Super-prime sales wilted as Americans prepared to vote

Making sense of the latest trends in property and economics from around the globe

3 minutes to read

Sales of super prime homes (US$10 million+) across 12 of the world’s mainstream cities slowed during the three months to September 2024, in large part due to election uncertainty in our five American markets.

Knight Frank's Global Super-Prime Intelligence report recorded a global tally of 406 deals worth US$7.4 billion, down 18% in volume and 17% in value compared to the previous quarter. Palm Beach, which typically sees its peak in the first quarter of each year, recorded its lowest sales figure since the end of 2022. Miami, too, experienced a decline, with sales dropping nearly 60% compared to Q3 2023 – a steep decline even when considering the market’s seasonal patterns.

Dubai also contributed to the decline as it transitions to a phase of more sustainable growth following the recent boom. While the city's 83 sales remain well above the average since 2021, they are down nearly 40% compared to the same period last year.

Bright spots

London was the only market among our 12 cities to see a quarter-on-quarter increase in super prime sales. The city’s 51 sales marginally improved upon the 47 reported in the second quarter – the first such increase since Q3 last year. This uptick confirms the speculation that the market was motivated to get ahead of the new Labour government’s budget.

However, London is still far from its post-pandemic peak. Between 2021 and 2023, the capital averaged US$1.5 billion in super-prime sales per quarter, whereas this year has yet to see a quarter breach the US$1 billion mark.

The wealthy weren't alone in seeking to squeeze deals through ahead of the budget. Net mortgage approvals for house purchase ticked up by 2,200 to 68,300 in October, the highest level since August 2022, the Bank of England reported on Friday.

Front-loading

The UK's business community took the tax rises announced in the budget badly. The Institute of Directors said yesterday that optimism among its members had fallen to the lowest since the onset of the pandemic.

Consumers appear much more sanguine. GfK's consumer confidence index jumped from -30 to -24 in November. While that's a negative reading, it is the biggest month-on-month improvement since the spring and surpassed the -28 economists had expected.

Labour put a lot of effort into frontloading the bad news, reminding the public for weeks that tax rises were on the way. It appears that the statement wasn't quite as bad as people feared, which helps explain why the price of the average UK home rose 3.7% in the year through November, up from 2.4% the previous month, Nationwide reported this morning. That's the fastest rate of annual growth for two years.

“A feeling the Budget could have been worse, the prospect of a stamp duty rise next April and the dwindling availability of sub-4% mortgages have all driven activity over the last two months," said Knight Frank's Tom Bill. "The main risk facing the UK housing market now is whether Labour’s Budget will work in the long term. Any extended period of upwards pressure on unemployment, inflation and borrowing costs would put downwards pressure on house prices and transaction volumes, and we have revised down our forecasts marginally for the next three years.”

Marking the scorecard

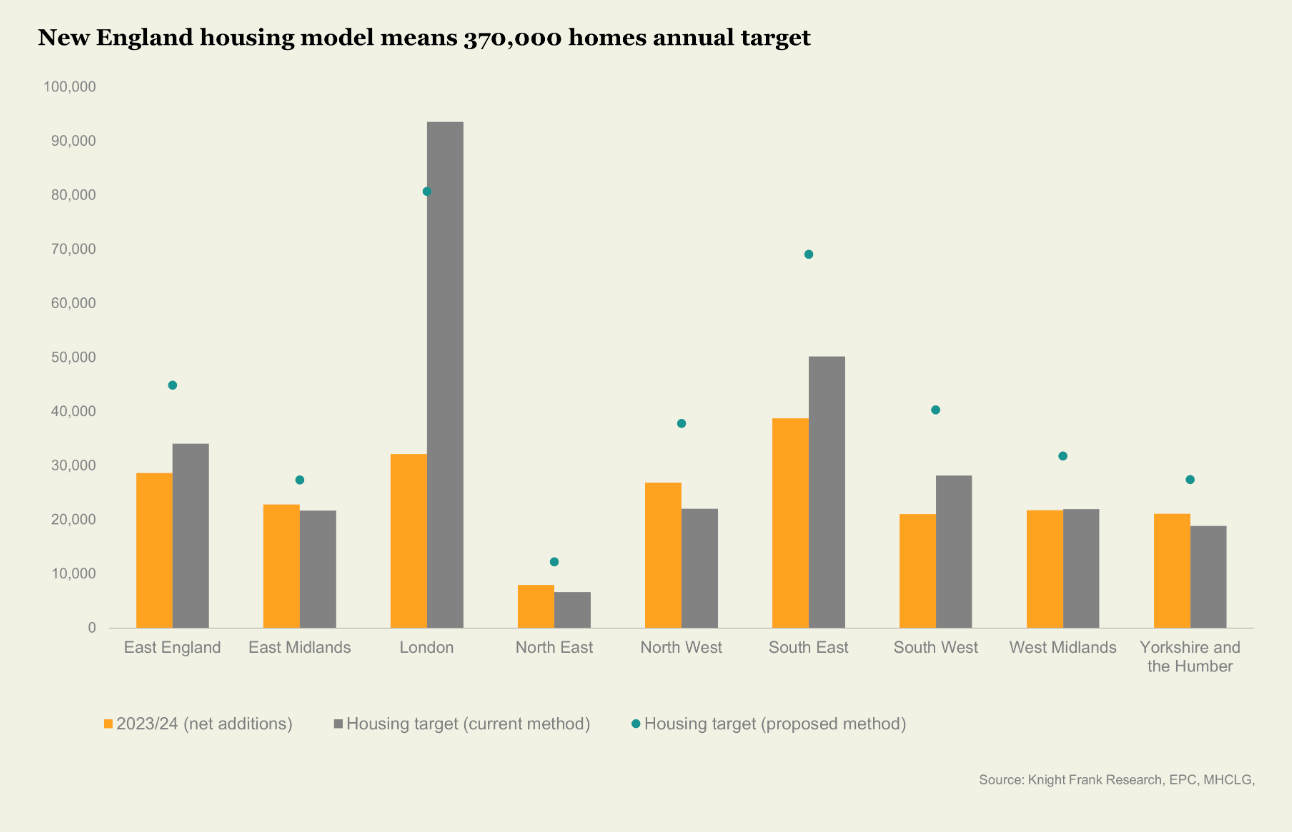

England’s annual housing delivery dropped 6% to 221,071 net additional dwellings in the year to end March 2024, with nearly all regions seeing declines, according to official figures out last week.

London’s output fell 9% to a nine-year low of 32,162 homes, which is a disaster for the government. The capital alongside the South East faces the largest shortfalls relative to the official 370,000 annual target - see chart. Meanwhile, housing completions across England up to mid-November, using EPC data as a proxy, are down 7% from 2023 and 14% from 2022.

The primary causes of all this pre-date the government, of course. Labour has been in power a little more than 150 days, which makes this a good moment to assess how they plan to turn things around. Anna Ward has the details.

In other news...

UK government sets new deadline to fix unsafe cladding on residential buildings (FT).