Will there be a bounce in UK home sales in Autumn?

A move by the Bank to reduce interest rates will be critical to relieving pressure on mortgage holders and boosting the housing market, but the timing and speed of future rate cuts is uncertain.

4 minutes to read

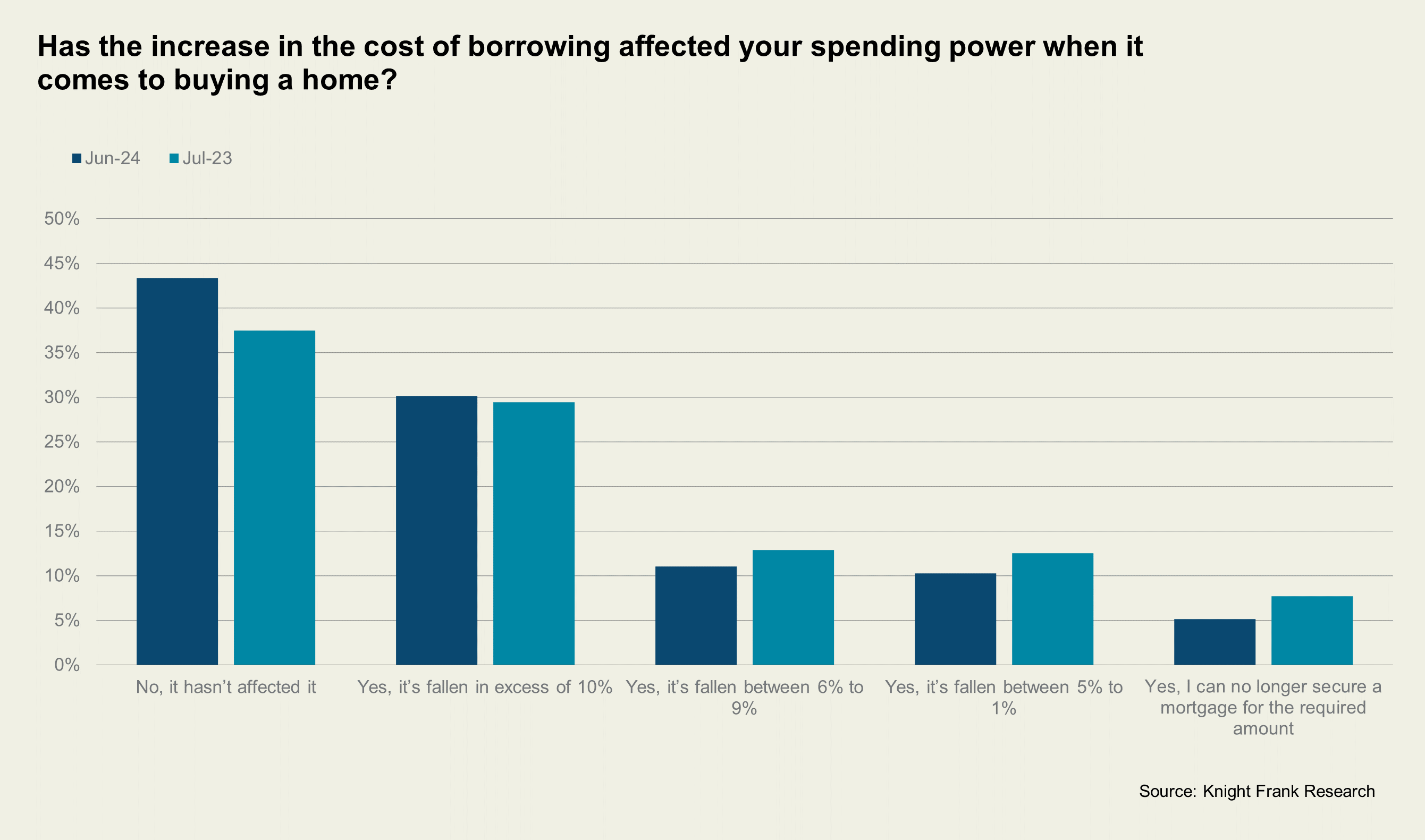

Six in ten UK mortgage holders have experienced a hit to their purchasing power for a new home due to the increase in the cost of borrowing.

That’s according to the results of our latest Knight Frank sentiment survey of over 300 plus individuals.

Overall, 60% of respondents looking to borrow money to buy a home said higher finance costs had impacted their spending budgets to some degree.

The Bank of England has raised interest rates 14 times since December 2021 to the current level of 5.25%.

But financial pressures could ease later this year if a rate cut comes into view, while some buyers said the UK election earlier this month had led them to put off plans to buy or sell until the Autumn which could contribute to an uplift in transactions.

The timing of a rate cut is uncertain with City investors trimming their forecasts for the likelihood of an August cut down from a 50% to a 35% chance this week after the government released higher-than-expected inflation data. But senior figures including chancellor Rachel Reeves support the Bank cutting the rate at its next meeting in August. Reeves claimed this would provide “relief” for homeowners.

Roughly three million households will see their mortgage payments rise over the next two years by an average of £180 a month, according to the Bank of England.

