A turning point for residential development

Build cost inflation is past its peak, land house price declines look to have bottomed out, and demand from prospective purchasers is stabilising.

4 minutes to read

Better-than-expected economic data and strengthening transaction numbers are providing a platform for a longer-term recovery in residential development volumes.

Inflation dropped to 3.4% in February, the latest figures from the ONS show, down from 4% in January and below market expectations of a fall to 3.6%. While the Bank of England opted to keep interest rates at 5.25%, eight members of the Bank’s rate-setting committee voted to hold while one voted to cut. Last month, two voted for a rise, which shows their stance is softening.

Money markets are betting on three cuts of 0.25% by December, with June looking more likely for the first cut than May. We are not out of the woods yet, but these indicators point towards an improving environment for developers throughout 2024 and into 2025.

That improving outlook is also showing in other market data. In January, the net reservation balance of the Home Builders Federation’s latest survey turned positive for the first time since February 2022, suggesting a rise in demand for new builds.

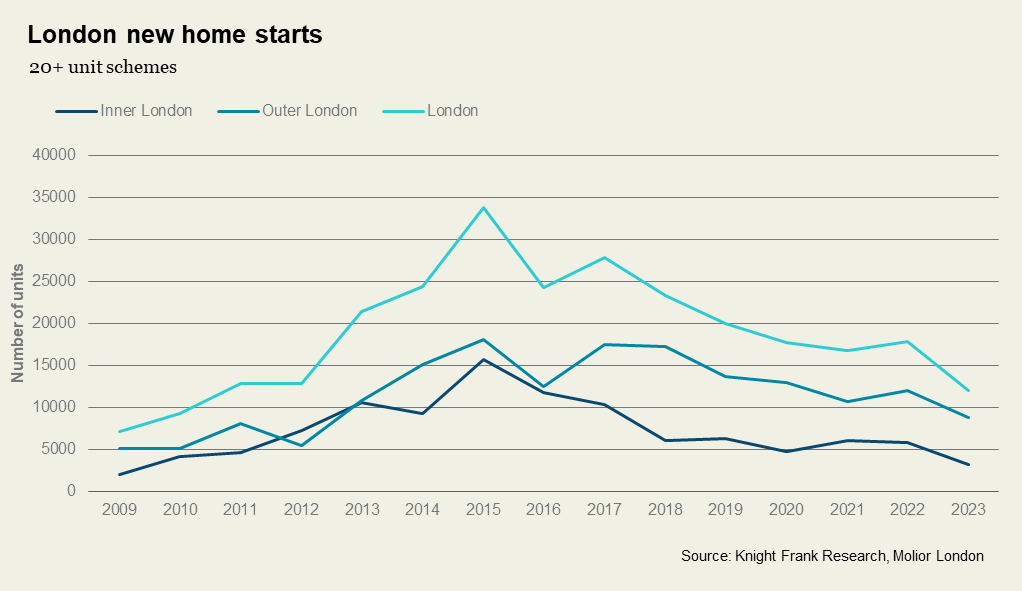

Any sustained strengthening in transactions should support a longer-term recovery in development - though any pick-up is going to be coming from a low base given the significant drop in new starts last year (see here). Take London, for example, where housing starts dropped 64% from their 2015 peak in 2023, hampered by a sharp increase in build costs and changing design requirements including dual staircases for tall buildings.

But the data does suggest we are at a turning point. Build cost inflation is past its peak, land values and house price declines look to have bottomed out, and demand from prospective purchasers is stabilising.

