Higher-Value Property Markets See Bigger Pre-Budget Slowdown

A non dom tells Knight Frank why they would only stay in the UK if a tiered tax regime was introduced.

3 minutes to read

The good news for anyone tired of Budget speculation is that the end is in sight.

After nearly four months of uncertainty and falling consumer confidence, the government will reveal its plans next Wednesday.

On balance, it was wise to subject its proposals to scrutiny rather than hold an emergency Budget in July, but investors haven’t particularly enjoyed the information vacuum.

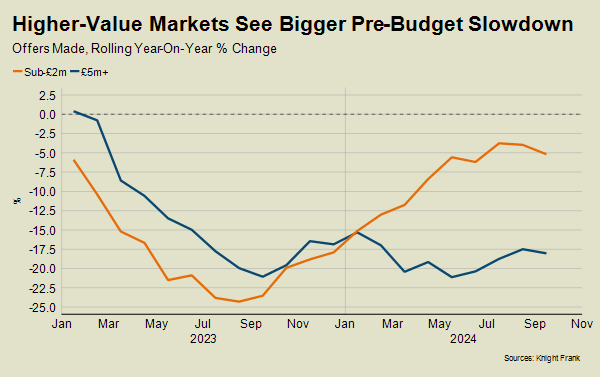

In the property market, it means needs-driven buyers have become more prevalent. Meanwhile, demand in higher-value and more discretionary markets has dipped.

The number of offers made on UK properties below £2 million fell 5% in the year to September, Knight Frank data shows. Meanwhile, the equivalent fall above £5 million was 18%.

Stamp duty on sales above £2 million accounted for 22% of the £11.7 billion raised last year, which is something the government may want to consider as it puts the finishing touches to its Budget.

Labour has said it won’t raise income tax, VAT, or national insurance, which means speculation has focussed on just about every other tax.

We know about VAT on private schools from January, but uncertainty also surrounds the taxation of private equity funds and pension tax relief rules. Rumours of a capital gains tax increase have caused some nervousness among landlords, but latest media reports suggest the rate for second homes will remain unchanged.

The taxation of non doms has also generated headlines and is one reason for the recent hesitancy in super-prime property markets.

However, a four-month delay between the election and the Budget has given the government time to consider the ramifications of its original plan for non doms.

Foreign Investors for Britain (FIFB) has encouraged Labour to widen its proposals by introducing a so-called Tiered Tax Regime (TTR). Under the proposed scheme, individuals would pay an annual amount based on their net wealth, which in turn would protect them from UK taxation (including inheritance tax) on overseas income.

An Oxford Economics survey found that 98% of non doms would accelerate their emigration plans under the current proposals, a figure that would drop to 13% if the TTR was introduced.

It estimates the current regime could therefore cost the government up to £1 billion by 2029/30. How much could the TTR raise instead? Expect a number in the billions to be announced this week.

Gabor Futo is a non dom who is originally from Hungary and has lived in the UK for three years. He is co-founder of Foreign Investors for Britain as well as real estate company Futureal, which invests in commercial and residential markets in the UK and Europe.

In the UK, his company employs around 50 people and owns assets worth £250 million, operating in the logistics, social housing, and build-to-rent sectors.

“The non dom regime has been in place for 100 years, so it makes no sense to undo all that work in 100 days,” he told Knight Frank, citing the issue of levying inheritance tax on non-UK assets as his key concern.

Based on the proposals set out in the Labour manifesto, he would leave for mainland Europe, saying the decision would be “uncomfortable but straightforward.”

“If I wasn’t living in the UK, I would be less interested in investing here,” he said. “If I stayed, as well as enjoying all the great things about living here, the company would invest more in the logistics and living sectors.”

“What isn’t always appreciated is that many non doms agree the system has been under-serving the Treasury and they would be happy to pay more tax.”