UK Logistics Market Outlook 2022: Sustainability & Resilience To The Fore

Onsite energy generation and storage will become increasingly important to operators, as will electric vehicle charging facilities. Operators will increasingly look for these features when securing a facility.

With prime yields now at c.3%, investors are mindful to protect their exit values. Sustainability standards are rising bringing greater risk of obsolescence, thus protecting exit values is becoming more and more important.

3 minutes to read

Energy crisis fueling the need for green energy

The need to improve operational resilience and mitigate against rising energy costs means greater self-reliance in terms of generating energy and this may prove critical to profitability. Onsite energy generation and storage will become increasingly important to operators, as will electric vehicle charging facilities. Operators will increasingly look for these features when securing a facility.

Energy security is becoming increasingly important, for government, households and for businesses. Warehouses and logistics operations can be very energy-intensive, with heating/cooling requirements for large buildings, plant and automation equipment, and transport and delivery costs associated with freight and fleet.

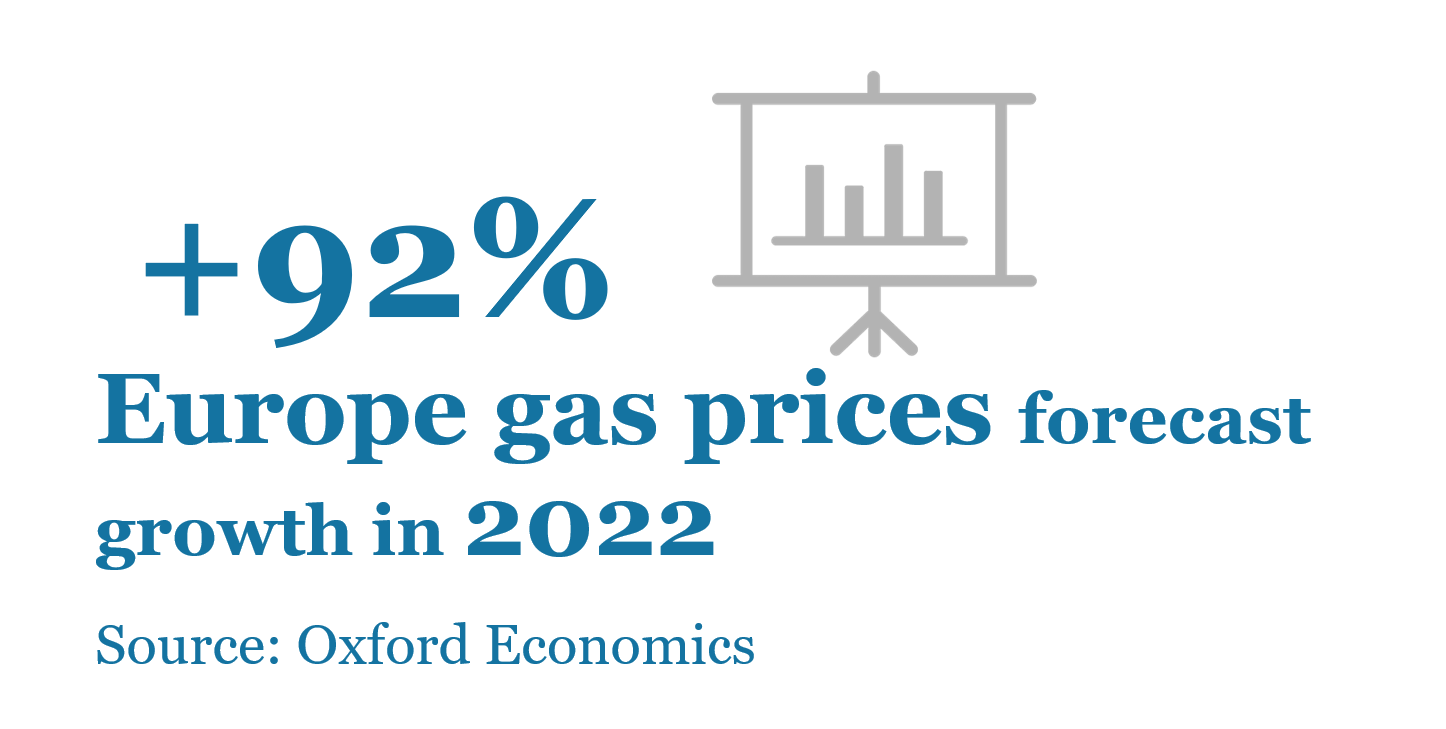

The cost of energy has increased significantly throughout the end of 2021 and into 2022. The current geopolitical tensions threaten to fuel further price growth throughout the rest of 2022. Oxford Economics forecast world energy prices to increase 33% in 2022, following a 120% increase in 2021. Gas prices in Europe have risen sharply in recent months and are expected to rise 92% this year. Meanwhile, oil prices are expected to rise 42% in 2022, following 69% growth last year (2021).

A longer-term view on sustainabiility

Acquisition decisions and development designs are increasingly being made with future sustainability requirements in mind. With prime yields now at c.3%, investors are mindful of the need to protect their exit values. Sustainability standards for investors, operators and policymakers are become increasingly stringent, heightening the risk of obsolescence, thus protecting exit values through improved sustainability is becoming more and more important.

Investor-developer partnerships are not new. However, it is this arrangement that encourages a longer-term view of an asset early on in the design and specification of a development. Investors who are looking to acquire assets at lower prices are achieving this by taking on some of the development risk and accessing development profit. These partnerships mean that assets that would have been traded, from developer to investor are no longer changing hands. Few developers are building with a view to trade the asset on an investment basis, and there are currently very few investors buying with a view to trade on.

Access to green finance

In the face of rising interest rates, along with land values, and development costs, the ability to access cheaper financing will enable developers to swallow a higher development cost.

Lenders are now bringing the environmental, social and governance (ESG) agenda to the fore when making lending decisions. This is influencing the financing of real estate assets and sustainable design features are becoming an appealing way for investors and developers to mitigate against the rising costs of finance, or refinance costs in the future.

Supply chain resilience

Supply chains will face ongoing disruptions in 2022 and this will drive manufacturers to widen their supplier base and hold higher levels of stock to protect their order books.

Industries with long, complex supply chains may look to secure components closer to home and manufacturers operating a “just-in-time” supply chain will need to consider whether this is cost-effective given the additional transportation costs and risks associated with delays.

Food security

We expect to see further growth in vertical farming in the UK as food manufacturers incorporate vertical farming within their production plants in order to reduce environmental impacts and reliance on third party producers.

It is not just concerns around energy security that the war in Ukraine has raised. The vulnerability of the global food system has also been highlighted. Russia is one of the world’s largest exporters of fertilizer and the largest exporter of wheat. Ukraine is also a major exporter of oils, grains and cereals. Alongside geopolitical and trade disruptions, there are also risks to agriculture and food security posed by climate change, pollution, and contamination.

Vertical farming operators have been expanding their footprint in the UK, taking larger and larger units from which to grow crops indoors. The need for greater food security, along with a desire to reduce the carbon footprint of the food we consume, and the use of fertilizers, is driving change in the way we produce food.