2025 Outlook: European real estate and political shifts

Plus, the elections and key events that lie ahead

3 minutes to read

2025 Residential Market Forecast

Low growth, low inflation, and low interest rates define Europe’s outlook for 2025. While challenges remain, our 2025 Prime Residential Price Forecast reveals continued growth in key luxury residential markets.

Economic growth may not significantly drive wealth creation in the region, but tax and policy changes abroad are expected to attract global wealth to Europe. Recognised for its stability, transparency, excellent education, and high quality of life, Europe remains a magnet for affluent investors.

Additionally, with dwindling savings rates across advanced economies due to interest rate cuts, those households that can afford may consider purchasing a second property as a holiday rental. These properties not only generate secondary income streams but also offer long-term asset appreciation.

The European Central Bank (ECB) slashed interest rates four times in 2024, with the current rate at 3.0%. Economists project rates could fall as low as 1.5% by the end of 2025. Lower rates - and the ECB’s faster moves compared to the Federal Reserve or Bank of England - are weakening the euro, presenting further opportunities for overseas investors.

Some experts anticipate the US dollar and euro could reach parity in 2025. Meanwhile, political instability in France and Germany could see the pound/euro exchange rate revert to pre-Brexit levels.

Read the full European Residential Forecast analysis here.

Political Landscape

Europe’s traditional powerhouses, France and Germany, are grappling with political upheaval. French President Emmanuel Macron’s fourth Prime Minister this year, François Bayrou, faces resistance in pushing a budget through a divided Parliament. Meanwhile, Germany’s political stability is under strain, with a vote of no confidence leading to new federal elections scheduled for 23 February 2025.

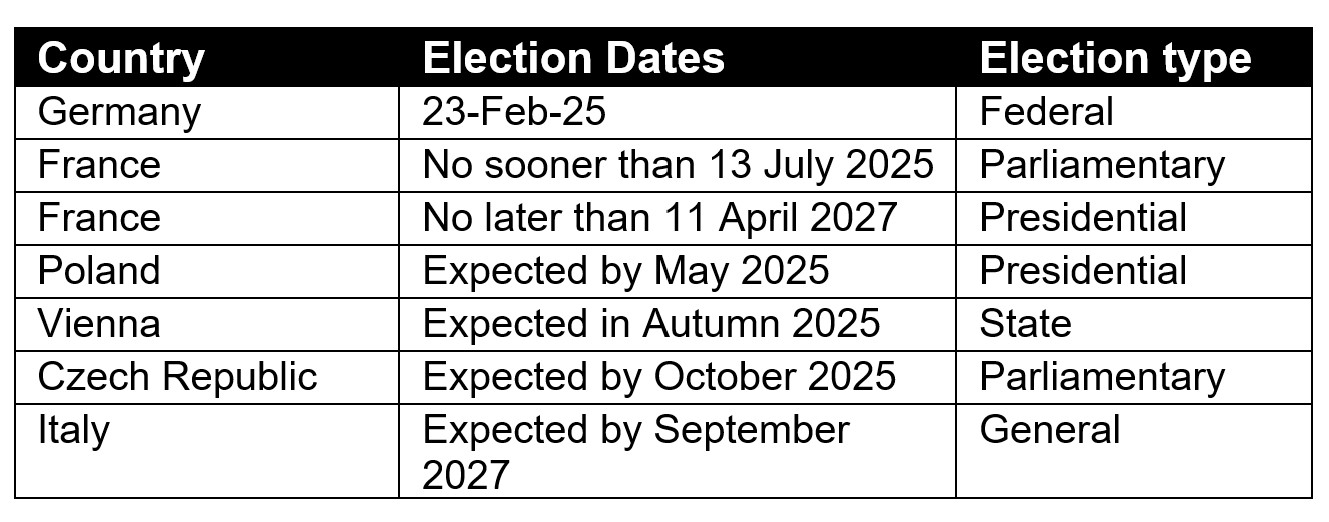

This political uncertainty mirrors 2024, a record-breaking election year that saw nearly 2 billion people vote globally. As 2025 unfolds, key European elections will keep uncertainty high:

Impact on Property Markets

Uncertainty clouds the outlook for Europe’s property markets. In France, a “special law” has extended the 2024 budget into 2025, freezing changes to the wealth tax. Michel Barnier’s proposed higher tax rate for the top 3% of households remains on hold until a new budget vote.

Despite this, Alison Ashby, Head of Junot Fine Properties, Knight Frank’s partners in Paris, notes a resilience in buyer activity:

“Political paralysis has had little effect on sales. US and UK buyers remain active, and many see this as the new normal after years of uncertainty, from Brexit and Covid-19 to the General Election and Olympics. International buyers are embracing the opportunity of a low Euro and pressing ahead with plans.”

Southern Europe: A Bright Spot

Southern Europe continues to shine in 2025, standing out in our prime residential forecast.

According to the European Commission new forecasts, Ireland (+4%) alongside the key southern economies of Spain and Greece are expected to outperform in 2025.

Spain and Greece are forecast to see growth of 2.3% in 2025 - nearly double the euro-area average of 1.3% - with Portugal not far behind its Iberian neighbour at 1.9%. In contrast, Germany’s economy will barely expand, with only 0.7% growth projected.

This growth is fuelled by tourism and a post-pandemic surge in visitors. However, the booming tourism industry is also spurring debates about holiday rentals and overseas homeownership. Expect stricter regulations in 2025 to address these tensions.

Key Updates for 2025

• Travel: Europe’s ETIAS travel authorisation and the Entry/Exit System (EES) will launch in Q2 2025. An ETIAS pass will cost €7 but is free for travellers under 18 and over 70.

• Italy: Considering a referendum on citizenship laws.

• Switzerland: The Canton of Geneva will lower income taxes starting 1 January 2025.

• France: New energy efficiency rules for rental properties come into effect on 1 January 2025.

• The French Finance Committee has proposed a US-style universal tax for expats.

Sign up here to receive my monthly European Residential Newsletter in 2025.