Country house price growth hits four-year high after record activity

Prime Country House Index 248.9 / quarterly change 2.0% / annual change 2.3%

3 minutes to read

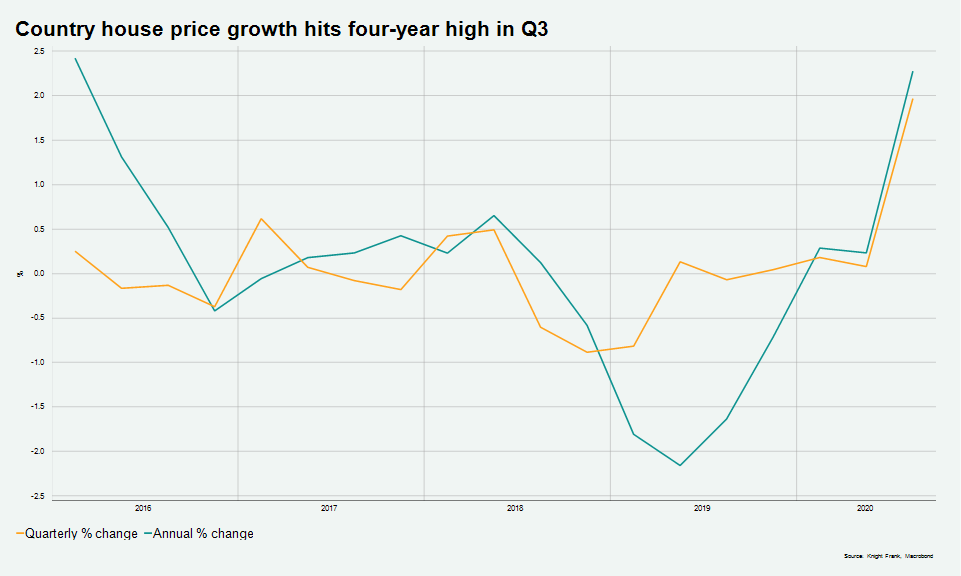

Country house prices grew at their strongest rate since the start of 2016 in the third quarter of this year, as buyers’ desire for space and greenery after lockdown continued to drive the market.

In the three months to September values rose by 2% taking annual growth over the year to September to 2.3%, according to the Knight Frank Prime Country House Index.

This was the strongest annual price performance since March 2016, when the impending 3% surcharge on second home purchases saw a spike in activity as buyers rushed to complete ahead of its introduction.

Similarly, it comes after a record-breaking run of activity during the summer months due to pent-up demand, which saw an all-time record for the amount of offers accepted outside of London in September. This, combined with the stamp duty holiday announced in July, has helped keep deal activity high.

“A record-breaking run of activity driven by a race for space post-lockdown, has sealed the recovery in the country house market and translated into the strongest price growth seen in more than four years.

“Despite a challenging economic outlook, people’s desire to get on with their lives after years of political uncertainty followed by lockdown has seen the property market continue to defy gravity, although there are signs that it is starting to normalise,” said Chris Druce, senior research analyst at Knight Frank.

Higher value properties outside London led the way out of lockdown earlier this year as previously explored, due to the combination of growing demand for outdoor space and buyers in a financial position to act more swiftly. Price growth for higher-value properties has also been weaker than the wider market in recent years due to a series of tax changes, leaving greater scope for future rises.

This momentum continued into the third quarter. While properties valued under £1m saw quarterly price growth of 1.8% in Q3 2020, those valued at £1m and above recorded price growth of 2.3% in the same period.

The £3m to £4m value band was the single strongest performing segment in the three months to September, with quarterly growth of 2.9%, although every value band recorded price growth in the period.

However, while activity has been strong there are signs that supply may be about to become more constrained. Appraisals for sale were 8% up versus the five-year average in the week ending 24 October 2020, but the margin has been narrowing for the past month. Inevitably, with winter approaching some people will now wait until the spring to list their property.

While the number of property viewings taking place remains elevated, at 35% above the five-year average in the same period, they too have been moderating. This suggests demand is softening due to the resurgence of the Covid-19 virus, rise of local lockdowns and weakening job market. Lengthening delays caused by a conveyancing system under increasing strain as people race to complete in time for the end of the stamp duty holiday on 31 March next year, could see some deals fall away in the coming weeks.

Despite this, offers accepted outside London reached an all-time high in the second week of October, suggesting that unless an unusual amount of deals are lost, exchanges will continue to rise in the run-in to Christmas even as other indicators weaken.

| Country House Prices Q3 |

| Annual Change |

Cottage |

Farm House |

Manor House |

Town House |

PCHI |

| Index |

267.6 |

264.9 |

228.9 |

128.6 |

248.9 |

Main photo by Sam Healey on Unsplash