Insight 2.1: Prime rents and forecasts

The qualities which characterise best-in-class buildings have evolved just as the requirements of office occupiers have shifted with a greater emphasis placed on sustainability and employee wellbeing.

5 minutes to read

Resetting prime rents

We have analysed recent trends in the leasing of new and refurbished offices, particularly those where achieved rents have been significantly higher than the market average prime rent and identified the quality characteristics shared by these buildings. As a result, we have incorporated more specific criteria in our assessment of prime rents and have raised rental levels in many London submarkets. Moreover, growing momentum to occupier demand, combined with a constrained development pipeline has led to an improvement to our five-year forecasts of prime rents.

Trends shaping the evolution of prime

Our current evaluation of a prime office focuses on new and refurbished offices with a minimum floorspace of 10,000 sq ft and excluding lettings of offices with terrace floors and in towers. This definition has served as a reliable method for benchmarking prime offices, but since the pandemic the qualities which characterise best-in-class have evolved. We have analysed transactions where the achieved rents were above the market average and found the following qualities to be common amongst best-in-class offices.

Highly sustainable – BREEAM certifications of Excellent or Outstanding and Energy Performance Certificates (EPC) of A or B.

Amenity rich – Offices with communal or private terrace floors. Open public spaces, rooftop gardens, public realm improvements, gyms, other real estate uses, and top-quality end-of-trip facilities.

Ease of access – Proximity to transportation hubs with less than five minutes walking time from stations, with multiple connectivity options.

Resetting our prime definition

To accurately reflect the evolving dynamics of the market in terms of rental levels, we have reviewed and improved our usual basket of prime transactions to reflect the following criteria:

• Minimum floorspace of 10,000 sq ft inclusive of lettings of terrace floors and in low to mid-levels of towers (levels 15 and below).

• Industry leading sustainability metrics.

• Accessibility to open public spaces, both communal and private.

• Comprehensive amenities/facilities promoting employee well-being.

• Within five minutes walking time of a mainline station and multiple transport options.

