Rural Update: Budget Special

Your weekly dose of news, views and insight from Knight Frank on the world of farming, food and landownership

10 minutes to read

Viewpoint

The biggest tax-raising budget in generations has confirmed our worst fears. Boxed in by her election pledges, the Chancellor has announced changes that threaten the very fabric of the countryside and the communities that, for generations, have been the custodians of the land that we all rely on for our day-to-day existence.

I, like many, was incredibly concerned about how farming and the wider rural sector would fare when Ms Reeves took to the podium yesterday afternoon. Having heard Defra Minister Steve Reed state at last December’s CLA Rural Business Conference that farmers and landowners had nothing to fear around Agricultural Property Relief from an incoming Labour government, I remained hopeful that the leaks of the past few weeks would prove to be inaccurate.

Sadly, this has not been the case, and one can only now wonder what else lies in store for a sector of the economy that every aspect of society relies upon, but also one which Mr Reed and Ms Reeves seem intent on dismantling.

All of this is in stark contrast to Mr Reed’s statement in August that the government would “restore stability and confidence in the sector by introducing a new deal for farmers.” If this is the new deal it doesn't look very appealing.

Read my full thoughts here and please get in touch if you need help with any of the matters arising from the Budget. Knight Frank is here to help.

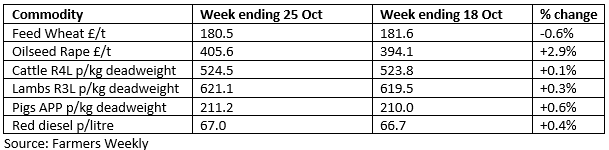

Commodity markets

Milk moves up

The price paid to dairy farmers for their milk has increased by 18% over the past 12 months. Farm-gate prices hit 43.06p/litre in September, according to the latest figures from Defra. This represented a 3.6% rise on August values. Analysts say rising prices could push many producers who have been losing money back into the black.

Rapeseed window

Oilseed rape values have nudged back over the £400/t mark. With Black Sea supplies scarce and Canadian and Australian shipments yet to arrive, European producers have a window of opportunity to take advantage of the highest prices in around 18 months.

Input/output shifts

Defra’s latest Agricultural Price Index shows the average value of farm outputs increased by 3% in the 12 months to August. Milk (+2.6%) enjoyed the biggest rise. Meanwhile, the average cost of farm inputs fell by almost 4%. Compound feedstuffs (-0.6%) saw the biggest drop.

Budget round-up

APR assault

As feared, Chancellor Rachel Reeves made drastic changes to Agricultural Property Relief (APR) and Business Property Relief (BPR) in yesterday's Budget. From April 2026, the first £1 million of the value of agricultural properties will be exempt from Inheritance Tax (IHT), but above that threshold, the combined relief available from APR and BPR will drop to 50% of the standard 40% rate of IHT. This means death duties of 20% will effectively apply on the value of farms and rural estates above £1 million, although there are other allowances available that could help partially mitigate the blow.

However, the Chancellor did confirm that APR will be available on certain environmental land management agreements from 6 April 2025.

Other tax rises

• The rate of employers’ National Insurance contributions will rise from 13.8% to 15% from April 2025. The threshold at which they kick in will also drop from £9,100 to £5,000. However, the Employment Allowance available to smaller businesses will increase from £5,000 to £10,500.

• The lower rate of Capital Gains Tax on the profits from selling assets like second homes will rise from 10% to 18%. The higher rate will rise from 20% to 24%.

• The Stamp Duty Land Tax surcharge on the purchase of second homes will increase to 5% from tomorrow (31 October).

• VAT on school fees will be applied from January 2025.

• IHT thresholds will be frozen until 2030. IHT will also be applied to inherited pensions.

• The current 75% business rates relief for hospitality businesses will drop to 40% from 31 March 2025. The relief, capped at £110,000 per business, will be in place until the end of 2026.

Minimum wage hike

Those aged 21 or over on the minimum wage will see their salaries hiked by 6.7% to £12.21/hour from April next year. As part of the government’s move towards a single adult rate, 18 to 20-year-olds will see their pay packets rise by 16% from a minimum of £8.60 to £10/hour. Apprentices will enjoy a hike from £6.40 to £7.55/hour.

Defra budget

Defra’s annual budget will remain at £2.4 billion. Although this is clearly better than a reduction, it is effectively a cut in real terms when inflation is taken into account. It is also a snub to organisations like the NFU that have been calling for a significant increase in funding to help farmers deliver more nature restoration and carbon mitigation measures.

Subsidy payments slashed

Further reductions to what remains of the delinked Basic Payment Scheme (BPS) were also announced by Defra yesterday. In 2025, a 76% deduction will be applied to the first £30,000 of payments, while no payments will be made for any portion of the payment above £30,000.

Twin cab tax

An announcement about the tax treatment of twin-cab pickups was buried deep in the Budget statement – page 133, point 5.91 if you’re interested! Following a judgement from the Court of Appeal, such vehicles with a payload of above one tonne will be treated as cars from 6 April 2025 for the purpose of capital allowances, benefits in kind and some deductions from business profits.

Carbon border tax

The government has confirmed that a UK carbon border adjustment mechanism will be introduced on 1 January 2027. This will place a carbon price on some of the most emissions-intensive industrial goods imported to the UK including fertiliser. This could increase the costs to farmers.

Nutrient mitigation

£45 million of extra funding for seven areas was announced as part of the second funding round from the £110 million Local Nutrient Mitigation Fund (LNMF). The government says this will “support local planning authorities to bring forward nutrient mitigation schemes and progress stalled housing development”.

