UK Budget: Five Key Takeaways for Europe’s Prime Markets

Most of the contents of Chancellor Rachel Reeves Budget speech had been leaked in the weeks prior but the one piece of detail which could influence potential wealth outflows from the UK to Europe was light on detail. Here are the top five takeaways that could send ripples across the continent.

2 minutes to read

1. Non-Doms: Tax Status Revamp on the Horizon

There’s been talk that the UK government might adopt a lighter touch on non-domiciled (non-dom) tax treatment, inspired by Italy’s flat-tax model. But Reeves kept things vague, despite heavy lobbying for clarity around inheritance tax exemptions on overseas assets and income. Here’s what we know:

- Reeves’ promise to abolish the non-dom tax regime and “outdated concept of domicile” by April 2025 signals a shift toward a new, residence-based system. This could mean big changes for the 83,000 UK-based non-doms, who may face tougher tax treatment on foreign assets.

- Lobby group Foreign Investors for Britain warns that these changes could weaken the UK’s appeal for international investors. They highlighted a potential 20% inheritance tax on business properties, arguing that stricter policies might divert investors to more tax-friendly countries like Switzerland or Italy.

Sign up to the European Residential Update where we’ll share the specifics of Reeves’ “residence-based scheme” once published and explore how it could reshape UK and European investment dynamics.

2. Stamp Duty Hike for Second Homes

In a surprise move, the UK government raised stamp duty on second homes from 3% to 5%, bringing the top rate to 19%. While the increase may seem small, it could prompt holiday home buyers and rental investors to look beyond the UK, where property costs and taxes are more affordable.

3. Interest Rates: The UK vs. Eurozone Path

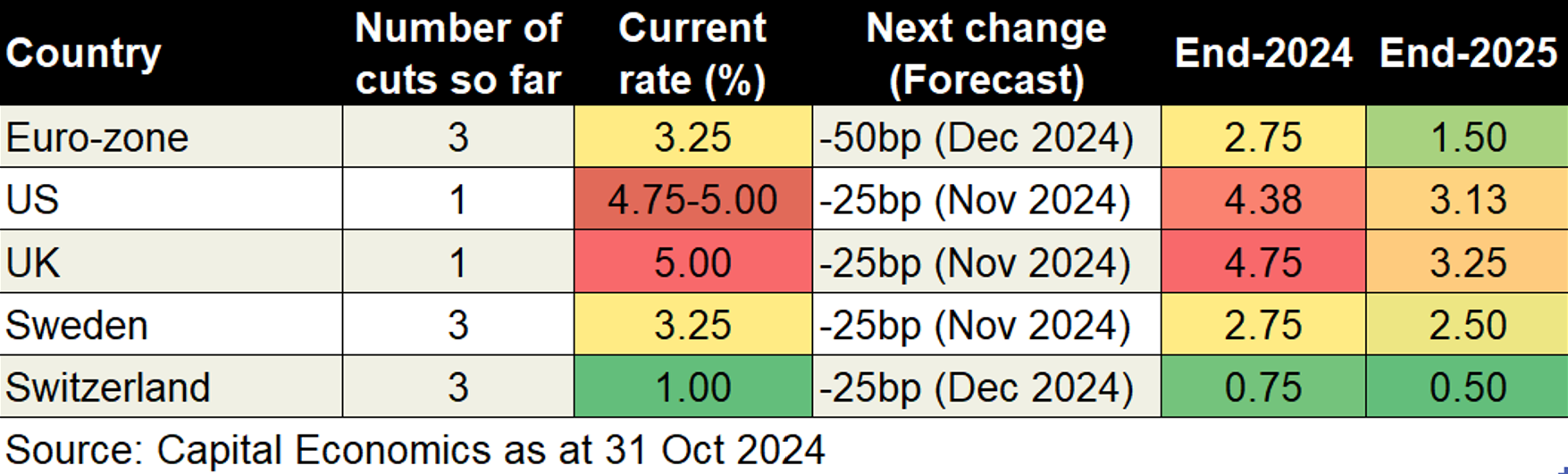

For anyone tracking interest rates, here’s the forecast: the UK may cut rates before Christmas, but any further reductions will be slow. The Eurozone, meanwhile, is expected to end 2024 with rates around 2.75% according to Capital Economics, while the UK could be sitting at a heftier 4.75%. That divergence could influence investor moves, especially for those eyeing currency gains in European assets.

4. Education Costs Rise: VAT on Private School Fees

The UK government’s decision to hike VAT on private school fees by 20% adds another factor for families considering relocation to Europe. As we highlighted in the European Lifestyle Report, education quality has long been a motivator for those looking to move to Europe, and this added cost could prompt families to explore international schools in destinations like Switzerland, Paris, or Mougins in the South of France, home to some of the region’s top international schools.

5. Private Equity Gains Taxed Higher, But Less Than Expected

Capital Gains Tax on private equity performance fees saw a modest increase from 28% to 32%, lower than some had anticipated. However, from April 2026, new rules will tax “carried interest” under the full income tax framework, setting a 34.6% rate, inclusive of national insurance. While this only affects about 3,100 people in Britain, the policy shift could influence private equity giants weighing UK and European investment opportunities.

For a deeper dive into the Budget's implications on the UK housing market, sign up to Tom Bill’s UK Residential Outlook