Dubai keeps driving the world's US$10m+ home sales

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

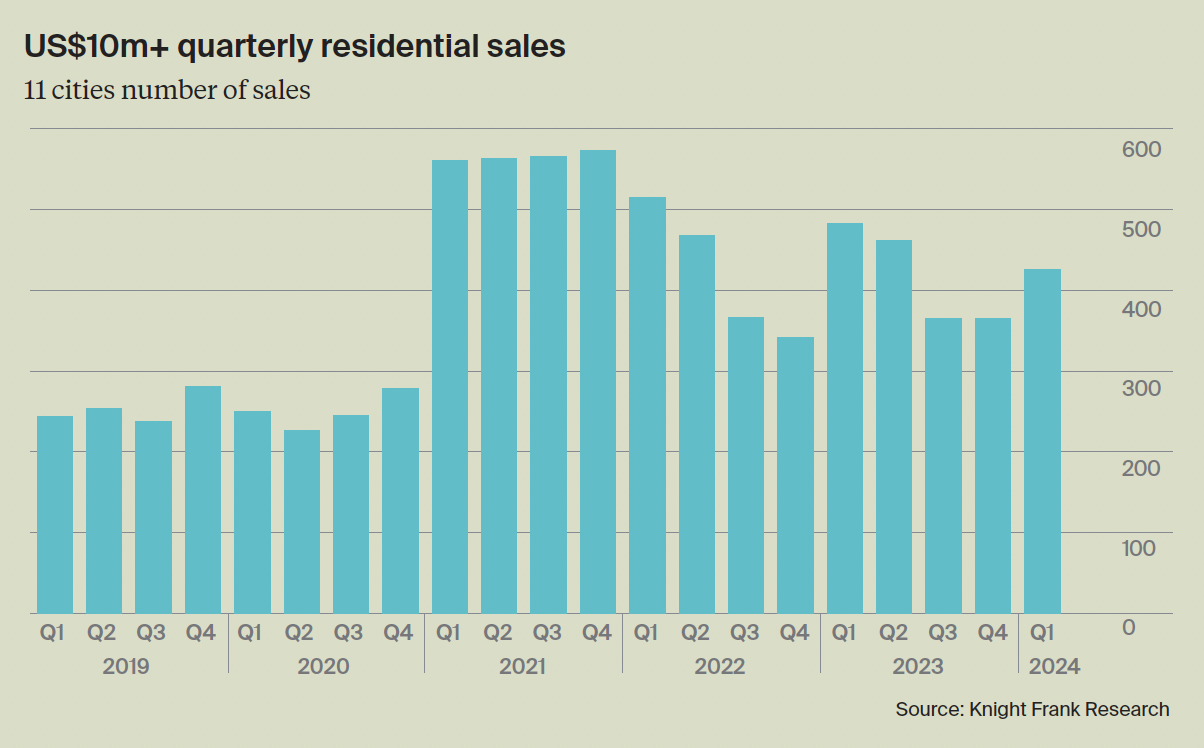

Dubai’s arrival as a super-prime hub has helped to support global sales of US$10m+ property.

There were 426 sales in Q1 across our basket of 11 key luxury markets, according to Knight Frank's Global Super-Prime Intelligence Report, out this morning. That's notably higher than the previous two quarters, but sales are down on an annual basis. Dubai leads our ranking with 105 sales, compared to second and third placed New York and Palm Beach – with 56 and 47 sales respectively. Dubai’s total was very strong compared to other cities, but marked the first quarterly decline in sales in the Emirate since we started our survey in 2019.

There were 1,618 sales across our basket in the 12 months to the end of March, the lowest annual total in three years. The annual total for super-prime sales seems to have settled in the 1,600 to 1,700 range, which is down from the post-COVID high experienced in 2021 and 2022, but is notably above the pre-COVID total.

The London super-prime market has been facing headwinds from the upcoming UK general election, most notably due to uncertainty around the existing non-domiciled taxation regime. Sales dipped in Q1, though London remains the second biggest global super-prime market on an annual basis, running 15% ahead of New York in terms of sales in the 12-months to March. Hong Kong is the biggest market in Asia, with 132 sales, compared to Singapore’s 88.

Holding steady

As we're seeing in London, each global US$10m+ market has its own selection of drivers or drags on activity, but the dissipating chances of summer rate cuts is having an impact almost everywhere.

The US Personal Consumption Expenditures Price Index, the Federal Reserve's preferred gauge of inflation, remained steady at an annual rate of 2.7% during the year to April, according to figures published on Friday. The core measure, which strips out volatile items, rose 2.8%.

Markets now expect just one quarter-point cut from the Fed this year, potentially at the September meeting, which would be the last ahead of the US election. For investors waiting for rate cuts, there were a few bright spots in various sets of official figures published last week suggesting that the US consumer is finally starting to pull back. Bloomberg has a good round up here.

