UK house prices feel the pinch of rising mortgage rates

Making sense of the latest trends in property and economics from around the globe

3 minutes to read

UK house prices

UK house prices fell 0.9% during September, the first monthly fall since July 2021, according to Nationwide. That brings the annual growth rate to 7.2%, from 9.5% a month earlier.

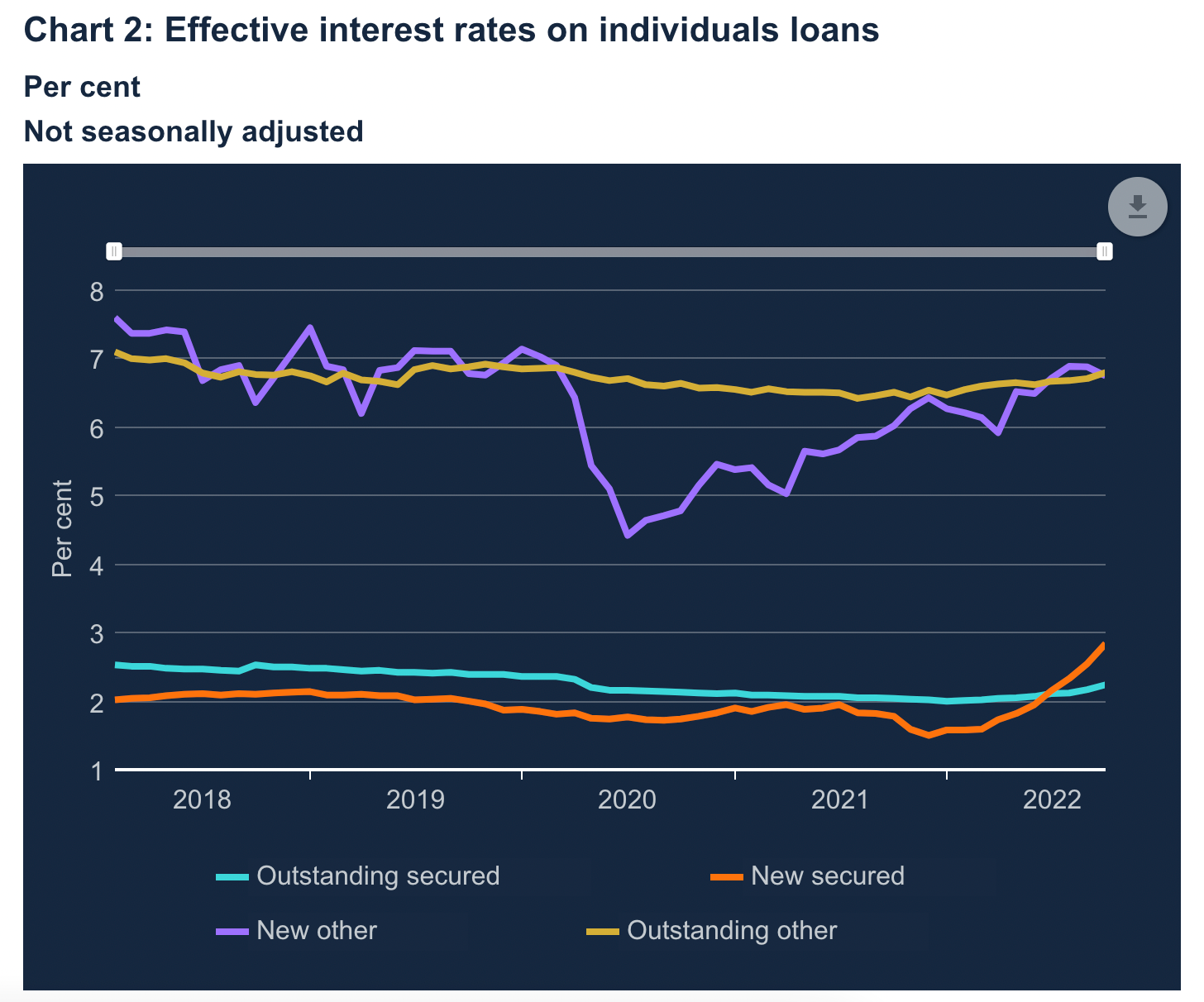

The pass-through rate from the mini-budget to mortgage rates was swift and it shows. The effective real interest rate on new mortgages rose by 29 basis points to 2.84% during the month, according to Bank of England figures released on Monday (see orange line on chart). Mortgage approvals for the purchase of homes - an indicator of future borrowing - slowed sharply to 66,800, from 74,400 in August.

Knight Frank's Tom Bill tells the Guardian: “government stability will help underpin transactions but we are witnessing a shift in rates after 13 years of ultra-low borrowing costs. Low unemployment, tight supply and well capitalised lenders mean we should avoid the kind of double-digit falls seen during the financial crisis.”

