Calling the bottom of US housing sales

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

Calling the bottom

US existing home sales fell 1.5% to 4.02 million in December, the eleventh consecutive monthly drop, according to the National Association of Realtors. Reuters makes that the lowest figure in twelve years.

Buyers at the time were grappling with near record mortgage rates and tight inventory levels. Mortgage rates have since improved markedly - average 30-year mortgage rates now stand at 6.15%, according to FreddieMac, down from a peak of more than 7% back in November (see chart). That sets the stage for a turnaround, according to the NAR:

“December was another difficult month for buyers, who continue to face limited inventory and high mortgage rates,” said NAR Chief Economist Lawrence Yun. “However, expect sales to pick up again soon since mortgage rates have markedly declined after peaking late last year.”

Much will depend on whether the Fed follows the approach that its officials have signalled, or opts for the more dovish approach that markets are expecting. Fed officials have indicated they intend to push the key interest rate above 5% and maintain that level until the end of 2023 at a minimum. Markets are sceptical - see the weekend FT - and suggest the Fed will cap the policy rate at 4.75% to 5% before implementing half a percentage point of cuts before the year end.

Warm weather

The Fed isn't the only central bank trying to keep a lid on optimism. European Central Bank President Christine Lagarde gave a pretty hawkish speech at Davos on Thursday, seeking to temper hopes that the ECB is nearing the end of its hiking cycle already.

The ECB raised the deposit rate by 250 basis points to 2% in 2022. Economists surveyed by Bloomberg expect a peak of 3.25% sometime this summer. December saw the first decline in headline inflation and several indicators published subsequently suggest that more good news will follow. German producer price inflation fell in December to less than half the record hit last summer, according data published Friday.

The fall in natural gas prices caused by unseasonably warm weather has shifted the outlook away from the worst-case scenarios that looked possible only a couple of months ago. As recently as December, analysts surveyed by Consensus Economics were predicting the bloc would plunge into recession this year. But this month’s survey, covered by yesterday's FT, found that they now expect it to log growth of 0.1% over the course of 2023. After falling below parity with the dollar last September, the euro has risen about 13% during the past three and a half months.

Rental rebalancing

There are clear indications that supply in the UK lettings market is growing from a low base, Tom Bill writes this morning.

A strong sales market, driven by a stamp duty holiday, low borrowing costs and the ‘escape to the country’ trend led to a sharp rise in the number of sales during the pandemic, exacerbating the supply shortage. Things are reversing as mortgage rates normalise and the sales market stutters, which means stock is rising and upwards pressure on rents is relenting.

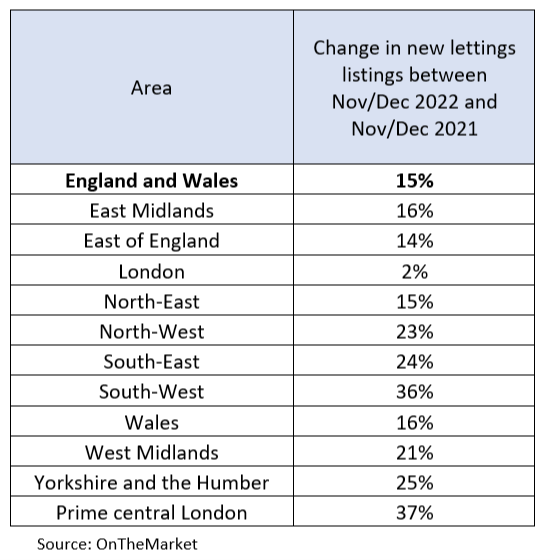

The number of new lettings listings in the final two months of last year was 15% higher in England and Wales than the same period in 2021, figures from OnTheMarket show.

“Most of our lettings offices in London are reporting that stock levels are as high as they have been since before the pandemic,” says Gary Hall, head of lettings at Knight Frank. “The majority of properties have come from owners who would otherwise have sold but based on the uncertainty surrounding prices and transaction volumes, have decided to sit it out.”

Retail spending

December's retail figures were awful, according to the ONS. The annual fall of 5.8% was the largest on record. Stephen Springham casts a sceptical eye over the data:

"Those figures are wildly at odds with the earlier reported ones from the BRC and with virtually all retailer reporting over the festive season. One suspects this is the case of overly-aggressive “seasonal adjustment” and the figures will probably be revised considerably (but quietly) in the months to come."

Analysts had been expecting a strong final quarter ahead of a slump in demand during 2023, according to Stephen. That still looks a good bet - British consumer sentiment fell for the first time in three months in January, returning to near historic lows, according to the GfK survey covered by Reuters.

In other news...

Andrew Shirley explores the wild west of carbon offsetting.

Elsewhere - JPMorgan expects smaller contraction in UK economy in 2023 (Reuters), Bank of England expected to keep up interest rate rises (FT), luxury boom shows the staying power of the ultra-rich (FT), housebuilders angry at being made to pay for others’ cladding errors (Times), Europe is bracing for a sharp and abrupt real estate reversal (Bloomberg), and finally, Dimon says remote work 'doesn't work' (Bloomberg).

Image by F. Muhammad from Pixabay