UK Property Market Outlook: Week Beginning 26 October

What does the high number of properties that have gone under offer tell us about what comes next?

3 minutes to read

Exchanges in the property market outside of London reached an all-time high in the second week of October this year.

Given the large number of properties that have gone under offer since the market re-opened in May, this should come as no surprise. However, the same week was also the highest on record for the number of offers accepted outside the capital, underlining how momentum continues to build across the UK property market.

The figures highlight an emerging incongruity as many parts of the UK become subject to tougher lockdown measures and uncertainty builds around the end of the government’s furlough scheme.

This mismatch looks likely to continue.

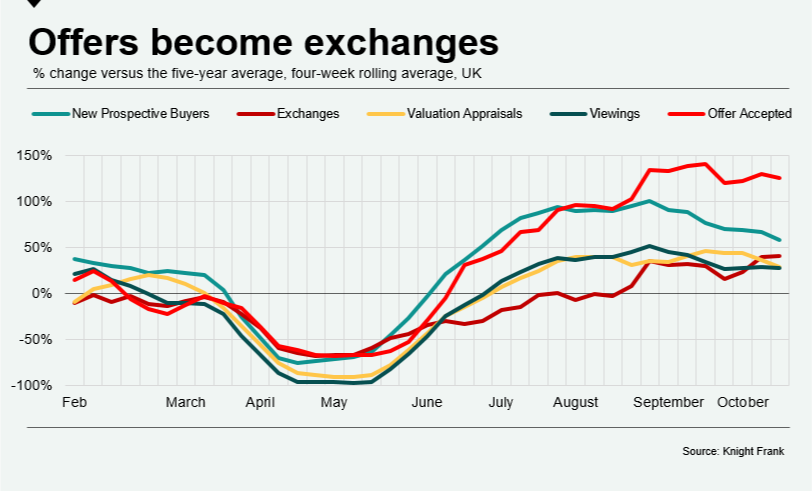

The number of offers accepted has been running far ahead of the five-year average compared to other measures of activity across the UK, as the below chart shows. As a result, the number of exchanges is starting to rise as other indicators flatten.

In an indication of how many of these transactions may fall through, 6.7% of deals that went under offer between January and June last year did not reach exchange within 6 months.

Furthermore, as we have previously noted, the majority of exchanges taking place in August and September originated before the lockdown. Meanwhile, government data from last week showed that the number of UK transactions in September was only 0.7% below the same month last year. That compares to an equivalent decline of -57% in April, demonstrating the extent to which activity has normalised, helped by a stamp duty holiday.

The system, however, is showing signs of strain due to a surge in activity at a time when staffing levels have not returned to normal levels due to Covid-19.

“Parts of the conveyancing market are struggling to cope,” said Mark Hayward, chief executive of NAEA Propertymark, the national estate agency group that consulted with the government during the market lockdown. “Lenders and valuers are being cautious so the time it takes to reach exchange is getting longer.”

Once an offer is accepted, it takes on average just over two months before exchange is reached, an analysis of Knight Frank data shows. The whole process, from the sale instruction to completion, takes on average six months.

With a stamp duty holiday ending at the end of March and a 2% surcharge for overseas buyers in place from April, the creaks in the system may start to get louder. As too will the calls to extend the stamp duty holiday, which Hayward believes will be needed to avoid what he calls the possible “cliff edge and chaos” after March.

As a reminder of how a stamp duty deadline can affect behaviour, the second highest week ever for exchanges in markets outside London was the seven-day period ending 2 April 2016, as buyers rushed to complete ahead of the introduction of a 3% surcharge for second homes on 31 March.

The major unknown is whether a full national lockdown will once again interrupt transactions.

The NAEA has not had a conversation with the government about this eventuality, said Mark Hayward. “I haven’t had that phone call and I would expect to if it was going to happen. Every indication we have from of all parts of the country is that estate agents are continuing to operate as normal.”