UK industry wilts

There is little doubt that the Bank of England will opt for a substantial rate hike tomorrow, but economic indicators suggesting that it may soon be time to ease off are piling up.

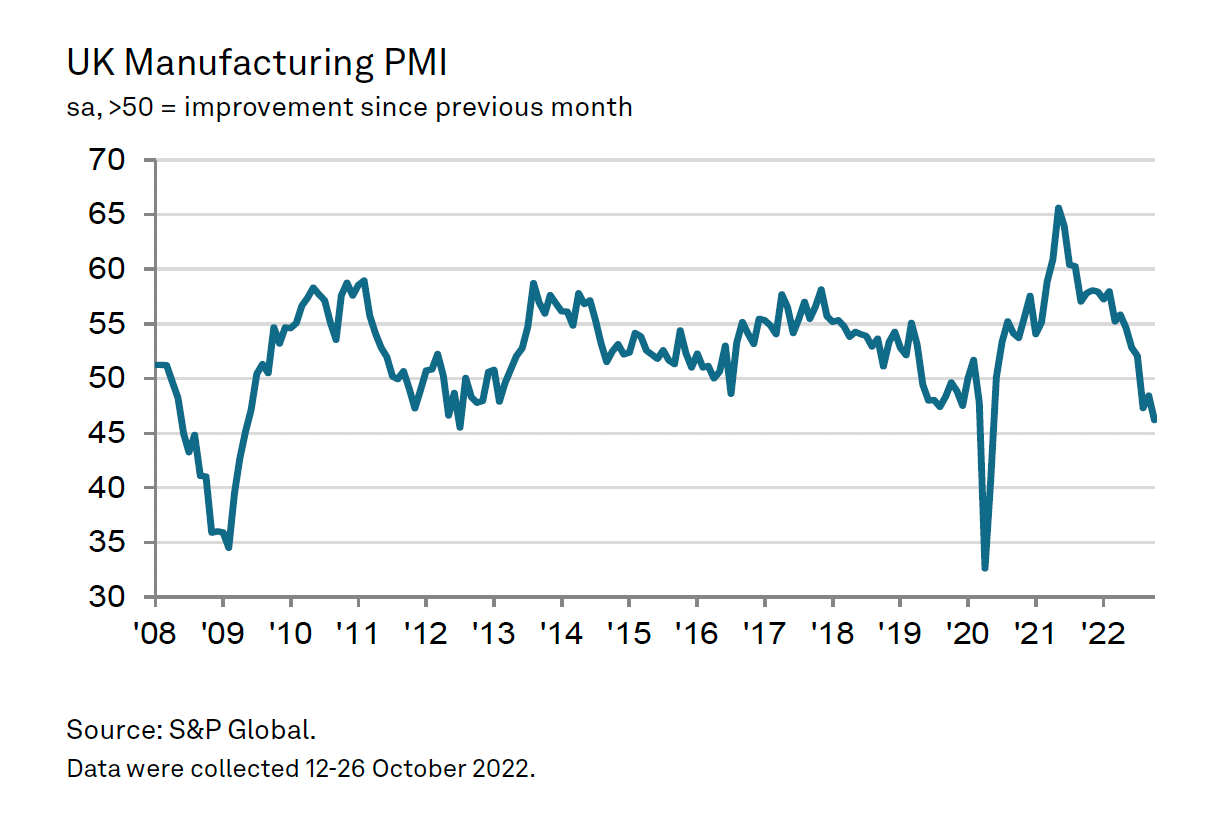

October's manufacturing PMI from S&P Global/CIPs was the worst for almost two-and-a-half years. Contributors cited a weaker domestic market, already high stock levels at clients, subdued client confidence and inflationary pressures - the impact of all four were felt right across UK industry.

New exports declined for a ninth month running. Job losses were reported for the first time since December 2020. Business optimism dipped to a two-and-a-half year low.

Price inflation remained substantial, illustrating the bind faced by BoE officials. The pace of rising input and output costs is easing, but both measures remain well above long-run averages.

Two jobs for every seeker

Today's Federal Reserve will be watched closely for signs of an imminent dovish pivot, as we discussed in Monday's note. A 75bps hike is priced in, but optimists think Fed chair Jerome Powell may signal that a smaller hike is coming in December, and possibly even a pause after that.

Recent data provides powerful counterpoints. Job openings rose again in December, according to official figures published yesterday. That leaves almost two job openings to every unemployed worker. Plus its earnings season and corporate America is sending some clear signals - executives expect to see sustained demand during the months ahead and many intend on raising prices. Anyway, we don't have long to wait, the Fed decision will be published at 2pmlocal time, or 6pm in London.

Similarly, Eurozone inflation climbed to a record annual rate of 10.7% in October, according to official figures published Monday. Again, that pours some cold water on hopes of an imminent pivot from the ECB (see Friday's note).

