Record levels of investment committed to UK Built to Rent

While the pandemic has injected uncertainty into some real estate sectors, those underpinned by long-term demographic trends stand to gain from growing demand from investors for secure, income-producing assets.

2 minutes to read

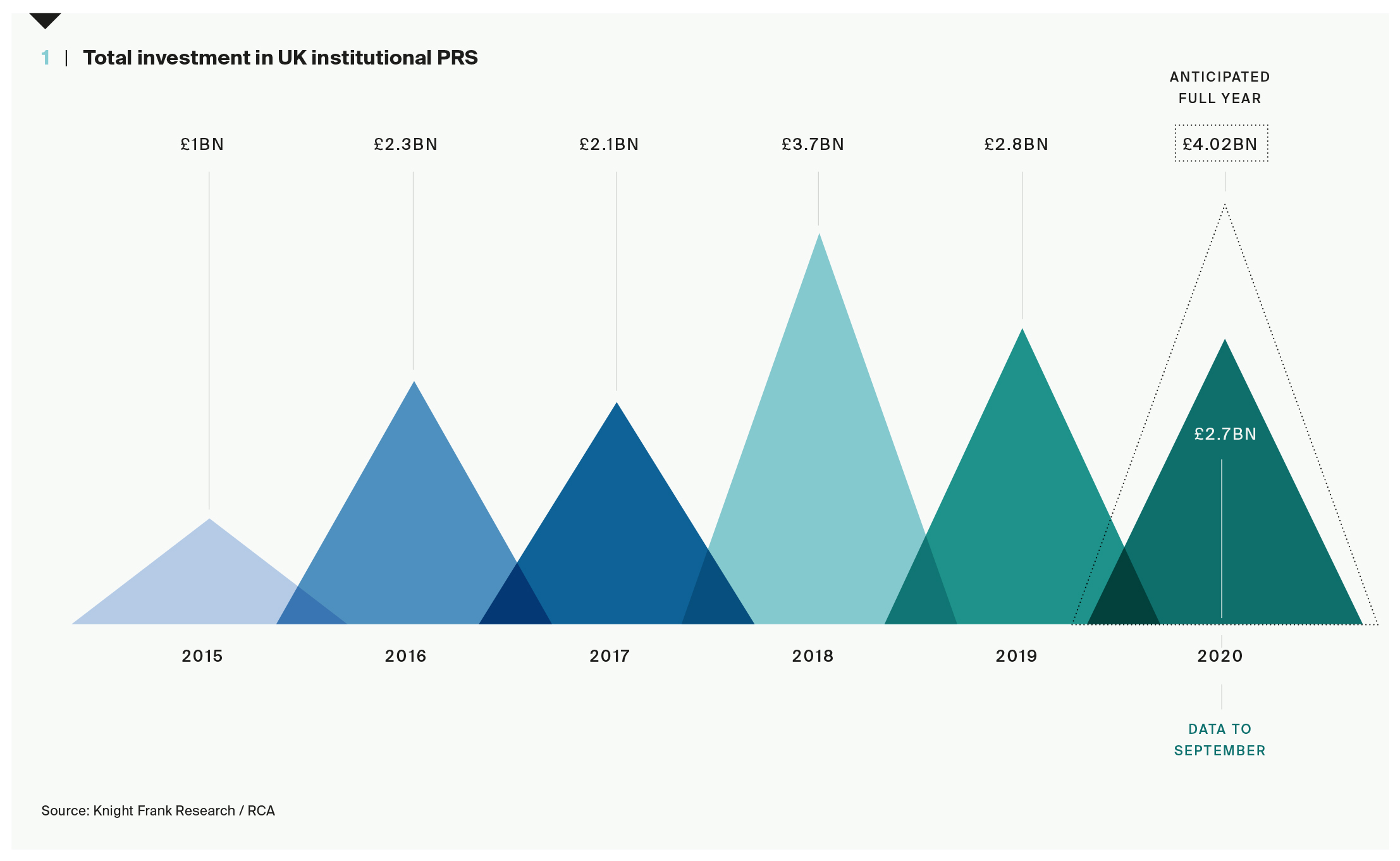

Investment in UK Build to Rent (BTR) assets is anticipated to hit a new record high in 2020 topping £4 billion for the whole year, up from £2.7 billion over the year to date, according to a new report from Knight Frank and HomeViews, the independent review website for the sector.

As investment rises, so too has delivery. Our analysis shows there are now 46,178 purpose-designed BTR homes complete in the UK within schemes of more than 75 units. A further 84,350 homes are either under construction or with planning granted and will be built, let, and managed by professional investors as homes for rent. Despite this pipeline, this represents only 2% of total UK rental dwellings.

