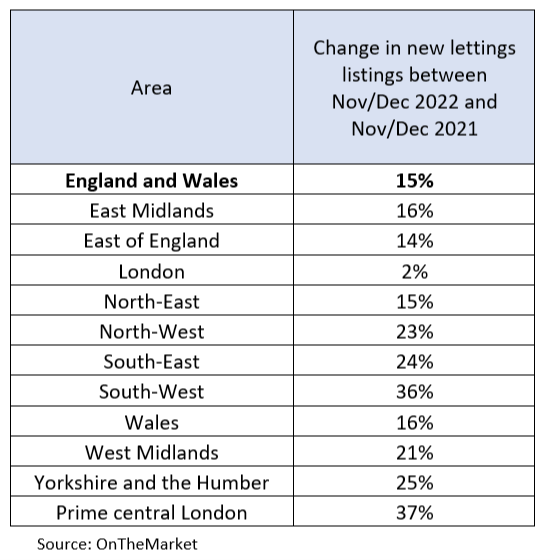

The number of new lettings listings in the final two months of last year was 15% higher in England and Wales than the same period in 2021, figures from OnTheMarket show.

September’s mini-Budget caused a spike in mortgage rates in the final quarter of last year that is still working its way through the system, which is bringing rates back down. However, as the Bank of England tackles high inflation and continues to raise the bank rate this year, a new (higher) normal for borrowing costs will emerge.

As a result, we expect prices to fall by around 10% over the next two years.

“Most of our lettings offices in London are reporting that stock levels are as high as they have been since before the pandemic,” said Gary Hall, head of lettings at Knight Frank. “The majority of properties have come from owners who would otherwise have sold but based on the uncertainty surrounding prices and transaction volumes, have decided to sit it out.”

There was some variation around the country, with stock levels rising by 36% in the south-west.

“There are a number of properties in the south-west with a lettings unit attached,” said Mark Proctor, head of south-west sales at Knight Frank. “After the recent spike in mortgage rates, more owners need the extra income and are renting them out. Meanwhile, people who want to buy in the south-west are increasingly going into rental accommodation first rather than making a decision quickly, so demand has picked up.”

There was also a discrepancy in the capital between the overall figure for London (+2%) and prime central areas (+37%).

London has a different tenure profile to the rest of the country, with 29% of homes privately rented compared to 17% in the rest of England, pointing to a higher degree of saturation. The London sales market is also benefitting from a return to more urban living as the pandemic winds down in the UK.

Furthermore, mortgage debt is higher and more prevalent in the capital, meaning owners have less room for manoeuvre when deciding whether to sell or let out their home.

The same cannot be said for prime central London, where there is a higher proportion of cash buyers, as we explored here. The increase in the number of lettings listings for higher-value properties tallies with data we have previously published.

“It has been one-way traffic from the lettings to the sales market over the last year and a half but that is changing,” said David Mumby, head of prime central London lettings at Knight Frank. “It is more noticeable for higher-value properties because there are fewer forced sellers. There is less leverage, which means owners can wait three or four years to sell and are able to let their property out in the meantime.”

Supply may pick up further after the spring as price expectations are more fully put to the test and more so-called ‘accidental landlords’ are created.

Whatever happens, the days of 20%+ growth in rental values appear to be behind us, as reflected in our latest forecast.