UK Logistics Market Outlook 2022: The Long And The Short Of It

We expect to see investors continue to target long-income opportunities in 2022, particularly as risk and uncertainty rise for the short to medium-term horizons.

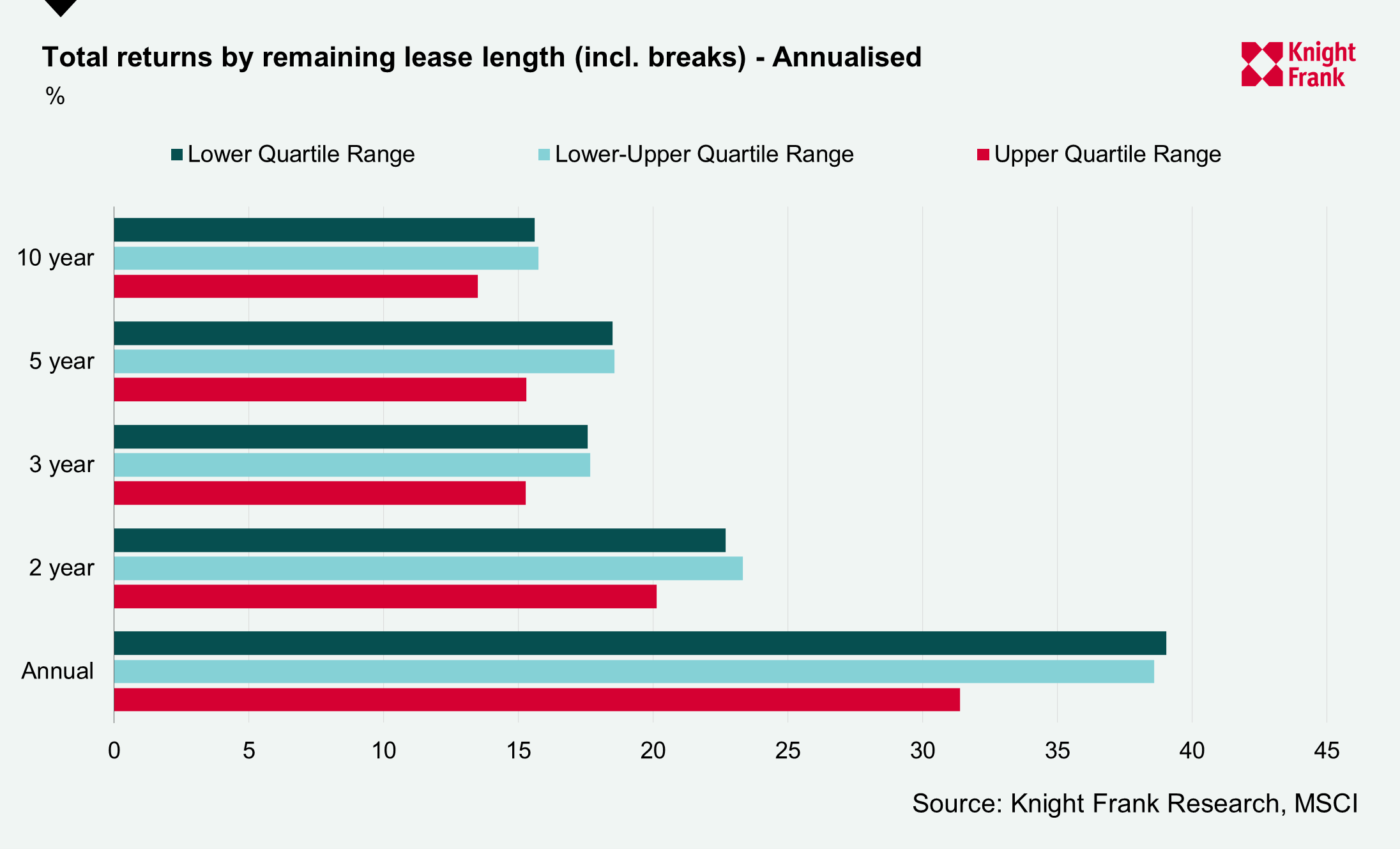

Assets with mid-length unexpired lease terms may indeed offer the most attractive risk-return profile for investors. Over the 10, 5, 3, and 2-year horizons, assets with mid-length unexpired lease terms outperformed.

2 minutes to read

Short leases, vacancies, and insolvencies – risk or opportunity?

Investors want to increase their exposure to the logistics sector, and some are looking to drive returns through rental growth via new lettings, re-gears and rent reviews.