The initial signs are that Covid-19 hasn't had a material impact on delivery of these new homes. However, the impact of recent events is being felt in other ways. The importance of well-being, wellness and social value for residents living in BTR schemes, for example, has been an even greater focus during lockdown.

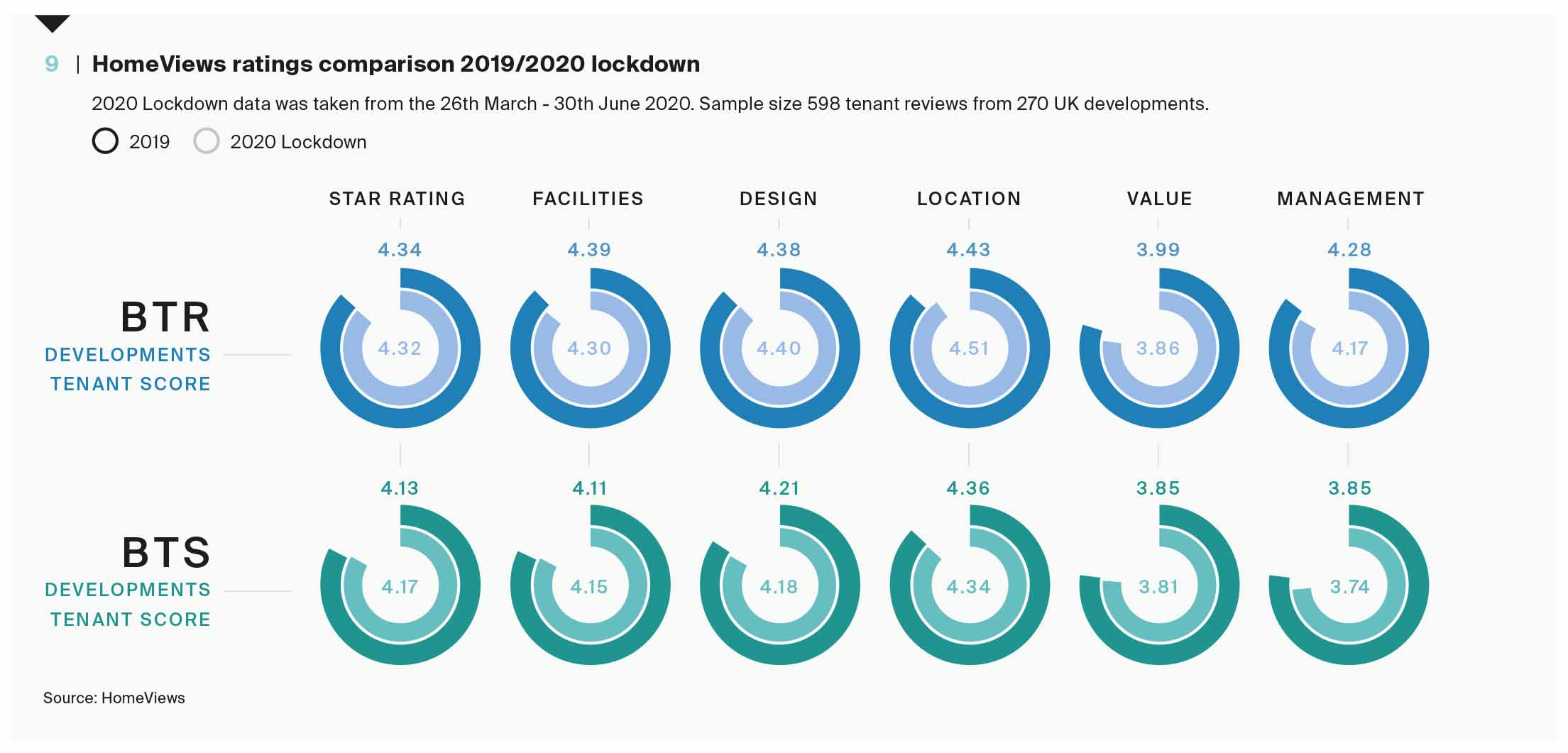

Analysis conducted by HomeViews of resident reviews submitted between March and June 2020 has highlighted the enhanced level of service that many BTR residents enjoy, as well as drawing attention to consistent references to ‘community’ and ‘neighbourhood’.

Longer-term, as tenant priorities change as a result of Covid-19, we expect the service-driven model adopted by operators - and valued by residents - will emerge as offering clear advantages over the traditional buy-to-let sector. Purpose-designed, affordable accommodation with a range of value-add features such as 24-hour security, all-inclusive bills, parcel collection and on-site support will be attractive.