Trading sideways

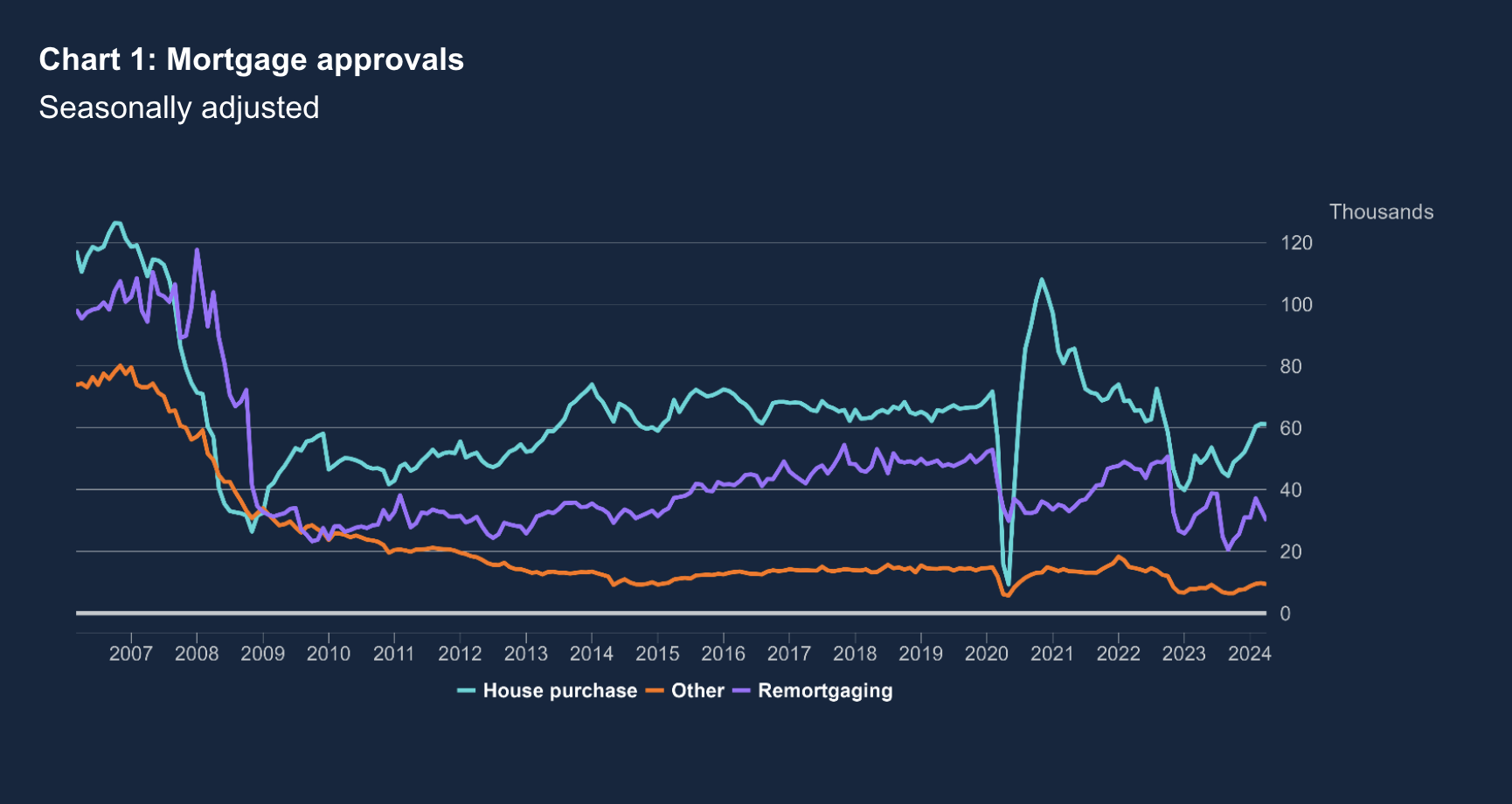

A slew of UK housing statistics published on Friday revealed a market creaking under the weight of higher mortgage rates but ultimately holding up.

Firstly, UK house prices climbed 0.4% in May, bringing the annual rate of growth to 1.3%, Nationwide reported. "High supply is keeping a lid on prices and stubborn services inflation means swap rates are rising and mortgages starting with a ‘3’ feel some way off," Knight Frank's Tom Bill said over on Linkedin.

Then, the Bank of England reported that net mortgage approvals for house purchases hit 61,100 in April, little changed from 61,300 in March. There have been few movements in mortgage rates over the past fortnight, with the lenders tweaking their ranges largely to control the flow of business and maintain service levels. That's likely to remain the case for the time being.

Finally, lagging data from HMRC data showed a pick up in transaction volumes thanks to more listings, particularly in the early weeks of the year. Sales were still 12% below their five-year average but should hold up this year despite the July election.

