Alpine Sentiment Survey: Understanding Motivations

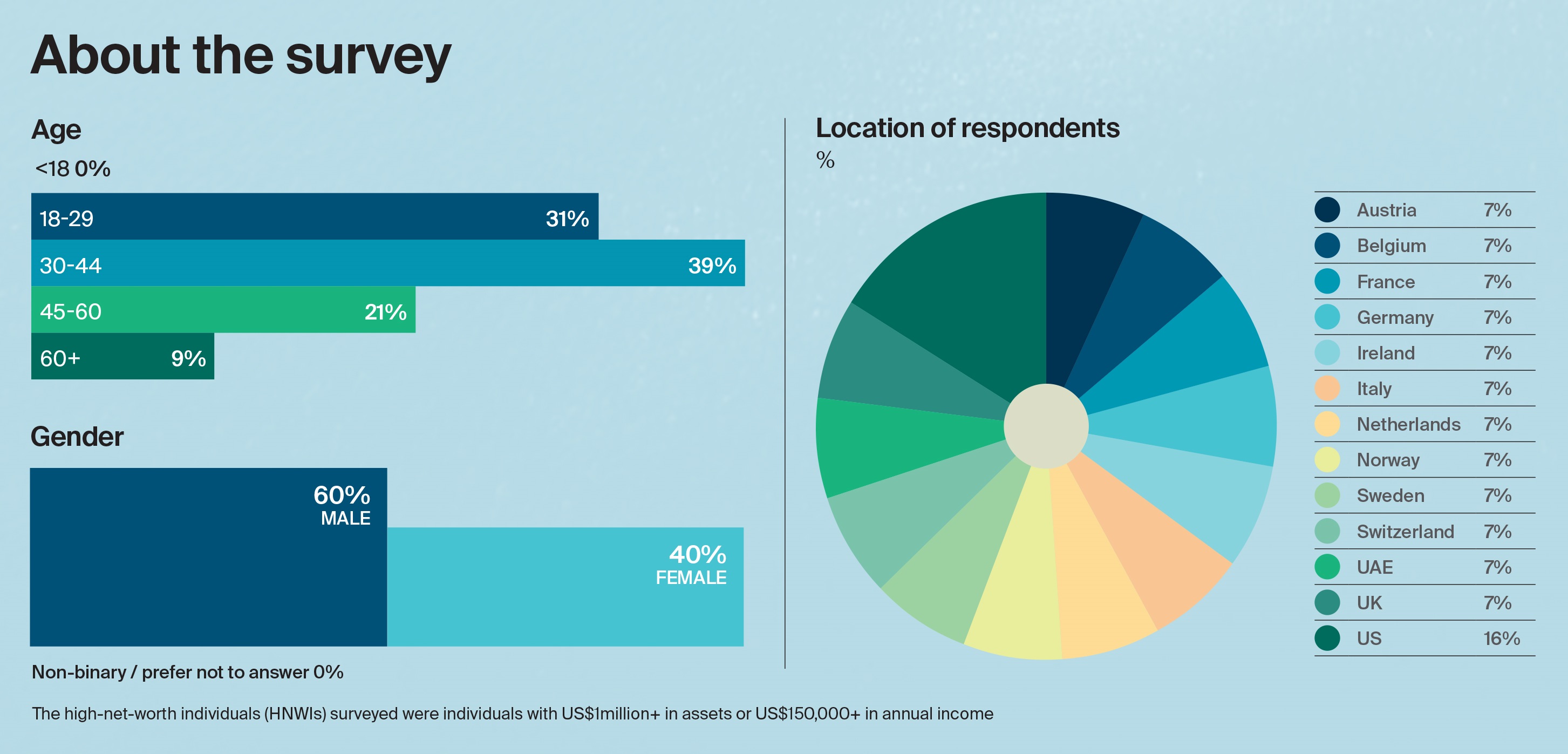

The survey encompasses the views of over 730 high-net-worth individuals (HNWIs) from across 13 countries, providing valuable insight into the motivations, preferences, budgets, and aspirations of prospective Alpine purchasers.

1 minute to read

This article is part of a series from the Alpine Property Report, previously known as the Ski Property Report, which evaluates current market trends in Europe’s top alpine destinations and highlights property conditions along with the growing year-round appeal of these locations.