Longer-term, as tenant priorities change as a result of Covid-19, we expect the service-driven model adopted by operators - and valued by residents - will emerge as offering clear advantages over the traditional buy-to-let sector. Purpose-designed, affordable accommodation with a range of value-add features such as 24-hour security, all-inclusive bills, parcel collection and on-site support will be attractive.

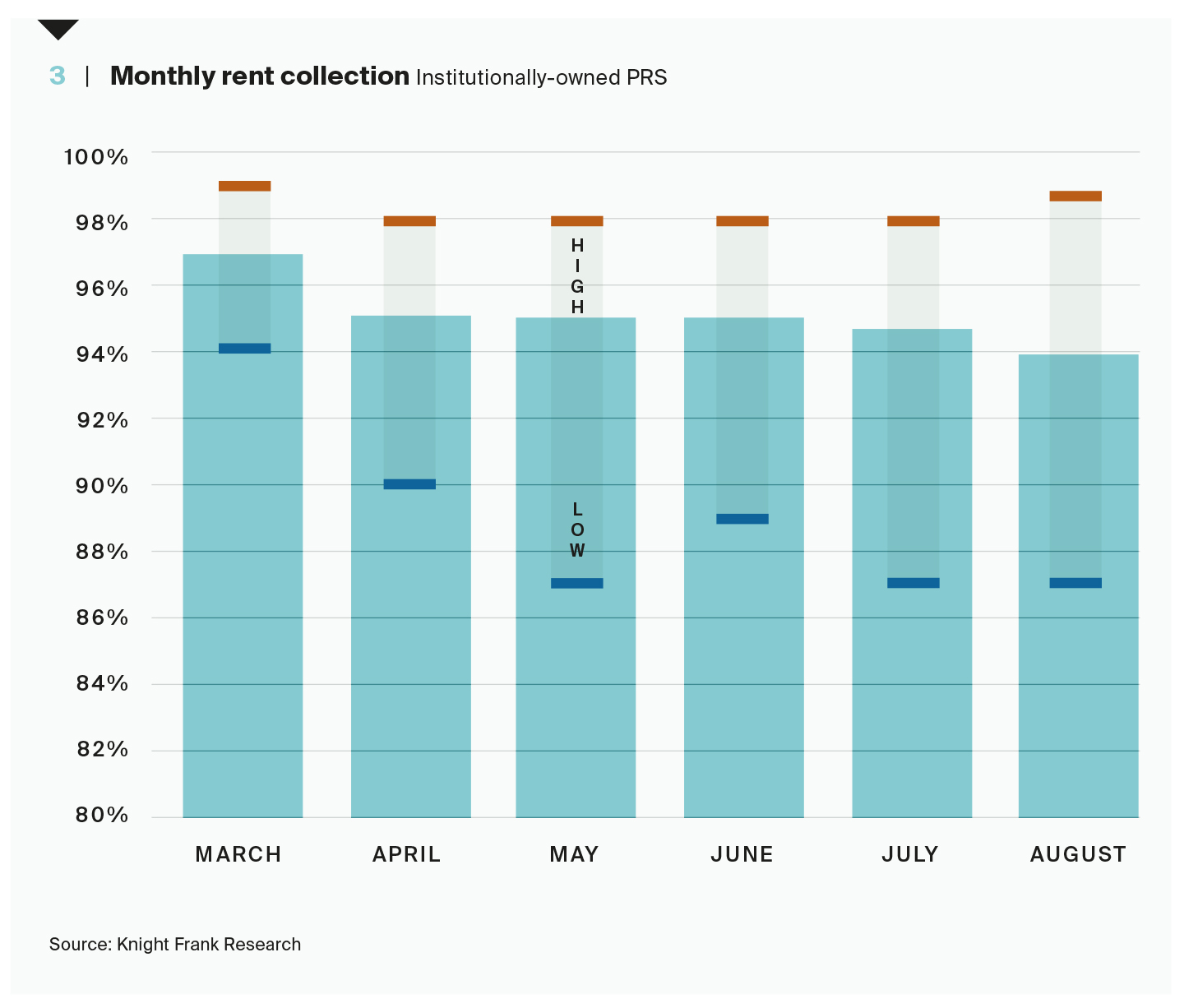

Inevitably, lease up rates of new schemes slowed during lockdown. However, investors and operators will be buoyed by the fact tenant demand has since recovered across the rental market. Rent collection rates, meanwhile, have proven to be strong, averaging 95.2% between March and August.

