Leading Indicators | Rate Hikes | CRE Lending | Business Sentiment

Discover key economic and financial metrics, and what to look out for in the week ahead.

2 minutes to read

Here we look at the leading indicators in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

BoE and Fed set to hike rates this week

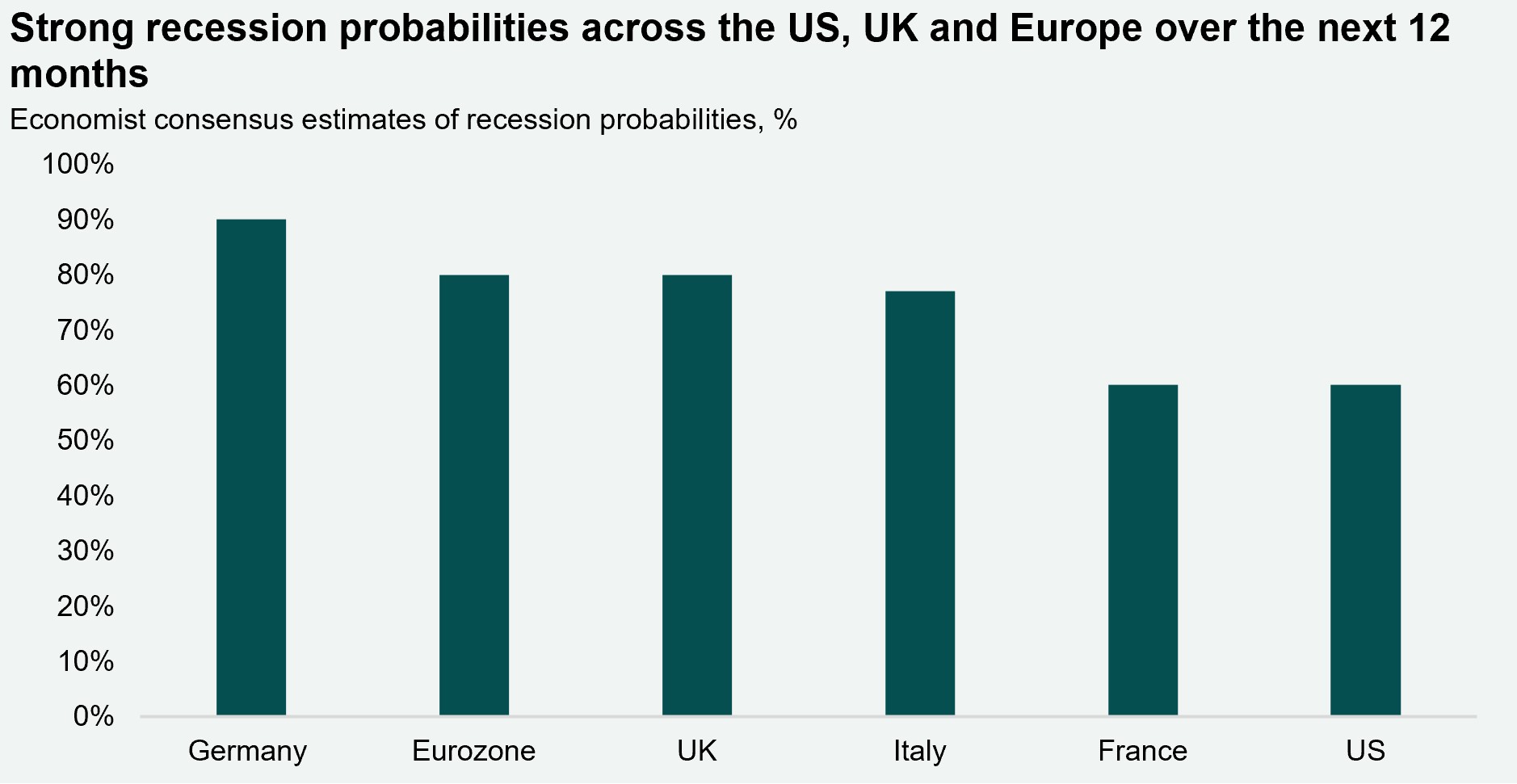

Money markets and economists are widely anticipating a 75bp rate hike by the Bank of England at its monetary policy meeting on Thursday. This will be the central bank’s largest rate rise since 1989 and would bring the base rate to 3.0%, its highest level since 2008. The BoE are also due to make a decision on whether it will start reining in quantitative easing. A rate hike of 75bps would match the ECB’s interest rate hike last week and is in line with money market expectations for the US Federal Reserve's interest rate decision due tomorrow. While rates are increasing, some economists are hinting at signs of abating. Economists expect the BoE to signal smaller hikes at meetings in the near future, with the UK not “far off” a policy pivot. Currently, money markets expect the BoE base rate to peak at 4.75% next year.

Elevated all in debt costs may lead to recapitalisation events next year

Lending to commercial property unexpectedly rose in September, increasing by £428m, the first increase since June. The rise was driven by lending to standing property, with development lending declining for the sixth consecutive month. With interest rates and the all in cost of debt elevated, this is leading to affordability challenges for UK investors. This is notable as All UK property investment in 2017 and 2018 was 30+% above the long term average, and assuming a 5-year loan term, debt back buyers will be facing higher refinancing costs as those loans come to maturity. Higher debt costs may limit refinancing LTVs leading to recapitalisation events in 2023, with investors having to either inject additional equity, refinance higher up the capital stack or bring assets to the market for sale.

Uncertainty is impacting sentiment

Amidst heightened volatility in financial markets, business confidence has weakened. The Lloyds Bank business barometer has declined to a 19-month low in October, led by the fifth consecutive monthly contraction in optimism regarding the economy. This is partly due to a rise in firms’ trading prospects, with 86 FTSE-listed companies forced to issue profit warnings in Q3 2022, which is up from 51 in Q3 2021 and the greatest amount since the GFC. Office occupier sentiment has also moderated in line with business sentiment. The Knight Frank CRESA Global CRE Sentiment Index turned negative in Q3, falling by 5.5% q-q. Despite the negative outlook, occupiers are focusing on enhancing workplace services and amenities to bolster utilisation.

Download the latest dashboard