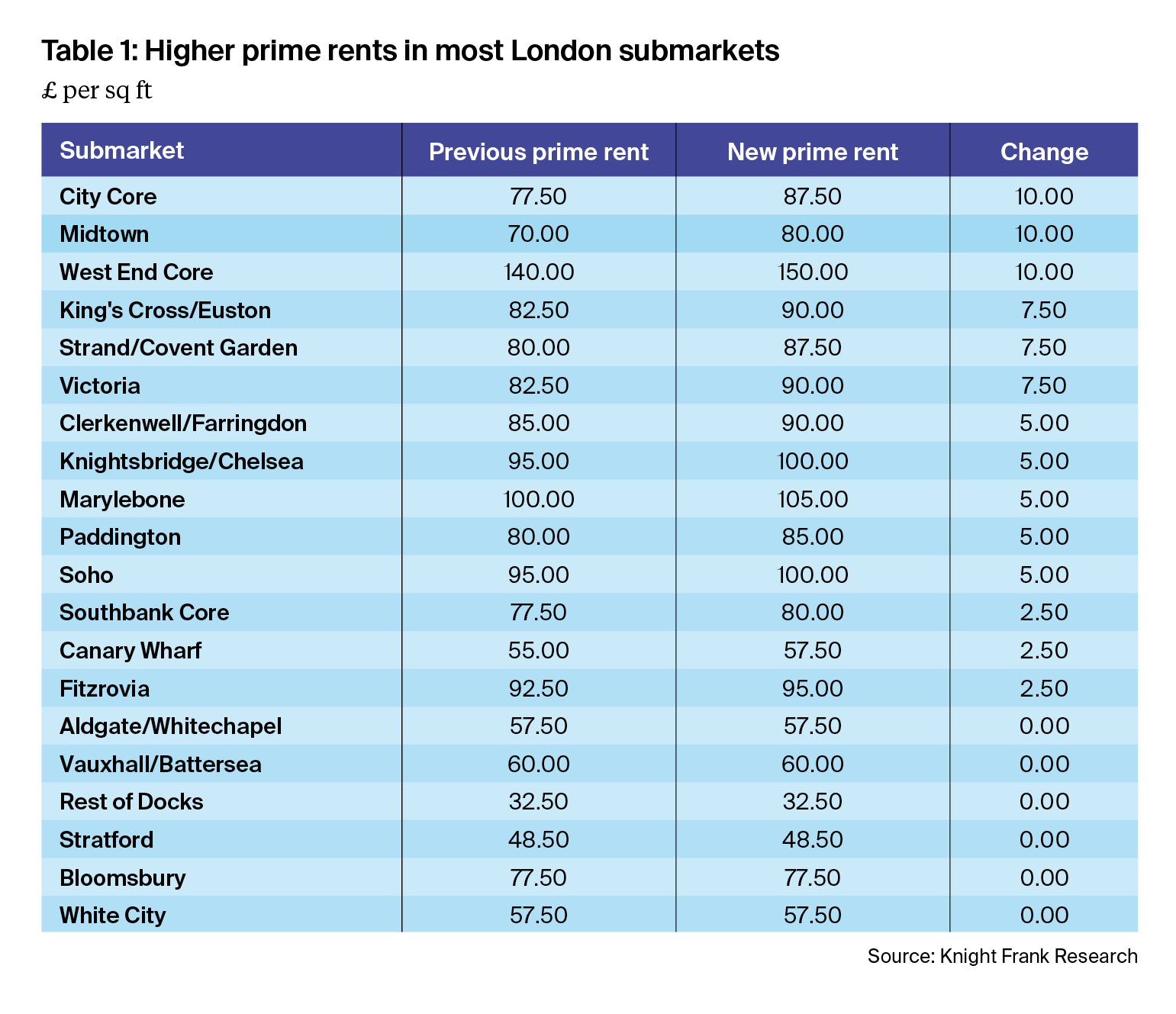

Table 1 shows the impact on rents from applying this adjustment to our basket of prime transactions. It shows higher prime rents in many of London submarkets and the most significant uplifts in many business districts. From £77.50 to £87.50 per sq ft in the City Core, from £70.00 to £80.00 per sq ft in Midtown and from £140 to £150 per sq ft in West End Core.

Near-term improvement to occupier demand

In our latest forecasting round, we have made positive revisions to our five year projections of prime rental growth. This change is driven by an improved near-term outlook for occupier demand and a development pipeline that remains below average levels of new and refurbished take-up.

Whilst independent forecasts remain subdued for 2024, they lag the insights shown by the release of more timely business and consumer surveys which show economic activity in London accelerated in the last quarter of 2023. Our proprietary demand side data concurs:

Record levels of prime take-up – In 2023 Q4, take-up of new and refurbished offices was 2.6m sq ft. This is the highest level we have recorded since we started measuring the data in 2004.

Active demand at a 10-year high – Requirements for space in London are 11.9m sq ft, 34% up on last year, and with more than 50 requirements seeking more than 50,000 sq ft.

Rising occupier viewings – Last quarter, our viewings figures were just over 4% higher compared with 12 months ago. This correlates strongly with a rise in near-term take-up. We expect these factors to drive further momentum in leasing transactions and for take-up to reach annual trend levels of 12m sq ft in 2024.

Supply squeeze in the long-term

The longer-term outlook for rental growth is underpinned by a constrained development pipeline and low availability of existing new and refurbished space:

Limited available prime buildings – Available new and refurbished buildings are less than 50% of total availability in three-quarters of the submarkets of London.

Low prime vacancy rates – Across London, the vacancy rate for new space is less than 2% whilst for refurbished space it is just below 4%. In contrast, two-thirds of leasing transactions are for new and refurbished space.

Expected under-supply of prime space – The under-construction speculative development pipeline at 11 m sq ft and completes by 2026, is well short of meeting average levels of new and refurbished take-up. We expect this under-supply to be 5.3m sq ft.

Moreover, including development schemes with planning consent that we believe will complete with a 50-75% probability increases the pipeline by only 3.8m sq ft and extends the delivery timeline to 2028. We have explored the structural imbalances that prevail in the London office market in greater depth in our second London Series insight paper – what drives leasing outperformance.

Improving prime rental growth outlook

We expect the delayed expansion and relocation plans of businesses to be re-assessed in-light of the more favourable interest rate environment and to result in higher levels of near term take-up for highly sustainable, amenity rich, and centrally located offices. Furthermore, with 28.3m sq ft of lease expiries occurring between now and 2026, and potential under-supply of prime space in core submarkets, we expect growth to spill over into other non-core submarkets.

