Prime London Sales Index June 2019

The latest snapshot of performance in the prime London sales market.

1 minute to read

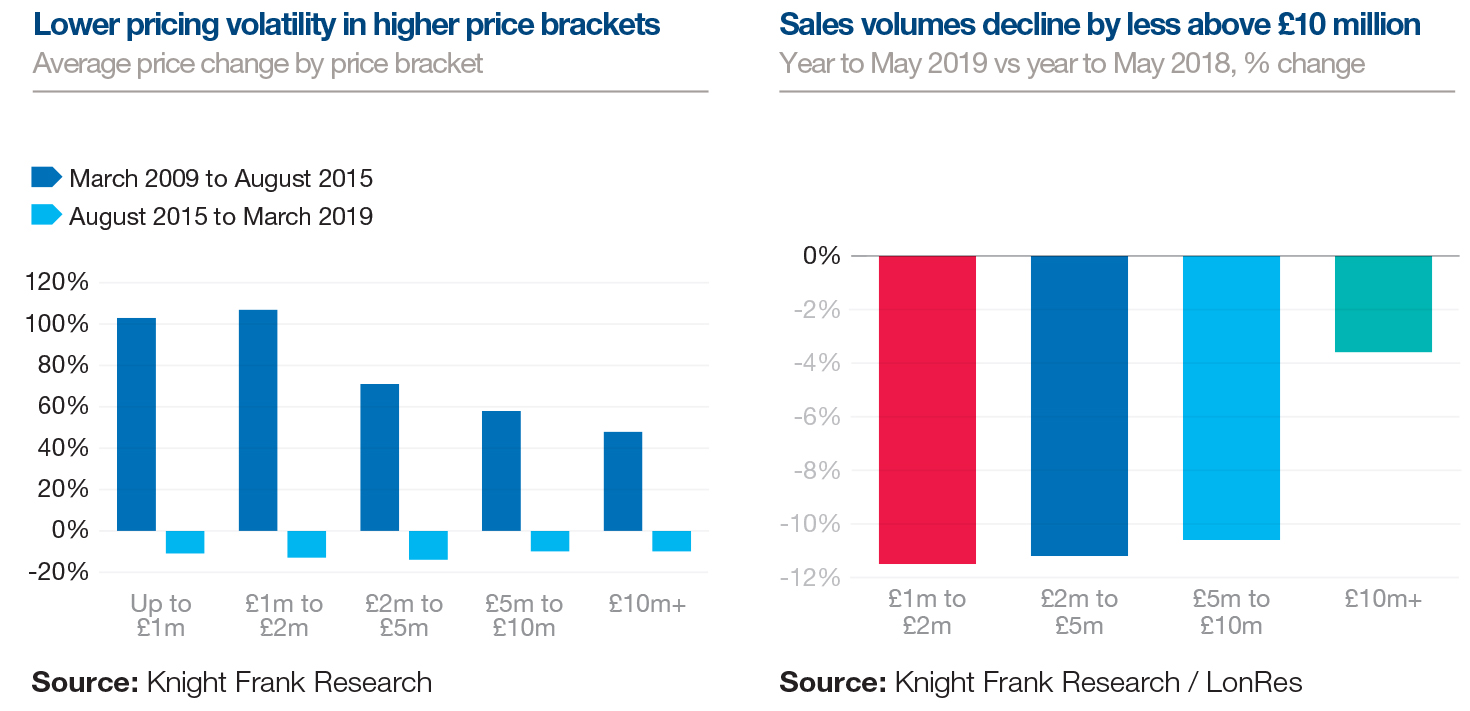

Latest results show between March 2009 and the last market peak in August 2015, average price growth above £10m in PCL was half of that recorded for properties worth less than £2m. As prices adjust to political uncertainty and tax changes, this relative difference in performance has helped underpin demand in higher price brackets.

The number of transactions above £10m fell 3.6% in PCL in the year to May compared to the previous 12 months. This compared to a decline of 11.5% between £1m and £2m, underlining the relatively stronger performance of the higher-value market.