Motivations

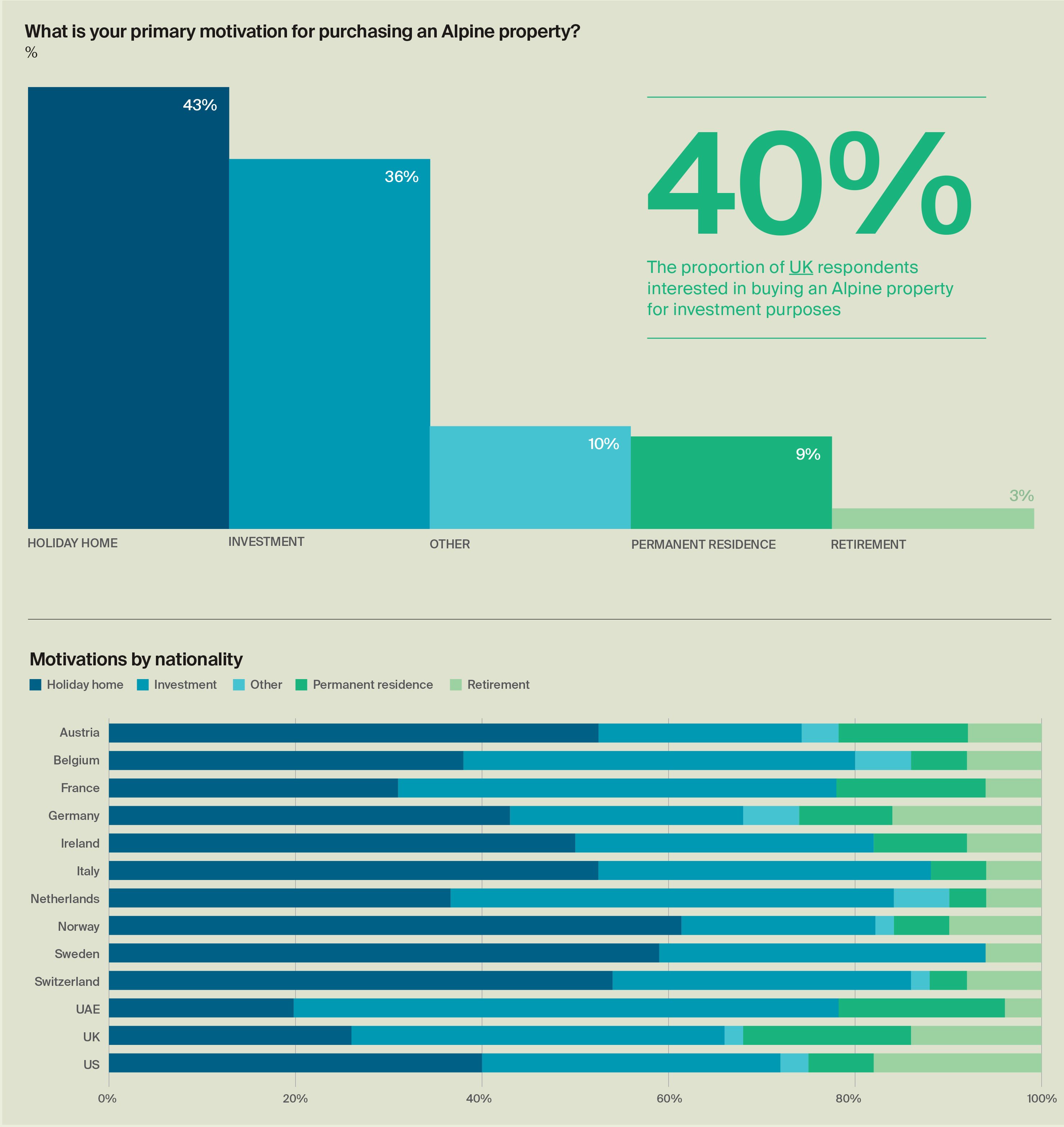

The primary reason for purchasing an Alpine property is to have a holiday home, with the largest proportion of respondents from Sweden and Norway selecting this as the top motivation.

Some 36% of respondents see their purchase as an investment, particularly those from the UAE, Netherlands, and France.

