Canary Wharf yet to feel Elizabeth Line impact

Office rents could see strong upward pressure once landmark infrastructure project goes live

2 minutes to read

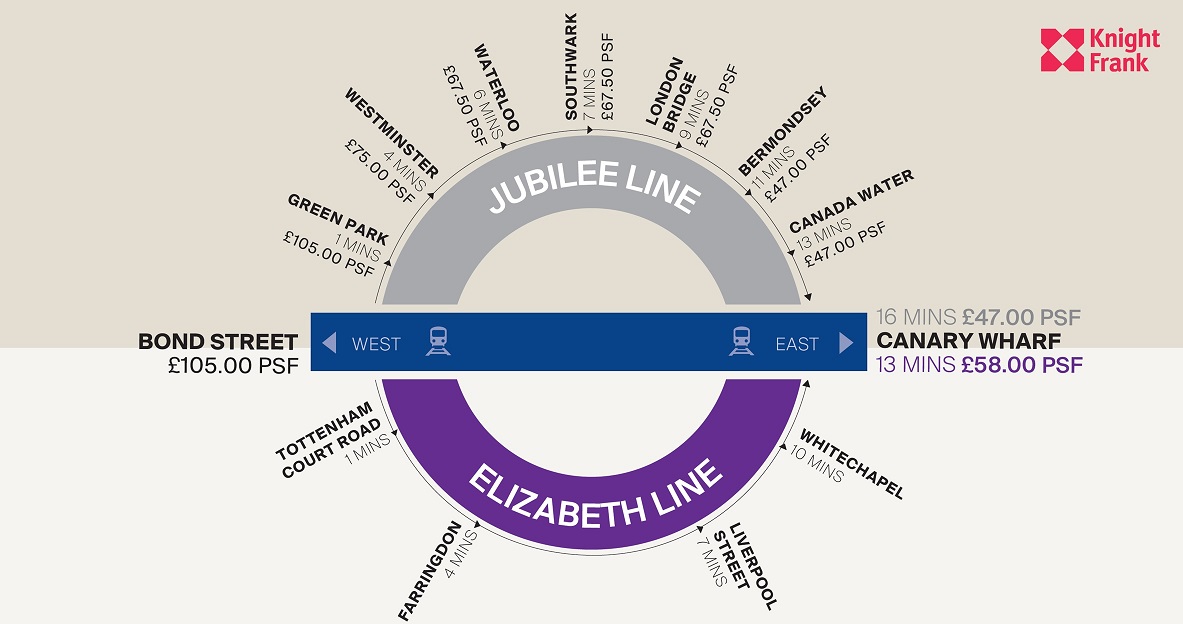

At £47 psf, prime headline rents in Canary Wharf are currently the most affordable in London and the market is seeing strong occupier interest.The opportunity for occupiers to capitalise on this will likely rapidly diminish once the Elizabeth Line is completed and the euphoria around the UK’s largest rail infrastructure project since WWII starts to put upward pressure on rents.

Our econometric forecasts show that Canary Wharf is, at 17%, likely to experience the third strongest rate of rental growth in Central London over the next five years, with only the City Core and Southbank likely to see slightly stronger rises of 17.1% and 17.8%, respectively.

The delayed Elizabeth Line will reduce the travel time between the West End and Docklands to 13 minutes, from 16 minutes currently. This three minute saving may well provide the impetus for occupiers to look more favourably at options in the Docklands.

London’s supply crunch is amongst the biggest challenges faced by the market. We’re tracking 28 active requirements over 100,000 sq ft, however only 18 schemes in the capital can service these. Of these 18, nine are located in the Docklands and five are in Canary Wharf.

Looking in isolation at the current commute time between Bond Street and Canary wharf has revealed that rents fall away by £3.63 psf for every minute of the West to East journey. Purely on this metric, the shorter commute should translate into an average prime headline rent of £58 psf for Canary wharf, once the Elizabeth Line opens. With prelets already taking place in the mid £50's psf, it is not beyond the realms of reality to expect prevailing headline rents to climb to this level.

However, as with all predictions, one variable cannot be looked at in isolation as there are a number of other drivers likely to influence rental performance.