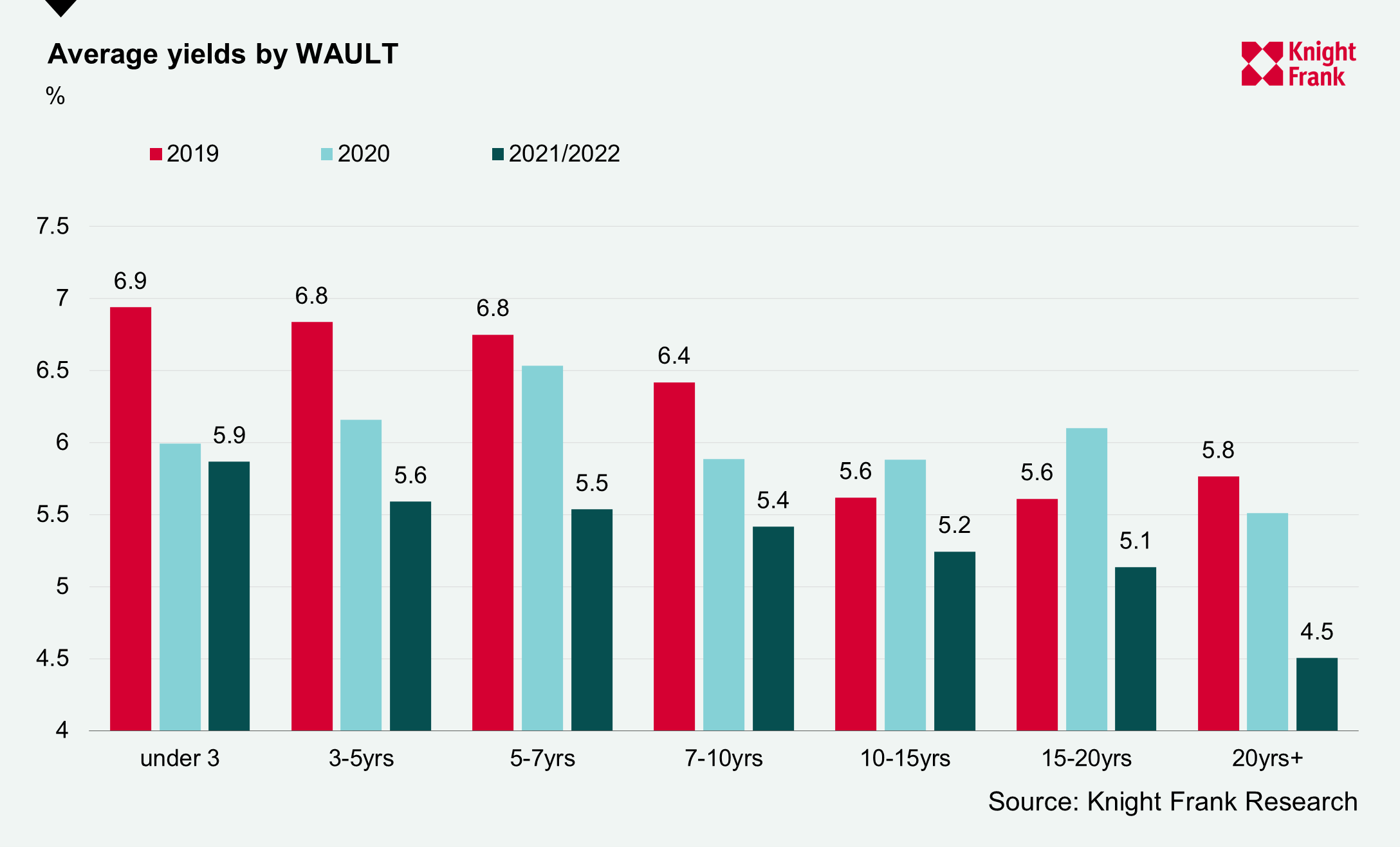

Shorter lease lengths and the potential to boost returns on the back of strong market rental growth piqued investor interest in 2020 driving down yields. Assets and portfolios with unexpired lease terms under three years recorded strong yield compression between 2019-2020, from 6.9% to 6.0% and below the average yields for transactions with longer WAULTs (weighted average unexpired lease terms) of 3-7 years.

The Covid rent moratorium is due to end in March 2022 and given the strong rental growth over the past couple of years, landlords or investors may see assets or portfolios with so-called zombie tenants as an opportunity, with the ability to secure vacant possession and thus realise the growth in market rents through a new letting.

Playing the long game

Not all investors are looking to drive returns through active management, however. Uncertainty plays positively to less volatile, long-lease strategies. Through previous market downturns, longer income assets outperform, with secure income profiles providing greater capital stability.

The war in Ukraine and geo-political instabilities are prompting investors to reassess their exposure to risk. With volatility on the rise in 2022, investors will increasingly look to long-income strategies, that offer stable income and a potential hedge against rising inflation and other volatility-triggering events.

The strongest yield compression over the past year has been recorded for transactions with a WAULT (weighted average unexpired lease term) of twenty years or more, with average yields in 2021/22 101bps below where they were in 2020.

Many of these long-lease acquisitions have been through sale-and-leaseback deals. For owner-occupiers offering strong covenant, this can offer an attractive funding option with the strength of their covenant key to driving price. The owner-occupier will remain as a tenant, typically paying inflation-linked rent over a 20 to 25-year period. These offerings have proved popular with liability-matching long income investors such as pension funds.

We expect to see investors continue to target long-income opportunities in 2022, particularly as risk and uncertainty rise for the short to medium-term horizons.

In terms of industrial assets and lease length, leases between 10-20 years have recorded the least yield compression over the past two years. Average yields compressed just 37bps for transactions with 10-15yr WAULTs and 48bps for those with 15-20yr WAULTS. This may be due to a polarisation in terms of investment strategies, with strong competition amongst both the value-add investors and long-income strategies.

Industrial total returns segmented by remaining lease length, demonstrate strong returns for assets with mid-length unexpired lease terms across previous cycles. Over the 10, 5, 3, and 2-year horizons, assets with mid-length unexpired leases (lower-upper quartile range) outperformed those with shorter or longer ones.

Assets with mid-length lease maturities may indeed offer the most attractive risk-return profile for investors in 2022.