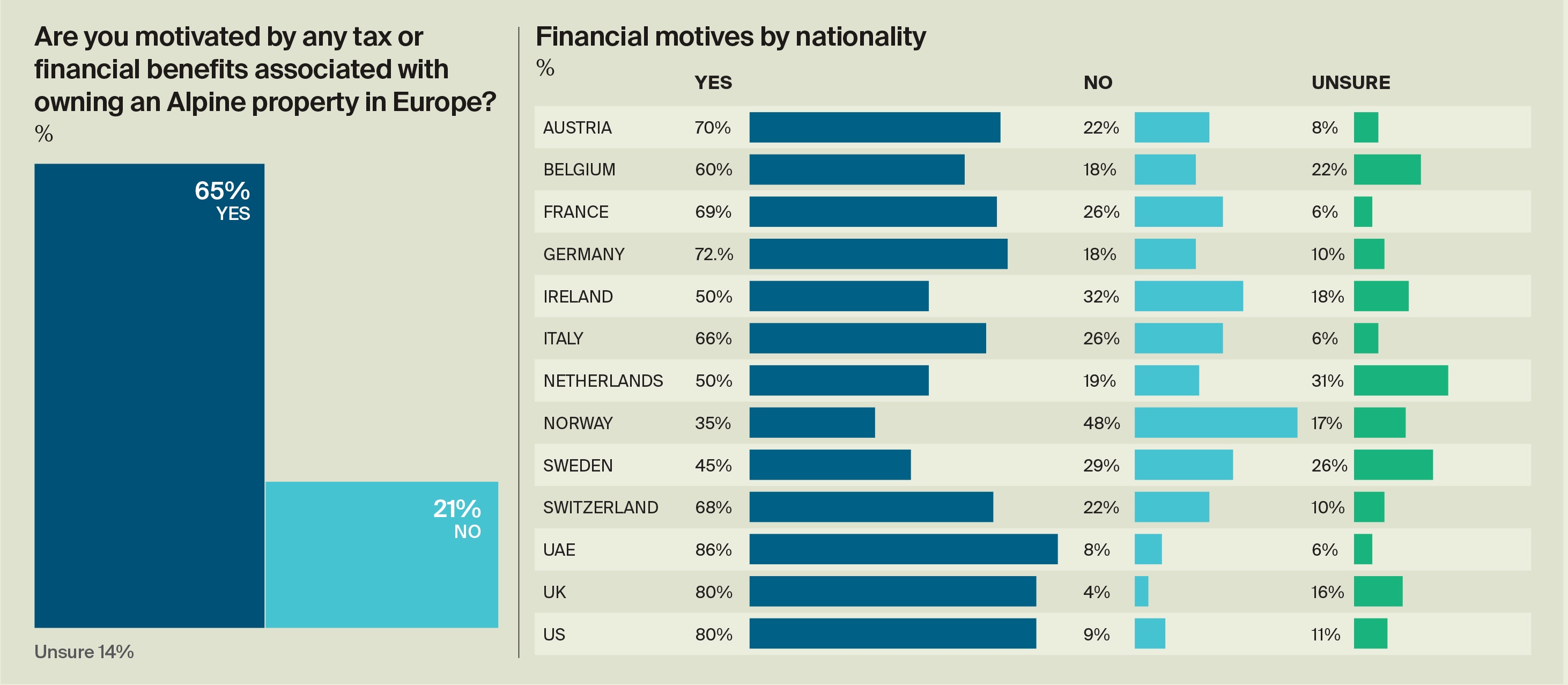

Buyers from the UK and UAE are most inclined to acquire a property as a permanent residence, while the US and Germany have the highest proportion of respondents buying for retirement purposes. Additionally, around 65% of participants are drawn by the tax or financial benefits of owning an Alpine home, especially those from the UAE, UK, and US.