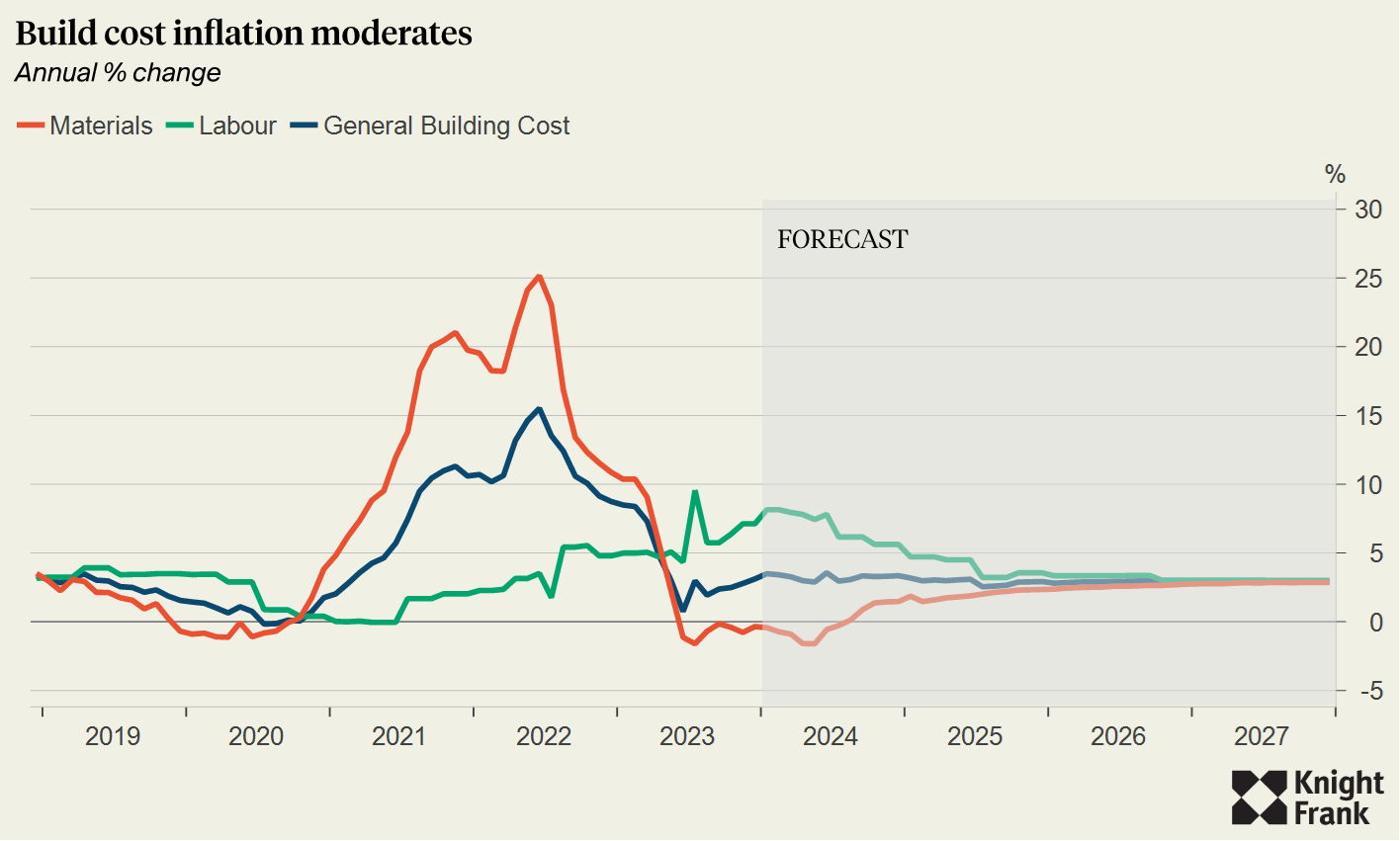

Build costs to moderate further

Weak construction activity over the last year also means inflation in material and labour costs is likely to be close to zero for the next year or so, which will support viability and reduce pressure on margins. That, in turn, will give investors and developers more incentive to take new or stalled projects forward.

Build cost inflation has already been moderating, down to 3.1% in 2023, from a peak of 15.5% in 2022, according to the BCIS. More stability is anticipated in 2024. Tender pricing is forecast to drop to 1.5% this year, from 3.5% in 2023. Materials and labour costs are also expected to come in notably lower than recent peaks.