Several of the UK's biggest lenders had already cut borrowing costs in anticipation of a potential interest rate cut in August.

This will help ease financial pressures for future homebuyers. In total, 30% of mortgage applicant respondents said their spending power, when it comes to buying a home, had fallen in excess of 10%, with a fifth saying it had fallen between 1-9% (see chart).

However, a significant portion are insulated from these pressures. Just over 40% said the cost of borrowing has not affected their spending power when it comes to buying a home.

Over 40% of our total respondents said this question was not applicable to them as they are cash buyers without the need for a mortgage.

This is reflected by the wider UK housing landscape in which 35% own their own home outright in the UK, while 29% are mortgagors, according to the government’s latest English Housing Survey.

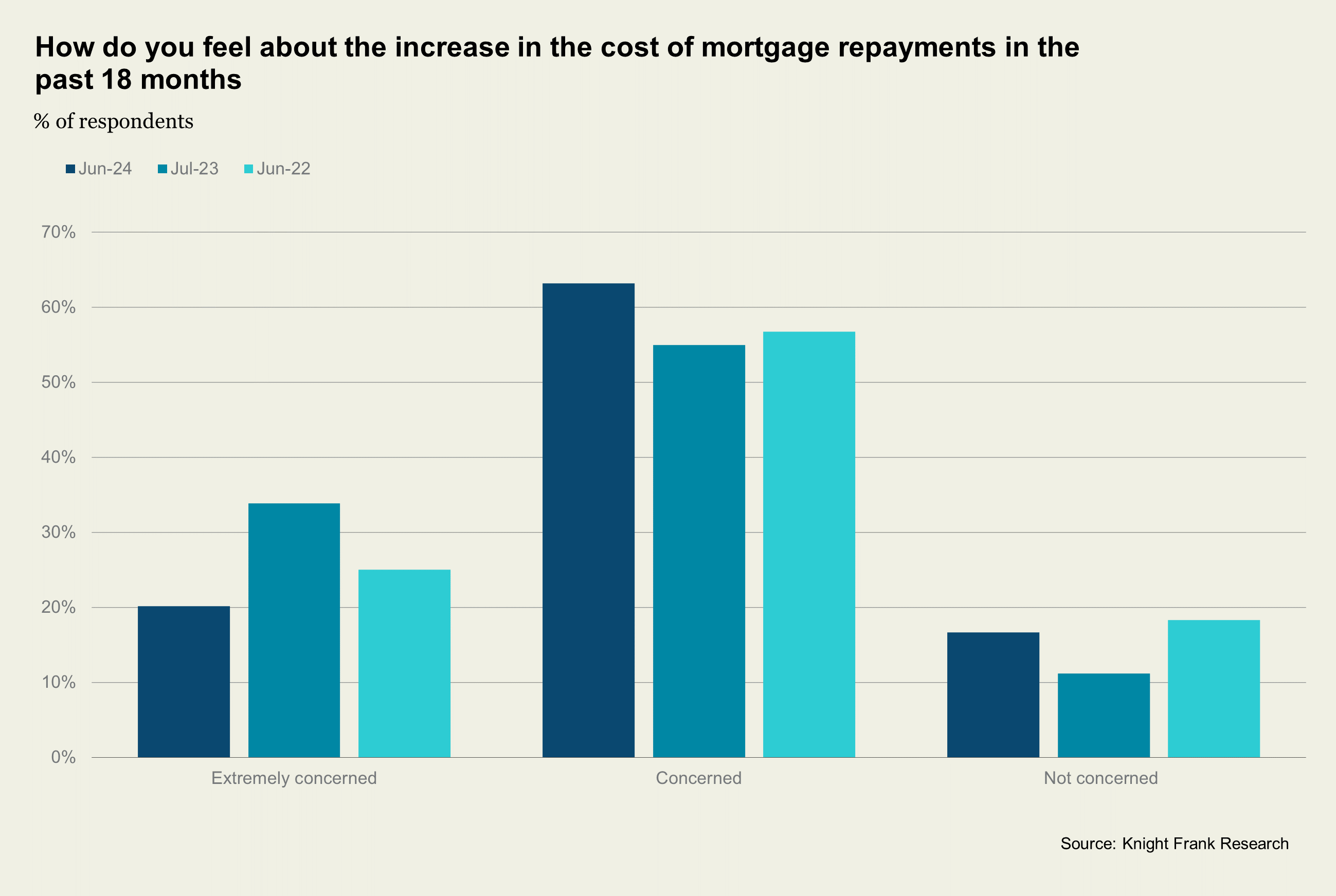

Focusing on mortgagor respondents again specifically, 80% said they were either concerned or extremely concerned about the increased cost of mortgage repayments in the past 18 months, down from 90% who said this last year.

Dusting off plans

While the majority (over 60%) said the UK election had made no difference to their plans, a fifth said they had delayed plans to buy a home until the Autumn.

In total, a third are looking to buy a home this year, with a fifth still deciding. The majority (80%) are seeking a new primary home, and just over half are looking to move and upsize their home, with a third looking to downsize, and 10% seeking to buy their first home.