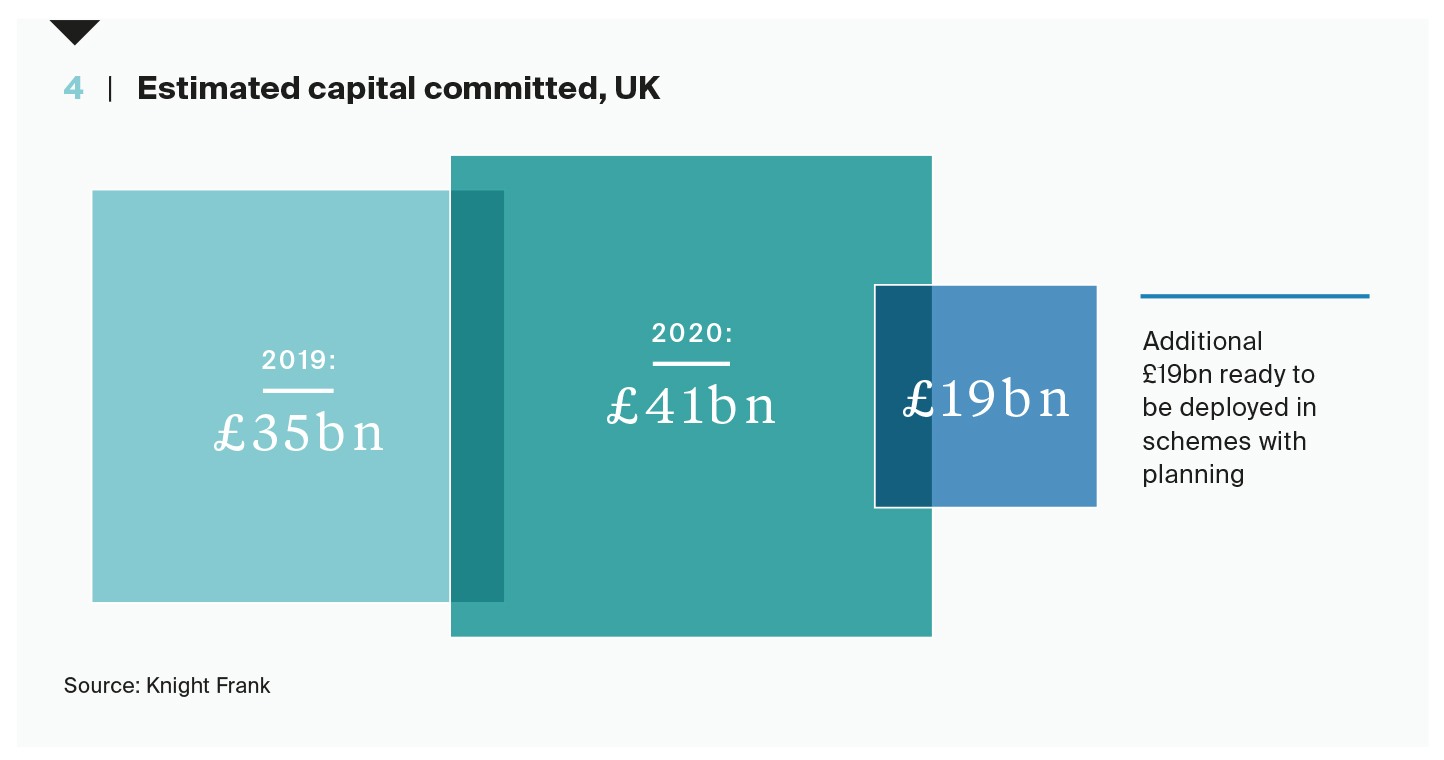

Rental demand has proven to be more resilient in times of uncertainty in the past and we expect that this will support the BTR market in the medium term, particularly if first-time buyers delay the long term commitment of home ownership until the wider economy recovers. In turn, this will support investment into the sector and we expect that capital committed will continue to rise as investors look to increase their exposure to real estate assets that offer secure and stable long-term income streams.

We estimate that the current volume of capital committed to the market for professionally-managed rental accommodation in the UK to date is £41 billion, up 17% from £35 billion in 2019. A further £19 billion of additional capital is ready to be deployed in schemes with planning granted.

Elsewhere, shifts in working patterns and behaviours will lead to discussions about how to approach increased home working, possibly through increased provision of dedicated space in amenity areas. The nascent nature of the sector is likely to be one of its biggest strengths in this regard, allowing operators and investors to react and adapt quickly.