Planning permissions fall (again)

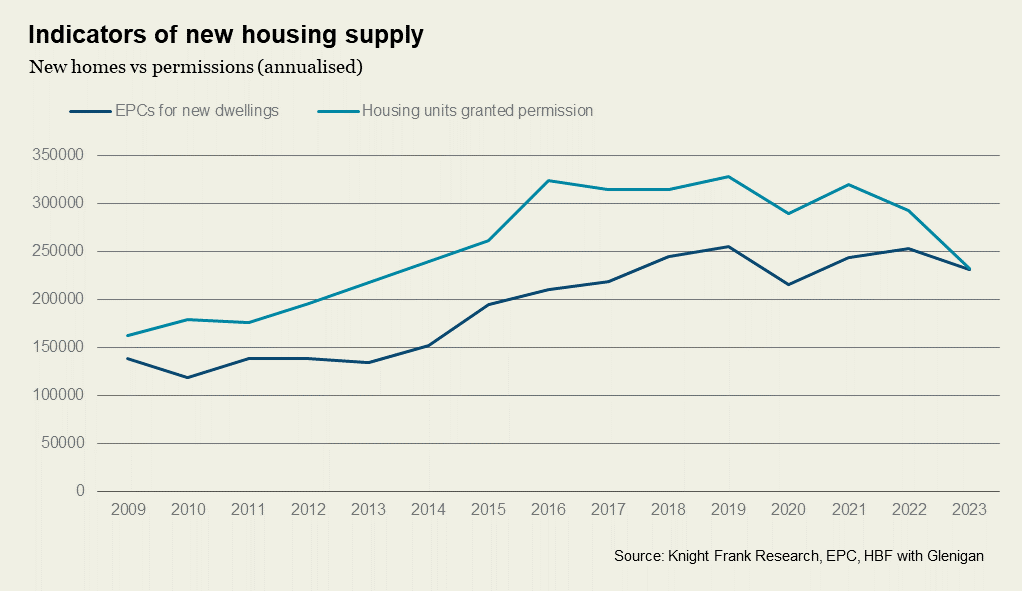

So far, so good. But it’s not all plain sailing. We mentioned a drop in new construction starts, but more concerning is new data which shows a further contraction in the number of planning consents granted.

The latest figures from the HBF show that, last year, permissions for just 231,215 homes were granted across England. That marks the lowest figure for planning consents in a calendar year since 2013.

Using EPC data as a proxy for housing completions, that means the number of homes gaining planning consent was just 140 more than the volume of homes which were completed in 2023 (see chart below), the narrowest gap on record. Given a portion of these consents are never built out, it’s a clear signal that housing delivery will fall in the medium term.

That will present opportunities for developers who are able to proceed with new schemes who will benefit from selling into a market that is likely to be starved of new stock.

The planning system came up a lot in the initial findings of the Competition & Markets Authority’s year-long study into the housebuilding sector, with researchers flagging it as one of the major issues blocking the delivery of more homes.

That won’t come as a surprise to many working in the sector. Planning delays have been the key concern for developers ever since the inception of our quarterly survey of SME and volume housebuilders.

Seniors Housing: Two lost years

Last week saw the launch of our latest Unlocking Potential for Seniors Housing Development report, produced jointly with Irwin Mitchell.

Now in its fourth edition, our latest report found that a third of local planning authorities across England still have not adopted specific planning policies and site allocations to help address major seniors housing shortages within their communities, while 10% have fallen behind on their commitments since the study was last conducted in 2022.

So what's going on?

Uncertainty around policy and politics has played a big part. Since the last report was published, there has been two changes of PM, three Secretaries of State at DLUHC, and six Housing Ministers. The Levelling-Up & Regeneration Act 2023 has entered the statute books, major amendments have been made to the NPPF, and more than a dozen consultations on proposed reforms to the planning system published.

If that wasn't enough, 64 Local Planning Authorities have delayed or withdrawn local plans; many of them citing recent uncertainty over the Gov’s planning policy direction as a key reason for doing so.

And yet, despite this inertia, a sense of urgency does, finally, seems to be taking hold. The Older Person’s Housing Taskforce is due to report later this year. And Government support for the sector is being felt – resulting both in greater recognition in the NPPF itself, but also in the Levelling Up and Regeneration Act 2023.

As in the wider housing market, a more consistent and supportive policy environment will unlock more supply, more propositions, and more choice for seniors.