The mini-budget looms over the 2024 election campaign

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

In September 2022, then Prime Minister Liz Truss and Chancellor Kwasi Kwarteng pledged to deliver the largest set of tax cuts since 1972. They were swiftly humbled by markets.

Investors dumped government bonds, sending yields soaring to record levels. Mortgage rates followed the cost of government borrowing north, bringing down Truss and locking in a volatile six months in the property market.

Tax cuts and giveaways win votes and election campaigning is gathering momentum. Should we be worried? Vivek Paul, BlackRock’s UK chief investment strategist, thinks so:

“As inflation falls in the UK and we get closer to the general election date, major UK political parties may be more tempted to promise looser fiscal policy — the more this occurs, the greater the likelihood of the return of the bond vigilantes,” he told Bloomberg News yesterday. “In the lead-up to this year’s UK election, we’re watching the fiscal policy stance.”

Promises, promises

The Conservative Party will rely on tax cuts to close a yawning gap in the polls. PM Rishi Sunak told the Sunday Telegraph that he planned to curb benefits and government spending to fund cuts on either side of the election, starting with a Budget on March 6th.

The Conservatives also plan to paint Labour as the party of higher taxes by targeting its 2021 pledge to invest £28bn a year in low-carbon infrastructure. The FT has a good piece on why - interest rates were 0.1% at the time, so borrowing to fund the proposals was uncontroversial. It's unclear now how Labour will fund the pledge, and the paper suggests sections are already being watered down, but clearly fiscal responsibility and the mini-budget will be weaponised by both parties as the campaigns gather pace. That does present a threat to falling mortgage rates, though a slim one for now.

Investors appear unphased so far. A government bond auction that took place yesterday attracted the strongest demand since April 2020 as investors bid for £2.25 billion of the 4.75% 2043 gilt. Bids totalled 3.62 times the volume of gilts on offer.

Mortgage rates

Lenders continue to announce cuts to mortgage rates. Barclays this morning cut rates on its lowest-priced two-year fixes by half a percentage point to 4.10%, though those deals will require a 40% deposit. Santander also announced a series of cuts, including a five-year fix at 3.89%.