Property preferences

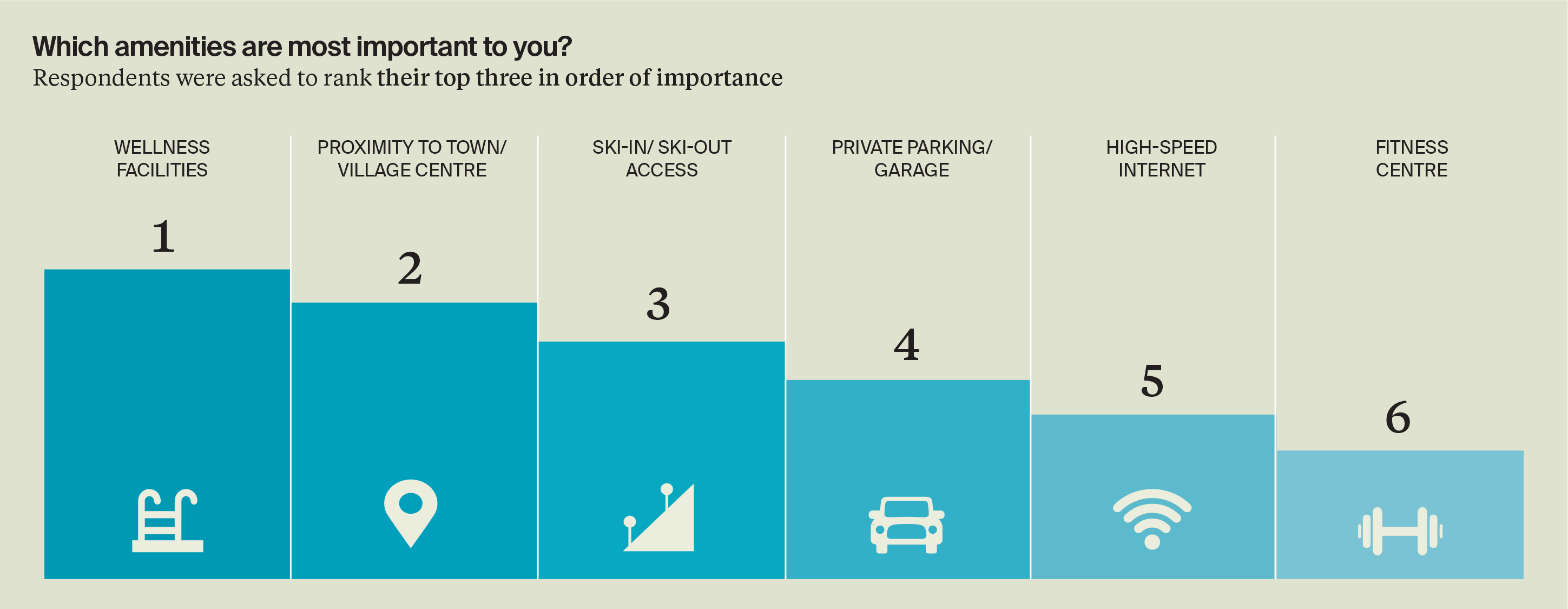

This year’s survey highlights the extent to which Alpine lifestyles are resonating with a broader cohort of buyers. Asked what Alpine lifestyle they are most interested in, and permitted to tick all that apply, the wellness category came top, closely followed by skiing and snowboarding.