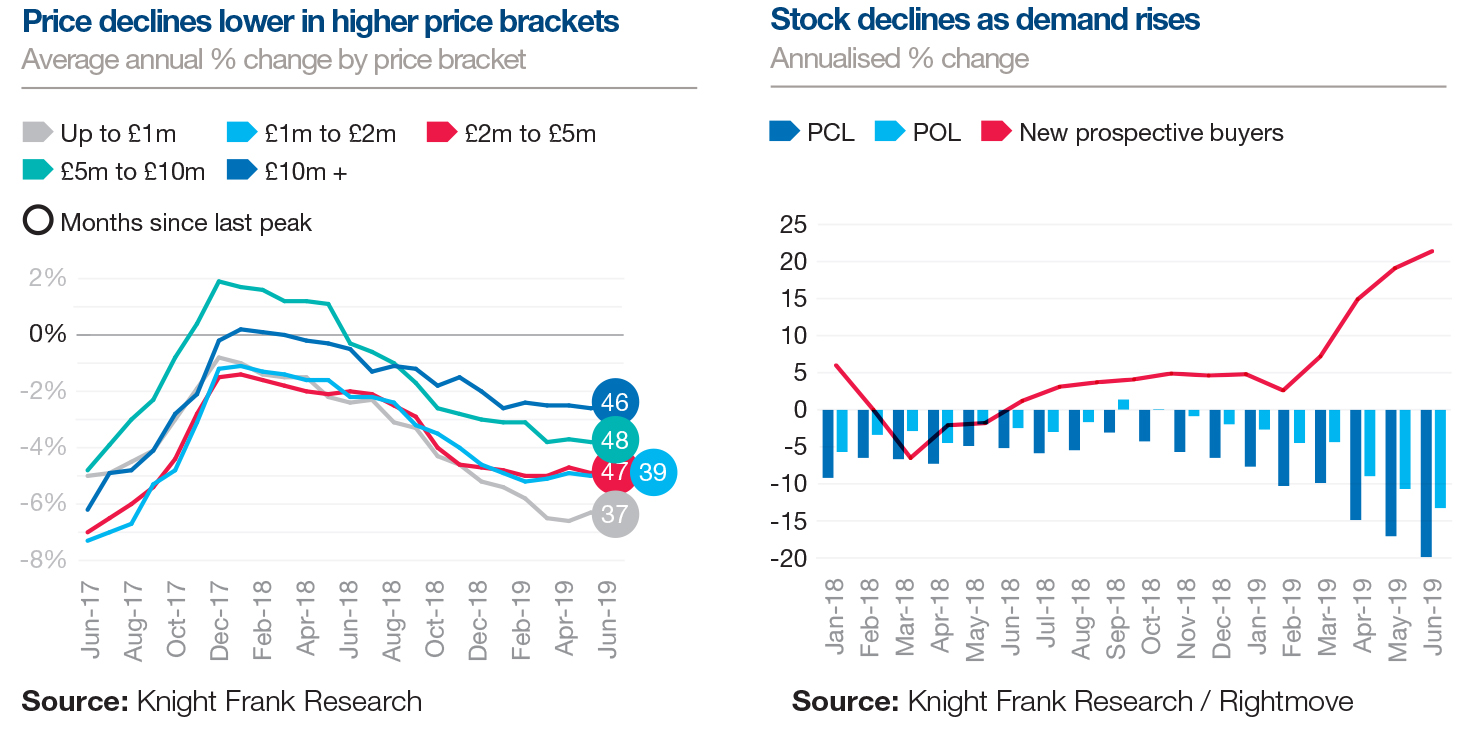

Average prices above £10m declined 2.5% in the year to June and it has been 46 months since prices last peaked in this price bracket. The decrease was 4.8% between £1m and £2m and it has been 39 months since the last peak, highlighting the longer adjustment period for higher-value properties.

Supply is shrinking in all price brackets as some vendors hesitate due to political uncertainty. Meanwhile the number of new prospective buyers rose by 21% in the year to May, showing how active vendors currently benefit from an imbalance between supply and demand.