Checking in on remote work

A new survey from Linkedin generated a lot of coverage this morning. The work-from-home trend may have peaked, according to Bloomberg's reading. Bosses are hauling staff back to the office, according to the Telegraph.

Remote jobs have dropped to 12% of the total advertised, according to Linkedin's data. That's down from 16% in January and is the lowest reading since September 2021. The power is “shifting back to employers as hiring slows down,” Josh Graff, MD at Linkedin tells Bloomberg Radio.

Granted, fully remote jobs are popular - they garnered 20% of all applications, according to Graff, but hybrid and office-based roles combined are more popular, particularly among the young. About a third of US employees want to be fully remote, according to research from Stanford economics professor Nick Bloom. That drops to 24% among those aged 20-29.

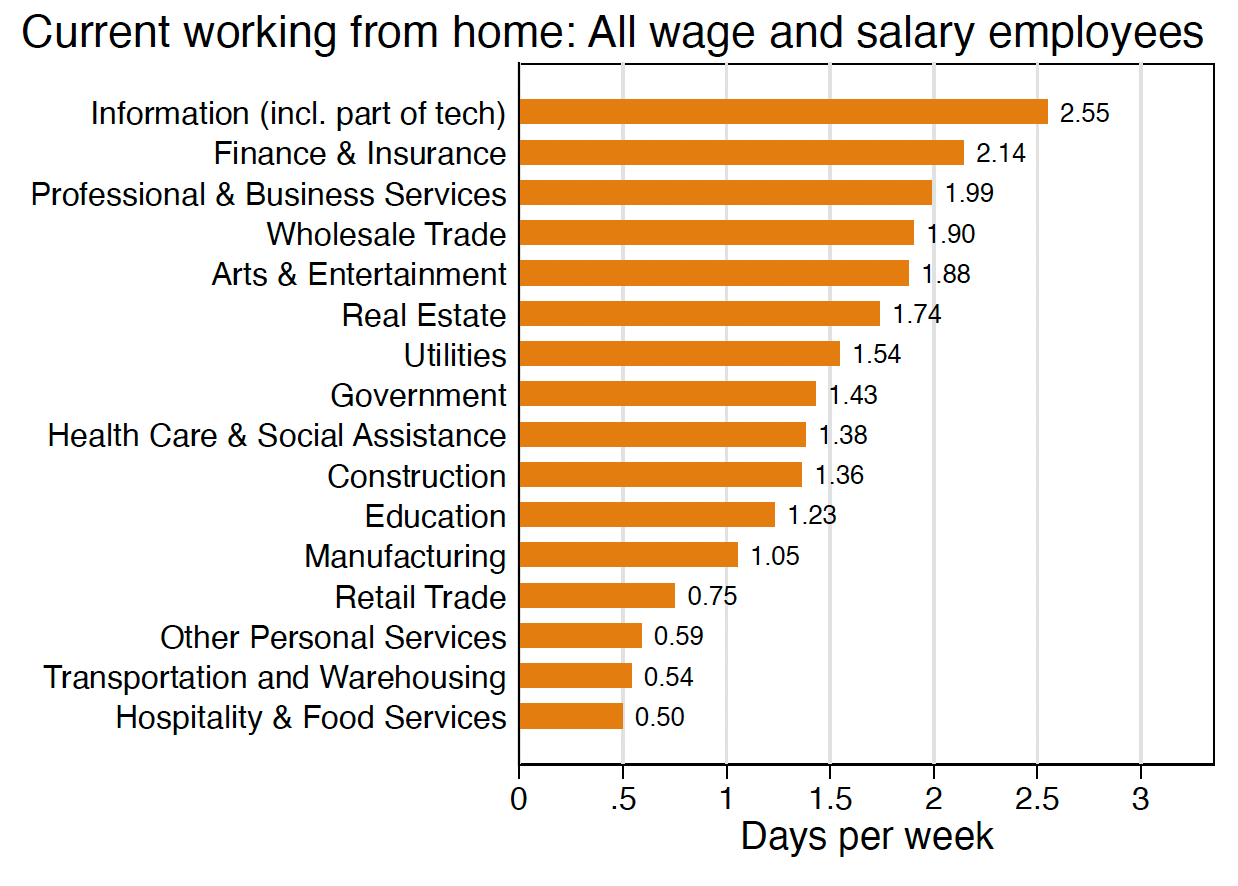

Bloom and colleagues regularly survey large US corporates and employees and the results show a steady moderation in the amount of work conducted from home, though there are significant differences by sector (see chart).

In other news...

We have updated our House View with new entries for UK retail, UK economics and global economics.

Also this morning, we check in with our research experts in Germany and New Zealand.

Elsewhere - Capco on leasing and valuations (Trading Update).

Photo by Max Vakhtbovych