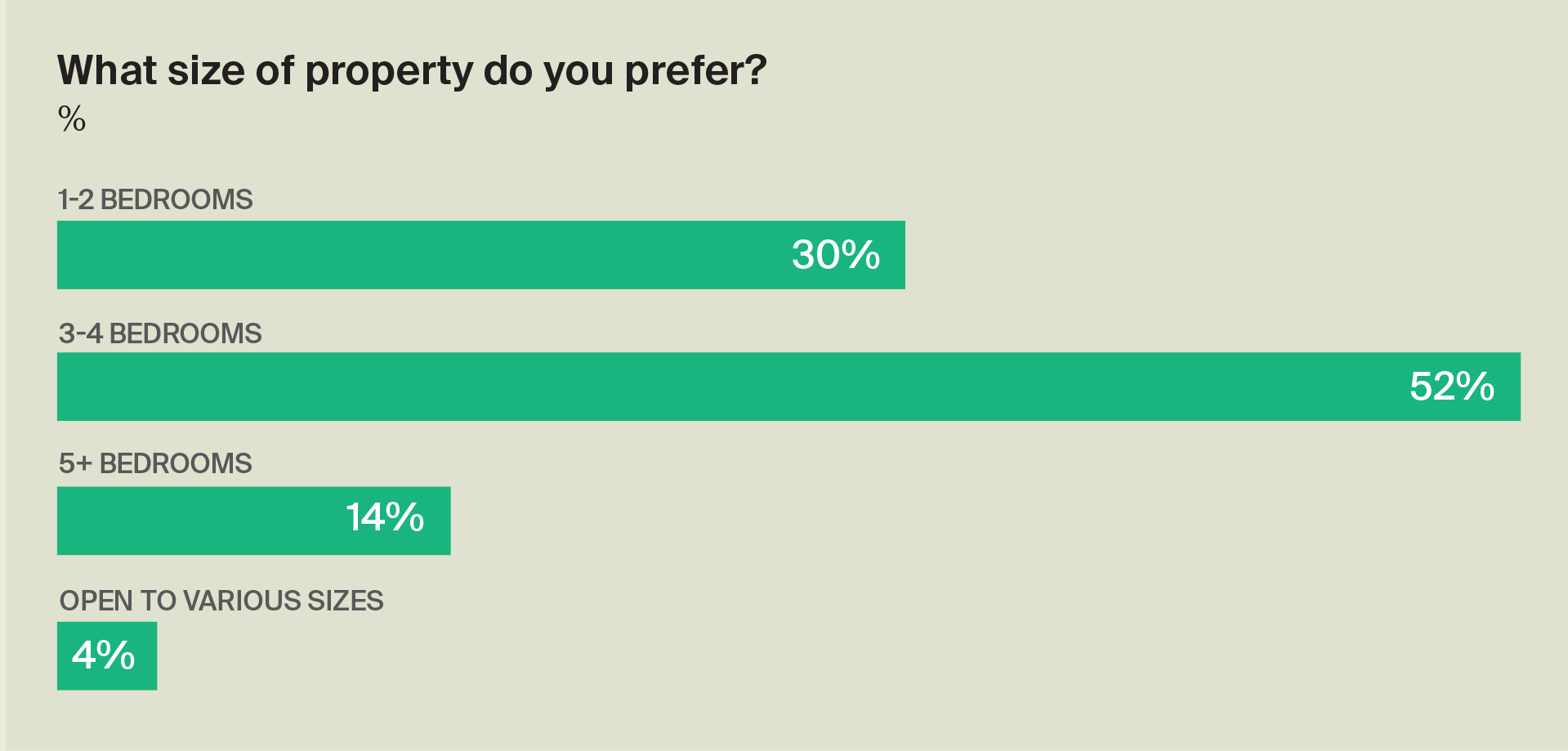

In terms of property size, demand is strongest for 3-4 bedroom homes, favoured by 52% of participants, while 30% prefer smaller 1-2 bedroom properties.