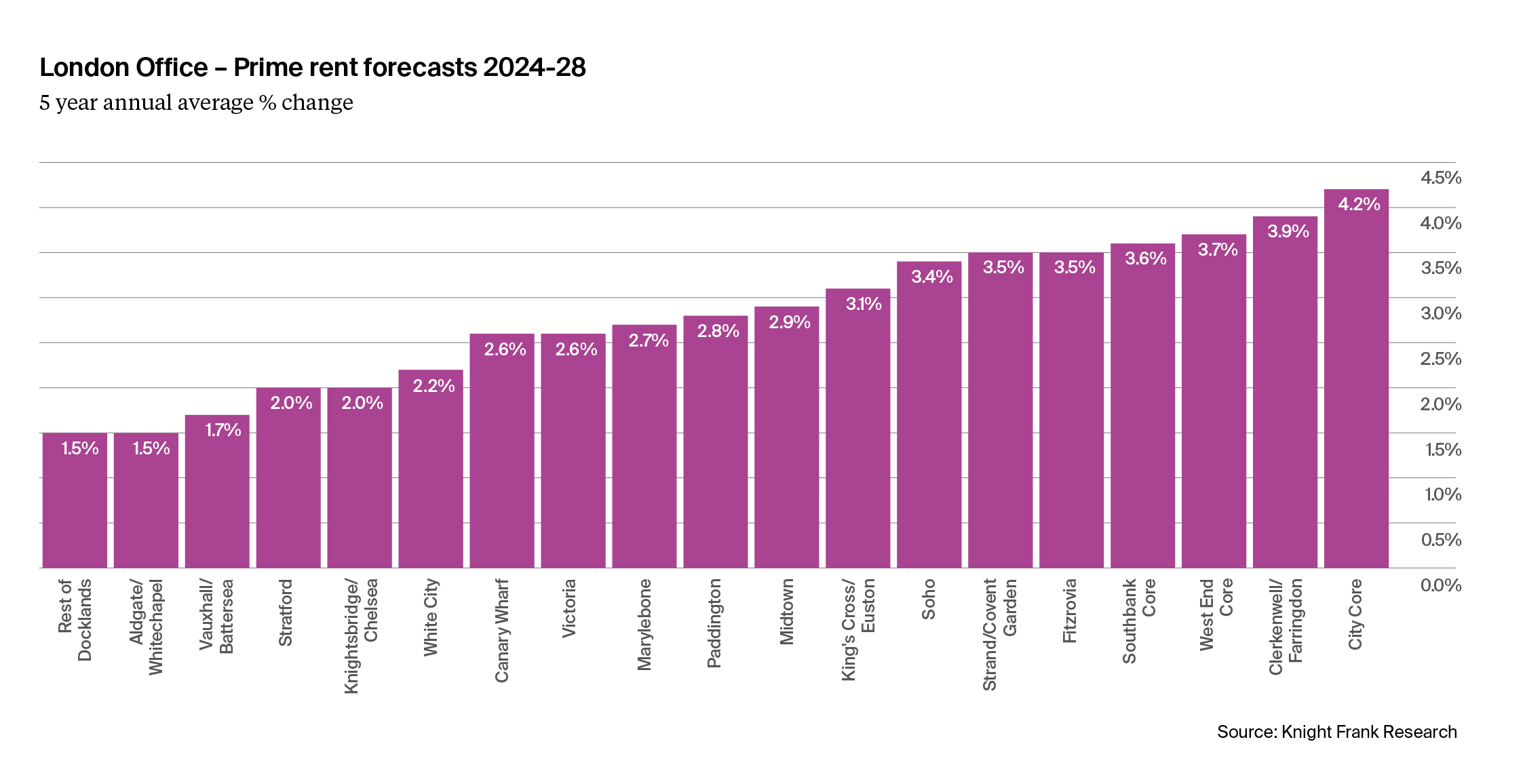

Over the next five years, we expect the strongest average annual growth in the City and Southbank to be in the City Core (4.2%), Clerkenwell/ Farringdon (3.9%), and Southbank Core (3.6%). In the West End, we expect the highest growth in prime rents in the West End Core (3.7%), Fitzrovia (3.5%) and Strand/Covent Garden (3.5%).

Resetting current and future prime rents

Our analysis has shown that occupiers have become more discerning with regards to how they view best-in class offices, and this necessitates an adjustment to the quality criteria we use to determine prime rents. This change has resulted in an uplift to prime rents in almost three-quarters of submarkets in London. Furthermore, whilst economic data points to a subdued short-term outlook for the UK economy, more timely surveys are pointing to stronger growth in London. This is in-line with our real time data on viewings and requirements which point to improving momentum for occupier demand. Combined with our analysis of the development pipeline, which shows over 5m sq ft of potential under-supply, has resulted in a positive revision to our five-year outlook for growth in prime rents.