Planning

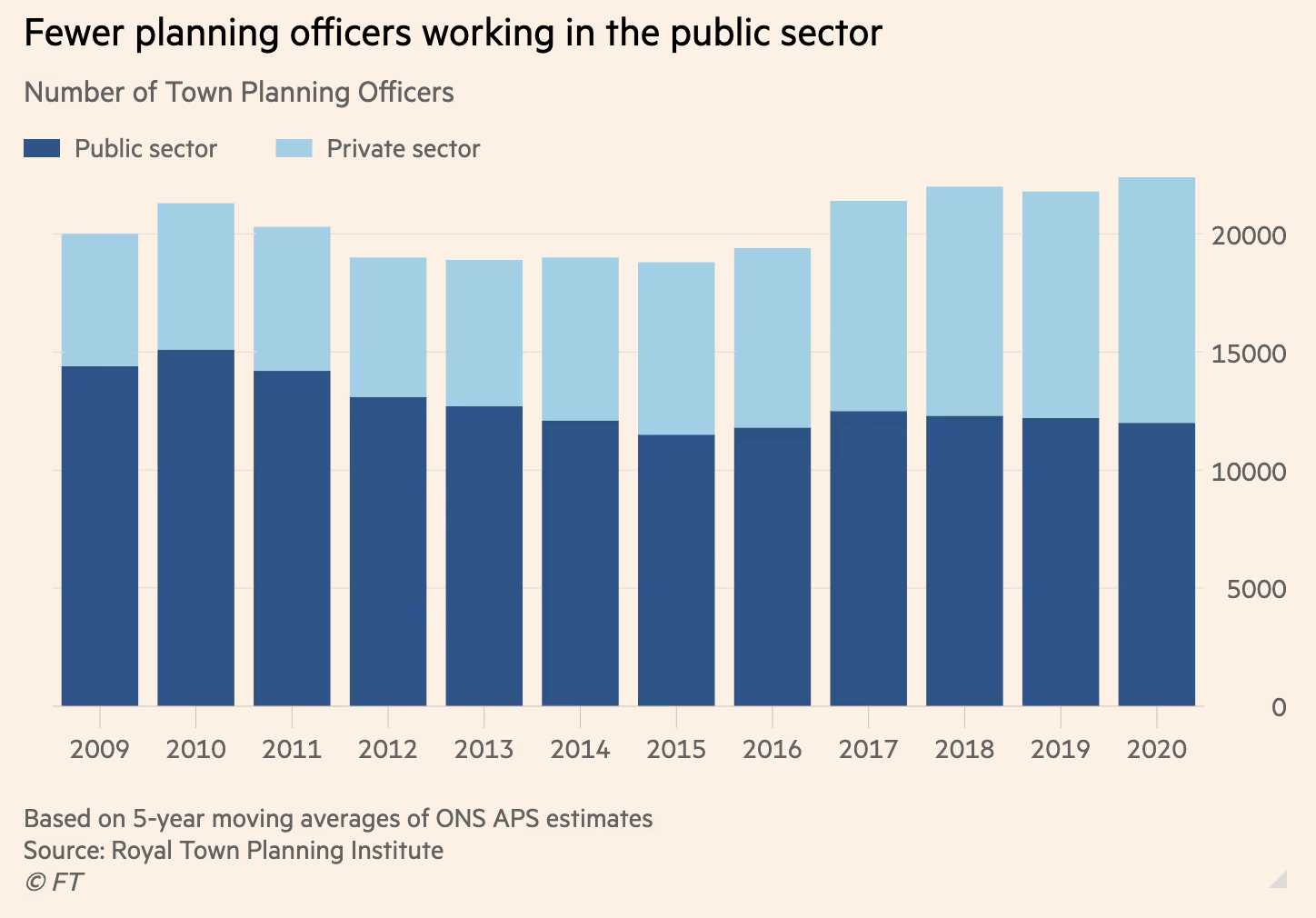

What are the UK's two main parties promising as they try to boost housebuilding? Our team has put together a Policy Matrix that we'll update as and when more detail emerges.

Labour has been keen to portray itself as “builders not the blockers” when it comes to housebuilding, trying to draw a line in the sand between it and the Conservatives. That message appears to be landing. Overall, 80% of the respondents to our latest Housebuilder Survey said they thought a Labour government would enhance the land and development market the most.

Properly staffed planning departments would be a priority for many developers, and Labour has pledged to to hire 300 planning officers to “get Britain building again”. That would be welcome, but Royal Town Planning Institute (RTPI) data shared with the FT yesterday suggests there would be much more to do. Those 300 officers would replace less than a tenth of the planners who left public service during the first decade of the current government (see chart).

In other news...

Khadija Hussain considers the election through a commercial real estate lens.

Elsewhere - Global banks start targeting a new breed of real estate risk (Bloomberg).

Property for sale in Dubai