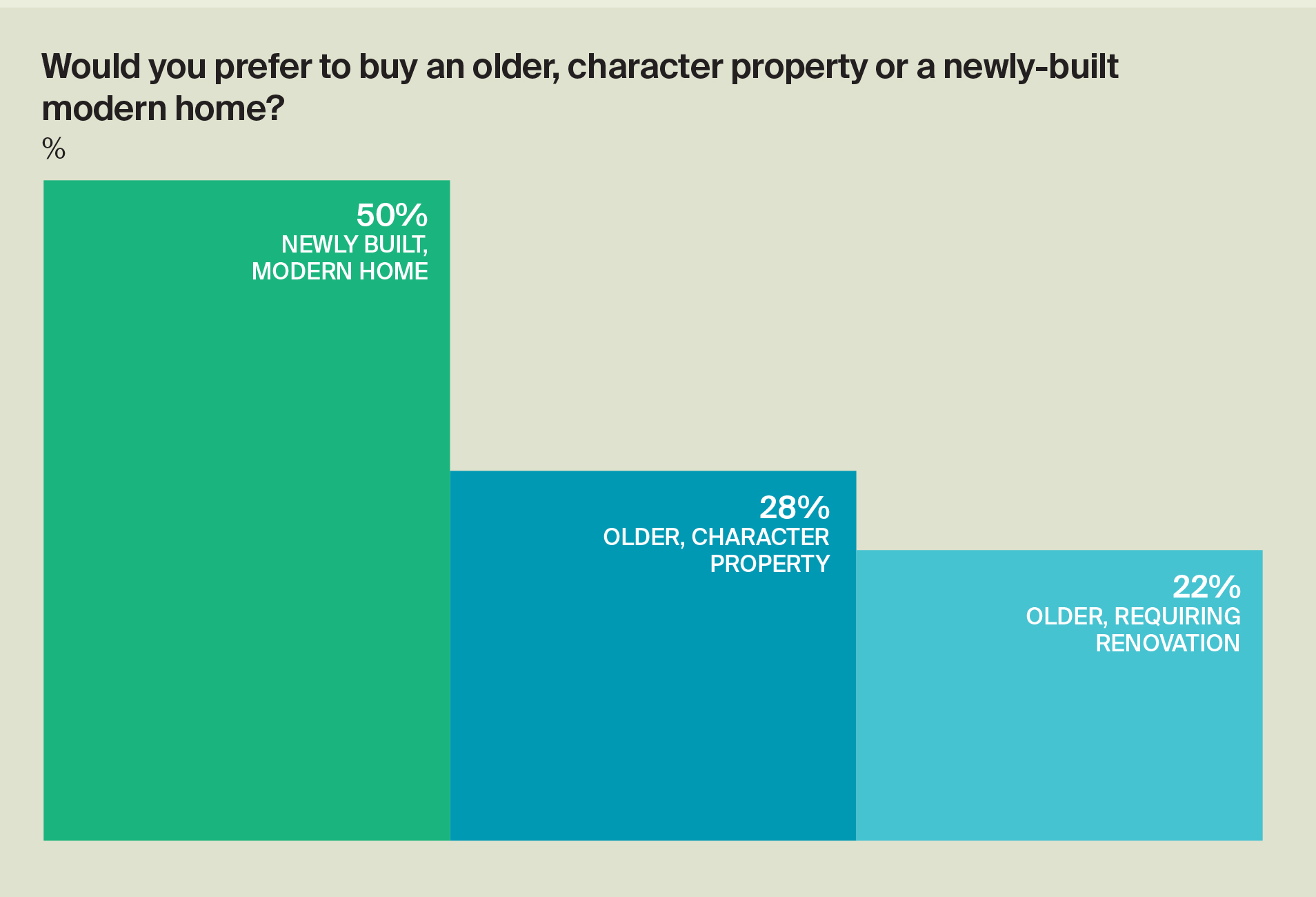

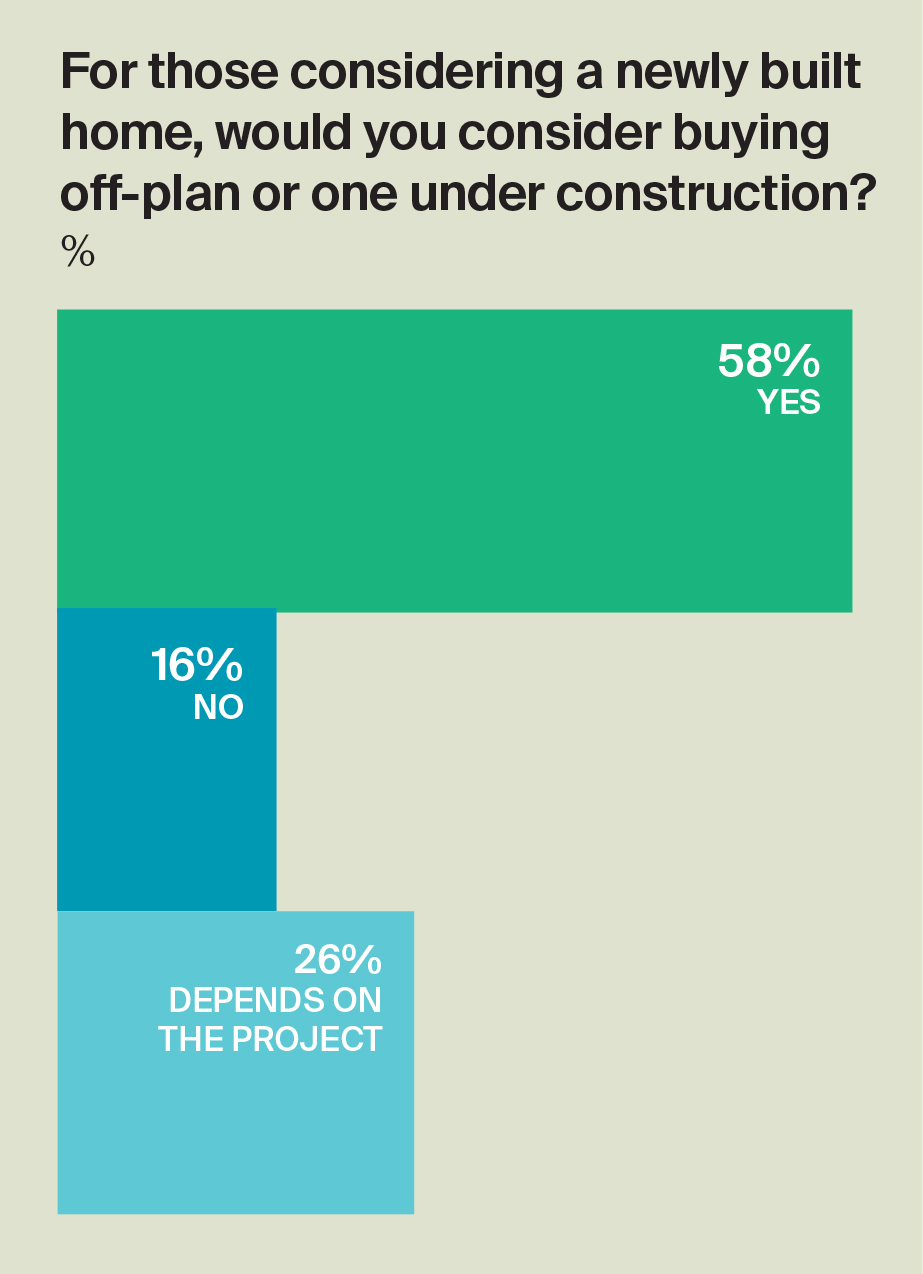

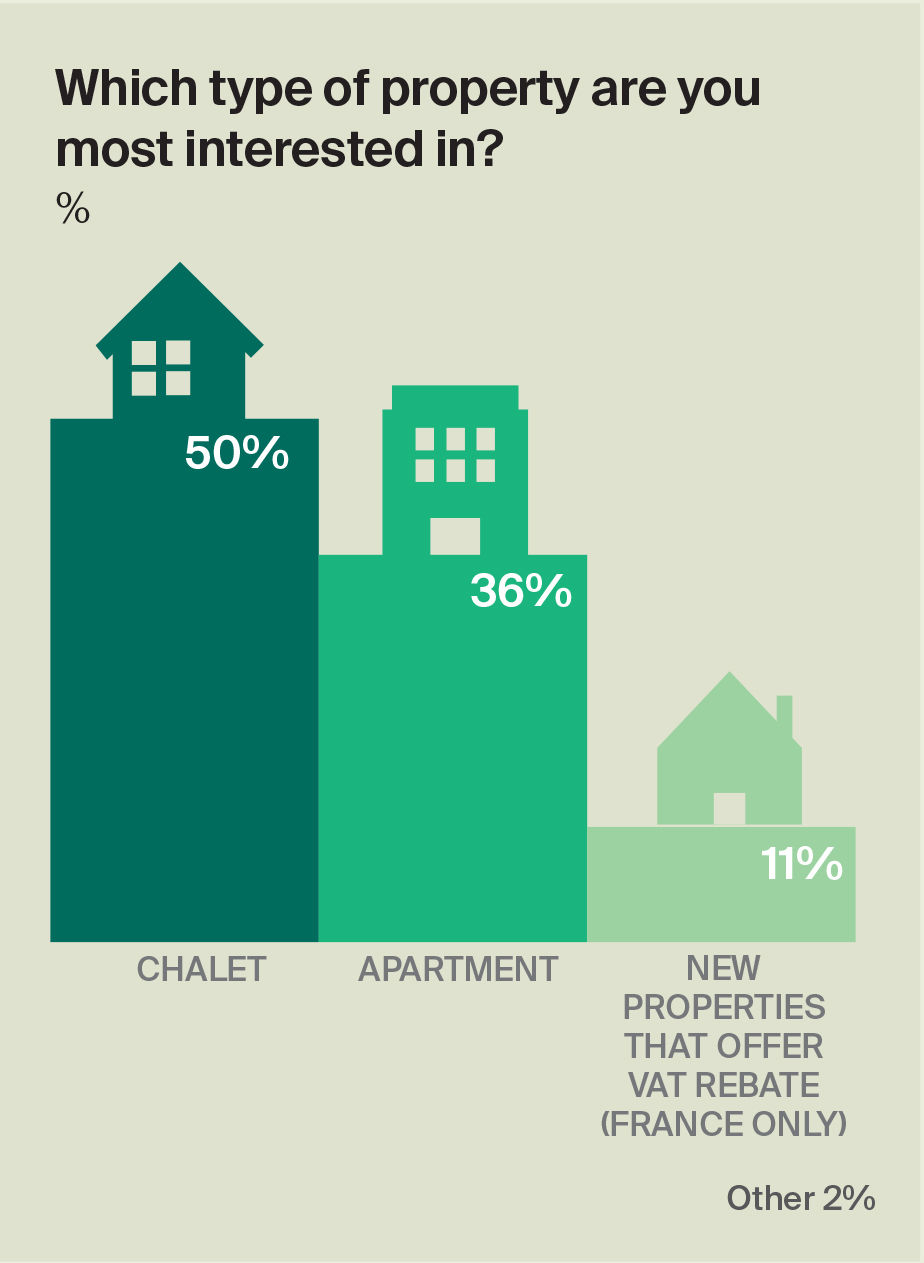

Property type preferences indicate 58% are open to purchasing off-plan or homes under-construction, while 50% favour modern builds. However, 28% seek older properties, and 22% are open to renovations. Top amenities ranked include spa facilities, central village access, and ski-in/ski-out options.