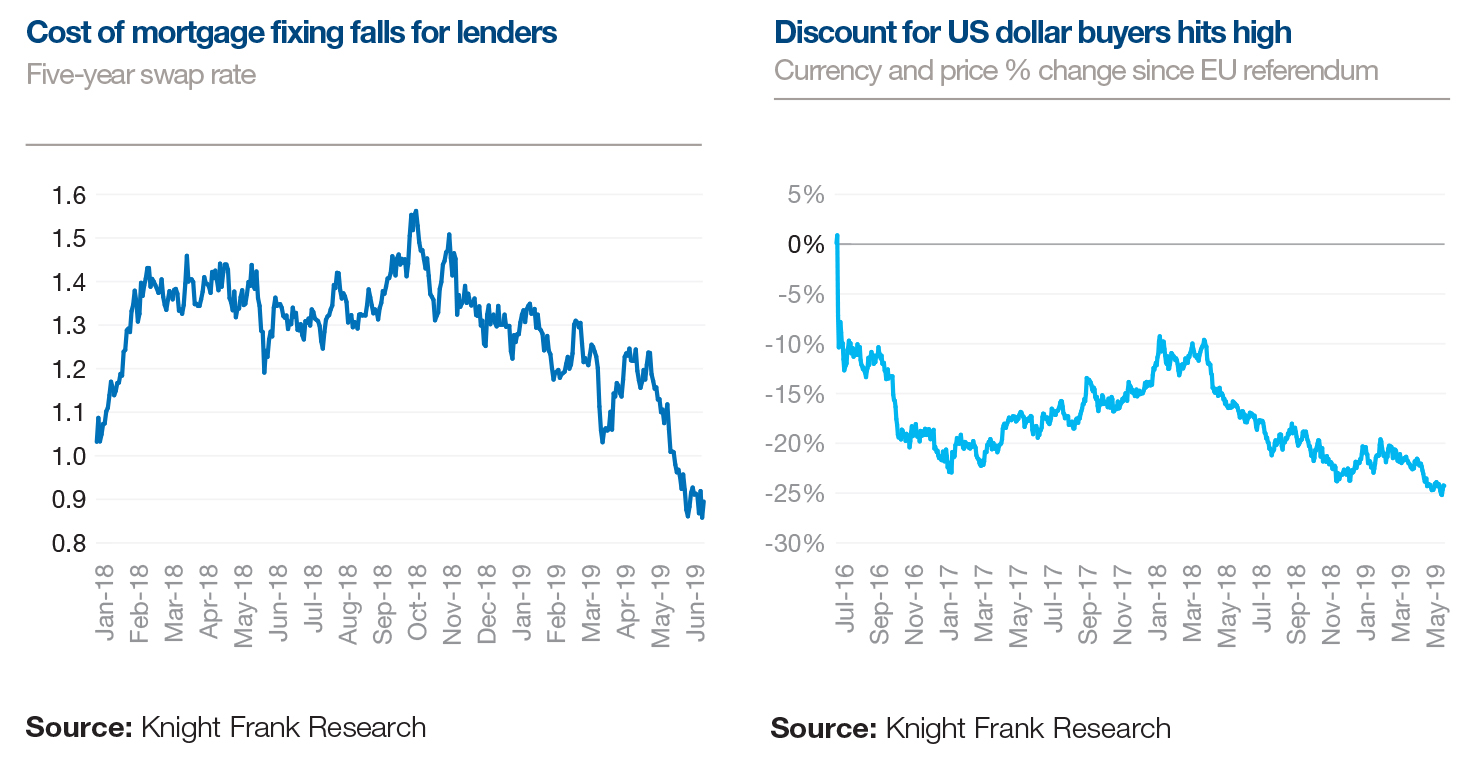

Five-year swap rates, which are used by lenders to acquire fixed-price mortgage funding, have fallen in recent months. This is a response to a more benign global interest rate backdrop, with the US Federal Reserve signalling it may cut rates this year. Lower rates will underpin mortgage market liquidity and housing demand.

The effective discount for US buyers in PCL, which combines currency and property price changes, reached 24.7% at the end of May, the highest figure since the EU referendum. Sterling has weakened in recent weeks in response to uncertainty generated by the Conservative Party leadership election.

For more information please contact Tom Bill