Post-Budget Limbo Boosts London’s Super-Prime Lettings Market

November 2024 PCL lettings index: 220.5

November 2024 POL lettings index: 223.5

2 minutes to read

While some foreign investors have left the UK since October’s Budget signalled the end of the non dom tax regime, others are still watching events unfold.

Labour’s replacement, a residence-based system that will operate for a maximum of four years, is subject to amendments as it goes through Parliament. Meanwhile, the Foreign Investors for Britain lobby group remains in talks with the government about the possible introduction of an Italian-style flat tax.

The fact some are keeping their options open is good news for London’s super-prime (£5,000+ per week) rental market.

The number of super-prime tenancies agreed in prime central London (PCL) in the three months to November was 17% higher than the same period in 2023, Knight Frank data shows.

“The reasons that demand has risen in recent years have been amplified by the Budget,” said Tom Smith, head of super-prime lettings at Knight Frank. “There hasn’t been a surge in demand due to the time of year, but activity should pick up in early 2025.”

An increase in the top rate of stamp duty to 19%, which was also announced in the Budget, could mean that more opt to rent rather than buy, said Tom.

At the same time, the supply of super-prime rental properties is increasing, which is putting downwards pressure on rents. “It depends on the property, but we have seen annual declines of 10% in some cases,” said Tom.

The number of market valuation appraisals carried out by Knight Frank for properties valued above £5,000 per week increased 29% in the three months to November compared with the same period in 2023.

“Some owners have decided to leave the UK temporarily after the Budget but want to keep a base in London, so have rented out their property,” said Tom. “More generally, the rising cost of debt means a greater number of owners want or need an income.”

Across the wider prime central London market, a pick-up in supply meant rental values rose 0.6% in the year to November, which was the narrowest increase since July 2021. Meanwhile, there was a 1.6% rise in prime outer London (POL), which was also the smallest annual growth recorded since the middle of 2021.

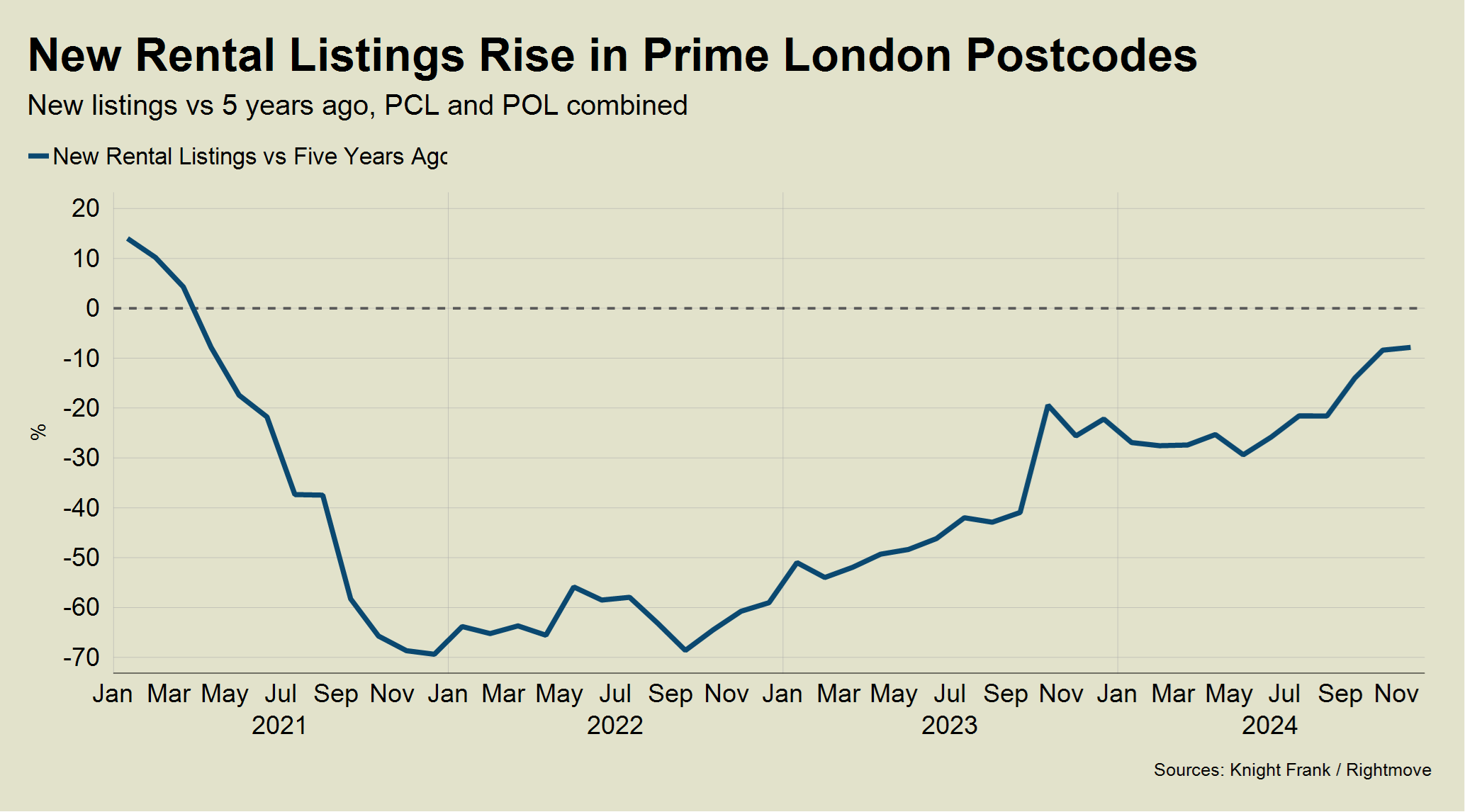

Supply fell in recent years due to tighter landlord regulations, higher mortgage costs, a growing tax burden for buy-to-ley investors and the disruption of the pandemic.

The number of new listings in PCL and POL in November was 8% below the same month in 2019, the last year of relative normality in the lettings market. It compares to an equivalent decline of 27% in January of this year, Rightmove data shows.