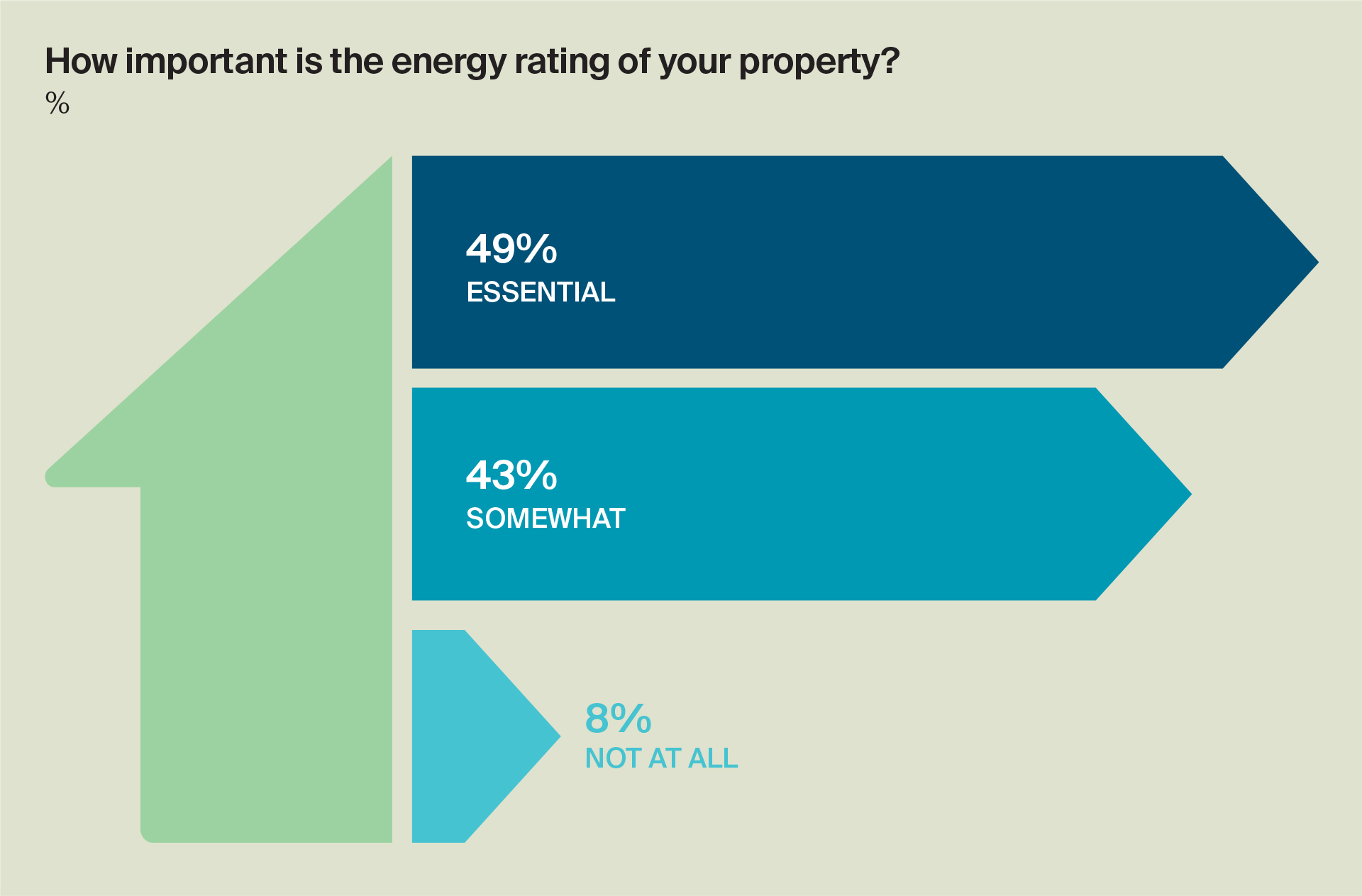

Energy efficiency is also a priority, with nearly half viewing a high energy rating as essential, particularly amongst US respondents.