Overall, a fifth said they were looking for a new-build home, up from 13% for the three consecutive prior years.

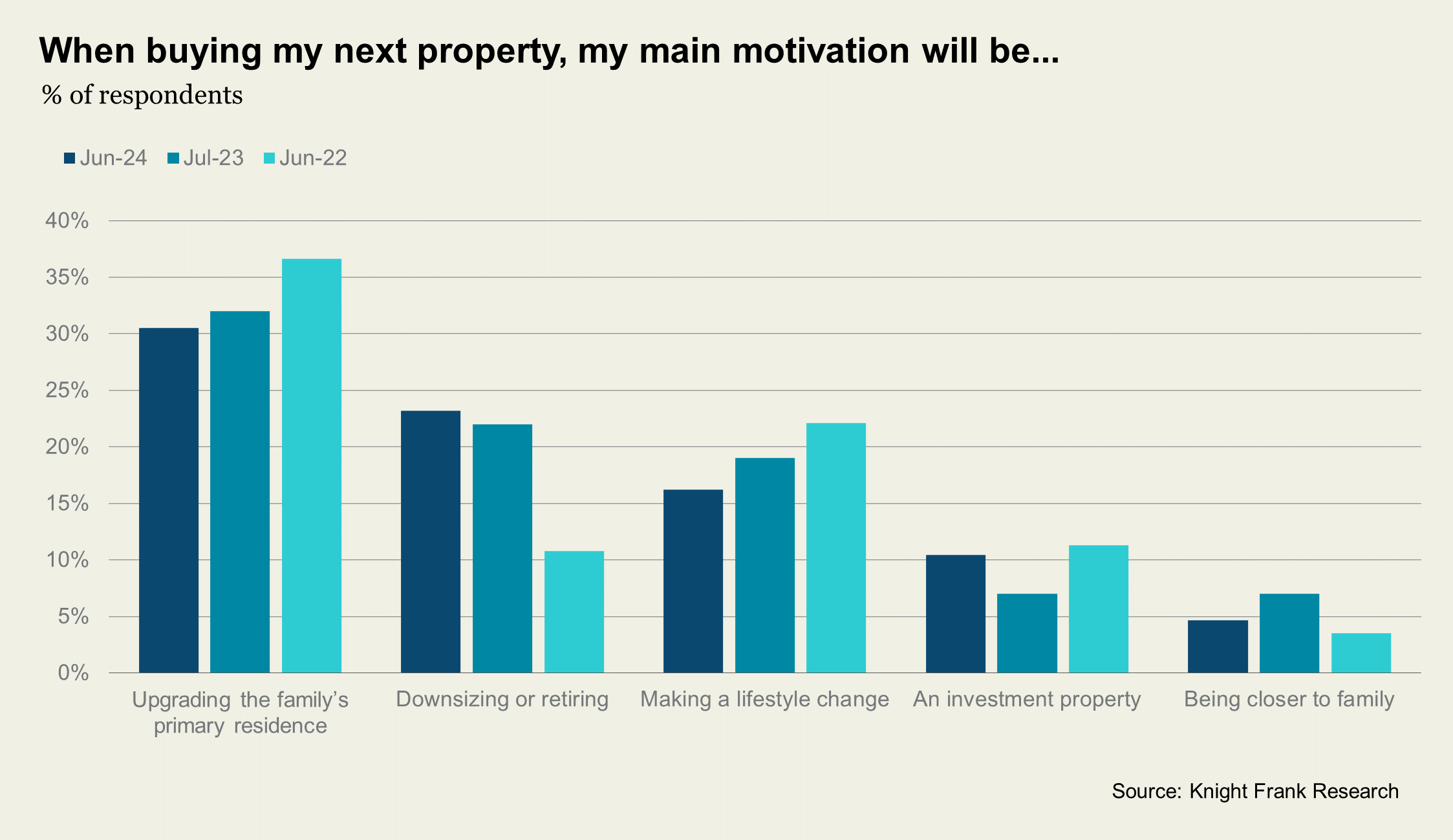

Their main motivations for buying include upgrading the family’s primary residence, downsizing or retiring and ‘making a lifestyle change’.

This is broadly unchanged from last year, but the proportion looking to downsize or retire has jumped from 11% in summer 2022 to nearly a quarter this year.

Their ‘must-have’s have broadly remained on a par with last year, with 70% listing a garden, outdoor space or access to land, followed by high-speed broadband and privacy.

But there has been a slightly bigger focus on transport links at nearly half of respondents versus 40% in 2023, as well as a slightly lower level of interest in space, both indoor and outside (see chart) – likely corresponding to a continuing recovery in commuting numbers.

Overall, just over a quarter are looking to sell with under a fifth on the fence. Of those still deciding, just under 30% citied an ‘inability to sell my property for the price I want or require’ as the key factor, followed by difficulty finding ‘something suitable to buy’ and the increased cost of borrowing and mortgages.

Of those undecided or not looking to buy, a third said an ‘inability to find something to buy’ has had the biggest impact, and a quarter cited the increased cost of borrowing and mortgages, followed by just over 10% pointing to rising costs and changing legislation around owning second homes and buy to let investments.