Some good news

There were a few glimmers of good news amongst the gloom. The freeze on fuel duty will remain in place next year, said Ms Reeves. In a surprise move, she also announced that she would not extend the current freeze on income tax thresholds imposed by the previous government. From 2028/2029 the thresholds will rise again in line with inflation. The company car tax exemptions for EVs will also continue. Duty on draft beers and ciders will fall by 1p/pint.

News in brief

Fix our broken food system

A damning new report – Recipe for health: a plan to fix our broken food system – produced by the House of Lords’ Food, Diet and Obesity Committee demands that the government should “develop a comprehensive, integrated long-term new strategy to fix the UK’s food system, underpinned by a new legislative framework”. The report concludes that obesity and diet-related diseases are a public health emergency that costs society billions each year in healthcare costs and lost productivity. “Because the food industry has strong incentives to produce and sell highly profitable unhealthy products, voluntary efforts to promote healthier food have failed. Mandatory regulation, therefore, has to be introduced,” it urges.

Meet the minister

If you weren’t happy with the way the agricultural sector was treated by Rachel Reeves in yesterday's Budget (see above), you can hear what Defra Minister Steve Reed has to say about it at the upcoming CLA Rural Business Conference on 21 November at the QEII Centre in London. It has just been announced that Mr Reed will be the keynote speaker at the event, which Knight Frank sponsors and this year has the theme Growing Profitable Partnerships.

Biodiversity Net Gain gap

The demand from developers for off-site Biodiversity Net Gain (BNG) credits could be smaller than anticipated, says James Shepherd of our Rural Consultancy team. Based on new research by our Analytics department, the annual demand for credits could be as low as 466 units across English Local Planning Authorities. Over three-quarters of developers say they plan to deliver any required BNG on-site. “With regards to the emerging BNG market, we are seeing suppressed demand for off-site BNG units, with a number of habitat bank operators and investors seemingly quite nervous,” notes James. Read the full report for more numbers and insight.

Insurance can boost nature

An interesting new report from insurer Howden and nature solutions business Pollination claims that the insurance industry could play a key role in helping restore nature at pace and scale. Through the Wilderness says one way that insurance products could help unlock nature finance is by de-risking investments in nature-based solutions.

Seasonal labour upset

Defra has confirmed that 43,000 temporary visas will be available under the Seasonal Workers Scheme during 2025. The government said this would provide certainty to farm businesses requiring temporary workers such as fruit pickers. But some within the horticultural industry are upset that this is 2,000 fewer visas than were available in 2024. Defra, however, pointed out that only 34,000 or so visas were actually issued.

Bluetongue update

Following the identification of a further case on the Buckinghamshire/Northamptonshire border, the Bluetongue restricted movement area now covers Bedfordshire, Berkshire (part), Buckinghamshire, Cambridgeshire, City of Kingston upon Hull, East Riding of Yorkshire, East Sussex, Essex, Greater London, Hampshire (part), Hertfordshire, Kent, Leicestershire (part), Lincolnshire, Norfolk, Northamptonshire, Nottinghamshire, Suffolk, Surrey and West Sussex. Read the latest updates and advice from Defra.

Harassment rules in force

Rural employers should be aware of new harassment rules that came into force last week (26 October). Under part of the Equality Act 2010, employers now have a duty to anticipate when sexual harassment may occur and take reasonable steps to prevent it. If sexual harassment has taken place, an employer should take action to stop it from happening again.

The Rural Report – Out now

The latest edition of The Rural Report, our flagship publication for farm and estate owners, looks at the numerous opportunities and challenges arising in the countryside following the election of a new government. Find out more or request a copy.

The Rural Report – Feedback

Thank you to all those who took the time to read the recently launched 20th edition of our flagship publication, The Rural Report. We hope you have enjoyed the report and found the insights from our team informative and thought-provoking. If you would like to provide feedback on the report, please click here.

Property markets

Country houses Q3 – Market waits for budget

Discretionary buyers are holding back from a new country house purchase until they find out what Labour’s first budget at the end of the month holds. Offers from potential buyers were down 10% in the three months to August, according to the latest results from the Knight Frank Prime Country House Index. However, the slide in average values has slowed with prices dropping by just 1.2% in the 12 months to the end of September - the lowest annual fall since Q1 2023 - points out Head of UK Residential Research Tom Bill. He predicts a total average price slide of 2% this year, dependent on the outcome of the Budget.

Farmland Q3 – Prices flatline

The farmland market in England and Wales is also on budget alert, judging by the latest results from the Knight Frank Farmland Index. Average values for bare land nudged up by just 0.2% in the third quarter of the year to £9,351/acre. This was the smallest increase for several years. For more insight and data please download the full report.

Development land Q3 – Greenfield sites up

The average value of greenfield land values in England rose 3% in the third quarter of 2024, according to the latest instalment of Knight Frank’s Residential Development Land Index. However, brownfield and prime central London prices stayed flat due to thin activity, with some market participants taking a “wait-and-see” approach ahead of this week’s Budget, says the report’s author, Anna Ward. Housebuilders are also sceptical that it will be possible to deliver the 1.5 million new homes pledged by Labour over the next five years. Download the full report for more insight and data.

Property of the week

Exmoor escape

This week we’re back in Exmoor where Alice Keith of our Farms & Estates team is selling Halsgrove Farm. The secluded property near Withypool includes a five-bed house, modern farm buildings and 162 acres of pasture and woodland. There are also grazing rights on Withypool Common. The guide price is £3 million.