UK residential house price growth stalls in September

Sentiment turning negative in the face of rising borrowing costs although property market remains active.

4 minutes to read

The UK residential property market showed clear signs of a slowdown last month, ahead of a mini-budget that unsettled financial markets.

Following a negative reaction by financial markets to the government’s growth plans, the cost of fixed-rate mortgages have climbed higher. The uncertainty continued last week with the sacking of chancellor Kwasi Kwarteng.

House price forecasts down

Consequently, we have revised our UK House Price Forecasts down.

Both Halifax and Nationwide reported that monthly price growth had stalled in September, with the former reporting a contraction of 0.1% and the latter no change at 0%.

Both lenders said the annual rate of house price inflation had dropped to single digits in the month as a result. Halifax reported average growth had fallen from 11.4% in August to 9.9% in September. Nationwide said annual growth was 9.5% in September, down from 10% a month earlier.

It came as RICS reported that the sales market continued to lose momentum.

House buyer demand falling

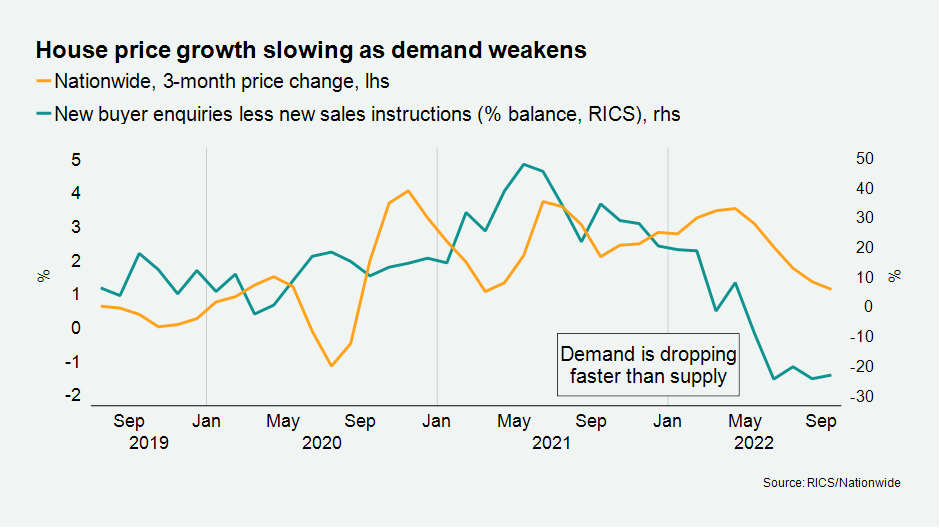

New buyer enquires fell for a fifth month in a row according to its monthly sentiment survey, although limited supply continued to support prices.

New buyer demand recorded a net score of -38% last month and new instructions were -13%.

Historically, when demand has dropped faster than supply (see chart), UK house prices have fallen, said Capital Economics in a note issued to investors.

In contrast, the lettings market is set for further rental growth with demand continuing to outstrip supply. A net balance of +42 of sentiment survey respondents saw tenant demand increase in the month, while a net balance of -13 saw a fall in landlord instructions (identical to last month).

While the IHS Markit House Price Sentiment Survey, where a score over 50 represents strengthening sentiment, remained in positive territory in September (it was compiled ahead of the mini-budget) both current and future house price expectations have now declined for three months in a row.

Some +56 of respondents said their home was worth more than a month ago (compared to +58 in August).

Asked what their home would be worth in a year’s time, at +56 it was the lowest score since March 2021.

Prime London sales report

The number of new prospective buyers in PCL and POL was 53% above the five-year average (excluding 2020) in September.

Supply has also been picking up after being subdued for most of last year. The number of new sales instructions was 22% above the five-year average and the number of offers accepted was up by 79%.

While we expect demand and price growth to come under pressure in coming months as mortgage rates remain high, there are no obvious signs yet.

Annual growth in PCL was 2.7% in September while the figure recorded in POL was 5.2%, both figures that have remained broadly the same for the past six months.

Prime London sales report September

Prime London lettings

Stock levels remain low by historical standards in the lettings market, with the number of new properties coming to the market down by around a third compared to the five-year average (excluding 2020).

Meanwhile, the number of new prospective tenants registering with Knight Frank across London in September was 68% above the five-year average.

As a result of this imbalance persisting for longer than anticipated, we have revised up our rental value forecasts for 2022 and 2023.

Rental values grew by 18.6% in the year to September in Prime central London and by 15.4% in Prime outer London.

Prime London lettings report September

The country market

The number of offers accepted outside of London hit its highest level for 20 weeks in the seven days after the mini-budget last month, as sellers became aware of rising interest rate expectations.

Transactional activity has been high throughout this year despite the end of the stamp duty holiday in 2021, with frustrated demand being increasingly matched by supply. Offers accepted were up 16% in the three months to September versus the five-year average.

The amount of property available to buy outside of London in September was at its highest level since January 2021. While the number of active applicants outside of London in the 12 months to September was unchanged on the previous year.

Prime Country House Index Q3 report

Sign up for more

For more property forecasts and market-leading insight into the UK property market, subscribe to the newsletter.