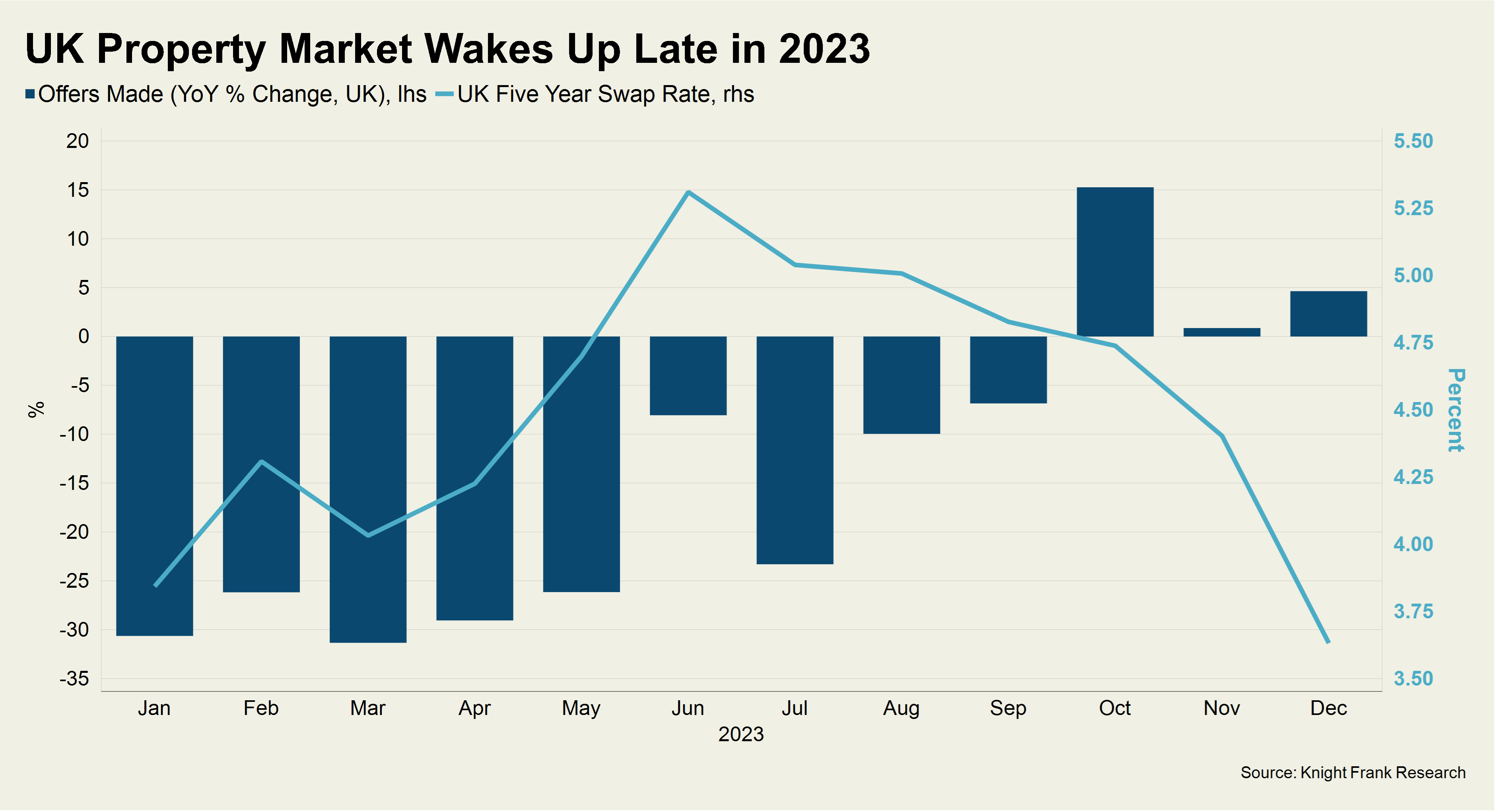

These are still painful rates for anybody moving off a sub-2% deal, but the shift in outlook has improved sentiment substantially. Earlier this week, Tom Bill touched on the degree to which falling borrowing costs prompted a rise in activity in late 2023. The chart below maps the five year swap rate against the annual change in activity - the number of offers made across the UK in October was 15% higher than 2022, for example.

Kate Everett-Allen takes a closer look at the degree to which sentiment has improved in the country homes market. For the first time since Q1 2022, our index’s annual rate of growth improved quarter-on-quarter in the final months of 2023, offering some hope that the worst of this cycle’s price declines may be in the rear view mirror.

Construction

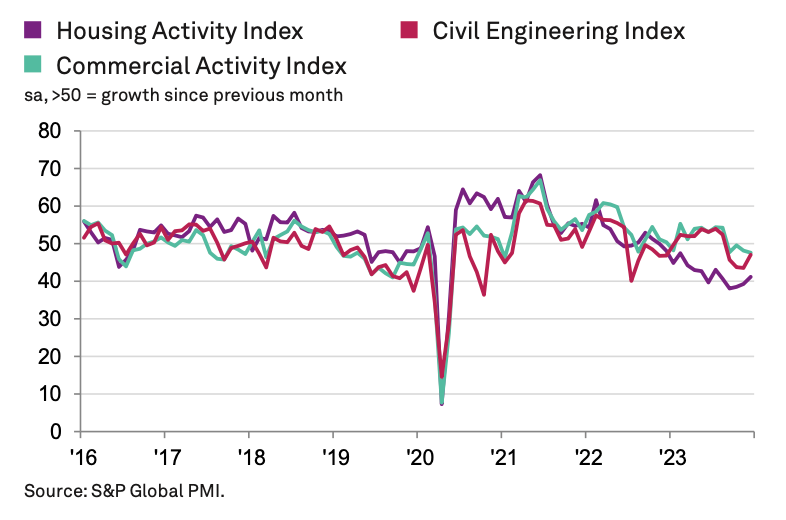

Residential construction activity continued its contraction in December, though the most tentative signs of green shoots have appeared in S&P Global's latest construction PMI.

House building remained the weakest-performing category of construction work (index at 41.1), despite the rate of decline easing to its slowest since July 2023 (see chart). Commercial construction meanwhile declined only modestly (index at 47.6), but the speed of the downturn accelerated to its fastest since January 2021. Some firms noted that concerns about the domestic economic outlook, alongside elevated borrowing costs, had led to greater caution among clients.

A softer decline in new work and hopes of a turnaround in demand conditions during 2024 contributed to a renewed but modest rise in employment numbers during the month. Around 41% of the survey panel anticipate an increase in business activity over the course of 2024, while only 17% predict a decline. Anecdotal evidence suggested that subdued forecasts for the UK economy were a key concern, while hopes of reduced interest rates and a turnaround in market confidence were factors cited as likely to boost construction activity.

In other news...

From our team - Stephen Springham weighs up the mixed messages from retailers' Christmas tradition figures, Andrew Shirley parses the dress codes at competing Oxford farming conferences for clues as to how rural views are changing, and Will Matthews uses his latest Leading Indicators to cover new research showing a resurgence in UK manufacturing.

Elsewhere - venture capital investment in UK firms still below pandemic-era peak (Reuters), EU faces potential €450mn post-Brexit bill on empty London offices (FT), US developer scraps plans for London Sphere (FT), and finally, investors pull £2bn from green and social funds (Times).